CPG Giants Embrace Animal-Free Dairy, Cultivated Meat Leader's SEA Plan, and Bean-Less Coffee

Also: "Asset-light" is hot right now

Hi, thanks for being here!

Here’s my favourite quote that I came across this week:

“It's really dangerous to rely on the US media narrative around cultivated meat, which is at the moment just relentlessly negative and polarising. It's very skewed, it's very myopic, and it's really missing the bigger picture of what's going on across the world […] It's really important not to conclude everything about cultivated meat from two big American companies.”

That was Sonalie Figueiras on the Green Queen’s Future Food podcast. She was talking about the positive developments happening in the cultivated meat space. Case in point: Israel’s Aleph Farms advancing its Southeast Asia strategy (you’ll see in a minute!)

Alright, let’s dig into the latest developments in biotech-enabled food innovation! 🍽

BIO TALKS

I’m excited to share the first issue of something new I’m working on with Better Bioeconomy! In this new series, I interview people who are helping build a better food system (using biotech).

♻️ Using agrifood byproducts to power the bioeconomy

Last week, I had a great chat with Rebecca Palmer, the CMO of Terra Bioindustries. With a background in plant biotech and marketing, she was an awesome first guest!

About Terra: Terra Bioindustries, based in Toronto, is transforming agrifood byproducts into sustainable B2B inputs. They have developed a negative-emissions platform for upcycling brewer's spent grain into valuable products.

100% upcycled and nutritious products: The startup has created two products, Protina and Recyclose. Protina is a dried plant-based protein ingredient. Recyclose is a barley syrup used as a fermentation feedstock and potentially as a sweetener in foods.

Power of storytelling: Storytelling is an important skill for bridging the gap between innovation and market acceptance. Rebecca’s main advice is to create an emotional connection with the audience by talking about personal stories behind the brand, such as the co-founders' motivations.

B2B food ingredient trends: In response to the cost-of-living crisis, businesses are now more price-sensitive. As for consumers, they are focusing more on buying healthier staples and ready-made meals than novel or premium products.

Biggest lesson: Actively engage with (potential) customers, peers, and mentors and act on their feedback.

Future plans: Terra is collaborating with partners to upcycle spent corn and other byproducts to expand product offerings. Additionally, they are launching a US$2.5 million seed round.

BIO BUZZ

🇮🇱🇹🇭 Aleph Farms partnered with BBGI and Fermbox Bio to set up Thailand’s first cultivated meat production facility

This collaboration is part of Aleph Farms' Southeast Asia expansion strategy. Aleph Farms uses an "asset-light" approach to manufacturing that focuses on a hub-and-spoke model to reduce costs and increase scalability.

The Israeli startup said that producing cultivated meat supports value chains that are “decentralised, compact, predictable, and conveniently located near end consumers.” This cuts supply chain risks. It also strengthens local food security and economic growth.

The partnership aims to boost production by optimising costs and scaling up operations. It will use BBGI's expertise in bio-based products and Fermbox Bio's in microbial fermentation and synthetic biology.

🍦 Unilever partnered with Perfect Day to introduce an ‘animal-free dairy’ frozen dessert under the Breyers brand

This is the first time a multinational ice cream and frozen dessert brand has sold a product using Perfect Day’s whey protein made from precision fermentation. It’s available all over the US at a manufacturer's suggested retail price of $4 and $8 for a 48-ounce tub.

Major CPG companies like Mars, Nestlé, and General Mills will likely closely watch the performance of these products. They have tried 'animal-free dairy' brands before with varying success.

'Animal-free' dairy typically refers to dairy products made with real dairy proteins like whey and casein proteins but without cows. Instead, they use genetically engineered microbes or crops. These provide sustainable and ethical alternatives while still delivering the nutrition and functionality of real dairy.

🥛 Vivici says it’s ready to supply commercial levels of fermentation-based whey protein to the US market

The startup, formed by Fonterra and DSM-Firmenich, has scaled up production to a 120m³ fermenter. Vivici will work with partners in Europe and the US for commercial manufacturing.

Nutritionally, Vivici’s beta-lactoglobulin (which constitutes majority of whey proteins) isolate is said to be better than plant protein isolates. The high-purity beta-lactoglobulin from Vivici, combined with its BCAA (branched-chain amino acids) and leucine composition, also offers superior benefits compared to whey protein isolate in applications for active nutrition.

The company aims to offer its whey protein at a price that is competitive with traditional whey protein. Vivici's entry into the market is timely, as there’s increasing interest from large manufacturers in sustainable alternatives like beta-lactoglobulin produced through fermentation.

MACRO STUFF

🇰🇷 South Korea has opened up the regulatory approval process for cultivated meat

Startups in South Korea can now file for approval from the Ministry of Food and Drug Safety to sell their cultivated meat products. So far, only Singapore, the US, and Israel have approved the sale of cultivated meat.

Dossiers for regulatory approval in South Korea must include comprehensive safety verification data. This includes the raw material name, cell origin, and manufacturing process. It also has donor information (for livestock and marine sources) and international recognition and usage history.

Companies must also provide detailed information on the human safety impact of the raw materials. This information should include digestibility, potential negative health reactions, allergies, toxins, and genetic stability between the raw material and the final product.

🚫 Alabama's Senate passed a bill which bans the sale, manufacture, and distribution of cultivated meat

The bill, sponsored by Senator Jack Williams, passed with 32 votes in favour and none against. Williams argues against the need for cultivated meat in Alabama. He cites the state's ample food supply and raises safety concerns.

However, cultivated meat has been deemed safe by the USDA and FDA. Opponents of the bill argue it stifles innovation. It also limits consumer choice and undermines efforts to meet growing global meat demand sustainably.

The legislation has sparked controversy. People are concerned about its impact on biotech innovation, consumer freedom, and Alabama's role in future food security. Critics point out the irony of concerns over food safety and alterations given the widespread use of antibiotics in livestock, which poses significant public health risks.

Williams said, “Anything that is artificial and not to do with our animals comes up on my radar.” Sir, the cells used to make cultivated meat come from your animals.

📝 FDA has issued guidance for the industry on voluntary engagement with the agency before marketing food from genome-edited plants

The guidance describes two voluntary processes for ensuring the safety of foods from genome-edited plants: premarket consultations and premarket meetings. The processes can ease the pathway to market while maintaining FDA safeguards.

Foods from genome-edited plants must meet the same safety requirements as those derived from traditionally bred plants. The FDA's Plant Biotechnology Consultation Program helps developers determine appropriate oversight pathways.

The FDA recommends voluntary premarket engagement based on a food's risk-based characteristics. Premarket meetings are suggested for foods less likely to raise safety questions. Consultations are recommended for those with certain risk-based characteristics.

“Advancements in the field of plant biotechnology are bringing new food products to the marketplace. Such advancements may contribute to helping meet the needs of a growing world population and to helping address food insecurity globally.”

BIO BUCKS

🇳🇿 Miruku raised $5M in a pre-Series A round to expand its molecular farming platform for producing dairy proteins and fats

The New Zealand-based startup plans to advance its dairy seed system, co-develop products with industry partners, and collaborate for field trials. They will work with the Commonwealth Scientific and Industrial Research Organization to test modified safflower varieties in Australia.

Miruku aims to disrupt New Zealand's dairy industry, which accounts for 1 in every 4 export $ the country earns ($25.7B in total). The startup plans to do this by working with farmers towards more planet-friendly farming processes.

Miruku's tech involves modifying plant cells into factories that replicate animal-derived molecules such as dairy proteins, fats, and sugars. It stands out from other molecular farming companies with a B2B model, a focus on proteins and fats within the same plant, and the use of safflower crops.

Fun fact: "Miruku" is derived from the Japanese word for milk.

☕️ Prefer raised $2M to scale up production and Asia expansion for its fermentation-derived bean-less coffee

The Singaporean startup produces bean-less coffee using food industry byproducts (surplus bread, tofu pulp, and spent brewer's grain). The ingredients undergo a 3-step process involving fermentation with food-grade microbes, roasting, and grinding. This replicates real coffee's essential aroma molecules.

Nearly 60% of all coffee species are endangered. Arable land for coffee is expected to halve by 2080. Prefer's tech offers a solution by producing coffee alternatives that reduce environmental impact.

The products are already gaining traction in Singapore, with products available in 12 locations. The company plans to expand into the Philippines and focus on the APAC market until 2025.

🍄 70/30 Food Tech raised $700,000 in a seed extension round to open a Mycelium Research Lab for developing mycelium-based protein products

The new research lab focuses on improving R&D on fungi-based proteins and scaling up operations. The Singapore-based startup selected Bangalore as the lab's location because of its affordability and India's position as one of 70/30's future product markets.

“The per capita consumption of meat in India is significantly low compared to [the] rest of Asia. However, there is a rising demand for poultry and we want to be on the brink of it and offer exciting solutions.” - Eve Samyuktha, CEO

Studies show that mycelium production could be a viable, large-scale, and low-cost protein source. It could help with global hunger and food insecurity. 70/30 Food Tech aims for price parity with conventional chicken by tapping into the demand for affordable alt proteins in Asia.

💰 Bluestein Ventures closed a $45M food tech fund

The firm specialises in early-stage investments in the food industry. It targets companies across the food supply chain, including consumer, software, and food tech businesses. The focus is on improving the food system's health, sustainability, and effectiveness.

Ashley Hartman of Bluestein Ventures said that “there is tremendous opportunity for improvement” in the food industry. She highlights the importance of investing in innovative companies to accelerate health and environmental benefits.

The firm believes in the alignment of impact and returns. “There shouldn’t be a tradeoff between impact and returns; in fact, 67% of our portfolio is making an impact in nutrition, 40% in sustainability, and 62% have a diverse founder.”

SOCIAL FEAST

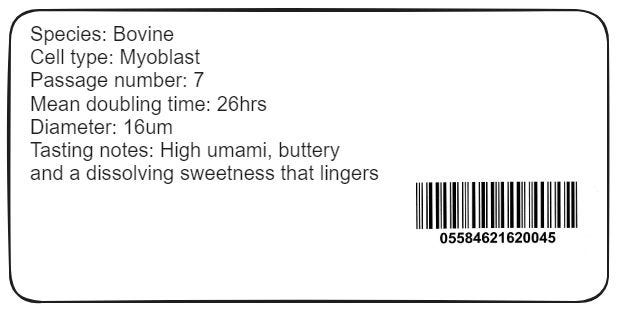

🤔 What if cultivated meat companies added flavour profiles of their cells similar to the flavour profiles of coffee beans?

Mentioning the flavour profiles of cultivated meat ingredients could add significant value. This could change the perception and experience of cultivated meat for B2C companies and consumers.

Providing taste profiles along with technical data (passage number, mean doubling time, and cell diameter) would demystify the science behind cultivated meat. It would also celebrate its culinary potential.

The approach suggests that the taste and nutrition of cultivated meat are influenced by both the cells used and the environment in which they are cultivated. This is similar to traditional animal farming.

Read full post on LinkedIn - James Ryall

🏭 "Asset-light" is what's hot right now

Venture capital traditionally avoids CAPEX-heavy businesses, preferring to invest in businesses that require less capital expenditure. Typically, these costs have been covered by other forms of financing, such as debt and government grants

However, through 2021, startups used venture money for large-scale manufacturing because cash was cheap. In the current funding environment, startups are adapting by finding "asset-light" and non-dilutive ways to fund CAPEX, as investors are less willing to “throw cash at anything.”

Nathan Paumier commented that for food tech startups and their investors, low CAPEX production and/or co-manufacturing is key because building factories is “rarely the path to 10X ROI.” And it’s also too risky to commit to just one startup, he added.

Read full post on LinkedIn - Steve Molino

😮💨 Outdated regulatory framework makes life much harder for alt protein companies

The European Union categorises new food sources under "novel foods." This includes a wide range of products, such as traditional foods from third countries, upcycled food, biomass, algae, mycelium, cell-based meat, and ingredients derived from precision fermentation.

Startups face challenges in identifying the necessary data for regulatory approval (e.g., toxicological, purity, and allergenicity studies). This is due to unclear guidance or because standardised methods of testing aren’t suited for innovative food.

Jurisdictional differences in regulatory requirements highlight the importance of understanding regulatory nuances. E.g., the EU's six-month notification period for novel food approval can significantly impact market strategy development. In contrast, some other jurisdictions may not even have this requirement in place.

Read full post on LinkedIn - Mathilde Do Chi

That’s a wrap. Thank you for taking the time to read this issue!

Are you new here?

Know anyone else who would dig this newsletter?