Financing and Developing Infrastructure for the Bioeconomy

Q&A with Synonym's co-founder, Joshua Lachter

What you can learn from this article

How Synonym empowers companies to bring bioproducts to market

Inspiration behind Synonym and the mission

Biggest challenges in biomanufacturing and how Synonym addresses them

What makes food biomanufacturing different from pharma in terms of economics

Why APAC’s fermentation capacity is trailing behind and if it's expected to improve

Sources of funding to increase biomanufacturing capacity

How Synonym empowers companies to bring next-generation bioproducts to market

Based in New York City, Synonym specializes in designing, developing, financing, and managing productized biomanufacturing facilities to advance the global bioeconomy. Synonym is focused on enabling and accelerating companies to bring their next-generation bioproducts to market.

For companies that are early on in their journey, Synonym builds them a roadmap towards commercialization and profitability. Synonym works closely with companies to help them build:

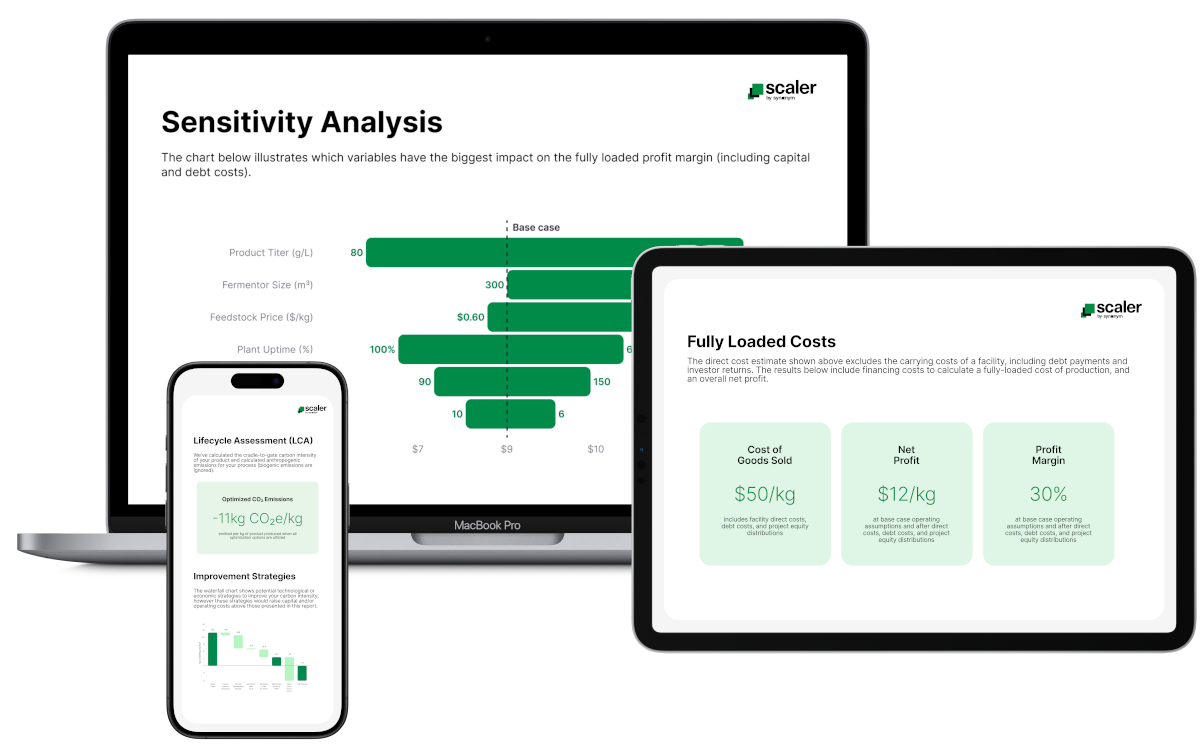

Techno-economic analyses (TEA) to understand COGS, CapEx requirements, key sensitivities, and trade-offs.

Conceptual engineering design studies (FEL 1) for them to scope their capacity and project needs before development.

Lifecycle assessments (LCA) to help them understand their product's carbon intensity and identify the levers to improve it.

For companies that are ready to produce at various scales, Synonym helps them find CMOs that fit their business and technical requirements. Synonym streamlines the CMO search process, leveraging its exclusive global network and insights into site-specific assets and availability.

And for companies that are further along on their commercialization journey, Synonym builds turnkey infrastructure to produce at scale. Synonym works with companies to develop, finance, construct, and operate dedicated, modular fermentation facilities “more cost-effectively than any other option.” The process includes:

Design: Develop detailed facility designs and CapEx and OpEX estimates customized to your bioprocess' requirements.

Finance: The capital markets team will help you secure off-balance sheet financing and manage the incentive process to maximize funding.

Build: Conduct site selection, engage EPCs, and oversee all construction activities to ensure project completion.

Operate: If desired, Synonym will operate the facility, including managing all staffing needs, to deliver a fully functional plant for your business.

Joshua Lachter (JL), co-founder of Synonym, generously took the time to answer my questions about Synonym and biomanufacturing. A special thank you to Alex Jaffe for facilitating this Q&A!

What inspired the founding of Synonym, and what’s the company's mission?

JL: Edward and I founded Synonym at the start of 2022, recognizing biomanufacturing’s massive potential to redefine how we produce everything from textiles to food to plastics in a more sustainable manner. Given the severity of the climate crisis, there’s great urgency for industry to evolve from petroleum-dependent, legacy processes to those powered by biology.

Synthetic biology, particularly in the food sector, has seen so much innovation as of late. There are tons of startups using precision fermentation to create better and sustainable alternatives to dairy and meat products. And demand for biomanufactured products is growing—whether to achieve ESG or sustainability goals, optimize production, or simply create a superior offering.

Of course, widespread adoption is the key to scale. However, without facilities and infrastructure with which to manufacture these products, this scale is impossible to achieve.

At Synonym, we know that biomanufacturing must scale effectively to become the default method of production, and bring production costs down. Our mission is to grow the build infrastructure for the bioeconomy, making it more affordable, more accessible, and bigger in both scales.

The infrastructure it will lay and the growth it will enable will empower the builders of the world's biological future and make biomanufacturing an option for even the largest capacity demands. This will shift worldwide production away from ineffective and unsustainable methods and catalyze the biomanufacturing revolution.

What are the biggest challenges you see in scaling biomanufacturing infrastructure for the food industry, and how is Synonym addressing them?

JL: In general, we’ve observed that in the food industry and in other industries, the impediment to getting to market is not so much a technology issue that needs to be overcome, but a financing one.

The disconnect is that you have to separate the synbio developers of these products from the actual means of production. So long as the means of production are intertwined, the financial markets are going to see the means of production and the ability to get to the market as too risky. The feedback loop between wariness from offtakers leading to difficulty in financing lead to decreased adoption is a hard cycle to break.

Most of these startups don’t have the facility development expertise — nor should they — because they’re food scientists and engineers. And in order for investors to invest in these kinds of projects, they’re going to have to believe that the companies can operate the facilities and sell their products in the market.

That’s a lot of risk for an investor to take on and, (sorry for the pun), digest. And as we’ve seen, investors haven’t really bought into the idea, so there aren’t many new facilities being built.

Our answer is to show that the means of production can be separated from the companies that are actually manufacturing products in those facilities.

In some ways, it’s very similar to how other industries have evolved. Twenty years ago, data centers existed, but they weren’t an asset class in the way that they are today. Controlled-environment agriculture is similar. These industries have crossed that chasm, but synbio hasn’t yet.

But we have to acknowledge that fermentation is a complex biological process that’s not as straightforward as building a warehouse or a data center. Our solution is to standardize what fermentation facilities look like. You can tap into a financing mechanism that hasn’t been available to this industry before. Ultimately, our job is to be a guide and a partner for any company bringing bioproducts to market.

What makes food biomanufacturing different from pharma in terms of economics?

JL: In biomanufacturing, the unit economics of pharma versus food are drastically different.

In pharma, you have business models that are built on high-margin, low-volume products with low sensitivity to costs. There are plenty of contract manufacturers (CMOs) that serve the pharma market because the unit economics make sense. By the time a bioproduct in pharma is ready for mass production, it’s been de-risked and a very lucrative market has already been established. Sure, there’s intense regulatory scrutiny and the pressure of producing often life-saving drugs, but from a business perspective, the “offtake” is clear.

On the other hand, in food, you’re talking mostly about commodities - low-margin, high volume products that are often very sensitive to costs. For non-pharma applications of fermentation, including those in food, there are very few CMOs that serve this market because the unit economics are unprofitable. This lack of infrastructure has made it extremely difficult for companies in the food industry to successfully produce at commercial scale.

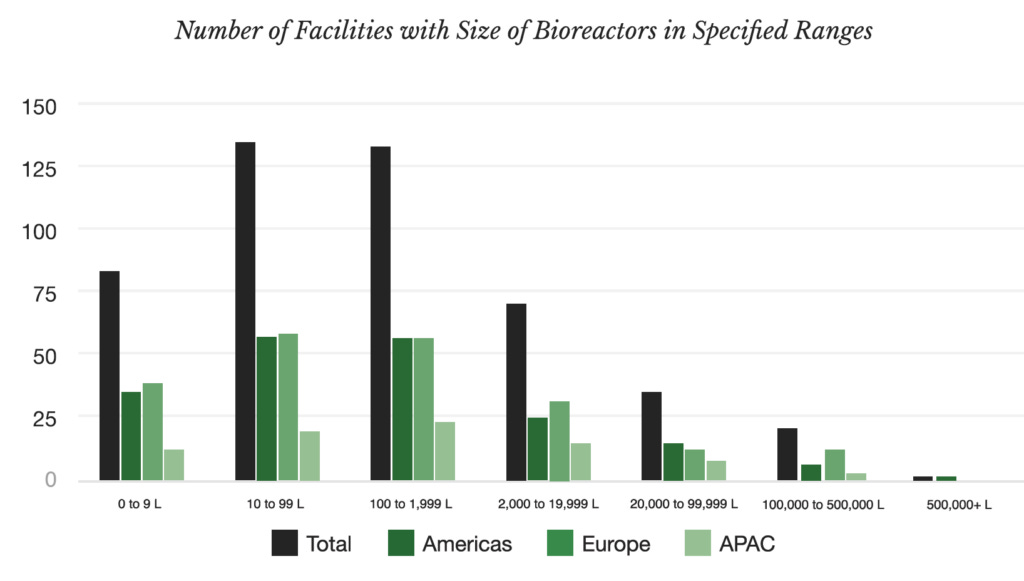

In last year's Capacitor report, you found that APAC has less fermentation capacity compared to Europe and the Americas. Why do you think this is the case, and do you expect APAC to pick up the pace in the next decade?

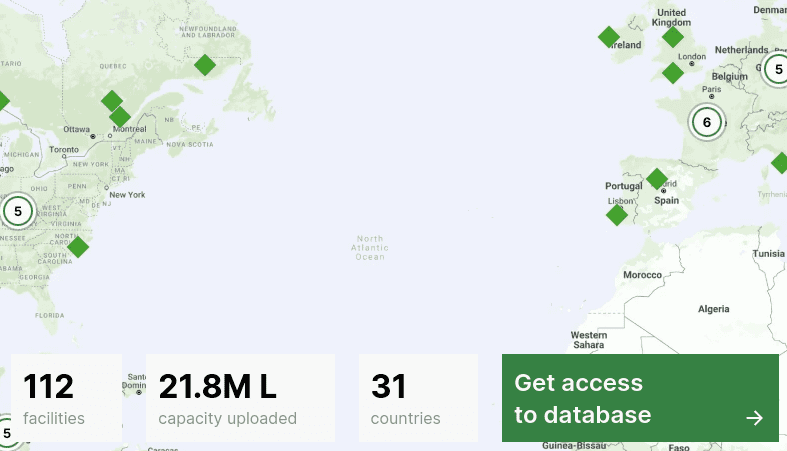

JL: If you look at Capacitor, which is our free directory of global fermentation CMOs, you’re right - you’ll see less capacity in APAC.

I think there are several factors at play. Europe and North America are probably a bit more mature when it comes to having a robust network of fermentation infrastructure (for both pharma and non-pharma use). Additionally, we’re based in the US and have stronger connections and knowledge of the landscape here.

There is definitely a strong infrastructure network in APAC, and we are working towards building a better inventory and more transparency around the capacity that exists in the region.

And yes, we expect to see more capacity in APAC in the future. There are several existing facilities with plans to expand and new facilities that are coming online in APAC in the coming quarters. ADM’s and Temasek’s ScaleUp Bio facility is one that comes to mind, and I know there are many others on the way.

In your recent report with BCG, you mentioned that for the industry to reach its full potential, biomanufacturing capacity must increase 20x from the current levels globally. This will require a lot of funding. Where do you think this funding should come from?

JL: Yes - to reach and surpass the estimated $200B market for specialty chemicals, food and chemical precursors by 2040, we need 20x more capacity globally.

This is indeed a lot of funding, and it will need to come from various sources. We expect the capital stack for these facilities to adapt over time.

The first facilities will likely leverage government-backed grants, incentives, and loans to demonstrate feasibility. Then, as the projects show more proven success, we’d expect governments to continue providing financial support and institutional private investors to begin to participate.

Once these kinds of infrastructure projects are more mature, banks can fund most facilities via project financing, and institutional investors (real estate and private equity funds) will continue to participate.

If you need a TEA, FEL-1, CMO, or dedicated facility, reach out at contact@synonym.bio and they’ll be in touch!

Let your friends know about Synonym!

Hungry for updates on biotech-enabled food innovations?