Major Cultivated Meat Cost Breakthroughs, Lego Factory Becomes Fermentation Hub, and AI Smell Tech for Harvests

Also: Researchers turned spent coffee grounds into yeast-derived biostimulants for crops

Hey, welcome to issue #105 of the Better Bioeconomy newsletter, your weekly dose of biotech’s latest in food and agriculture. Thanks for being here! 👋🏾

This week, Meatly shattered cost barriers for cultivated meat, unveiling tech that could match chicken prices. Meanwhile, Gourmey’s techno-economic analysis shows it can reach an impressive $3.43/lb for cultivated meat. Scentian Bio's insect-inspired AI sensors are revolutionising kiwifruit harvesting, and Millow turned a former Lego factory into an oat-and-mycelium protein powerhouse, slashing emissions dramatically. Plus, researchers transformed coffee waste into beneficial crop biostimulants.

Let’s dig in!

BIO BUZZ

Products, partnerships, and regulations

🇬🇧 Meatly unveiled bioreactor and culture media breakthroughs that move cultivated meat closer to chicken price parity

UK-based cultivated pet food startup has built a 320-litre pilot bioreactor that delivers industrial-grade performance for just £12,500 ($16,900), about 95% less than traditional systems, which can run up to £250,000 ($338,000).

They’ve also slashed the cost of their food-safe, serum-free, protein-free culture medium from £1 per litre to 22p (30 cents), with expectations to bring it down further to just 1.5p (2 cents) at scale. This was achieved by replacing expensive components like albumin and insulin, an industry first.

The medium supports over 175 cell doublings without microcarriers, improving efficiency and keeping the process entirely animal-free. Together, these breakthroughs could enable Meatly’s cultivated chicken to be produced at prices competitive with standard EU chicken breasts, a milestone previously doubted by many.

Source: Green Queen

🤔 Thoughts:

Building purpose-built bioreactors signals a broader shift toward specialised infrastructure for the cultivated meat sector. Instead of adapting equipment designed for million-dollar-per-kg biologics, cultivated meat players are now engineering for cost-efficiency at food scale.

This could reshape the risk profile of the entire sector. By reducing their reliance on pharma-grade cleanrooms and GMP supply chains, startups can build faster, scale more cost-effectively, and unlock modular manufacturing models. This decoupling opens the door to a new class of players: equipment builders, process engineers, and contract manufacturers with capabilities in food, not pharma.

The need for 22× more bioreactor capacity, as McKinsey notes, won’t be met by pharma incumbents alone. It will be built by an emergent supply chain purpose-built for low-cost bioproduction, and Meatly (among a handful of others) just showed that this next-gen ecosystem is already taking shape.

🇫🇷 Gourmey can produce cultivated meat at $3.43 per lb according to techno-economic analysis

A recent techno-economic analysis by consulting firm Arthur D Little shows that the French startup can produce cultivated meat at $3.43 per pound using its 5,000-litre bioreactor system. Notably, this cost is achievable without relying on large-scale infrastructure.

The end product is made up of roughly 50% cultivated cells and 50% plant-based ingredients. Their use of stem cells with self-renewing properties, fast growth (doubling in under 16 hours), and a proprietary, protein-free cell feed dramatically reduces input costs to just $0.20 per litre.

Gourmey is currently pursuing regulatory approval in six markets and was the first to submit an application for regulatory approval in the EU, with approval in Singapore expected soon.

Source: Green Queen

🤔 Thoughts:

Gourmey’s sub-$4/lb figure sets a new benchmark that the rest of the companies will have to chase, potentially accelerating a cost-down race across the sector. As startups iterate better production processes, their economics begin to resemble those of food production more than those of pharmaceuticals. This inflection could attract cautious investors back by showing a credible path to margins that justify scaled deployment.

🇳🇿 Scentian Bio uses AI biosensors that mimic insect smell receptors in a trial with the world’s largest kiwifruit marketer

The New Zealand-based startup’s biosensors mimic insect smell receptors to deliver ultra-sensitive, real-time detection of volatile organic compounds (VOCs). This helps growers more accurately determine the best time to harvest, outperforming lab tools like gas chromatography mass spectrometry.

The project is supported by Zespri’s $2 million annual innovation fund, which backs initiatives aimed at boosting climate resilience and efficiency across a global network of over 4,000 growers. While traditional methods like Brix and dry matter testing require lab processing and offer limited insight, Scentian’s approach detects spoilage earlier, helps predict flavour, and improves storage outcomes, all in the field.

By combining AI models with a receptor database, Scentian can match specific VOCs to sensors, making the tech adaptable for different fruits and ripening stages. They’re currently running pilots with five global food companies to explore broader applications beyond kiwifruit.

Source: AgFunder

🤔 Thoughts:

Instead of relying on blunt proxies like Brix or dry matter, real-time VOC biosensors let growers assess ripeness directly in the field, potentially compressing decision cycles from days to minutes.

This isn’t just about operational efficiency. Kiwifruit are increasingly exposed to erratic weather that disrupts ripening. Scentian’s tech gives Zespri a way to buffer against that volatility, enabling more consistent quality across its network.

If metabolic sensing proves reliable, it could reshape how fresh produce is graded and moved with implications for post-harvest logistics, shelf-life prediction, and even pricing models.

🇸🇪 Millow is repurposing a Lego factory to produce an oat-and-mycelium protein with 97% fewer emissions than beef

The process uses just 3-4 litres of water per kilogram of protein, which is 99% less than soy-based proteins. It is said to require only a third of the energy and capital investment compared to typical mycelium liquid fermentation methods.

Using a patented dry-state fermentation process, the Swedish startup can make protein in under 24 hours. The result: 27g of complete protein per 100g serving, plus fibre and just 140 calories. The system also allows for flexible grain substrates, opening up options for local sourcing worldwide.

By converting a 25,000 sq m facility in Gothenburg instead of building new, Millow avoids ~1,400 tonnes of CO₂ emissions. Once fully equipped later this year, the site will produce up to 500kg of protein daily. Millow plans to roll out products like meatballs, minced meat, döner kebab, chicken-style bites, and paneer alternatives in both retail and foodservice channels.

Source: Green Queen

🤔 Thoughts:

Millow points to a future where protein production isn’t limited to giant greenfield plants. Instead, companies might retrofit idle industrial sites globally into modular, locally distributed protein factories, which could reduce time-to-market and environmental impact.

This modular model could bring production closer to consumers, further reducing emissions, reinforcing food security, and decreasing reliance on long-haul supply lines. It also shows that climate-friendly infrastructure (reusing buildings, minimising new concrete/steel) can align with scaling needs, potentially setting a new industry benchmark for sustainable expansion.

🇨🇦 After quadrupling sales, Lucent Bio’s Soileos fertiliser has been shown to sequester up to 10 tonnes of CO₂ per acre

A recent greenhouse gas study shows that Soileos, on average, sequesters 2.3 tonnes of carbon per acre, with some trials reaching as high as 10 tonnes under certain conditions.

Soileos is produced from upcycled agricultural by-products, avoids microplastics and synthetic additives, and enhances soil health by improving the soil microbiome and increasing organic carbon content.

After a fourfold jump in sales over the past year, Lucent Bio is scaling up, with plans underway for a new seed coating facility. Soileos is designed to support more sustainable food systems by helping producers and supply chains lower their carbon footprint.

Source: iGrow News

🤔 Thoughts:

Soileos doesn’t just reduce emissions, it helps turn farmland into a carbon sink, and it presents a climate-aligned crop input designed to meet both yield and decarbonization goals. As more food brands and retailers set Scope 3 targets, they’ll start pushing their supply chains to adopt inputs that store carbon, not just reduce it.

It also reflects a broader shift in how we think about soil. Instead of treating it as a passive medium, Soileos supports the soil microbiome and builds organic carbon, showing how fertilisers are starting to work with living systems rather than just feeding plants.

BIO BUCKS

Funding, M&As, and grants

🇳🇴 NoMy raised €1.25M led by Japan’s top beet sugar producer to accelerate the rollout of its mycoprotein technologies

The funding builds on a partnership announced in April 2024 between Norwegian Mycelium (NoMy) and Japan’s Nitten Sugar, focused on using sugar beet processing side streams to scale NoMy’s mycoprotein platform.

The investment will support NoMy in growing its fungal fermentation-based production, expanding sustainable protein supply in Japan, Norway, and across Europe.

By turning sugar beet byproducts into protein-rich fungi, the collaboration promotes efficient resource use and waste reduction, aligning with both companies’ sustainability strategies.

💰 Other investors: TD Veen, EIT Food, Farvatn Venture, and others.

Source: vegconomist

🇺🇸 Confluence Genetics acquired Benson Hill assets out of Chapter 11 to rebuild as a leaner, next-gen developer of soybean traits

Confluence Genetics is launching a new chapter as a robust agtech start-up, backed by seasoned investors like Expedition Ag Partners and S2G Investments. The company will focus on ultra-high protein soybeans for animal feed and expand its speciality food-grade portfolio.

The company will scale its proprietary soybean genetics and expand into new markets, using its unique soy germplasm, AI-driven CropOS® platform, and high-speed breeding facility to deliver differentiated, high-value traits.

The acquisition includes a robust intellectual property base with over 350 patents, as well as a 2029 soybean class that has already been planted for 2025 trials.

Source: Business Wire

🤔 Thoughts:

Confluence is stripping Benson Hill back to its core: soybean trait development and seed genetics. It’s shedding the rest, including costly processing assets and food ingredients, that stretched the original business too thin. The vertically integrated model proved unsustainable, especially as demand for plant-based protein softened and capital dried up.

More broadly, this looks like part of a wider reset in agrifood tech. The “do-everything” model is giving way to a more focused approach: build strong IP, form the right partnerships, and stay asset-light. Instead of trying to create new value chains from scratch, companies are finding it smarter to plug into existing ones by licensing seed traits to processors and feed suppliers rather than owning the full stack.

🇨🇦 The Canadian government is investing $15M in Protein Industries Canada to boost the use of genomics and AI in agriculture

The funding is split into two streams: $7M for Genomics and $8M for Artificial Intelligence. It’s part of a broader effort to improve Canada’s food security.

The genomics stream will focus on developing and commercialising new pulse and cereal crop varieties using advanced breeding tools, while bringing together players from across the value chain.

The AI stream aims to strengthen tech across the sector, supporting innovations in seed genetics, on-farm data, supply chain management, and food safety, to help increase overall efficiency.

Source: iGrow News

GEEK ZONE

Latest scientific research papers

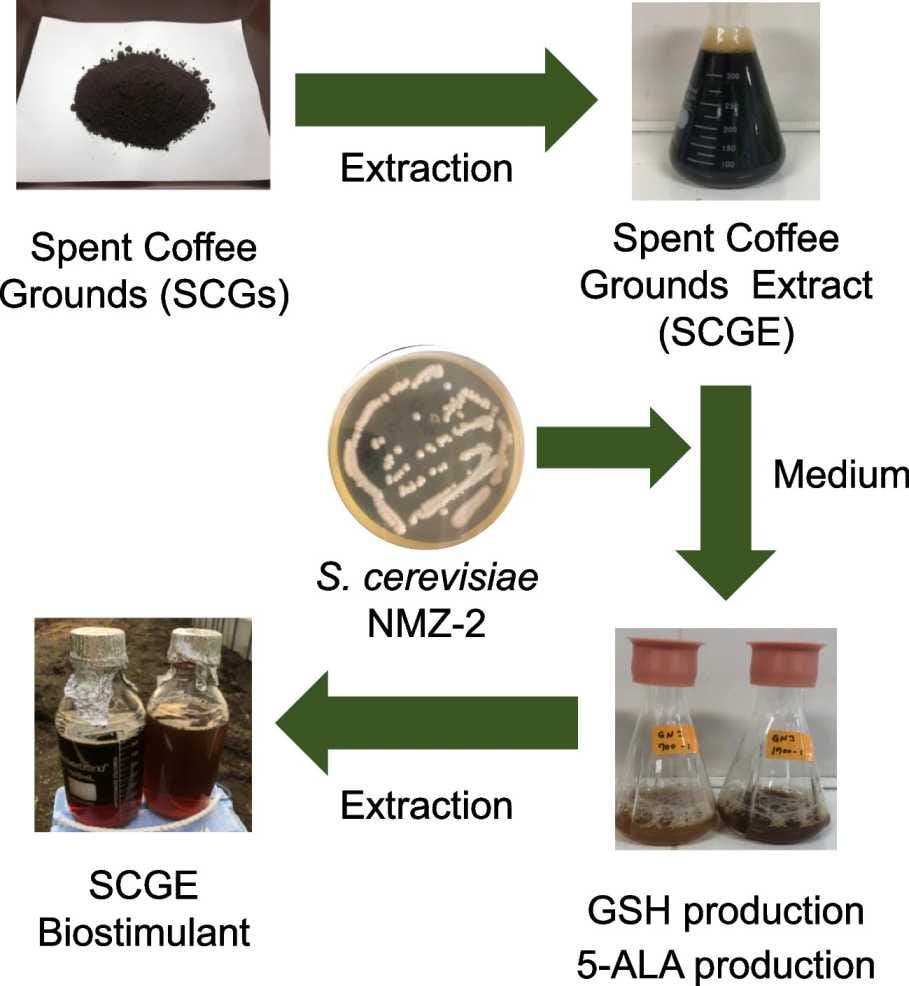

☕️ Researchers turned spent coffee grounds into yeast-derived biostimulants for crops

Using Saccharomyces cerevisiae (brewer’s yeast), the team produced glutathione (GSH) and 5-aminolevulinic acid (5-ALA), two agricultural biostimulants, by fermenting extracts from spent coffee grounds (SCGs).

They fine-tuned the growth media with SCG extract (SCGE) and adjusted glycine levels to control production ratios. SCGE at 68-116 g/L more than doubled yeast growth. GSH peaked at around 50 mg/L with 68-116 g/L SCGE, while 5-ALA reached approximately 3.5 mg/L at higher SCGE concentrations.

This approach valorises coffee waste into dual-use biostimulants that can be added to biofertilizers, helping to cut costs and improve soil health, while supporting a more circular, climate-friendly agricultural system.

Source: Applied Biochemistry and Biotechnology

🌱 Microalgae grown on dairy wastewater tripled bean germination while treating industrial waste

Researchers cultivated Scenedesmus sp. microalgae in a medium made from 80% dairy wastewater, aiming to treat the waste and produce high-protein biomass. They then applied the algae to common bean (Phaseolus vulgaris) crops, using both live cultures and cellular extracts, and compared the outcomes to conventional synthetic fertiliser and a water-only control.

Algae grown on dairy wastewater achieved biomass productivity of 0.22 g/L/day and protein content of 384 mg/g, while removing 79.2% of nitrogen and 77.1% of phosphate from wastewater. This process significantly improved crop outcomes. Germination jumped to 305% (vs 127% with synthetic fertiliser), plant height reached 49.5 cm, leaf counts exceeded 60, and flower numbers rose by up to 256%.

This circular bioprocess transforms dairy effluent into something useful on two fronts: it recycles nutrients and enhances crop performance. For food and dairy producers, it points to a potentially scalable path toward low-footprint, circular agriculture.

Source: Frontiers in Plant Science

🦠 New biocontrol bacteria reduced sugar beet disease nearly as well as fungicides and raised yields by 15%

Researchers tested a newly isolated Bacillus velezensis KT27 strain for its ability to control fungal pathogens, especially Cercospora beticola, the main culprit behind Cercospora Leaf Spot (CLS) in sugar beets. The team assessed lab and field performance, focusing on antifungal effects and plant growth benefits.

In vitro, KT27 inhibited C. beticola by 60.2%, though it was less effective against other fungi. The antifungal impact depended on live bacterial cells, not just secreted compounds, and improved when primed with inactivated fungal material. In field trials, KT27 protected sugar beets nearly as well as chemical fungicides (just 9.1% less effective) and increased root yields by up to 15.2%.

With rising resistance to chemical fungicides and growing pressure to reduce agrochemical use, KT27 offers a potent, low-impact alternative for managing CLS. It also delivers a growth boost, positioning it as a dual-benefit bio-input for sugar beet producers aiming to combine sustainability with productivity.

Source: PLOS One

EAR FOOD

Podcast episode of the week

🎧 Co-commercialise, then acquire: The new playbook for ag biologicals M&A?

Host: Sarah Nolet

Guest: Matthew Pryor (Tenacious Ventures), Shane Thomas (Upstream Ag Insights)

Syngenta’s acquisition of Intrinsyx Bio wasn't just about the tech, it was about owning the control point of distribution. In a fragmented biologicals space, having the trust of growers and the ability to deliver at scale matters more than marginal product improvements

Deals like ICL × Lavie Bio and Syngenta × Intrinsyx show that corporates tend to co-commercialise microbial products before making a full acquisition. These partnerships help reduce technical risk and test portfolio fit. If you’re trying to spot the next acquisition, look at who’s already collaborating.

Unlike biocontrols, which often compete with synthetic crop protection, nitrogen-fixers open up a new line item in the farmer’s wallet. For a company like Syngenta, it’s an additive revenue stream, not a replacement. For incumbents, that could make biological nutrient solutions strategically more attractive than biocontrols.

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Hi Eshan, how are you doing on this very nice day? Thanks so much for outstanding issue #105. I always learn something important from your fantastic informative issues. You are appreciated. Have a wonderful week friend 👍❤️