Cultivated Breast Milk, EU-Approved Cultivated Pet Food, and $12.7T Hidden Cost of Food

Also: An investment of $125B could help reduce Asia’s agri-food emissions by 12% by 2030

BIO BUZZ

🇨🇿 Bene Meat Technologies is the first company to receive EU approval for producing and selling cultivated meat for pet food

The Czech startup obtained the license from the European Feed Materials Register, authorising the commercialization of its products.

The approval for cultivated meat feed in Europe is a significant milestone, with no other companies having received such approval. Other companies are in the pre-submission phase for regulatory approval of cultivated meat food products.

BMT plans to offer cultivated pet food products by 2024, providing a sustainable and ethical alternative to traditional pet food without harming animals, thanks to it’s cost-effective and industrial-scale meat cultivation platform.

Read full article - vegconomist

🇿🇦 Newform Foods and Project Assignments have partnered to establish a cultivated meat demonstration facility in Africa

South Africa’s Newform Foods, with its advanced biotechnology, aims to offer end-to-end solutions for meat manufacturers, cultivated meat producers, and retailers. This includes services such as media development, cell lines, prototype development, and scaling (bioreactor plans).

The collaboration with Project Assignments is geared towards providing an accessible platform for future customers to expand their cultivated meat products without the challenges of intensive R&D and associated costs.

The partnership is already underway, with both companies working on a blueprint design to bring Newform Foods' bioproduction platform to the global food industry.

Read full article - vegconomist

🇨🇳 CellX, known for cultivated meat, has ventured into mycelium fermentation to expand its portfolio of sustainable proteins

The Shanghai-based startup uses a mycelium strain boasting over 40% protein and over 20% dietary fibre. The amino acid score coefficient is as high as 0.98, comparable to conventional beef.

The mycelium venture is seen as a strategic move to capitalise on the cost-effectiveness and scalability of mycelium fermentation. This aligns with the company's commitment to lowering production costs and aiming for competitive pricing in the market.

CellX plans to leverage mycelium fermentation to create hybrid meat products by combining cultivated proteins with plant-based and fermented ones. The company sees hybrid products as a compelling choice for consumers.

Read full article - Green Queen

🫀 Impossible Foods' Beef Lite has received certification from the American Heart Association's Heart-Check Food Certification Program

The Beef Lite product is certified as a heart-healthy alternative, offering health-conscious consumers a viable option. It contains 75% less saturated fat and 45% less total fat compared to conventional 90/10 lean beef.

Additionally, it provides 21g of protein per serving, has a low saturated fat content, and is free from trans fats and cholesterol, aligning with growing consumer preferences for healthier food choices.

The certification and health-conscious product development reflect a broader trend in the alternative meat industry. The focus on health is driven by consumer demand for plant-based options that align with environmental concerns and address personal health considerations.

Read full article - Green Queen

🇦🇺 Vitasoy Australia is expecting its highest annual production volumes, with an expected output of around 70M litres of plant-based milk

This represents a sevenfold increase since the company's facility in Victoria commenced operations in 2002, marking the significant growth in demand for dairy alternatives.

The growing popularity of plant-based milks is attributed to factors such as the rise of veganism, health considerations like lactose intolerance, and increased availability in cafes and restaurants.

Over the past decade, the alternative milk market has transformed from a niche product in health food shops to a mainstream item, with approximately 40% of Australian households now having plant-based milk in their refrigerators.

Read full article - vegconomist

MACRO STUFF

🌏 An investment of $125B could help reduce Asia’s agri-food emissions by 12% by 2030

In South and Southeast Asia, agrifood systems could account for 45% and 50% of greenhouse gas emissions, respectively. Despite having 35% of arable land, Asia is responsible for 42% of global agri-food emissions. Key emission contributors include rice cultivation, fertiliser use, livestock farming, food loss, and deforestation.

The report calls out the urgent need for climate action in Asia's agrifood sector. The proposed measures include embracing cleaner technologies, reducing transportation carbon footprints, and adopting eco-friendly farming methods.

The report stated that addressing emissions in the food sector is more cost-effective than in energy or aviation. The investment required to achieve a similar emissions reduction in aviation would be 45 times higher and 3 times higher in the energy sector.

Read full article - Green Queen

📊 Synonym’s State of Global Fermentation Report provides insights on the existing microbial fermentation capacity and profitability drivers

The report highlights the significance of scale and technology interventions in reducing costs in microbial fermentation. While a 2x increase in scale leads to a 1.4x decrease in cost of goods sold (COGS), technology interventions, such as a 2x increase in titer, result in a 2x decrease in COGS.

To avoid obsolescence and ensure continual technological advancements, facility designs need to be flexible. Adaptable designs help to prevent current equipment investments from becoming stranded assets in the face of evolving technology.

The report reveals a significant gap between the industry's demand for fermentation capacity and the actual supply. While there is a proliferation of smaller facilities, the majority focus on bench and pilot scale, with limited attention to demo and commercial-scale operations.

Read full article - vegconomist

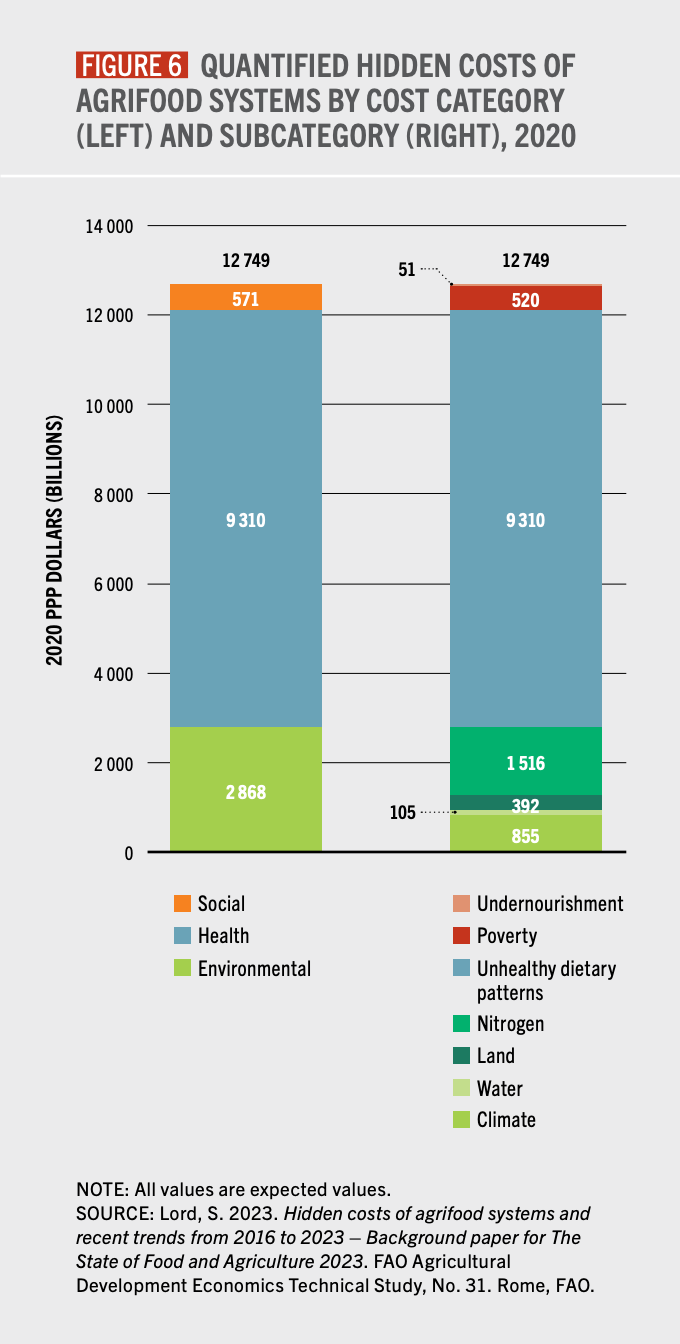

🌎 The hidden costs of the global agrifood system amount to $12.7T annually, UN FAO's report reveals

Health is the primary driver of hidden costs, accounting for 73% of quantified hidden costs in 2020. These costs, exceeding $9 trillion in 2020 PPP dollars, result from dietary patterns leading to obesity and non-communicable diseases, impacting labour productivity.

Environmental factors contribute to 20% ($2.9 trillion) of hidden costs, primarily associated with greenhouse gas emissions, nitrogen emissions, water use, and land use change. Notably, lower-income nations bear twice the environmental cost compared to middle- and higher-income countries.

There is a stark contrast in the impact of hidden costs on different countries, with low-income countries experiencing the most significant impact (27% of GDP). Poverty and undernourishment account for half of the total hidden costs in these countries.

Read full article - Green Queen

🇸🇰 The Slovak plant-based food market continues to thrive, according to new report by Jem pre Zem

The report reveals that 36.8% of the Slovak population is actively reducing or considering reducing their consumption of animal-based products. Slovak households have notably increased their spending on plant-based alternatives and tofu, reaching €40.4 million in 2022.

The interest in reducing animal-based consumption is widespread across all age groups, with the highest involvement observed among individuals aged 25 to 34. This demographic shows that 24.7% have already reduced their intake.

Traditional soy products like tofu, tempeh, and textured soy protein constitute the majority (37.9%) of plant-based purchases. The market for plant-based alternatives in Slovakia continues to expand, presenting a promising opportunity for food manufacturers and retailers to tap into this growing trend.

Read full article - vegconomist

🧭 A guide to strategic ingredient selection for food tech startups

Consumers increasingly prefer clean labels with recognisable ingredients. Avoiding synthetic additives, binders, and emulsifiers can give products a competitive edge.

Startups need to balance cost control with ethical and affordable ingredient choices. Local sourcing and smart budgeting, including bulk purchases and co-branding agreements, can optimise cost structures.

Leveraging trends and innovations, such as upcycled ingredients and fermentation technologies, can provide sustainable and cost-effective solutions.

Read full article - Stray Dog Capital

🐶 Dogs can maintain good health on plant-based diets

The research specifically examined the impact of vitamin D2 (from plants) versus vitamin D3 (from meat) on dogs. The findings show that vitamin D2 is effective in maintaining dogs' total vitamin D levels without adversely affecting bone mineral content or density.

While the idea that dogs, omnivores, can thrive on plant-based diets might be expected, the study suggests potential health benefits even for cats, which are carnivores.

Shifting cats and dogs to a vegan diet could have substantial environmental advantages. This includes saving a significant amount of land, reducing water use, lowering greenhouse gas emissions, minimising biocide use, and decreasing pollutants, according to recent research.

Read full article - vegconomist

New here? Devour the free subscription and join a list of founders, investors, and biotech enthusiasts leading the food revolution!

BIO BUCKS

🤱🏾 Nūmi raises €3M in pre-seed funding to advance cultivated breast milk development and expand team

The French startup is developing breast milk using mammary gland cell cultures, imitating the natural processes in women's bodies. Nūmi plans to seek regulatory approval in the US, Europe, and Asia.

The startup argues that current alternatives lack nutritional suitability for infant growth and can pose issues like dairy protein intolerance. Nūmi aims to provide a solution that closely mimics human breast milk, emphasising its unique composition that aids in immunity, metabolism regulation, and brain development.

Recognising that various factors limit breastfeeding for some women, Nūmi aims to cater to mothers facing challenges such as physiological inability, insufficient milk production, or nutritional deficiencies.

Read full article - Green Queen

💸 Leading Nordic plant-based investor, Kale United, aims to raise 12M SEK in preparation for IPO

A portion of the capital raised will be used to launch a fund for sustainable investments, targeting large institutional investors. This is expected to increase Kale United's assets under management by 150 million SEK (€12.9 million).

Kale United intends to continue investing in both new and existing portfolio companies. The company highlights the anticipation of high growth for its subsidiary, Kale Foods, which distributes products from its portfolio companies in Scandinavia.

Kale United, founded in 2018, boasts a consistent annual share price increase of 28.9%. The company's current portfolio includes well-known plant-based companies such as Beyond Meat, Oatly, Veg of Lund, Hooked, Heura, and others.

Read full article - vegconomist

🧀 Dreamfarm secured €5M for almond-based mozzarella, the first plant-based mozzarella to achieve government-certified liquid status

The almond-based mozzarella contains less than 1% saturated fat, a significant reduction compared to conventional mozzarella and other plant-based alternatives. It has received a Nutriscore of A, the highest possible rating.

The funding was used to establish a production facility with optimised machinery for Dreamfarm's patented production process. This process involves fermenting almonds with proprietary, selected cultures and combining them with simple ingredients to replicate the taste and texture of cheese.

Dreamfarm plans to expand distribution channels in Italy and abroad, conduct further R&D for new products, and position Dreamfarm as a leader in developing sustainable and authentically Italian plant-based foods.

Read full article - vegconomist

♻️ Nimbus Capital committed up to £20M in a growth equity agreement with Letoon Holding, a vegetable waste firm preparing for a London IPO

Letoon Holding has developed a method using ultrasonic technology to extract nutrients from plants and vegetables. The extracted nutrients have diverse applications in the food, cosmetics, and pharmaceutical sectors.

The company aims for an IPO no later than September 30, 2024. The investment commitment from Nimbus is structured to support Letoon Holding for 36 months post-IPO.

With Nimbus's support, Letoon Holding aims to contribute to a more sustainable, tech-driven circular economy by processing food waste for valuable ingredients, aligning with global industrial demand for sustainable commodities.

Read full article - UKTN

🇺🇸 The plant-based meat market in the US is projected to experience a CAGR of 23.5% from 2023 to 2028

Increased health consciousness among consumers is a primary driver for the growth, with plant-based meat being promoted for its lower saturated fat, calorie, and cholesterol content compared to animal meat.

Awareness of the environmental impact of traditional meat production and concerns about animal welfare are identified as additional factors influencing the growth of the plant-based meat market.

The improvements in taste and texture of these alternatives, coupled with mainstream media coverage and influencer endorsements, are contributing to the increasing acceptance among consumers, including those looking to reduce meat consumption (flexitarians).

Read full article - IMARC

SOCIAL FEAST

🤔 “Do you need to offer exclusivity?” Answer this question before raising money using a licensing business model

If adopting a licensing business model, communicate to investors that the goal is to be acquired at 2X current value in 12 months. Acknowledge that it might not be a billion-dollar success, but be honest about the acquisition strategy.

To address client discomfort about licencing your tech to their competitors, provide exclusivity options across different geographies or specific applications, alleviating concerns and fostering a more comfortable in-house adoption.

Clearly articulate the expected return on investment for potential acquirers. Be transparent about the realistic multiple you aim to achieve, ensuring alignment with the expectations of investors, particularly recognising that this may not fit the criteria for larger venture capitalists but could appeal to angel investors.

Read full post on LinkedIn - Alex Shandrovsky

🍽 Are upcycled ingredients fit for the plate or destined for the bin?

Sustainability is a central consideration for businesses in the alternative protein industry, particularly in the development of upcycled food ingredients, aiming to reduce environmental impact compared to traditional counterparts.

Despite sustainability benefits, upcycled ingredients may face regulatory obstacles as they may be initially classified as unfit for human consumption. Authorities may require specific treatments before considering them suitable for the market, necessitating a case-by-case food law analysis.

The absence of a legal definition for "upcycled food ingredients" poses a challenge, making fitness for consumption the primary criterion for market approval, as determined by the jurisdiction's standards.

Read full post on LinkedIn - Mathilde Do Chi

💪🏾 How to scale fermentation bioprocesses to conquer the commercialisation valley of death

Scaling up a fermentation process is a critical phase for synthetic biology companies, often referred to as the Commercialization Valley of Death. The financial investment and potential inefficiencies during scale-up pose significant risks to the success of bioproducts in the market.

Early-stage companies must prioritise consistent data management and analysis workflows for bioprocess data. This includes codified parameter tracking, standardised data presentation, and ensuring accessibility to relevant data. Clear and standardised data workflows enhance decision-making during scale-up.

Meticulous documentation of bioprocess versions and implementing robust version control systems are essential. This ensures clear communication and alignment across teams and facilitates effective collaboration with CMOs during scale-up.

Read full post on LinkedIn - Liberation Labs

Got a taste for this newsletter? Dish it out to your friends!👇🏾

EAR FOOD

🎙 Takeaways from Reuter’s Food Transformation USA 2023

Show: The Plantbased Business Hour

Host: Elysabeth Alfano

The conference primarily featured established industry players, including Nestle, General Mills, Unilever, and others. However, there was a noticeable absence of tech innovators, indicating a focus on preserving the existing system rather than embracing disruptive solutions.

Despite the widespread commitment to achieving regenerative agriculture goals by 2030, there was a lack of clarity on what regenerative agriculture actually means. Some participants struggled to define it, leading to moments of uncertainty and even laughter.

Unilever proposed the concept of "collaborative competition," suggesting that even competing companies should collaborate to address the significant challenges in the food industry.

THAT’S ALL FOR THIS WEEK!

Take care, and have an awesome week! 🙌🏾

Are you new here?

Know any other geeks who would dig this newsletter?

There's a correction on the Bene Meat news - sorry about the mix-up!

Bene Meat is the first to list its cultivated pet feed on the official EU register. This is not the same as regulatory approval. Read the updated version here:

“Bene Meat has listed their cultivated cells of mammalian origin in the EU feed materials register…so it is true that cultivated meat could be classified as a feed material,” it was important to clarify that this is “not the same as an EU regulatory approval or certification”

https://www.greenqueen.com.hk/cultivated-pet-food-cultured-lab-grown-meat-bene-meat-technologies-eu-register/