EU Votes to Make Biotech A Strategic Priority, World’s Largest Chocolate Maker Explores Cultured Cocoa, and 1650-Tonne Gas Protein Deal

Also: Triple-microalgae biostimulant application increased plant yield by 32% and photosynthesis efficiency by 25%.

Hey, welcome to issue #110 of the Better Bioeconomy newsletter, your weekly dose of biotech’s latest in food and agriculture. Thanks for being here! 👋🏾

Quick note before we dive in: I’m experimenting with switching to a biweekly schedule (every two weeks) for two reasons.

First, I write this newsletter mostly on weekends, and like many of you, juggling a full-time job, time with friends, gym sessions, and life in general is not always easy. Second, as you may have realised, I’ve started going beyond just curating headlines and summaries to include more of my own commentary. I’ve been enjoying this mental workout, but it also means each issue takes more time and thought.

A biweekly rhythm gives me the space to go deeper to curate more meaningfully, share more thoughtful takes, and experiment with new content formats I’ve been wanting to try, like company deep dives.

As always, I’d love to hear what you think. Let’s get into it!

BIO BUZZ

Products, partnerships, and regulations

🇪🇺 EU Parliament backs report calling to make biotech a strategic priority following €350M life sciences push

Earlier this month, the European Commission’s life‑sciences strategy allocated €350M to improve biomanufacturing efficiency, fund sustainable innovations and cement the EU’s bioeconomy leadership. A delayed but comprehensive Biotech Act (now slated for late 2026) aims for faster approvals for novel foods like cultivated meat and precision‑fermented proteins.

Now, MEPs overwhelmingly backed a parliamentary report that labelled biotechnology and biomanufacturing as strategic industries for sustainability, economic security, and food security. The sector is recognised as one of 10 strategic technologies critical to Europe’s competitiveness and decarbonisation goals.

Despite Europe’s strong research base, the report notes that patchy policy frameworks and a lack of scale‑up infrastructure hinder the sector’s potential. It urges coordinated action, de‑risking instruments at the European Investment Bank, stronger public‑private collaborations, world‑leading R&D hubs and initiatives to build public awareness

The proposed Biotech Act should harmonise fragmented approval processes, learn from non‑EU frameworks and use regulatory sandboxes to test new biotech products. MEPs recommend simplified approvals for products already authorised in like‑minded countries and call to double the EU research budget, reaching 3 % of GDP for R&D by 2030.

Source: Green Queen

🤔 Thoughts:

The EU’s shift on biotech marks a move toward boosting industrial competitiveness. It’s stepping away from a fragmented, risk-averse approach and leaning into science-based, innovation-friendly frameworks to be more in line with global frontrunners. If new tools like regulatory sandboxes and harmonised approval pathways come through, Europe could go from playing catch-up to becoming a serious player in biomanufacturing, especially for novel foods.

What stands out is how biotech is being tied to the EU’s broader push for strategic autonomy. This goes beyond food. It’s also about strengthening supply chains, cutting industrial emissions, and building economic resilience with bio-based inputs.

By weaving biotech into its digital and green agendas, and linking it to AI and trade policy, the EU is pointing toward more aligned regulations and global partnerships through its innovation strategy. If this plays out, we could see a new wave of EU bio companies that don’t just innovate, but scale and manufacture closer to home.

🇫🇮 Solar Foods signed a letter of intent to commercialise up to 1,650 tonnes of its Solein gas protein

The letter of intent was signed with a global health‑and‑performance nutrition brand that could see 500–1,650 t of gas‑fermented Solein protein sold annually from 2026‑2030.

Combined with two MoUs signed in May for 6,000 t/year, these deals would secure roughly half the 12,800 t output planned for its forthcoming Factory 02. Factory 02, currently in pre‑engineering, is planned in three phases with first production by 2028 and full capacity by 2030.

The company estimates the Factory will bring production costs to €4.30‑5.20 per kg and potential net sales of €80‑200 M. About €83 M has been raised toward the €110 M in grants offered by the EU Commission and Business Finland for production build-out.

Source: Green Queen

🤔 Thoughts:

As microbial protein companies scale, we could see a shift toward infrastructure-style financing. Solar Foods’ offtake deals suggest that having committed demand is becoming essential to unlock capital at an industrial scale.

It’s a familiar playbook from renewables, where long-term power purchase agreements help de-risk upfront investment. Fermentation startups may head the same way: lining up multi-year supply contracts to access blended financing, including equity, debt, and possibly green bonds tied to emissions or volume.

If this approach takes hold, it could change how alt protein companies raise capital by opening the door to infrastructure investors, development banks, and climate-aligned asset managers, not just venture capital.

🇨🇭World’s largest chocolate supplier partners with the Zurich University of Applied Sciences to explore cell‑culture tech for cocoa alternatives

Hit by climate shocks and record-high cocoa prices, the company has seen a 6% drop in sales volume over the past nine months and is now looking to strengthen its supply-chain resilience.

The partnership combines Barry Callebaut’s chocolate expertise with the deep cell-culture experience of ZHAW professors Tilo Hühn and Regine Eibl-Schindler. Growing cocoa cells in bioreactors could significantly reduce emissions, water use, and land reliance by reducing the need for farmland and stable weather.

Rather than replacing conventional cocoa, Barry Callebaut sees this as a way to expand consumer choice and future-proof its supply, while continuing to support farming communities.

Source: Green Queen

🤔 Thoughts:

Barry Callebaut’s move signals that large incumbents are beginning to see cellular agriculture as a hedge against climate-driven supply shocks. Even if this collaboration is still in the early stages of R&D, it is heading in a promising direction.

By framing cell‑cultured cocoa as a complement, not a replacement, the company points to a future of hybrid supply chains where conventional beans sit alongside cultured inputs. That approach mirrors early launches of other novel foods (e.g., blended meat burgers, hybrid cultivated‑meat products, blended coffee, etc.), letting firms test premium, lower‑impact SKUs while maintaining existing supply chains.

While near‑term production costs for cultured cocoa will likely exceed farm‑gate prices, the strategy buys time to refine bioprocessing, gather consumer feedback, and navigate evolving regulatory rules, ultimately smoothing the industry’s gradual shift toward lower‑footprint ingredients.

🇩🇰 21st.Bio launched a program to help companies produce alpha-lactalbumin whey protein via precision fermentation more affordably

The Danish company’s development launchpad program aimed at enabling companies to produce recombinant alpha-lactalbumin, a protein making up 25% of bovine whey. It’s said to be the first solution enabling companies to make this protein themselves.

This solution uses a high-yield microbial strain licensed from the biosolutions company Novonesis to produce efficient and pure alpha-lactalbumin. Due to its essential amino acid profile, digestibility, and potential cognitive benefits, the protein is particularly important for infant formula and general nutrition.

The program guides partners from early development to commercialisation, offering production strains, fermentation process support, pilot-scale infrastructure (including a 3,000L plant in Copenhagen), and regulatory assistance. It follows a royalty-based licensing model.

Source: Green Queen

🇨🇳 China leads globally in cultivated meat patent filings, with 8 of the top 20 applicants

That’s more than double the number from the US, which has just three. China’s list includes private firms and universities, highlighting a coordinated national effort around food security and alternative proteins.

Much of this innovation is being driven by public institutions. Universities like Zhejiang University and the China Meat Research Centre are among the top filers. Together, their output surpasses that of all public institutions in the US and Europe.

Asia-Pacific leads in cultivated meat R&D, outpacing the US and Europe together in total patent filings. Patent families point to deep, diverse innovation, especially in China, where institutions work on various fronts of cultivated meat tech, from media formulation and cell scaffolds to efficiency-enhancing processes, indicating a mature and strategic innovation landscape.

Source: GFI APAC

🤔 Thoughts:

Scaling cultivated meat takes significant R&D and proprietary know-how. China is leaning into this by encouraging universities and public institutes to file patents and building a broad domestic IP base to reduce dependence on foreign tech and strengthen supply-chain resilience. This effort goes hand-in-hand with recent investments in pilot plants and dedicated “future food” zones.

One development to watch is that top filers like Zhejiang University could eventually spin out patent-heavy startups. That said, a large patent portfolio doesn’t always translate to commercial success. Many filings are early-stage or defensive, and their real-world value still needs to be tested.

BIO BUCKS

Funding, M&As, and grants

🇦🇺 Eclipse Ingredients secured AUD $7M funding to develop high-value ingredients using precision fermentation, starting with lactoferrin

Lactoferrin offers a range of health benefits, including supporting immunity, gut health, and iron regulation, along with antimicrobial and anti-inflammatory effects. However, extracting it from milk is inefficient: it takes about 10,000 litres to produce just 1 kilogram, making it impractical at scale using conventional methods.

While several startups are working on producing lactoferrin this way, the Australian startup differentiates itself through a strong IP portfolio and strategic execution. It aims to enter the market efficiently as a “fast-follower " with a “super capital-efficient” approach, using existing infrastructure and expertise at the University of Queensland and CSIRO.

Although human lactoferrin has been studied for many years, it has only recently become feasible to produce it at scale. Advances in fermentation technology and rising demand for proven health ingredients have made this a timely moment for commercialising non-pharma applications.

Source: Green Queen

💰 Investors: Commonwealth Government (delivered by Australia’s Food and Beverage Accelerator), AgFunder, and angel investors

🤔 Thoughts:

The Eclipse model points to a quiet but important shift in how biotech startups think about scale. Instead of building everything in-house, some are beginning to assemble scale through partnerships, leased capacity, and public infrastructure. This asset-light approach may be less of a cost-saving tactic and more of a strategic reconfiguration of risk and speed.

This approach puts less emphasis on proving capital readiness and more on proving execution. It also repositions public R&D infrastructure as part of the commercial pipeline, not just the academic one. If fermentation hubs and university-linked facilities become embedded in early scale-up, they will become a core component of how biotech reaches the market.

Owning a facility may no longer be the default signal of maturity. Instead, smart access to infrastructure and well-structured scale-up partnerships could become the new benchmark. If the model holds, we may see a generation of fermentation startups that stay smaller longer, move faster, and get further before committing to major capital investments.

🇦🇷 Gates Foundation backs Puna Bio to bring extremophile-based ag biologicals to Africa, its first investment in an Argentine startup

Puna Bio develops agricultural biologicals using extremophiles, microorganisms that thrive in extreme environments. These are used as seed coatings to help crops better withstand climate-related stress.

In addition to the Gates Foundation, Corteva Catalyst led the Series A round, which included participation from At One Ventures in April. The funds will support product development and international market entry, especially in regions vulnerable to climate impacts.

Working with the Gates Foundation, Puna Bio plans to tailor its solutions for sub-Saharan Africa, aligning with shared goals around food security and leveraging the Foundation’s experience in scaling technologies for smallholder farmers.

Source: AgFunder

🤔 Thoughts:

Access to advanced agtech often struggles to reach smallholder farmers, especially in developing regions, where cost, distribution, and product focus often skew toward premium markets. The Gates Foundation’s investment in Puna Bio aims to close that gap by supporting the adaptation and rollout of extremophile-based tools for sub-Saharan Africa, where affordable, climate-resilient tools are badly needed to improve yields and soil health. Smallholders grow most of the food in these regions but often remain excluded from innovation.

This also expands Puna Bio’s reach beyond Latin America, where ag biologicals are already gaining traction. More than half of farmers use bio inputs in some form in Brazil, but adoption in Africa is still early. It’s a step toward correcting the geographic imbalance in access to biological inputs and, ideally, a sign of more development-focused capital flowing into agtech as climate and food pressures intensify.

🇨🇦🇺🇸 Miraterra acquired soil DNA startup Trace Genomics for deeper soil insights

The acquisition brings Trace’s advanced biological tools, IP, products, and its lab in Ames, Iowa, into the fold. This allows Miraterra to integrate biological, mineral, and hydrological testing into a more complete approach to soil health. The added lab capacity, combined with Miraterra’s Raman spectroscopy tech, is expected to help cut costs and speed up product development and revenue.

Trace’s soil DNA sequencing helps growers understand underground biology for better crop decisions. Still, the technology is more expensive than traditional tests, which limits farmer adoption despite environmental and economic benefits.

The acquisition reflects broader challenges in the agtech sector, where profitability concerns are prompting acquisitions and raising doubts about standalone business models in this field.

Source: AgFunder

🤔 Thoughts:

Soil biology is edging toward the agronomy mainstream, moving beyond academic novelty into practical decision‑making. This acquisition is one of several moves aimed at bundling chemical, physical, and microbial data into a single soil‑health platform.

It reminds me of how weather data evolved. What began as standalone forecasts eventually became a system input, streamed into planting models, irrigation schedules, and insurance underwriting. Soil data may follow a similar path.

Once microbial profiles can be cost-effectively layered with chemical and physical metrics, we could get a new class of agronomic models. These would not just flag nutrient gaps but predict which microbial interactions drive yield, resilience, and input efficiency in specific fields. A platform that can collect, interpret, and embed this data into recommendations could reshape how agronomic services are delivered.

🇺🇸 Spearhead Bio secured an NSF STTR Phase I grant to push forward genome engineering in corn, using the plant’s natural DNA

With the funding, the startup (launched by Danforth Technology Company in 2025) will begin corn transformation work earlier than planned using its TAHITI genome-editing platform. This platform enables fast, targeted edits aimed at boosting crop resilience.

TAHITI (Transposase Assisted Homology Independent Targeted Insertion) relies on the plant’s own transposase machinery to precisely insert genes, whether in transgenic or non-transgenic crops.

Spearhead points out that developing new corn lines typically takes up to 16 years and costs around US$115M. Their goal is to cut that timeline and cost significantly, building on TAHITI’s success in soybeans and model plants.

Source: Danforth Center

🤔 Thoughts:

CRISPR is highly precise for cutting, but inserting larger traits in most plant systems still brings low efficiency and more off‑target integrations. TAHITI combines a plant transposase with a nuclease to target insertions. Early Arabidopsis and soybean data point to higher precision. The corn trials funded by NSF will test whether that advantage holds.

If the results translate, the method could make it practical to add disease‑resistance or yield traits without disrupting other genes, eventually enabling trait stacking with minimal collateral effects. By pairing a natural “glue” with CRISPR “scissors,” Spearhead Bio shows proof‑of‑concept for a promising ‘cut‑and‑paste’ genome‑engineering toolkit that could evolve into a modular platform at scale.

🌏 7 startups join Big Idea Ventures’ Global Food Innovation Fund II to tackle major food system challenges using science-driven solutions

The cohort addresses multiple fronts: fermentation-based ingredients (e.g., Abydos Bioscience), cocoa alternatives (Motai Group), and shelf-life improvements, using technology like plant cell culture and agricultural by-product transformation.

Abydos Bioscience’s clean-label fats and EarthKind’s edible oils aim to significantly reduce environmental impacts in food and personal care applications, presenting scalable solutions to replace traditional inputs.

Other notable companies, such as BioBlends, Darewin Evolution, and Prozymi Biolabs, are innovating in biopreservation, sustainable omega-3 sourcing via algae, and making gluten-free bread more accessible and nutritious.

Source: vegconomist

GEEK ZONE

Latest scientific research papers

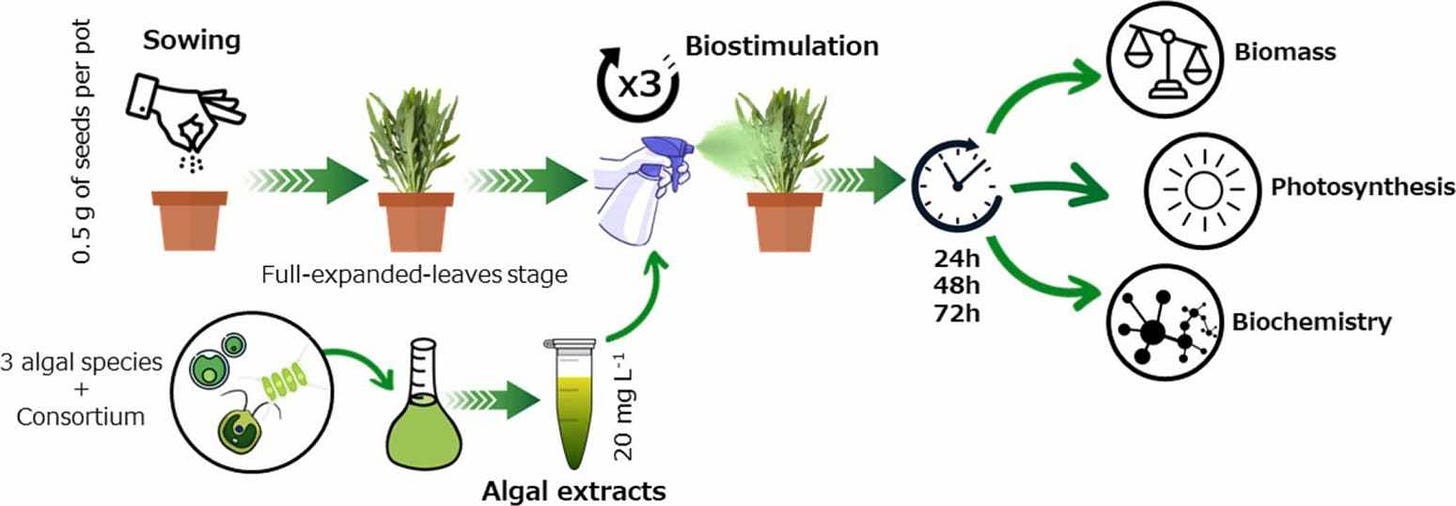

🌱 Triple-microalgae biostimulant application increased plant yield by 32% and photosynthesis efficiency by 25%

Researchers tested foliar sprays made from three microalgae species (Auxenochlorella protothecoides, Tetradesmus obliquus, and Chlamydomonas reinhardtii ), applied individually and as a mixed-species blend to wild rocket (Diplotaxis tenuifolia) plants at the early vegetative stage.

The microalgal consortium increased fresh biomass by up to 32% and improved photosynthetic efficiency by 20–25%. They also boosted chlorophyll and carotenoids by 10–15%, enhanced nitrate accumulation and nitrogen assimilation, and triggered a transient antioxidant spike. All these effects occurred within 72 hours.

This study shows the potential of multi-species microalgae as biostimulants. Particularly for fast-growing leafy greens like wild rocket, this approach could enhance yield, nutritional quality, and shelf life with minimal environmental footprint.

Source: Plant Science

🌾 First rice-specific LLM trained on 98% of global rice data outperformed GPT-4o and DeepSeek-R1 on rice-specific tasks

SeedLLM⋅Rice is a 7-billion-parameter language model built from 1.4 million rice-focused publications, covering over 98% of global rice research. It’s been fine-tuned on domain-specific QA datasets and linked to a Rice Biological Knowledge Graph (RBKG) with transcriptomic, proteomic, and genome annotation data from more than 1800 studies.

In evaluations, SeedLLM outperformed GPT-4o and DeepSeek-R1 on rice-specific tasks, with win rates ranging from 57% to 88%. Human experts gave it a median score of 85/100, ranking it above general LLMs and undergrad benchmarks. With RBKG integration, it handled complex multi-omics queries that others missed.

This marks the first LLM designed specifically for rice biology. It offers a fast, accurate way to retrieve research insights. It's freely accessible via SeedLLM.org.cn and hopes to accelerate seed design and crop research globally.

Source: Molecular Plant

💧 A plant-insertable multi-enzyme biosensor for the real-time monitoring of stomatal sucrose uptake

Tracking sucrose movement in plants is vital for understanding their physiology and improving growth, but real-time, in-plant monitoring tools are limited. This study created a minimally invasive biosensor with enzyme-coated electrodes (glucose oxidase, invertase, mutarotase) connected via agarose gel for real-time sucrose detection inside living plants.

The sensor showed high sensitivity (6.22 μA mM⁻¹ cm⁻²), a 100 μM detection limit, a 60 mM range, and a 90-second response time. It retained 86% of the signal over 72 hours. It captured day-night sucrose flow and confirmed light-dependent sucrose uptake via stomata in seedlings.

This approach enables continuous, in vivo monitoring of sugar transport. It opens new possibilities for optimising crop metabolism, stress response, and water-nutrient interactions in precision agriculture.

Source: Biosensors and Bioelectronics

EAR FOOD

Podcast episode of the week

🎙 ‘Biologicals need a new mindset’: A conversation on ag biologicals featuring insights from a researcher and a grower

Host: Tim Hammerich

Guests: Josh Armstrong (Corteva researcher), and Joe Coelho (grower)

What’s driving the rise of biologicals? Three main forces: growing consumer demand for fewer pesticide residues, tighter regulations phasing out synthetic chemistries, and the need for crops to better handle both pests and climate stress.

Water could be a make-or-break issue. In drought-prone areas like California, growers like Joe Coelho are testing biologicals, especially biostimulants and soil enhancers, as tools to improve water efficiency by boosting root growth, hormone balance, and soil health.

There’s cost-saving potential. Some biologicals are showing promise as input replacements. Joe’s trials suggest savings of up to $450 per acre by reducing gypsum, sulfur, and other amendments, making these products more than just yield enhancers.

Still, ROI isn’t always clear. Many products lack solid field data on performance and return. As a result, growers often take a wait-and-see approach, testing cautiously or watching neighbours’ results before scaling up.

Biologicals need a new mindset. These products may require different application conditions than traditional inputs, and some should be seen as longer-term soil health investments, not just quick fixes. That shift can be a hurdle, but also a path to more resilient and sustainable systems.

APAC AGRI-FOOD INNOVATION SUMMIT

Happy to share that Better Bioeconomy is returning as a Marketing Partner for the Asia-Pacific Agri-Food Innovation Summit 2025! 🇸🇬

From breakthrough food systems to next-gen agri-tech, this is where Asia’s innovation leaders connect, collaborate, and create impact.

👀 Use my exclusive partner code for 10% OFF your pass: BIO10

💰 Save $500 SGD with the Super Early Bird offer before August 14

Learn more: https://tinyurl.com/s9k5x3d7

See you in Nov!

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

An important and much needed read, thanks