Chicken From a Feather, Precision Fermentation to the Moon, and Cultivated Meat Nears Europe

Also: The alternative protein industry may be at peak pain

BIO BUZZ

🇨🇳 CellX has successfully completed a 200 L fish cell pilot production, a significant milestone towards industrial application of cultivated seafood

The Shanghai-based startup has developed a high-mobility technology platform that allows rapid progress in suspension culture of fish cells, achieving in six months what typically takes one to two years.

The company’s production cost of fish cells is lower than 400 yuan per unit (below $55) and under $100 per pound. Industrial-scale manufacturing is expected to bring the cost down further.

CellX aims to target the high-end market initially and leverage Chinese government incentives for cultivated meat to lower costs and promote sustainable fisheries development.

Read full article - Green Queen

🌭 The Cultivated B enters pre-submission phase for regulatory approval to sell hybrid cultivated meat products in Europe

The company will become the first biotech company to apply for EFSA certification for cultivated meat, provided there are no other applications during this period.

Aleph Farms previously applied for regulatory approval in Switzerland but would still require European Commission authorization for market placement in Switzerland.

The approval process for Novel Food Regulation in the European Union is rigorous and expected to take at least 18 months.

Read full article - vegconomist

🇬🇧 Hoxton Farms has opened the “UK's first” pilot production facility for cultivated animal fat

The facility features specialised laboratories, a food development kitchen, and a hardware workshop for manufacturing bioreactors, designed to improve fat cell growth while reducing capital costs.

Hoxton Farms' technology platform, blending computational biology and mathematical modelling, plays a vital role in scaling production and developing prototype products with partners.

Hoxton Farms’ team will be able to increase production capacity to 10 tonnes of cultivated fat each year, with the company on track to reach cost-parity with plant oils at commercial scale.

“Cultivated fat is the missing ingredient for creating irresistible meat alternatives.” - Max Jamilly, Co-Founder of Hoxton Farms

Read full article - Future of Protein Production

🪶 A team at the University of Trento in Italy is making chicken meat with a feather

The cells are extracted from feathers obtained by petting the chick, and these cells can be grown successfully for months, yielding tens of millions of cells from a few initial ones.

The first phase of the project financed by the Italian Save the Chickens Foundation has been completed, successfully identifying feather types and optimal conditions for obtaining and growing chicken cells.

The ultimate goal is to develop chicken cell lines suitable for cultured meat production, with plans to continue with subsequent project phases.

Read full article - vegconomist

🍔 Shake Shack partnered with Zero Acre Farms to trial Cultured Oil on select menu items by swapping soybean oil

Zero Acre's Cultured Oil is a more eco-friendly and healthier cooking oil made from rain-fed sugarcane, offering a neutral taste and a 90% smaller environmental footprint compared to conventional vegetable oil.

The partnership aims to replace vegetable oils, which are widely used and account for a significant portion (20%) of American calories, with a healthier and planet-friendly alternative.

Shake Shack is actively pursuing sustainability initiatives, including waste reduction, ethical sourcing, and renewable energy use, recognising the importance of ESG goals for its brand image and reputation.

Read full article - Green Queen

🇸🇪 Mycorena and Atria Sweden are forming a strategic partnership to develop sustainable mycoprotein products

Mycorena specialises in mycoprotein production using a proprietary fungal fermentation process, aiming to become a global supplier of sustainable mycelium-based products and technologies.

Atria Sweden, a leading meat and food company in Northern Europe, is committed to a carbon-neutral food chain and plans to use mycoprotein to create climate-smart meat substitute products.

The partnership sets out to revolutionise the global mycoprotein supply, benefiting from Mycorena's production expertise and Atria's product development capabilities to meet the growing demand for sustainable protein sources in the European market.

Read full article - Future of Protein Production

🇮🇱 Meatafora’s collaboration with Technion Israel Institute accelerates its premium cultivated meat product development

The collaboration with Technion has led to two important milestones:

The development of an oleogel fat substitute to improve the taste and texture of cultivated meat

The creation of edible, plant-based microcarriers to scale up cultured meat production

The company’s mission is to provide a premium cultivated meat product that is highly nutritious and cost-efficient using a scaleable process that it claims can reduce costs by up to 50%.

Meatafora recently completed a multi-million dollar funding round led by New Gate Capital, which will support further R&D efforts and help execute its go-to-market strategy.

Read full article - vegconomist

📦 Meati opens online D2C store with a subscription for mycelium steak, chicken and new mystery products

The Innovation Kitchen Subscription is priced at $169. It provides customers with Meati’s current products and introduces new and innovative alt-meat products every month. Subscribers get exclusive access to these new releases.

Meati values customer feedback and will use it to shape its product and sales strategies. This engagement approach rewards loyal customers and helps the company adapt and improve its offerings based on consumer preferences and needs.

Meati's strategy to engage directly with its customers and innovate in response to their feedback shows a forward-thinking approach to navigating the competitive landscape.

Read full article - Green Queen

🇩🇪 Alzchem Group is launching an animal-free creatine designed for the food industry

Creatine, available in small amounts in meat and fish, has potential benefits for athletes, including increased strength, injury prevention, and muscle mass. It also has potential benefits for cognition, bone health, and skin aging.

The new product, Creavitalis, is a tasteless powder that can enhance the nutritional value of plant-based meat alternatives, making them equivalent to animal meat in creatine content.

The product has approvals from European and US authorities, offering opportunities for manufacturers of meat substitutes to enhance the nutritional profile of their products without requiring special approvals.

Read full article - vegconomist

🇭🇰 Geb Impact Technology publishes findings on optimising microalgae cultivation for high-productivity biomass production

The paper, published in Algal Research journal, highlights that fine-tuning factors like LED lighting, medium composition, and cultivation duration significantly improve protein and paramylon content, leading to a more valuable biomass.

The Hong Kong-based biotech company’s technology enables the production of high-protein Euglena gracilis biomass with increased productivity and shorter cultivation times, offering potential cost savings for commercial applications.

High-protein Euglena biomass has superior digestibility compared to Spirulina and Chlorella, making it a sustainable and nutrient-rich ingredient that is capable of contributing to the mitigation of food insecurity challenges.

Disclaimer: I work there!

MACRO STUFF

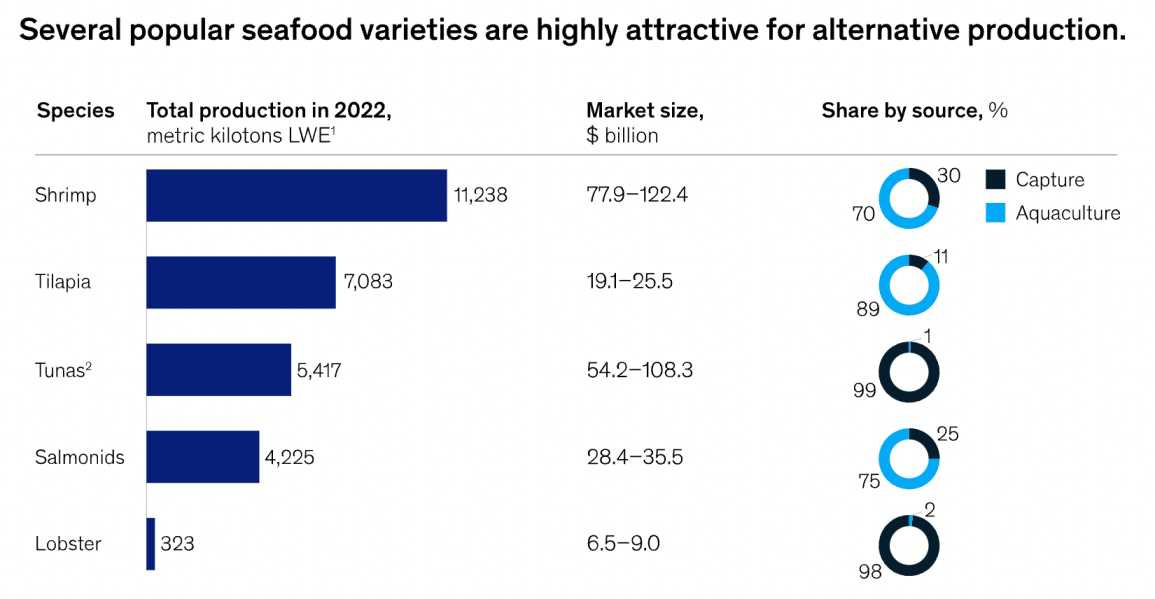

🐟 McKinsey report highlights the significance of alternative proteins in addressing the challenges faced by the seafood industry

Despite the overexploitation of 85% of global fish stocks, demand for seafood is still on the rise. Traditional aquaculture alone cannot meet this demand. Fish alternatives have the potential to address the growing demand for seafood while mitigating environmental concerns in the seafood industry.

Conventional seafood production faces challenges like limited licences, mercury contamination, and long-distance transportation, which alternative seafood does not encounter.

To succeed, alt seafood producers must lower prices, improve taste, and invest in R&D to gain consumer acceptance. Increasing investments and year-over-year growth in seafood alternatives indicate their potential impact on the industry.

Read full article - McKinsey & Co.

😖 The alternative protein industry may be at or close to ‘peak pain’

In 2021-2022, the alt protein market faced challenges, with U.S. plant-based meat sales stagnating or declining, leading to concerns that the sector was a passing trend or in decline.

Monetary expansion and fiscal policies influenced the alt protein sector, increasing funding to startups. However, rising inflation and interest rates negatively affected companies, leading to a downturn in early 2022.

Despite the challenges, there is optimism that the alt protein sector will rebound. This optimism is based on expectations of consolidation, reassessment of products and valuations, and a continued focus on developing sustainable alternatives to address environmental concerns related to the global food system.

Read full article - Unovis Asset Management on Substack

💡 CellRev's new white paper explores the challenges and opportunities in commercial-scale cell manufacturing

The white paper highlights the need for innovation and substantial investment in large-scale facilities to make cultivated meat products mainstream and economically viable.

Increased investment in large-scale facilities can pave the way for automated production methods, reducing the reliance on skilled labour. Moreover, adapting equipment and processes specifically for growing animal tissues can improve the industry's scalability.

The paper also highlights promising trends such as decreasing processing costs, financial support from some governments, and the potential for regulatory approvals in more countries. These factors provide optimism for the future of commercial-scale cell manufacturing in the cellular agriculture industry.

Read full white paper - CellRev

New here? Devour the free subscription and join a list of founders, investors, and biotech enthusiasts leading the food revolution!

BIO BUCKS

🚀 The global precision fermentation ingredients market is projected to grow from $2.8B in 2023 to $36.3B by 2030, at a CAGR of 44%

Startup activity in precision fermentation, driven by increased investor interest, is a major growth driver. Additionally, it’s fueled by rising concerns for animal welfare, environmental sustainability, and demand for alternative proteins.

Key market highlights include growth in the pharmaceutical and meat and seafood segments, with precision fermentation enabling cost-effective production of biopharmaceuticals and meat alternatives.

The APAC region is expected to witness the highest growth, driven by the adoption of meat-free diets and rising demand for precision-fermented egg alternatives.

Read full article - Research and Markets

📉 More deals, less money – food tech VC funding continues to fall for the sixth consecutive quarter

The food tech VC space received $2.2 billion of deal value across 268 deals in Q2 2023. That value is down by 13.9% compared to Q1 and has shrunk by over 70% year-over-year.

Marking a 13% increase in deal count – 268 deals in Q2 compared to 237 in Q1, senior analyst Alex Frederick said this may be an indication of returning investment activity.

Given rising interest rates and the closure of Silicon Valley Bank, many investors are waiting on the sidelines while staying cautious and selective towards investments. There are still high levels of dry powder to be deployed if valuations come to a reasonable level.

Read full report - AgFunder

📈 Plant-based meat sales to reach $139.4B by 2035, according to a report by Ernst & Young

Plant-based dairy sales are expected to grow from $14.4 billion in 2021 to $51.3 billion in 2035.

The study is conducted based on data provided by the FAO, GFI, and other sources to evaluate various factors, including increased price sensitivity, tight labour markets, higher preference for healthy foods, and rapid growth in emerging markets.

The CEO of Protein Industries Canada remains optimistic about the plant-based meat sector despite the short-term economic challenges; its latest $10 million fund is focused on plant-based food tech projects using artificial intelligence.

Read full report – Protein Industries Canada/Ernst & Young

SOCIAL FEAST

🫡 Cultivated meat is not guaranteed to succeed, but it’s a moonshot worth taking

The cultivated meat industry faces serious challenges, and it's not guaranteed to succeed. While cultivated meat may not be guaranteed, there is hope that with scaling and technological advancements, it could become a viable solution in our lifetime.

Meat demand is rapidly rising, and some governments are even reversing their commitments to move away from factory farming due to the demand for cheap meat.

The taste and accessibility of meat alternatives are crucial to consumers, and the science behind cultivated meat is still in its early stages. Venture capitalists are taking a high-risk, high-reward approach, and while there are naysayers, the industry is addressing the pressing issue of meeting meat demand with limited resources.

Read post on LinkedIn - Jennifer Stojkovic

💪🏾 Optimism, re-evaluations, and urgency: Reflections from The Good Food Conference

The Good Food Conference featured discussions about the challenges facing the alternative protein industry, including difficulties, survival strategies for companies, and the need to continue pushing forward.

Instead of powering through, most attendees were focused on re-evaluating current approaches to find optimal solutions for building a sustainable and caring food system.

Despite the challenges, there is optimism and a commitment to challenging existing hypotheses and working collectively to push the food system in the right direction with energy and urgency.

Read post on LinkedIn - Steve Molino

🤝 Student leaders, collaborative futures, and industry resilience: Reflections from The Good Food Conference

Student leaders and scientists play a crucial role in advancing alternative protein innovations, and the future of food systems will be shaped significantly by their efforts.

Alternative proteins are not a passing trend but are essential for addressing food security and climate change in the future. The resilience and adaptability of the industry demonstrate its significance.

Collaboration among industry leaders is necessary to scale the alternative protein sector, including joint manufacturing facilities and the introduction of cellular agriculture. Additionally, diversification beyond alternative proteins is needed to address gaps in fats, oils, fibers, and related solutions.

Read post on LinkedIn - Samyak Baid

Got a taste for this newsletter? Dish it out to your friends!👇🏾

EAR FOOD

🎙 This week in alternative protein

Show: Green Queen Alt Protein Weekly

Host: Sonalie Figueiras, Steve Molino

McDonald’s Netherlands is introducing four new meatless products to its range and has listed them before beef on menus. The new product range is an important step for the world’s largest food chain, as the fast-food sector aims to meet consumers’ plant-based demands.

Upside Foods is building a new commercial-scale manufacturing facility for cultivated chicken products near Chicago. However, in light of a recent article that investigated Upside’s production capabilities, questions regarding the company’s capital allocation were raised.

Alpro, a plant-based dairy leader, has undergone a packaging redesign, focusing on highlighting ingredients and emphasising the product's quality. And PepsiCo-owned Muscle Milk is launching ready-to-drink plant protein shakes, potentially challenging the traditional perception of protein sources in the fitness industry.

🎙 Conversation with Aleph Farms’ Didier Toubia

Show: Green Queen in Conversation

Host: Sonalie Figueiras

Guest: Didier Toubia, co-founder and CEO of Aleph Farms

Didier's interest in cultivated meat stems from a desire to address systemic issues in the food system, particularly related to food security, sustainability, and public health. He sees cultivated meat as a solution to decentralising food production and making the food system more resilient.

Aleph Farms is focus on cultivated beef cultivation is driven by its high environmental impact, with cattle farming being a major contributor to greenhouse gas emissions, land use, and water consumption. The company aims to reduce these environmental impacts significantly through cultivated beef.

Didier highlights the importance of perceiving cultivated meat as an evolution of food culture rather than a processed or unnatural product. He talks about why Asia will likely be the most important market for cultivated meat in the next decade and why Africa needs cellular agriculture more than Europe and the US.

THAT’S ALL FOR THIS WEEK!

Take care, and have an awesome week! 🙌🏾

Are you new here?

Know any other geeks who would dig this newsletter?