Developing Market Agrifood Funding Up 63%, Saudi Invests in Fermentation for Food Security, and Turning Dairy Waste to Casein

Also: Biokraft Foods unveiled India’s first cultivated trout fillet prototype in government-backed collaboration

Hey, welcome to issue #99 of the Better Bioeconomy newsletter. Thanks for being here! 👋🏾

I took a short break from the newsletter over the past two weeks, as work got pretty busy, and my family visited Hong Kong for the first time, so I was busy showing them around. Had a great time with them! 🙂

This week, Biokraft Foods teamed up with a government research institute to launch a cultivated trout prototype, marking a milestone for India’s growing cultivated protein sector. In France, Standing Ovation is turning dairy waste into casein proteins, thanks to a major partnership with Bel Group. Over in Saudi Arabia, Liberation Labs is building a precision fermentation hub with NEOM to strengthen local food security.

Meanwhile, developing markets are defying global trends, with agrifood tech funding there jumping 63% year-over-year. And in industrial biotech, the merger of Manus and Inscripta sets the stage for faster, more scalable production of bio-based products.

Alright, let’s dig into the latest updates on how biotech is transforming food and agriculture for a climate-friendly food system.

BIO BUZZ

Products, partnerships, and regulations

🇸🇦🇺🇸 Liberation Labs partners with NEOM Investment Fund to build a precision fermentation facility in Saudi Arabia to boost food security

The US startup is partnering with Saudi Arabia’s NEOM Investment Fund, an existing investor in the company, to develop a new precision fermentation facility in the Kingdom. The move comes as Saudi Arabia looks to strengthen its food security, with 80% of its food currently imported.

The new facility is expected to be modelled after Liberation Labs' plant in Indiana, a 600,000-liter site that can scale up to 4 million liters. A feasibility study will kick things off, and thanks to strong industrial support on the ground, the build is expected to be relatively smooth.

Once up and running, the site is expected to produce a range of bioproducts including animal-free dairy and egg proteins, specialised nutrition components like lactoferrin and human milk oligosaccharides (HMOs), and key intermediates for the pharmaceutical industry.

Source: AgFunder

🤔 Thoughts:

We’re hopefully seeing sovereign wealth funds treat food tech infrastructure with strategic importance similar to that of energy or transportation. This partnership reflects a growing pattern: governments recognising that investing in biomanufacturing is a way to future-proof their food systems.

It’s also part of a broader shift in resource-rich nations looking to diversify. Just as some Gulf states are backing solar and hydrogen to prepare for a post-oil economy, they are also investing in alt proteins as a step toward a more resilient, post-farm food system.

These moves point to a new kind of food geopolitics. Countries are increasingly focused on securing the technologies and infrastructure they’ll need to stay competitive and self-sufficient in the next era of agriculture.

🇮🇳 Biokraft Foods unveiled India’s first cultivated trout fillet prototype in government-backed collaboration

The Mumbai-based startup and the ICAR-Central Institute of Coldwater Fisheries Research developed a structured cultivated trout fillet made from native trout cell lines using 3D bioprinting tech. The prototype contains ~3% cell biomass, with the rest made up of algal and plant-based ingredients.

Next up, Biokraft is preparing to submit the country’s first application for the sale of cultivated meat, starting with chicken. Their platform uses 3D bioprinting to closely mimic the texture, flavor, and structure of traditional meat.

Following India’s first public tasting of cultivated meat, which featured a hybrid chicken breast, the company has more tasting events lined up. Biokraft is also setting up a dedicated R&D and pilot facility, part of its broader plan to bring cultivated chicken and seafood to market by 2026.

Source: Green Queen

🤔 Thoughts:

Biokraft’s partnership with government-backed institutes like ICAR’s fisheries research center adds a layer of credibility that could support downstream acceptance. Having a public institution involved may not directly influence regulatory decisions, but it could help validate the work in the eyes of policymakers, investors, and the public.

This kind of affiliation signals alignment with national priorities around food security and sustainability, which could make cultivated meat more visible and relevant in policy discussions over time. It also reflects a shift in how trust is built for novel foods in emerging markets: local institutional backing might carry more weight than private-sector claims alone.

From an investment perspective, a clear approval process de-risks the space for investors in India. Knowing there is a timeline and criteria for getting to market (possibly by 2026 for Biokraft’s products) makes the cultivated meat sector more attractive for funding.

🇫🇷 Standing Ovation partnered with Bel Group to convert dairy industry’s biggest waste product into casein proteins using precision fermentation

The collaboration will see Standing Ovation use whey serum provided by the Bel Group, which is also an investor in the startup. With 80-90% of milk used in cheese production ending up as whey, and ~180-190M tonnes of it generated globally each year, this approach taps into a major opportunity to reduce waste and promote circularity.

Standing Ovation’s process uses fermentation to convert the sugars found in whey, such as lactose and galactose, into casein, the key protein in milk. Their proprietary method works with all types of whey, making it both flexible and scalable.

Access to Bel Group’s whey supply also allows the startup to reach a broader market. One production stream supports the vegan sector, while the other can be used to complement conventional dairy, positioning its proteins as a sustainable ingredient in both sectors.

Source: Green Queen

🤔 Thoughts:

This model reduces reliance on virgin agricultural inputs by valorizing a massive sidestream. Whey disposal has been an economic and environmental headache. Turning whey into a profitable protein ingredient means dairies can generate new revenue (possibly) instead of waste treatment costs.

It also provides a local protein source, contributing to “protein autonomy” and food security. Strategically, this is a strong example of incumbents turning an ESG challenge (waste and emissions) into a competitive advantage by cutting GHG emissions and differentiating products as more sustainable (Standing Ovation’s fermented casein may carry a much lower carbon footprint).

Hoping to see more of this kind of industrial symbiosis where solving for sustainability also unlocks real business value.

🇺🇸 The Better Meat Co has received its sixth patent, this time for a process that turns potato waste into mycelium protein

The patented approach involves growing strains from the Neurospora and Aspergillus genera in a potato-based liquid medium, transforming what’s often a low-value, underutilised byproduct of potato processing into a protein- and fibre-rich biomass.

The resulting product, Rhiza, boasts impressive nutritional value. It contains 50% protein by dry weight, higher than eggs, and has a digestibility score between 0.87 and 0.96, putting it on par with animal proteins like beef and casein. Plus, it’s free from cholesterol and low in saturated fat.

The patent also extends to various downstream applications, such as pasteurising, grinding, and blending Rhiza into different food products. This can include shaping it into items like nuggets, sausages, and patties, and integrating it with flavours to mimic meats such as chicken, beef, or pork.

Source: Green Queen

🤔 Thoughts:

This is a great example of mycelium’s versatility as a biomanufacturing platform. Better Meat Co is showing how mycelium can be used as a high-efficiency, adaptive chassis that can grow on low-cost feedstocks like potato waste. That’s important in the broader effort to improve the unit economics of fermentation-based proteins by relying on more affordable, readily available inputs.

There’s also the environmental upside. Using waste streams helps reduce the footprint of production. Over time, approaches like this could support a protein supply chain that uses fewer resources and generates less waste, moving us closer to a more efficient, modular model of food manufacturing.

BIO BUCKS

Funding, M&As, and grants

🌏 Agrifood tech funding in developing markets up 63% YoY, while global funding fell 4%

According to the AgFunder report, despite a global dip, agrifood tech investment in developing regions soared 63% to $3.7B in 2024. These markets now make up nearly a quarter (23%) of global agrifoodtech funding.

Although deal count dropped 8.4% to 523, late-stage funding surged by 133% YoY. Growth-stage deals rose 54%, while early-stage growth was nearly flat (+1%).

Ag Biotechnology funding reached $118M (up 56% YoY) across 42 deals, while Innovative Food hit $70M (up 79% YoY) across 24 deals. Both categories outperformed their global counterparts, where funding declined.

Source: AgFunder

🇪🇺 European food tech startups raised €4.1B, just 2% less than 2023, showing signs of stabilising

According to the DigitalFoodLab report, European food tech funding showed resilience after a 57% drop from the 2021 peak and a stronger position compared to the global 72% drop from the same period .

German startups led food science investments in 2024, raising €250M. The UK (€240M) and France (€130M) followed, with strong showings also from Switzerland and Finland (€110M each). These countries stood out due to their large and engaged consumer markets.

Alternative proteins emerged as the most active category by number of deals, with notable raises from Formo (€61M), Infinite Roots (€58M), and Onego Bio (€55M). Many of these companies take a B2B approach, tapping into Europe’s strengths in ingredients and supply chain innovation.

Source: Green Queen

🤔 Thoughts:

Europe continues to stand out as a global leader in food tech investment, accounting for 28% of global agrifoodtech funding last year. It’s encouraging to see the concept of “future foods” expanding beyond alternative meat. The report’s “Food Science” category includes not just alt proteins, but novel ingredients and functional compounds, attracting €830M in 2024 (up 25% YoY).

While alt proteins remain central, Europe’s funding momentum is also being shaped by innovations like cocoa-free chocolate and beanless coffee. These products broaden the climate and ethical agenda beyond animal agriculture, addressing risks like deforestation, commodity volatility, and overreliance on fragile global supply chains.

By supporting these developments, Europe is taking steps toward a broader food transition that connects decarbonization with supply chain resilience, ethical sourcing, and regional self-reliance.

🇺🇸 Manus and Inscripta merged to form an end-to-end platform to accelerate commercialisation of bioalternative products

The merger integrates Inscripta’s genome engineering technologies with Manus’ strengths in cell factory engineering, biomanufacturing, and commercialisation, helping streamline development and improve efficiency in industrial biotech.

The merged entity leverages complementary product lines in food ingredients, wellness, and ag chemicals, supported by over 60 products in the market and partnerships, including one with Tate & Lyle.

Backed by domestic manufacturing capabilities and plans to use AI for process optimisation, the company is focused on scaling production, reducing costs, and advancing the shift toward bio-based solutions.

Source: Manus Bio

🤔 Thoughts:

This helps address a key fragmentation challenge where a promising lab innovation can stall before reaching commercial scale. For customers, it could offer a one-stop shop for rapidly prototyping and producing bio-based ingredients, reducing the coordination burden that often comes with working across multiple tech providers.

After years of specialised startups focusing on either the “digital” side (like strain design) or the “physical” side (like fermentation), the industry seems to be stitching those pieces back together.

In some ways, it’s a shift away from the earlier “platform economy” vision, where companies would each specialise and partner, toward a more integrated approach. Feels like a full-circle moment for synbio, as the field revisits end-to-end models that defined its early days.

GEEK ZONE

Latest scientific research papers

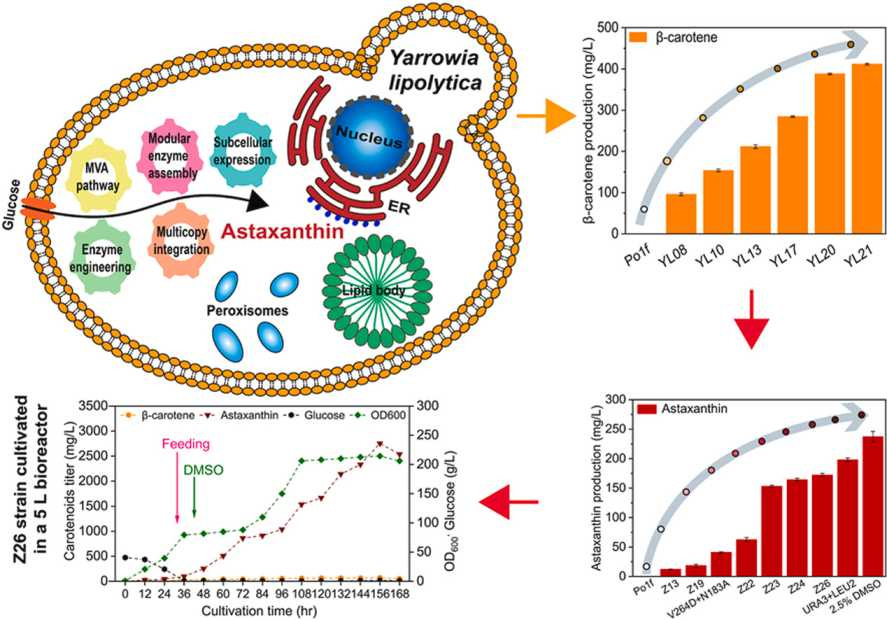

📈 Engineered yeast strain achieved record-breaking astaxanthin production through metabolic and process optimisation

Researchers successfully engineered Yarrowia lipolytica to produce astaxanthin, a valuable antioxidant, using an inexpensive mineral-based medium.

While initial output was modest at 12.3 mg/L, forming a single enzyme complex (HpBKT and HpCrtZ) boosted levels to 41.0 mg/L. Further improvements, like integrating genes iteratively and directing pathways to specific cell compartments, helped raise production to 237.3 mg/L.

The final, optimised system in fed-batch fermentation produced an ‘industry-leading’ 2820 mg/L of astaxanthin, a 229-fold increase over the original strain, with a daily productivity of 434 mg/L and an efficiency of 5.6 mg/g glucose.

Source: Synthetic and Systems Biotechnology

🛠️ A novel hollow fibre bioreactor enables scalable tissue biofabrication for cultivated meat by ensuring uniform and precise nutrient delivery

A stereolithographically fabricated HFB (hollow fibre bioreactor) using densely packed semipermeable fibres achieved leak-free, high-pressure perfusion and uniform nutrient delivery, supporting tissue growth on a centimetre scale.

Tissues with perfusion showed improved cell density, protein markers, sarcomere alignment, and produced more flavour-associated amino acids (e.g., umami and sweetness) compared to non-perfused controls.

A robot-threaded 1125-fibre HFB successfully produced >10g whole-cut cultured chicken meat, showing consistent perfusion, active metabolism, and potential for industrial-scale automation.

Source: Trends in Biotechnology

🌱 Researchers identified the first plant CLE peptide that promotes, rather than suppresses, symbiosis with arbuscular mycorrhizal fungi

Medicago truncatula CLE16 (Mtcle16) is the first known plant CLE peptide that positively regulates arbuscular mycorrhizal (AM) symbiosis, in contrast to previously described CLE peptides that function as negative regulators.

MtCLE16 enhances arbuscule abundance and fungal colonisation by working through the pseudokinase MtCRN, which helps lower reactive oxygen species (ROS) and dampens immune responses in root cells.

Meanwhile, the AM fungus Rhizophagus irregularis produces a CLE-like peptide called RiCLE1 that mimics MtCLE16. Although it doesn’t affect arbuscule growth, RiCLE1 supports colonisation by also acting through Mtcrn and reducing ROS, a case of molecular mimicry. This study reveals a signalling mechanism where plants and fungi use CLE peptides to modulate interactions.

Source: Proceedings of the National Academy of Sciences

EAR FOOD

Podcast episode of the week

🎧 From Apple to Tesla to biotech: Lessons on scaling breakthrough ideas in industrial biology

Hosts: Karl and Erum

Guest: Veronica Breckenridge, founder of First Bight Ventures and BioWell

Veronica brings years of experience from companies like Apple, Motorola, and Tesla, where she worked at the intersection of innovation, industrial engineering, and supply chain strategy. That background shapes how she now approaches scaling in deep tech/synthetic biology.

She sees biomanufacturing not just as a tool, but as core infrastructure, much like how cloud computing transformed the digital world. Biology, she notes, is local and plentiful, offering a way to build supply chains that don’t rely on distant, resource-intensive inputs.

Biology is also scaling fast. Genome sequencing costs, for example, have dropped even faster than Moore’s Law in computing. This convergence of biology and tech is accelerating the path to industrial-scale innovation.

But science alone isn’t enough. Even if something works in the lab, it doesn’t always translate to a viable product. Founders need a strong grasp of market fit, cost competitiveness, alternative production methods, and what customers actually want.

As Veronica puts it, great technology doesn’t guarantee success. Building a company also takes operational know-how, clear storytelling, the right team, and the ability to connect with the market.

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Got any feedback/suggestion? Drop them here:

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organizations I am associated with.

Welcome back Eshan! I'm glad you had some good quality time visiting your parents. They must be very proud of you and all your excellent accomplishments! It's always a pleasure to get your veey informative newsletters. I always learn some encoruaging news from them. Now more than ever, in the rapidly changing would of tarrifs, creating sustainable alt protein sources is paramount. Thank you for all your outstanding work in the field. You are appreciated 👏 ♥️