Alt Proteins Raised $235M in Q1, Tetra Pak Supports Animal-Free Dairy Scale-Up, and UAE Grows the World’s Highest-Protein Wheat

Also: Phytolon and Ginkgo Bioworks have tripled the efficiency of colour-producing yeast for natural food colouring, amid synthetic dye phase-out.

Hey, welcome to issue #101 of the Better Bioeconomy newsletter. Thanks for being here! 👋🏾

This week, alt protein funding jumped 102% from Q4 2024, with fermentation companies leading the charge, even as investors stay cautious in a high-interest world.

Standing Ovation teamed up with Tetra Pak to streamline production of animal-free caseins. Phytolon and Ginkgo tripled the output of bio-based food colours, just as regulators move to ban synthetic dyes.

Over in the pet aisle, MicroHarvest’s fermented protein is winning over cats and dogs. And in the UAE, a biotech-bred wheat variety is thriving in desert conditions with world-record protein levels.

Alright, let’s dig into the latest updates on how biotech is transforming food and agriculture for a climate-friendly food system.

BIO BUZZ

Products, partnerships, and regulations

🇺🇸🇮🇱 Phytolon and Ginkgo Bioworks have tripled the efficiency of colour-producing yeast for natural food colouring, amid synthetic dye phase-out

Phytolon’s natural colours are developed using baker’s yeast fermentation and enhanced by Ginkgo’s AI modelling expertise. As part of their ongoing multi-product collaboration, Ginkgo received additional equity to pursue future projects aimed at sustainable and cost-efficient food colour development.

With US regulators aiming to phase out synthetic dyes by 2026, companies like Phytolon are well-positioned to offer natural, consistent, regulation-compliant alternatives like “beetroot red” and “prickly pear yellow.”

Phytolon targets food categories like salty snacks, yoghurt, and baked goods, where its high-purity colours can offer both strong performance and better cost efficiency compared to other natural alternatives.

Source: Food Ingredients First

🤔 Thoughts:

Tightening regulations on artificial food-color additives is accelerating the shift toward bio-manufactured alternatives, with biotech startups helping brands stay compliant without sacrificing performance. Regulatory pressure has become an innovation catalyst, and synthetic biology is stepping in to fill the gap.

As certain synthetic dyes face restrictions in key markets, demand for scalable, affordable replacements continues to grow. This breakthrough between Phytolon and Ginkgo shows how fermentation could move bio-based colors closer to the required volume and price points.

Moves like this hint at a new supply chain model for food brands. One that’s increasingly decoupled from traditional agriculture and built around programmable, fermentation-based infrastructure.

🇫🇷🇸🇪 Standing Ovation partners with Tetra Pak to optimise downstream processing of precision-fermented caseins

The strategic partnership centres on improving key processes like separation and purification in downstream operations, using Tetra Pak's advanced technology to make the French startup’s production more efficient.

As part of the deal, Tetra Pak will supply equipment and support the design and construction of both pilot and industrial-scale units, tailored to Standing Ovation’s patented fermentation process.

The collaboration aims to accelerate the launch of Advanced Casein, Standing Ovation’s flagship animal-free protein designed as a sustainable alternative to traditional dairy.

Source: FoodBev Media

🤔 Thoughts:

Standing Ovation’s microbes already produce animal-free casein, but scaling from lab to full-scale factory runs remains costly and complex. Downstream processing alone can absorb ~30 % of plant CAPEX. By tapping Tetra Pak’s filtration trains, membrane know-how, and QA systems, the startup keeps its focus on upstream (eg: strain engineering) while the incumbent tackles the biggest remaining cost line.

More broadly, equipment giants are positioning as platform integrators for biomanufacturing. Their stainless-steel expertise plugs neatly into the alt protein stack, offering turnkey modules any microbe-design outfit can slot in. If partnerships like this keep chipping away at DSP costs, precision-fermented dairy could inch toward price parity and cement a new division of labour: startups own the biology, incumbents deliver the scale, similar biotech-CMO dynamics in pharma.

🇺🇸 Earth First Food Ventures and DeNovo Foodlabs formed PFerrinX26, a JV to produce bovine lactoferrin at scale using precision fermentation

The 50:50 joint venture (JV) is aiming to produce 300 tons of bovine lactoferrin annually within the next 10 years through precision fermentation using DeNovo’s high-yield strains.

Lactoferrin, an iron-binding antimicrobial protein found in milk, can cost up to $650/kg due to limited supply from traditional sources. Precision fermentation could help make it more accessible, with potential uses expanding into adult and performance nutrition.

Unlike most competitors who use co-manufacturing, Earth First Food Ventures opts for in-house production facilities with backing from a major global foundation, precision fermentation partners, and 6–7 committed off-takers across various nutrition markets.

Source: AgFunder

🤔 Thoughts:

This feels a bit like lactoferrin’s insulin moment. When fermentation made insulin widely available, it didn’t just replace an animal-derived source, it reshaped how we thought about access, pricing, and regulation, eventually enabling new treatment models. We could be seeing the early stages of something similar here.

With current prices, lactoferrin has remained a niche additive, used sparingly in infant formulas and supplements. The JV aims to cut that to under $300/kg while adding meaningful volume, enough to shift lactoferrin from “rare bonus” to “functional baseline” in a wider range of products.

If they succeed, the ripple effects could be significant: formulators may rethink how they build immune or gut health claims into foods, and incumbent dairy players could lose one of the few high-margin ingredients extracted from whey. Like insulin, the first win is access, but the long game is what new applications become viable once the economics shift.

🇩🇪 Most pets showed a strong preference for MicroHarvest’s microbial protein over a conventional formula

In palatability trials, 68% of cats and 58% of dogs picked MicroHarvest’s MPX, a fermentation-derived protein, before the conventional option.

The MPX-based kibble also led to a notable increase in food intake. Cats ate nearly 50% more and dogs 44% more, suggesting that the product appeals in taste and consumption quantity.

Owners backed this up, with 75% of cat owners and 90% of dog owners saying their pets ate the same or more than usual.

Source: vegconomist

🤔 Thoughts:

Palatability has been one of the biggest hurdles for novel pet proteins. Especially for cats, notorious picky eaters. By showing cats and dogs willingly over-consume a microbial-protein kibble, MicroHarvest turns the conversation from “Will pets accept this?” to “Can we hit the right cost and supply milestones?”

That matters for procurement: once taste risk is lower, big pet food brands can justify long-term offtake contracts, giving startups bankable demand for new plants. The next gating items are price parity, regulatory clearance, and proving digestibility at scale, but the taste question just moved down the risk register.

🇦🇪 Mleiha Wheat Farm developed a wheat variety with 19.3% protein, the world’s highest, to enhance food security and export potential

Sharjah’s Mleiha Wheat Farm has cultivated the high-protein wheat on 1,400 hectares of desert terrain, using AI-driven irrigation systems and organic farming methods to yield an anticipated 6,000 tonnes of high-protein wheat this season.

With less than 2% of the UAE's land classified as arable and a 90% reliance on food imports, this innovation represents a meaningful step toward greater self-sufficiency.

The farm’s resilient Sharjah 1 wheat variety, designed to withstand high salinity and drought, was developed through biotech-led genetic improvement, selected from over 1,450 tested strains, and is grown using clean, desalinated water.

Source: Green Queen

🤔 Thoughts:

This project shows how tech innovation could help address some of agriculture’s toughest conditions. It’s a kind of “terraforming Earth”, not to support human life, but to grow crops in places once seen as too harsh for farming.

In a world shaped by climate volatility and geopolitical risk, including recent grain supply disruptions from war, building domestic, high-tech farming systems could offer a new form of resilience and sovereignty.

The emphasis on nutrient density over yield is also telling. High-protein staples like this wheat variety could ease pressure on animal-based protein sources, provided quality and bioavailability stack up. For food manufacturers, it may eventually reduce the need for fortified blends, offering cost savings in reformulation and streamlining ingredient sourcing for things like pasta or baked goods.

🇺🇸 BlueNalu plans California debut for its cultivated bluefin tuna, with partnerships in place to take the product global

BlueNalu has filed for FDA approval in the US and aims to debut its cell-cultured bluefin tuna toro in San Diego. The city’s strong food culture and health-conscious consumers make it a fitting starting point.

The company is also expanding globally, focusing on markets with clear regulatory paths and strong partnerships. It’s seeking approval in Singapore, taking part in the UK’s cultivated meat sandbox, and exploring options in Asia-Pacific and the Middle East.

BlueNalu is targeting species like bluefin tuna that already carry high market value. This reduces the price gap between traditional and cultivated versions while highlighting advantages like safety, consistent quality, omega-3 content, and sustainable production.

Source: Green Queen

🤔 Thoughts:

By launching through high-end foodservice, BlueNalu positions cultivated toro in the part of the market where wild supply is most volatile and quality expectations are highest.

For distributors, cultivated protein becomes a strategic hedge as wild toro grows more unreliable and harder to source sustainably. If cultivated seafood can consistently fill these premium gaps, it could secure a long-term role in high-margin supply chains.

And by normalising the “cultivated” label in fine dining first, BlueNalu lowers the lift required to win over mainstream consumers and supports broader industry adoption, provided cost and throughput challenges are solved quickly enough to meet downstream demand.

🇳🇱🇸🇬 Dutch startup Meatable is partnering with a newly launched TruMeat to build a cultivated meat facility in Singapore

Singapore-based TruMeat is led by industry veterans with strong experience in large-scale biomanufacturing and cell culture media production. Meatable, which has already submitted regulatory filings in Singapore, plans to accelerate the development of cultivated meat infrastructure across Asia.

The pilot-scale production facility, built on Meatable’s proprietary technology, is set to begin construction later in 2025, contingent upon new funding being secured.

Once operational, the facility aims to be the “first in Singapore” to produce cultivated meat at the cost and scale needed to support product testing, development, and commercial launch.

Source: AgFunder

BIO BUCKS

Funding, M&As, and grants

🌏 Alternative protein companies raised $235M in Q1 2025, with over 60% going to fermentation-focused ventures

While this marks a 28% drop compared to the same time last year, it's also a 102% jump from Q4 2024. Fermentation companies led the way with $146M in funding, followed by $54M for plant-based and $35M for cultivated proteins.

Four major deals stood out: Formo raised $36M, Vivici brought in $33.8M, Liberation Labs secured $31.5M, and Aleph Farms landed $29M. The top three highlighted continued investor interest in precision fermentation.

Even as inflation eases in some regions, persistent high interest rates and geopolitical uncertainty are keeping investors cautious. For alternative protein startups, finding creative ways to attract capital remains essential.

Source: Good Food Institute

🇺🇸 Synthesis Capital invested in Pow.bio to help unlock reliable, cost-effective biomanufacturing

Pow.Bio’s continuous fermentation platform boosts productivity by 2-5x and cuts unit costs by 50–80% compared to fed-batch methods.

By tackling long-standing issues in continuous fermentation like sterility, genetic stability, and process control, through proprietary media, dual-bioreactor design, and AI process management, Pow achieves stable, high-yield outputs over time.

Designed to work with existing equipment, Pow’s system can be retrofitted at around 1% of the cost of building new facilities, enabling faster and more cost-effective scaling. Its broad applicability across microbes and product types positions it to serve a large portion of the $800B biomanufacturing market.

(More on Pow.Bio in the ‘Ear Food’ segment of today’s newsletter!)

Source: Synthesis Capital

🇧🇪 Paulig’s venture arm PINC invested in Rainbow Crops to develop climate-resilient crop varieties

Rainbow Crops, a spin-off from research institute VIB, has a proprietary Trait Foundry™ platform. The platform integrates AI, gene editing, and automated phenotyping to enhance complex traits such as drought tolerance, heat resilience, and input efficiency, which are challenging to breed for.

This investment marks PINC’s third in 2025, reinforcing Paulig’s mission to promote a food system that benefits both people and the planet.

With corn as the initial POC crop, the Belgian agtech startup is aligned with commercial needs, especially relevant to Paulig’s product lines such as corn chips and tortillas under brands like Santa Maria, Poco Loco, and Zanuy.

Source: Paulig

🤔 Thoughts:

The backing of Rainbow Crops by Paulig’s venture arm shows that food and CPG companies are no longer waiting for upstream ag players to address climate-related risks to their supply chains. They are becoming active participants in crop innovation. Instead of relying on seed companies to eventually deliver resilient varieties, manufacturers are funding targeted solutions to secure their ingredient supply.

This reflects a deeper form of supply chain alignment where downstream players set sustainability targets and actively fund upstream innovation, like drought-tolerant or low-input crops, to achieve environmental and sourcing goals.

That could accelerate deployment, especially when corporate buyers drive farmer adoption. For agtech startups, it opens a faster path to scale through built-in offtake, validation, and distribution. In the long term, such integration could lead to co-developed proprietary crop varieties tailored to specific company needs.

GEEK ZONE

Latest scientific research papers

☀️ A one-time spray of a sunlight-activated sugar signal boosted wheat yields by up to 17%, no extra water or fertiliser needed

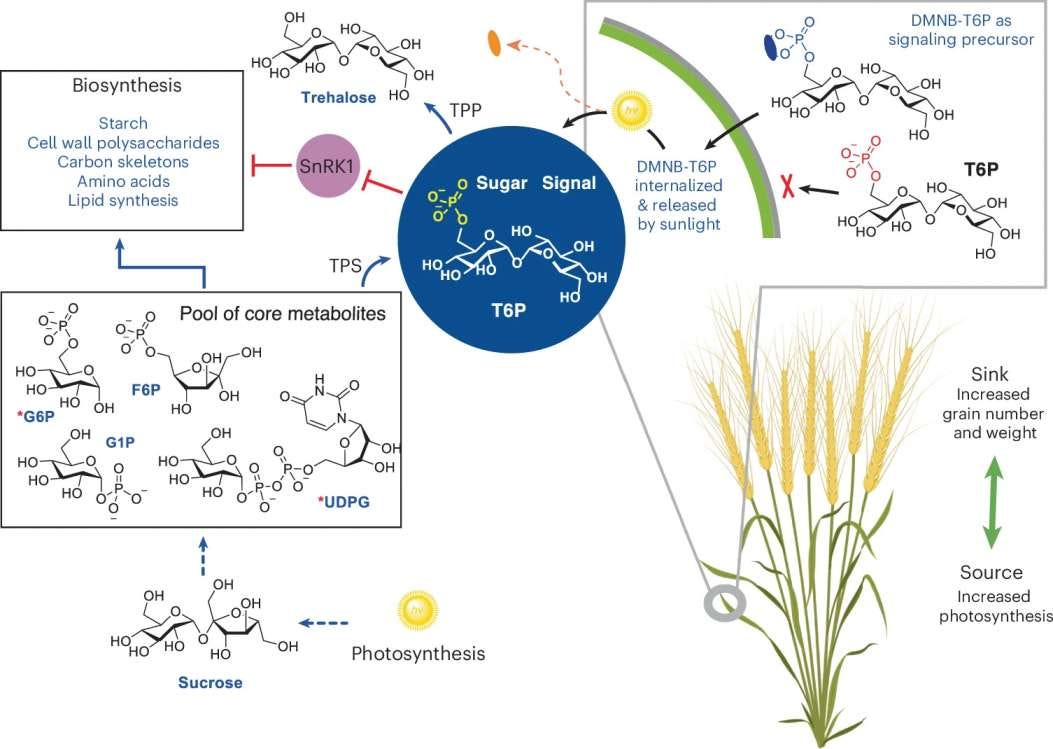

Researchers engineered a sunlight-activated, plant-permeable precursor (DMNB-T6P) that triggers the trehalose-6-phosphate (T6P) pathway to enhance carbon fixation and grain starch biosynthesis. Applied as a single foliar spray during early grain fill (10–16 days after anthesis), the treatment was tested across 7 wheat genotypes in 4 years of field trials under irrigated and rainfed conditions.

The spray increased wheat yields by an average of 10.4%, with peaks of +17% under optimal rainfall and +9.3% in drought years. Yield gains came from grain number and weight, with no dilution in protein content. Performance was consistent across genotypes, and similar gains (+11–24%) were observed in sorghum and barley under controlled conditions.

This non-GMO biostimulant offers a scalable way to boost cereal crop yields under optimal and water-stressed conditions at a projected cost of just a few cents per hectare.

Source: Nature Biotechnology

🌾 Rice plant length grew by up to 78%, and biomass increased by 195% when treated with selected bacteria under high heat stress

As rising temperatures continue to challenge rice production and affect beneficial bacteria, this study looked at five endophytic strains from Asian cultivated rice (Oryza sativa). Under 40 °C conditions, these strains helped boost rice growth, with Bacillus coagulans LB6 showing the highest biomass gain at 195%.

The bacterial treatments also improved chlorophyll SPAD values, raised phytohormone levels (especially abscisic acid, ABA), lowered lipid peroxidation by 68%, and increased proline accumulation. Together, these changes point to stronger photosynthesis, better stress response, less oxidative damage, and improved heat tolerance.

Among the strains, LB6 showed particular promise as a biofertilizer for enhancing rice thermotolerance, supporting future research into gene expression and combined fertiliser strategies.

Source: Microorganisms

🧬 Engineered cotton to produce the antioxidant astaxanthin, delivering a triple benefit: higher yield, better nutrition, and lower toxicity

Scientists engineered cotton to produce astaxanthin, a red pigment and antioxidant, using either one gene (CrBKT) or a combination of four genes. Interestingly, the single gene was enough to boost production, with no extra gain from the multi-gene setup.

Plants with the Crbkt gene developed larger, heavier seeds, suggesting that carotenoid pathways might support seed growth. They also had much lower levels of gossypol, a natural toxin that limits cottonseed's edibility.

The study shows that cotton engineered for astaxanthin production could be a scalable, cost-effective biofactory, offering a nutrient-rich, lower-toxicity alternative for human food, animal feed, and functional ingredients.

Source: Plant Biotechnology Journal

EAR FOOD

Podcast episode of the week

🎧 Unlocking scalable biomanufacturing with AI-enabled continuous fermentation

Hosts: John Cumbers

Guest: Shannon Hall, co-founder and CEO of Pow.bio

Pow.bio’s continuous fermentation system keeps microbes in a high-performing state for extended periods, enabling multi-week runs with better yields, lower utility use, and smaller bioreactor footprints. Compared to traditional fed-batch setups, this leads to notable gains in volumetric productivity.

Beyond hardware, Pow.bio also integrates an AI agent that fine-tunes process parameters during steady-state fermentation. This setup generates hundreds of data points per run and can boost productivity by 2–3x in just a few iterations.

Their digital twin software models fermentation in real time, offering live, guided adjustments that are useful for managing variability across batches and fluctuations in feedstock quality.

Current use cases span precision-fermented dairy proteins like lactoferrin and casein, industrial enzymes, and biomass for probiotics and ag inputs, areas where performance and scalability matter.

Pow.bio’s modular platform supports the trend toward more flexible, distributed biomanufacturing that is well-suited for regional pilots, new ingredient development, and cost-efficient retrofits of existing sites.

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Got any feedback/suggestion? Drop them here:

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organizations I am associated with.