Agricultural Biologicals: Why Adoption Lagged, and Where Momentum Is Building

“Snake oil” scepticism to cautious optimism.

Hey folks!

Thanks for being here. In issue #113 of the newsletter, I’m diving into a topic I’ve been fascinated by over the past few months: agricultural biologicals. More specifically, why adoption has been slow historically, and where momentum is building.

Like all the topics I cover here, my understanding of the topic keeps evolving as I learn more. So, if you spot something I’ve missed or got wrong, let me know. Let’s dig in!

Agricultural biologicals (ag biologicals) can boost crop yields, improve soil health, and reduce dependence on synthetic fertilisers and pesticides. Yet adoption has lagged. Why has progress been so uneven despite these benefits, and where is momentum starting to build?

It’s a question I’ve been wrestling with as someone who spends my days speaking with agrifood tech founders and investors, and digging into real-world results. To find answers, alongside these conversations, I’ve drawn on perspectives from industry stakeholders and third-party studies.

Every few days, another headline lands: a microbial fertiliser that lifts yields by double digits, a biopesticide that matches synthetics in trials, or a biostimulant blend that promises drought resilience. The science sounds transformative, and early field results look promising.

But uptake has been slow and uneven on farms around the world. It’s not that growers aren’t paying attention. It’s because many have seen this cycle before: bold claims, patchy performance, and products that struggle once they leave the greenhouse and meet real-world conditions.

Now, there are signs the story is shifting. The science is maturing. Products are becoming more reliable and easier to use. Major agrichemical players are making billion-dollar acquisitions. And the pressure to adapt, from regulators, supply chains, and climate extremes, is becoming harder to ignore.

Developments in recent years make me optimistic that agricultural biologicals may be approaching a turning point, with momentum shifting from isolated successes to scalable, repeatable adoption.

Before looking at what’s held adoption back, and where the momentum is building, it’s worth being clear on what agricultural biologicals are and how they work.

What are biologicals?

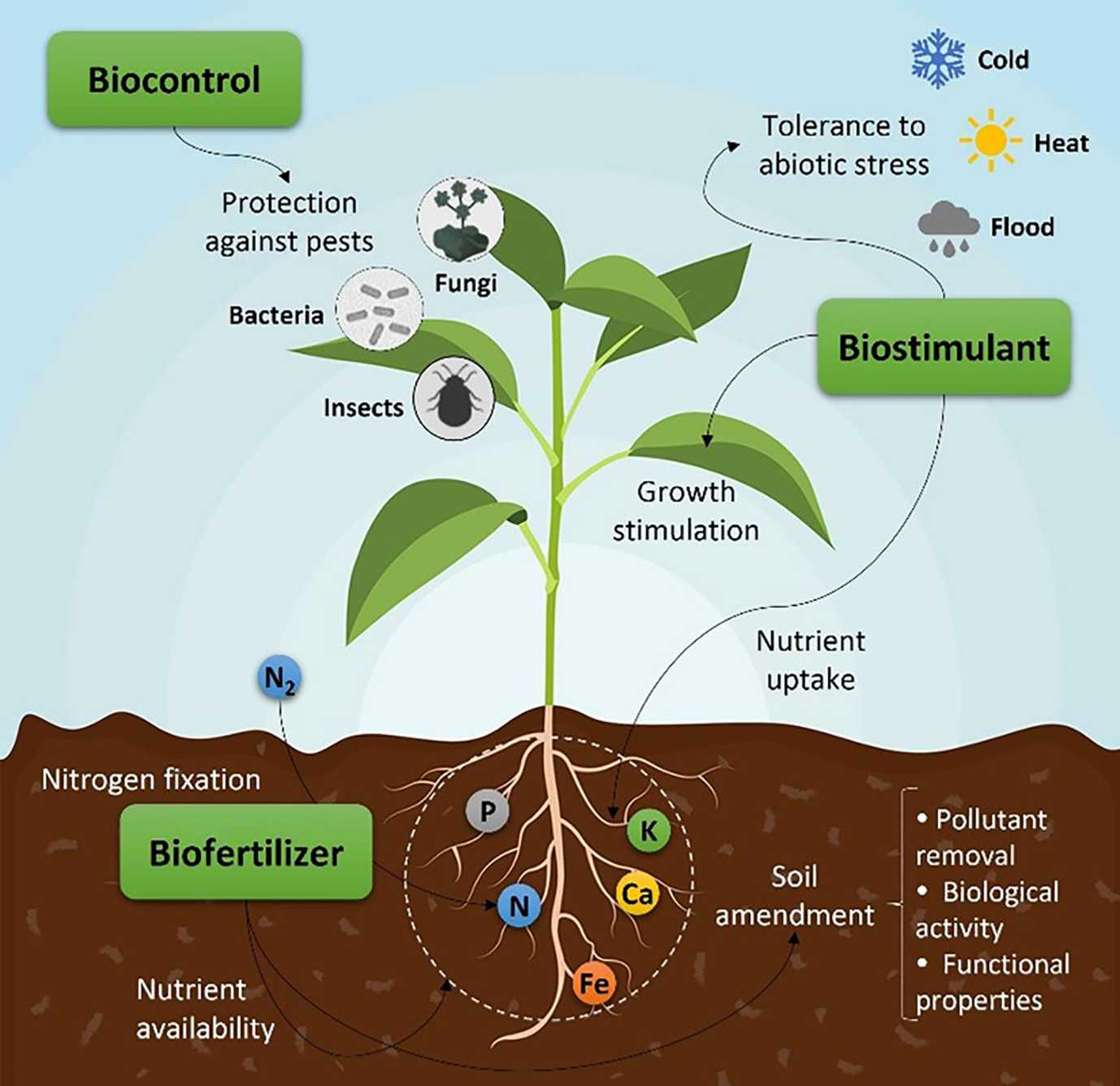

In agriculture, biologicals are crop inputs derived from living organisms or naturally occurring substances, designed to improve plant health or control pests. They fall into three broad groups:

Biostimulants improve plant vigour, nutrient use efficiency, or tolerance to heat, drought, or salinity. Examples include seaweed extracts that help vegetable crops withstand stress, or microbial metabolites that boost root nutrient uptake.

Biofertilisers contain living microbes that supply or unlock nutrients. Nitrogen-fixing bacteria such as Azospirillum can reduce the need for synthetic fertiliser in cereal crops, while mycorrhizal fungi help plants access phosphorus in the soil.

Biocontrols or biopesticides use living organisms or biologically derived compounds to suppress pests and diseases. These range from Bacillus strains that protect vegetables from fungal pathogens to pheromone lures that disrupt insect mating cycles in orchards.

Each category differs in how it works, how it’s handled, and how it’s regulated. What unites them is a shared goal of making farming more productive and resilient while reducing chemical dependence.

Synthetic fertilisers and pesticides have been instrumental in feeding the world. They have delivered dramatic yield gains, lowered food prices, and helped lift millions (likely billions) out of hunger. It would be wrong to overlook those contributions.

However, these same tools have also brought unintended costs, such as degraded soils, biodiversity loss, and mounting resistance in weeds and pests after decades of overuse. Biologicals are not a drop-in replacement for synthetic inputs. They can, however, help farmers cut back on chemical use, protect ecosystems, manage resistance, and, especially in an era of high input prices, reduce the financial burden on growers.

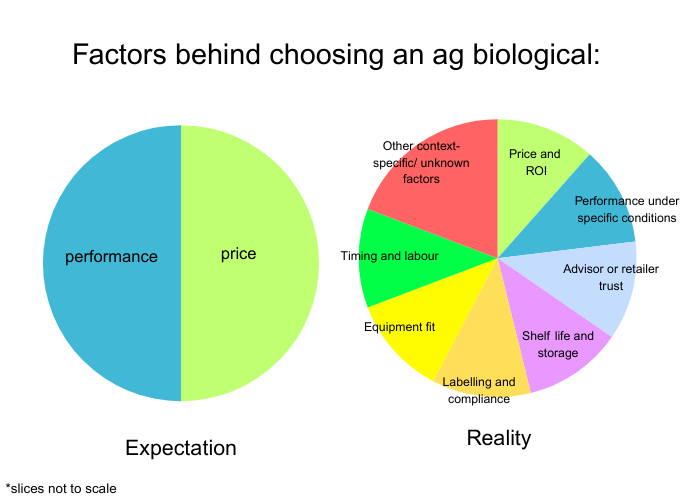

Given these potential benefits, why haven’t biologicals yet become a standard part of crop programs? Unsurprisingly, since I’m not a farmer, I’ve learned that what matters in the field often isn’t as straightforward as I once assumed.

Why adoption has lagged

1. Performance and trust issues

I’ve lost count of how many times I’ve come across terms like “bugs in a jug” or “snake oil” when farmers explain why they hesitate to adopt biologicals. It’s shorthand for products that failed to meet their claims. CropLife’s 2025 Biologics survey puts numbers to that sentiment: 41% of the ag retailers and their grower-customers cited lack of trust in product performance as the top barrier.

Part of the challenge is visibility. Synthetic chemistries deliver immediate, noticeable results, while many biologicals, especially biostimulants, provide benefits like improved soil health, stress resilience, or nutrient uptake. These benefits are subtle, delayed, and highly context-dependent. When gains are hard to see, confidence is slow to build.

Understanding how a product works matters as much as seeing the outcome. As AgFunder’s Rob Leclerc points out, unclear modes of action erode trust. And in high-stakes uses like fungicides or insecticides, the bar is even higher. Biotalys CEO Kevin Helash puts it bluntly: these products must “replicate the performance of synthetic chemistry, because, from a farmer’s perspective, there’s zero room for poor performance[.]”

Until biologicals can match that standard reliably in the field, trust will remain the biggest barrier to scaling adoption.

2. High costs and uncertain payback

Farmers run on thin margins. When uncertainty is high, good intentions do not move budgets. They need to see that the economics work. Cost and inconsistent performance remain the most cited barriers in surveys, making ROI hard to underwrite, especially when results vary by field, season, and program.

Biologicals are often priced higher than traditional crop protection products, and their selective, targeted nature typically requires multiple applications. That translates to more passes across the field, adding both product and operational costs. For growers looking for the most cost-effective way to produce their crops, these extra steps can make biologicals a harder sell.

Non-adopters are not hostile, just unconvinced. In a benchmark survey of 500 US row-crop producers, most farmers who were not yet using biologicals said they would try them if profitability were better proven. Growers and retailers want multi-season, multi-site evidence under their conditions, not just greenhouse data or a single season.

I’ve seen some founders try to bridge that gap with first-acre rebates to de-risk trials. This raises customer acquisition costs in the short term but can help build the multi-season proof buyers need. Seasonality makes this harder. Unlike weekly fermentation runs in food tech, crop inputs follow the calendar. Missing a season can delay validation by a year, an eternity for startups often on a tight runway.

3. Knowledge gaps and limited farmer training

It’s easy to assume farmers aren’t using biologicals because they don’t want to. More often, they just don’t know how. Even as interest grows, awareness and practical know-how remain limited. Biologics pioneer Dr. Pam Marrone notes that roughly half of growers still “don’t know about biologicals” or lack the training to use them effectively.

The gap isn’t just awareness. Biologicals often require different storage, handling, timing, and compatibility considerations than synthetics. For growers without a trusted advisor or agronomist, that added complexity raises the risk of misapplication. In those cases, sticking with the familiar can feel safer than experimenting with something new. Closing this gap requires hands-on technical support, not just marketing.

4. Poor compatibility with farming practices

As ATP Nutrition president Jarrett Chambers says, “logistics trumps technology.” Even the most promising science can lose out if it adds friction to day-to-day operations. Short shelf lives, special handling, and poor tank-mix compatibility add hassle in an environment where farmers are already juggling multiple inputs. Such complexity can kill adoption before products have a chance to prove themselves.

Distribution challenges make this worse in emerging markets. Mark Trimmer of DunhamTrimmer explains that in India, for example, cold-chain requirements can be prohibitive since “hundreds of retailers would need [refrigeration],” and that infrastructure simply doesn’t exist. Packaging sizes and formulations must also match the equipment farmers already own, or products risk being unusable from the start.

5. Fragmented and slow regulation

For much of the last decade, regulation has been a drag on adoption. Rules were fragmented, inconsistent, and slow to navigate, keeping many products in niche status.

In the US, the lack of a federal definition for “plant biostimulant” meant companies faced a patchwork of state requirements, slowing launches and inflating compliance costs. In the EU, products were regulated under slower national systems or plant-protection rules, with no mutual recognition between countries. In fast-growing markets like Brazil and India, outdated or unclear rules left companies waiting months or years for approval.

For farmers, this meant fewer proven products on the shelf, more reasons to doubt performance claims, and little incentive to change established crop programs. It’s no wonder the “snake oil” reputation stuck.

Where momentum is building

Against that backdrop of persistent barriers, several shifts in technology, market conditions, and farmer attitudes appear to be changing the trajectory for ag biologicals. The picture is still uneven, but things are heading in the right direction.

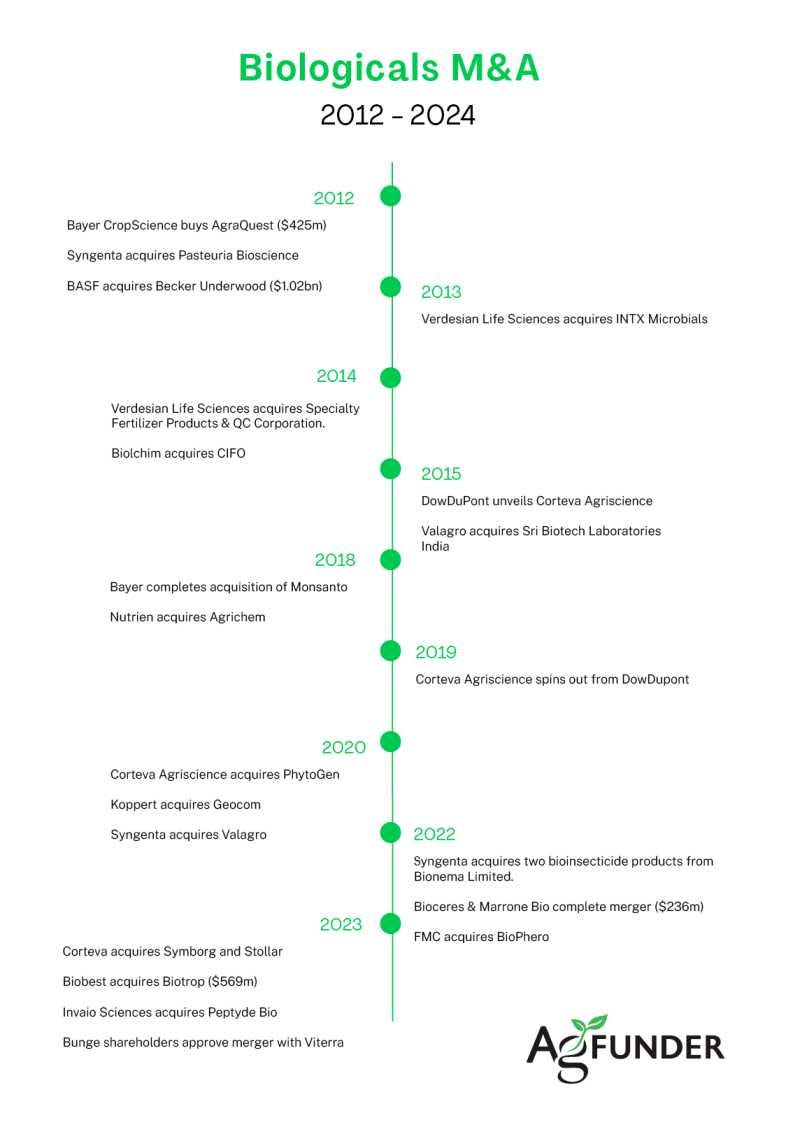

1. Big ag bets on biologicals

The centre of gravity is shifting from startups to industrial-scale players. Large agrichemical companies are integrating biologicals into their core strategies. This matters because big balance sheets, established channels, and integrated portfolios can accelerate adoption in ways startups alone can’t.

Corteva’s 2022-23 acquisitions of Stoller (for $1.2 billion) and Symborg (for $370 million) brought a global portfolio in biostimulants and microbials with 60‑plus‑country distribution. In 2023, the acquisitions contributed ~$420 million of net sales, and by 2024, the company guided to ~$500 million in biological sales, putting the category firmly in the core plan under “Corteva Biologicals.”

Syngenta, taking a build-and-buy approach, folded in Valagro and launched “Syngenta Biologicals” in 2023. It also partnered with Biotalys to add novel protein-based biocontrols. FMC acquired BioPhero and set a $1 billion pheromone revenue target by 2030, the kind of numbers that would put any category on notice.

Distribution leaders are also committed. Nutrien has expanded its Loveland portfolio with biocontrol assets and now positions biologicals as growth drivers on earnings calls. Speciality-crop players are scaling too. Biobest’s €532 million acquisition of Biotrop instantly created a LATAM bioinputs platform, while Koppert’s €140 million capital raise is funding new production and M&A.

These moves are not just portfolio padding, they change the go-to-market math. Large players can bundle biologicals with seeds and synthetics, underwrite multi-season trials, improve supply reliability and shelf life, and target placements where biology delivers the most value. This can lead to faster scaling, broader market penetration, and a higher probability that biologicals become part of standard crop programs rather than optional extras.

2. Shifting regulatory pressures

Policy changes have not made biologicals “easy,” but clearer definitions, harmonised data requirements, and more predictable timelines are reducing regulatory risk. This doesn’t guarantee performance, but it makes it easier for biologicals to be tested in mainstream programs and supported in long-term supply agreements.

In the European Union, since mid-2022, the EU Fertilising Products Regulation (FPR 2019/1009) has created an EU-wide category for plant biostimulants with CE-marking and mutual market access. The Commission’s 2025 FAQ and guidance address practical questions, while delegated acts keep the framework evolving. Microbial biostimulants are now explicitly defined around a short list of permitted organisms, reducing label ambiguity and testing disputes. On crop protection, the “low-risk” pathway offers longer approval periods (up to 15 years) and fit-for-purpose dossiers, with new guidance improving predictability for semiochemicals and microbial metabolites.

At the same time, parts of the conventional chemistry toolbox in Europe are running into constraints. The EU’s microplastics restriction begins phasing out many polymer seed coatings between 2028 and 2031. A broad PFAS restriction is progressing, and Brussels has floated tighter import rules for crops grown with pesticides banned in the EU. These changes don’t eliminate synthetics but raise compliance and formulation complexity, nudging programs to test biological and IPM alternatives.

In the United States, two things changed kind of recently. First, PRIA‑5 (enacted late 2022, in force since 2023) refreshed fees and statutory review timelines, giving sponsors more certainty on biopesticide decisions. Second, after years of patchwork rules, AAPFCO adopted a model bill and uniform definition for plant biostimulants in 2024, which states are now beginning to align their labels and claims.

EPA also states that biopesticides typically register faster and with leaner data packages than conventional chemistries, which matters for startup burn and retailer planning. The industry has reinforced this with the TFI “Certified Biostimulant” program, which anchors claims in the AAPFCO standard.

Over in Latin America, Brazil’s National Bioinputs Program (2020) culminated in the Bioinputs Law (Lei 15.070/2024), defining the category and setting rules for production, registration, commercialisation, and on-farm use. MAPA began issuing implementing acts in 2025, replacing regulatory grey zones with a unified framework that should improve distributor confidence and attract investment in manufacturing.

Here in Asia‑Pacific, India formalised plant biostimulants under the Fertiliser Control Order in 2021, introducing central registration and data requirements, and expanded specifications in 2025, raising quality standards and making claims more comparable. Australia’s APVMA has updated guidance that provides clear guidance for microbial and biochemical products and proportionate pathways for lower‑risk cases and clarifies data expectations, reducing uncertainty for such products.

3. Better science, stronger field results

Today’s biologicals have come a long way from the “bugs in a jug” era that cemented early scepticism. Advances in strain selection, modern fermentation, and formulation, from encapsulation to on-farm activation, are delivering more consistent performance across seasons and geographies.

Practical bottlenecks are also being addressed. Indigo’s on-farm CLIPS system, for example, uses a seed-box pod that applies biological seed treatments at planting, cutting steps for retailers and growers. Novonesis has extended shelf-life windows on select BioAg products and lists up to 30 days on-seed survivability for its US soybean inoculant line, reducing spoilage and timing risk. Encapsulation platforms like AgroSpheres are moving from R&D to practice, shielding actives from UV and pH swings while allowing controlled release.

Products are also starting to show stronger field-level evidence. Pivot Bio’s on-seed format reduces handling and timing friction for biological nitrogen. Company-reported 2024 results from 172 fields across 20 states showed yield parity while replacing about 37 lb/acre of synthetic nitrogen, with multi-year analyses suggesting positive ROI in certain contexts. Its N-OVATOR program has paid over $6 million to farmers by early 2024 for adopting and verifying microbial nitrogen use.

Field efficacy examples are now harder to dismiss. In crop protection, Vestaron’s SPEAR LEP peptide insecticide matched leading synthetics in 2024-2025 IPM trials on almonds and pistachios. BASF has also expanded labels for its Beauveria-based Velifer, signalling that these products are being slotted into real production systems, not just research plots.

Each incremental gain in shelf life, ease of use, and multi-season proof reduces perceived risk for farmers and retailers. This is the inflection point where adoption is less about belief in the science and more about whether products fit seamlessly into existing programs.

4. Digital and precision ag make biologicals more reliable

One of the biggest frustrations with biologicals has been timing and placement. Many products only work when applied under very specific conditions, like before a stress event, or in precise contact with a target pest. Digital agronomy can help close that gap. In the US, adoption of operations-focused technologies is already substantial: 61% of farmers report using digital agronomy services, and 51% use precision-ag hardware. These tools can identify when and where stress will occur, enabling more targeted applications that improve consistency.

A joint report by Cambridge Consultants and Agri-TechE suggests that integrating biologicals into existing precision-ag systems could simultaneously reduce the grower’s implementation cost and increase efficacy. That combination of lower cost per effective treatment and greater consistency across fields and seasons is what ultimately shifts adoption. Spot spraying, direct-injection hardware, and autonomous platforms are particularly well suited to biologicals, whose narrow application windows and selective modes of action have historically been liabilities.

Examples of this convergence are beginning to emerge. In January 2024, John Deere and Corteva announced a collaboration aimed at pairing digital equipment with biological inputs, an early sign of how mainstream players are building biologicals into existing agronomy workflows rather than requiring growers to overhaul their practices.

The potential is especially clear for biostimulants that mitigate abiotic stress. Many of these products work by priming plant defences, delivering the most benefit when applied just before or at the onset of stress. Weather-driven spray-timing tools and field-level sensing make those tight windows more predictable, raising the odds of applying the right product in the right field at the right time.

As digital workflows become standard, they improve application logistics and could reduce the variance that has long undermined confidence in biologicals. And as equipment, formulation, and data converge on per-plant targeting, multi-season ROI, once elusive, becomes easier to demonstrate at scale.

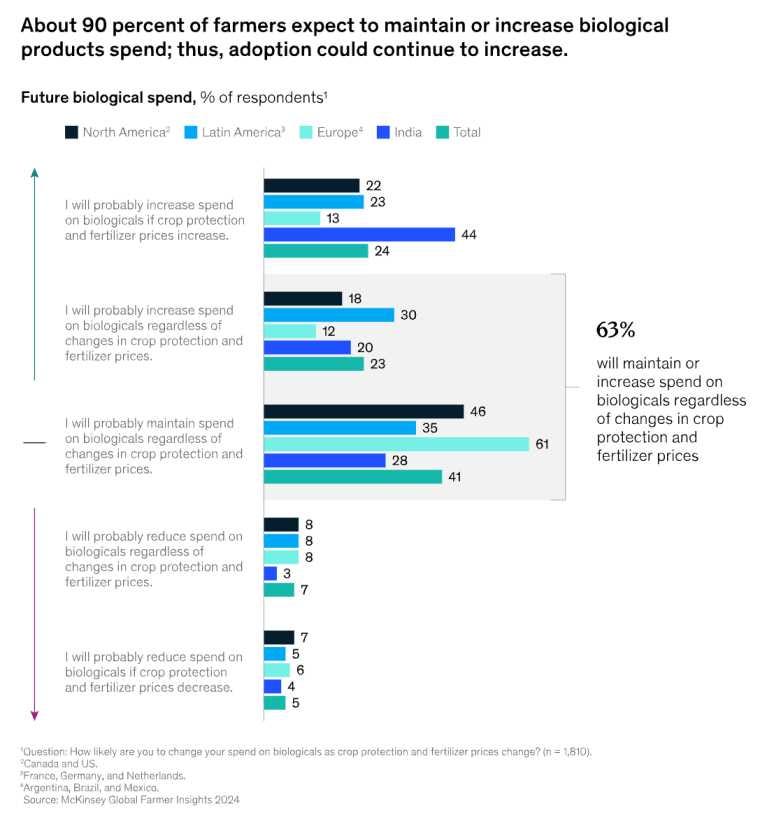

5. Rising adoption rates

After a long period of cautious trials, adoption is broadening. In US row crops, 45% of growers in 2024 reported using a biological product, up from 37% in 2022, with awareness also climbing to 87%. About 90% of farmers already using biologicals expect to maintain or increase spending, according to McKinsey’s multi‑country study, indicating that adoption is not only expanding but deepening. That said, headline adoption figures may not tell us if can many farmers are still in trial mode of using biologicals on a few acres or specific crops rather than fully integrating them at commercial scale.

That same study found input inflation and climate volatility are driving growers to try new tools. Producers across regions flagged higher input prices and extreme weather as top risks, with a priority on improving productivity through new products and practices, including biologicals.

The pattern is not limited to the US. In Brazil, more than half of farmers now use some form of bioinput, with applications covering 156 million hectares in 2024, a 13.4% rise from the previous year. In India, adoption has risen from 7% of farmers in 2022 to 11% in 2024, with biostimulant use jumping from 5% to 13%. In China, government data (translated from Mandarin using ChatGPT, sorry for any misinterpretations) show green prevention and control, which is an umbrella category that includes biological controls, pheromones, microbial pesticides, and other eco-friendly methods, covering 54.1% of major-crop pest/disease management area in 2023, rising to 57.7% in 2024.

Uptake is no longer confined to early adopters or niche crops. Penetration in major row crops and large markets like Brazil and India shows that biologicals are moving into the commercial mainstream.

Final thoughts

Biologicals will not replace synthetics everywhere, certainly not anytime soon. The more practical future is one where biology earns a stable role in mainstream crop programs because it is reliable, easy to use, and economically sensible under real farm conditions.

That shift depends less on a single breakthrough and more on getting the system right: consistent field performance, strong distribution, friction-free formulations, clear labels and claims, and digital tools that get the correct timing. When those pieces come together, the “snake oil” narrative fades because the product behaves like any other trusted input.

For founders and investors, the risk profile is shifting. Scientific risk is giving way to scale and execution risk of manufacturing reliability, shelf life, compatibility, agronomy support, and channel incentives.

If momentum continues, so will integration. Biologicals will be bundled with seeds, nutrients, and chemistries, prescribed through the same digital tools, financed on similar terms, and warranted by the same channel partners. In that world, farmers are not “trying a biological,” they are running a program that happens to include one.

If you found value in this newsletter, consider sharing it with a friend who might benefit from it! Or, if someone forwarded this to you, consider subscribing.

Hi Eshan! How are you doing on this wonderful day? Excellent issue #113! You're doing the Lord's work my hard working talented friend. I was thinking that the real game changer will be when a company makes an alt protein fermented device, something like a refrigerator or even a microwave. This appliance can be bought from Amazon. The User would buy starting cell cultures from Amazon or a website. This is a game changer for poor nations and rural communities. When people can make their own alt meat at home with little effort and the product is real 'meat.' Especially if it costs less than factory farmed meat. So I throw this idea 💡 out into our marvelous Universe. Love ❤️ your great work Eshan. Have a very nice and peaceful week 😊

Excellent post. The manufacturing supply chain for ag biologicals is highly fragmented and of dubious quality - we have a team focused on this at Biosphere.