China’s Alt Protein Insights, Germany Continues to Impress, and Will the UK Go 50by25?

Also: It’s the cow, not the how

BIO BUZZ

🇬🇧 50by25 campaign aims to encourage UK restaurants to make 50% of their menus plant-based by 2025

The initiative, led by British vegan charity Viva! and Citizen Kind co-founder Emma Osborne, seeks to address the significant environmental impact of the UK food sector (accounts for 35% of the country's emissions) by promoting plant-based meals and reducing meat consumption.

Notable food industry players, including Wagamama, Beyond Meat, and renowned chefs like Alexis Gauthier, have joined the 50by25 pledge, demonstrating a collaborative effort to drive the transition towards more sustainable and plant-based dining options.

The campaign plans to engage consumers through a visible logo on menus and windows, providing a tangible way for diners to support restaurants that have embraced the 50% plant-based menu goal. The initiative aims to become a widespread movement similar to Veganuary, encouraging a climate-positive approach to dining out.

Read full article - Green Queen

🍼 TurtleTree obtained first-ever self-affirmed Generally Recognized as Safe (GRAS) status for its precision-fermented lactoferrin protein

The Singaporean food tech startup plans to sell its lactoferrin product, labelled LF+, at a positive gross margin.

The self-affirmed GRAS status enables TurtleTree to commercialise its lactoferrin more quickly, cost-effectively, and confidentially, although it does not involve FDA review, in contrast to the more rigorous GRAS notification process.

Lactoferrin, a prominent whey protein in human milk and bovine colostrum (known as 'first milk'), is in high demand due to its nutritional value. However, it’s scarce, as producing 1kg of purified lactoferrin requires ~10,000L of milk and is priced between $750-$1,500 per kg, restricting its application to essential products like infant formula and supplements.

Read full article - Green Queen

🇨🇭 Bühler Group introduces food innovation hub in Switzerland to develop sustainable foods, including plant-based meat

The Protein Centre, in collaboration with Endeco, focuses on developing plant-based foods, including meat alternatives, plant-based drinks, and ingredients, equipped with wet isolation and fractionation equipment.

The Flavour Centre allows customers to create flavours and products, leveraging Bühler's expertise in chocolate, nuts, and coffee, providing innovation, training, optimisation, and raw material analyses.

The Energy Recovery Centre, in partnership with Vyncke, utilises waste and by-products from all ATCs to heat Bühler's headquarters, serving as a platform for CO2 footprint reduction and energy cost testing.

Read full article - vegconomist

🇩🇪 German scientists study mung beans as a promising climate-resilient solution for plant-based meat

The researchers at the University of Bonn and Fraunhofer Institute studied three plant protein extraction methods—isoelectric precipitation (IP), micellization (MP), and a hybrid of both (HP)—to understand the optimal source for protein isolates from mung beans.

The study found that isoelectric precipitation at pH 5 resulted in the highest protein yield (67.5%). Micellization was effective in reducing antinutritive compounds but had a low product yield for large-scale applications. The hybrid method (HP) increased protein yield compared to micellization alone.

The research underscores the need for further investigation and knowledge to unlock the potential of underutilised crops like mung beans. Additionally, it shows the importance of pH, solubility, structural changes, and the protein’s native state in selecting extraction methods for sustainable and economically viable protein isolation.

Read full study - The National Library of Medicine

Read full article - vegconomist

MACRO STUFF

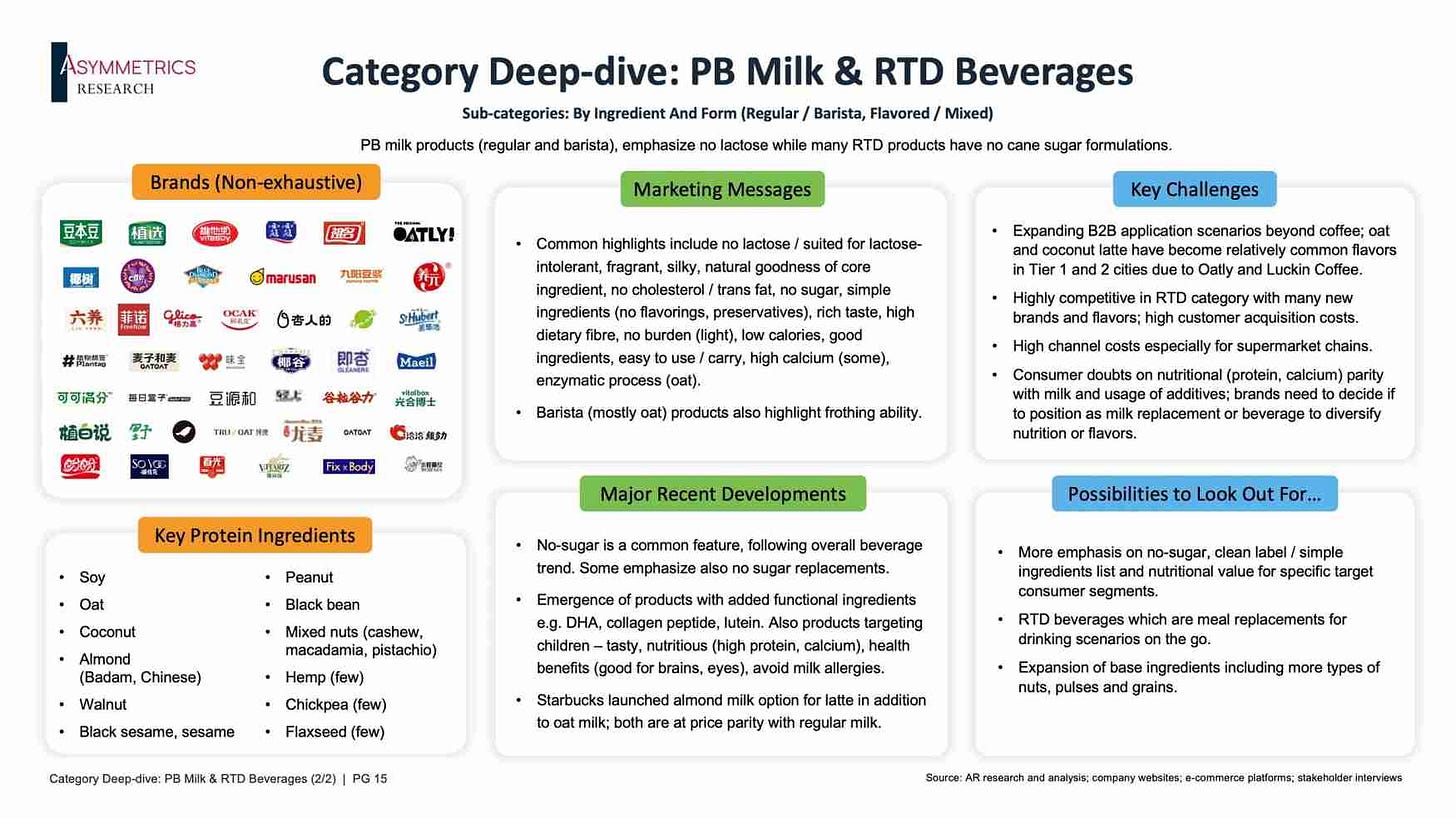

🇨🇳 Challenges in fundraising and macro landscape slow China’s alt protein investments in 2023 according to Asymmetrics Research

Plant-based meat and milk sectors are undergoing restructuring, with companies adjusting portfolios, brand positioning, and controlling costs. Some are diversifying across categories to target specific consumer segments and scenarios.

Challenges in fermentation-based technology include regulatory approval, product application expansion, production scale-up, and gaining consumer understanding. The number of companies in cell-based culture has grown, but it faces challenges like cost, scaling up production, obtaining regulatory approval, and gaining consumer acceptance in the long run.

Alternative protein players must focus on providing tasty, high-value offerings meeting immediate consumer health needs and expanding technology aligned with policy directions for long-term success.

Read full report - Asymmetrics Research

📉 The cultivated meat industry is facing a difficult time, with some predicting that 70-90% of companies may fail in the next year

This is attributed to changes in funding environments, scepticism from investors, and media narratives highlighting issues such as greenwashing and business failures.

Despite the challenges, there has been notable technological progress in cultivated meat production. Advances in cell culture media, AI, machine learning, and genetic engineering are addressing key issues such as cost and scale. Companies are exploring innovative approaches to optimise processes, reduce costs, and enhance the quality of cultivated meat.

The commercial viability of cultivated meat is a topic of debate. Some suggest a hybrid approach, combining cultivated cells with plant-based ingredients in varying percentages, is more economically feasible than producing 100% cell-cultured products, especially for whole-cut items like steaks.

Read full article - AgFunder

🧫 New scientific review by Mosa Meat discusses challenges in cell biology for cultivated meat

The review highlighted the crucial role of a detailed understanding and accurate manipulation of cell biology in the development of cultured meat bioprocesses. Despite significant interest and breakthroughs in the field, challenges persist at all stages of biomanufacturing.

The focus of the review is on identifying suitable starting cell types, tuning proliferation and differentiation conditions, and optimising cell-biomaterial interactions to create nutritious and appealing cultivated meat products.

The paper highlights the need for coordinated scientific efforts to address biomanufacturing bottlenecks and highlights non-scientific challenges such as regulatory approval, consumer acceptance, and market feasibility that must be addressed for successful implementation.

Read full article - vegconomist

New here? Devour the free subscription and join a list of founders, investors, and biotech enthusiasts leading the food revolution!

BIO BUCKS

🇫🇮 Solar Foods raised €8M to ramp up production of “food out of thin air”

The funding round, initially planned to be open until November 10, closed almost two weeks early due to overwhelming demand from investors.

The Finland-based company plans to use the funding to scale up production at its first commercial-scale facility, Factory 01. The company aims to commercialise Solein, its protein product, in various food products.

Solar Foods produces protein by feeding microorganisms with carbon, hydrogen, oxygen, and nitrogen from the air. The process, claimed to be up to 20 times more efficient than photosynthesis, results in a protein-rich powder containing up to 70% protein.

Read full article - vegconomist

🍄 Kynda secured a non-dilutive grant from Germany’s Ministry of Food and Agriculture to produce mycelial protein more efficiently at scale

In collaboration with the German Institute of Food Technologies, Kynda will use the funds to advance a project focused on efficiently scaling up the production of mycelial protein using its fermentation platform and waste side streams.

Germany’s Kynda positions itself as a pioneer by offering clients low-cost "plug-and-play" bioreactors, starter cultures, and operational support for biomass fermentation, particularly for producing edible mycelium.

Kynda's B2B services empower food and ingredient companies to implement in-house fermentation units, enabling them to generate revenue from their food processing waste, even if they lack expertise in edible mycelium production.

Read full article - vegconomist

🌱 Nordzucker AG, a leading sugar company, plans to invest €100M in developing a new plant proteins business segment

The company will construct a plant-based protein processing plant starting in the fall of 2024 and completing it by mid-2026, generating ~60 jobs.

The decision aligns with the global shift in eating habits towards plant-based alternatives for meat, egg, and milk, presenting a lucrative market opportunity.

Nordzucker will focus on processing locally grown yellow peas to produce protein concentrates and texturates for both plant-based foods and animal feed, anticipating double-digit growth rates in this segment.

Read full article - vegconomist

🏆 Mush Foods won $250k in the Grow-NY Food and Agriculture Business Competition

The awarded funds will support Mush Foods in its mission to cut global meat consumption in half by providing alternative meat ingredients made from mycelium.

The Israeli food tech company specialises in cultivating mycelium, which is grown from upcycled food and agricultural waste. Mycelium offers a highly sustainable and fast-growing alternative to traditional meat sources, taking only 8-10 days to grow.

Mush Foods' flagship product, the 50CUT mycelium protein ingredient, is designed for hybrid blended meat products but can also serve as a standalone replacement for meat.

Read full article - vegconomist

🦠 Quazy Foods secured €800k in pre-seed funding for microalgae cultivation and developing functional plant-based food ingredients

The funding will allow the Berlin-based biotech startup to advance to pilot-stage production, create initial microalgae samples, and make strategic hires for future growth.

Quazy Foods highlights the nutritional and functional potential of microalgae as a sustainable ingredient to feed the future.

The startup aims to provide F&B companies with microalgae ingredients to create nutritionally superior and sustainable plant-based products for the growing global population.

Read full article - vegconomist

🥛 The global plant-based milk market is projected to reach $47.55B by 2030, growing at a CAGR of 11.7%

The growth is driven by factors such as lactose intolerance, milk allergies, increased health awareness, environmental concerns, and support from governments and investors. Oat milk is anticipated to experience the highest growth rate.

Challenges include fluctuating raw material prices, consumer preferences for animal-based dairy, and potential allergies to soy, nuts, and grains.

Emerging economies in Asia-Pacific and Latin America are expected to provide new growth opportunities, fueled by a rising vegan and flexitarian population along with the growing popularity of Western-style diets in the region.

Read full article - Research and Markets

🧀 The global fermentation-enabled alternative protein market is projected to reach $1.19B by 2031, growing at a CAGR of 14%

The industry consists of companies using traditional, biomass, and precision fermentation technology, with >50 players identified, predominantly based in the United States.

Market growth is propelled by the rise of flexitarianism and increasing demand for sustainable proteins, leading to substantial investments in fermented protein companies.

Dairy alternatives currently dominate the market share within the fermentation-enabled alternative protein sector, attributed to technological advancements, regulatory support, and a rising demand for dairy substitutes.

Read full article - vegconomist

SOCIAL FEAST

🐮 It’s the cow, not the how

"It's not the cow, it's the how" But more and more research shows us that it is indeed the cow, and how many. Relying solely on carbon sequestration in grasslands to offset greenhouse gas emissions from ruminant systems is not feasible. Soil carbon sequestration is a time-limited benefit, and the amount of carbon required to offset continuous methane and nitrous oxide emissions is substantial.

Researchers found that one cow per hectare of grassland is the maximum that the grasslands can offset, even under optimistic assumptions about soil carbon sequestration potential. This indicates a limit to the capacity of grasslands to absorb and mitigate the emissions associated with cattle farming.

Achieving a more sustainable way of farming cattle would likely require having significantly fewer cows to stay within the Earth's carrying capacity. The scalability of regenerative practises is questionable, highlighting the challenges of adopting cattle farming as a widespread climate solution.

Read full post on LinkedIn - Irina Gerry

🤨 Are you a CPG or an ingredient provider? Make up your mind

Choosing an ingredient-focused approach offers long-term cost advantages, allowing startups to leverage corporate strengths in marketing and brand building. It also involves lower initial capital expenditure (CapEx) as corporations scale up infrastructure based on proven technology.

Opting for a CPG focus allows startups to control the entire product development process, from inception to consumer enjoyment. Direct-to-consumer (D2C) sales are highlighted as a strategy to achieve higher profit margins, particularly in the final stage of the sales cycle.

Typically, at the moment, Alex recommends focusing on ingredients and technology and not brand due to the prevailing investment climate that is less favourable to capital expenditure-heavy products.

Read full post on LinkedIn - Alex Shandrovsky

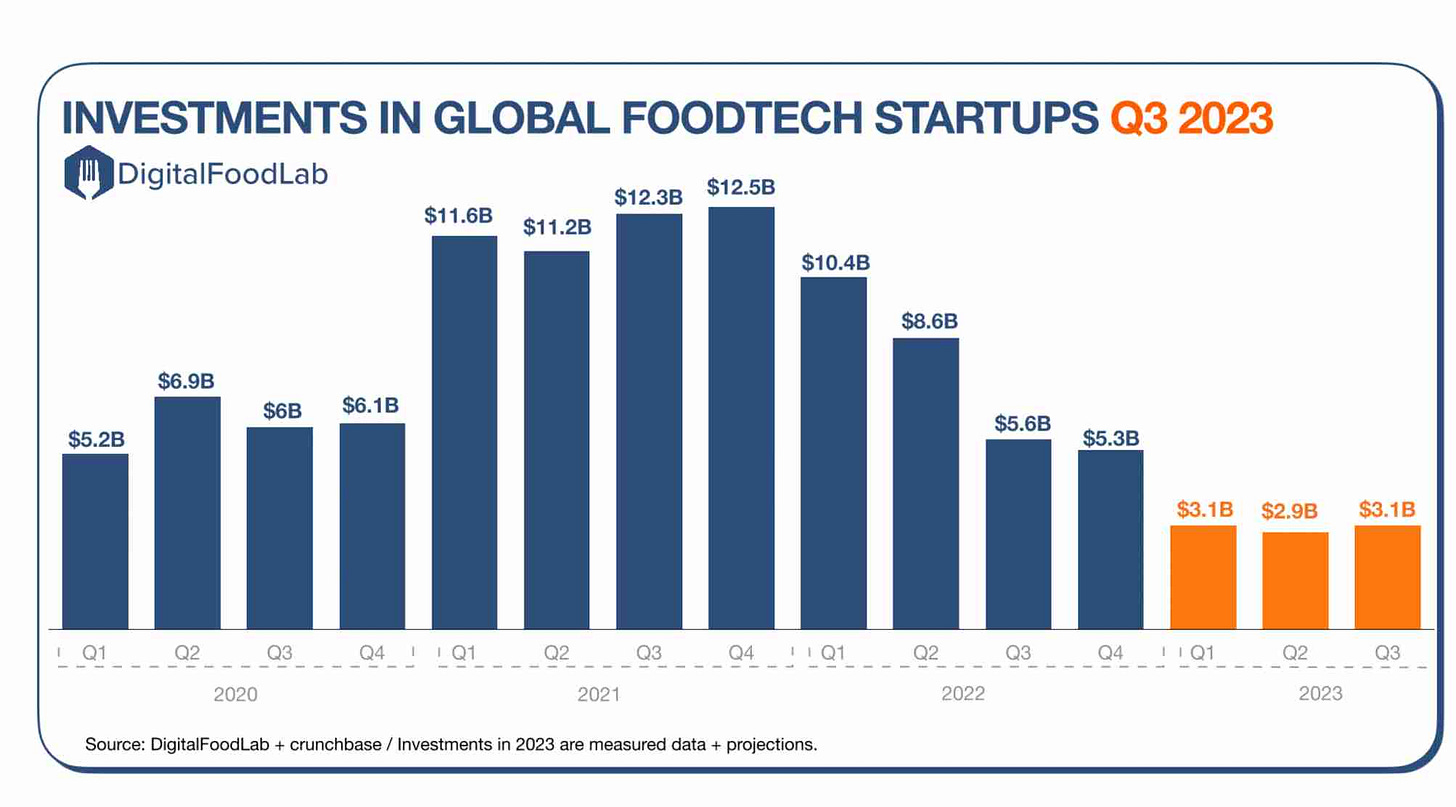

📊 After a year of decline, FoodTech investments have reached a solid $3 billion per quarter

The majority of investments are directed towards early-stage ventures (pre-seed, seed, and series A), showcasing investors' appetite for risk. This reflects a belief that the situation will improve in the next 18 to 30 months when these startups require more substantial funding.

There is a significant amount of capital available for investment, with many deep-pocketed funds actively seeking opportunities. The top deals chart highlights substantial investments in selected startups, indicating continued interest and financial support.

Europe's share of FoodTech funding has risen from 12% in 2020 to 30%, indicating a significant increase. This suggests a specific positive trend in the European FoodTech sector, capturing the attention and investment of global investors.

Read full post on LinkedIn - Matthieu Vincent

Got a taste for this newsletter? Dish it out to your friends!👇🏾

EAR FOOD

🎙 Solarpunk movement: A world where technology sustains and harmonises us with nature

Show: Another ClimateTech Podcast

Host: Ryan Grant Little

Guest: Nate Crosser, VC at Blue Horizon

Solarpunk is a literary and design movement centred around imagining a future where people live in harmony with each other and nature. It envisions a society shaped by the responsible use of technology, particularly green technologies like solar power and innovative approaches to food production.

Similar to other "punk" movements, Solarpunk is countercultural, reacting against mainstream narratives, particularly those in traditional sci-fi genres. It stands as a positive and grandly optimistic vision in contrast to the often dystopian outlook of futuristic media.

There is a risk of Solarpunk being co-opted for greenwashing, where corporations use the aesthetic to mask unsustainable practises. Consumers are urged to remain vigilant and sceptical, recognising the difference between genuine efforts towards a sustainable future and marketing strategies that may not align with Solarpunk ideals.

THAT’S ALL FOR THIS WEEK!

Take care, and have an awesome week! 🙌🏾

Are you new here?

Know any other geeks who would dig this newsletter?