Food Biotech Heads to Space, Moolec’s Mega Merger, and $8M for Light-Activated Seed Traits

Also: Checkerspot developed ‘world’s first’ non-GMO algal oil closely matching the fatty acid profile and performance of high-oleic palm oil.

Hey, welcome to issue #100 (🥳) of the Better Bioeconomy newsletter. Thanks for being here! 👋🏾

This week, scientists launched a mini-lab into orbit to explore how microbes can produce food in space, opening new frontiers for food security. Checkerspot debuted a non-GMO algal oil designed to replace high-oleic palm oil in premium sectors like infant nutrition.

BioLumic raised fresh funding to scale light-activated seed traits that boost yields and cut emissions. Meanwhile, Asahi introduced Japan’s first yeast-derived non-animal milk, creating new options for allergy-friendly nutrition.

Alright, let’s dig into the latest updates on how biotech is transforming food and agriculture for a climate-friendly food system.

BIO BUZZ

Products, partnerships, and regulations

🌏 Scientists have launched a mini lab into Earth’s orbit, packed with microbes designed to produce proteins in space

This lab, which carries yeast for precision fermentation experiments, aims to find new ways to create edible proteins, a step that could help tackle food security both in space and on Earth.

The project, developed by Imperial College London, the Bezos Centre for Sustainable Protein, Cranfield University, and partners from the European Space Agency, launched aboard Phoenix (Europe’s first commercial returnable spacecraft) via a SpaceX mission.

Since feeding astronauts can cost ~£20k per day, researchers are working on engineering yeast strains to produce food, pharmaceuticals, fuels, and bioplastics in microgravity. The experiment will return specimens to Earth for detailed analysis, advancing space-based manufacturing.

Source: Green Queen

🤔 Thoughts:

Space-based research is becoming more accessible and compact. Using a “lab-in-a-box” on a returnable spacecraft, the experiment shows that complex biotech trials no longer need massive modules or astronaut time.

Private players like Frontier Space and SpaceX are making microgravity R&D more routine, allowing startups and universities to run relatively low-cost experiments that could unlock food innovation breakthroughs.

In addition to reducing payload weight and mission cost, it solves issues of freshness and variety. Rather than relying on years-old freeze-dried rations, crews could enjoy freshly produced protein-rich foods or ingredients made during the mission.

It also helps fill critical data gaps on how fermentation behaves in microgravity, laying the foundation for biological life support systems essential for long-term space missions. Lessons from growing food in extreme conditions could ultimately reshape food production in disaster zones and harsh environments on Earth.

🇺🇸 Checkerspot developed ‘world’s first’ non-GMO algal oil closely matching the fatty acid profile and performance of high-oleic palm oil

The California-based company developed the oil from the microalga Prototheca moriformis through classical strain improvement (chemical mutagenesis) that achieves 55-57% oleic acid content, surpassing high-oleic palm oil (~49%), and mirrors its saturated fat profile.

Instead of competing in low-margin markets, Checkerspot’s algal oil is intended for high-value sectors like infant nutrition, cosmetics, nutraceuticals, and pharmaceuticals, where customers are willing to pay more for benefits like pharmaceutical-grade purity, batch consistency, and ethical sourcing.

Rather than investing heavily in production infrastructure, Checkerspot focuses on joint development agreements and licensing models, collaborating with companies to co-develop and commercialise products.

Source: AgFunder

🤔 Thoughts:

One of the key problems Checkerspot is addressing is a formulation and quality challenge. Products like infant formula or specialised supplements often require fats with very specific structures, such as high oleic content or the OPO triglyceride found in human breast milk.

In the past, formulators had to make do with options like fractionated palm oil or animal-derived fats. Checkerspot’s fermentation platform allows them to “dial in” exact fat profiles with pharmaceutical-grade purity, giving companies the specific functionality they need, whether it’s melting point, texture, or nutritional profile, and without contaminants.

This gives companies new flexibility, eg, an infant formula maker can now use an algae-based OPO fat that’s closer to the structure of human milk fat, without relying on palm oil. And since these algal fats aren’t genetically engineered, they can also meet the needs of markets that prefer non-GMO ingredients.

🇫🇮 A Finnish government-commissioned report estimates the country’s cellular agriculture sector could generate €1B in annual exports by 2035

With strong biotech know-how and natural resources, Finland has the tools to become a leader in cellular agriculture. However, hurdles like a lack of capital and restrictive EU novel food regulations are slowing things down.

To move forward, the report outlines an eight-step plan, including a €100M R&D programme, a dedicated Ministry of Future Food, and better support for infrastructure and startups to attract global investment.

Finland’s biomass (e.g., straw, sawdust) offers feedstock potential. Meanwhile, consumer trust must be built through public tastings and transparent communication about the role of cellular agriculture in future food systems.

Source: Green Queen

🤔 Thoughts:

I really like how this strategy thoughtfully integrates traditional agriculture with cellular agriculture, tackling a commonly overlooked issue: farmer buy-in and the effective use of existing resources.Instead of positioning high-tech fermentation in opposition to farming, the plan brings farmers into the fold by using crop residues like straw and wood chips as feedstock for bioreactors, and encouraging them to participate in emerging value chains.

It also points to a broader systems-level shift in how we think about food production. The future food system isn’t a clean break from the old, it’s a hybrid model where biotech and agriculture co-evolve.

There’s also a cultural shift underway: innovation with inclusion. By educating farmers and the public through tastings and demos of cell-cultured foods, Finland could align consumer perception and legacy stakeholders with the new technology.

🇯🇵 Asahi Group launched Japan’s first yeast-derived non-animal milk in response to food allergies and other dietary preferences

The new product, LIKE MILK, uses the company’s proprietary yeast technology. It is free from the 28 major allergens, while offering a similar protein and calcium profile to cow's milk, but with 38% less fat.

LIKE MILK is part of Asahi’s broader food diversity initiative, driven by direct research and interviews with families managing dietary restrictions, such as food allergies.

Asahi is advancing yeast research as a cornerstone for future growth and health solutions, supported by its Future Creation Headquarters, which focuses on innovation in AI, space technology, and beyond.

Source: vegconomist

🇺🇸 Compound Foods expanded its bean-free ingredients platform to help food companies replace at-risk commodities like coffee and chocolate

Climate change is putting serious pressure on coffee and cocoa production, leading to more frequent crop failures, supply shortages, and sharp price hikes. In 2024, both commodities hit all-time price records, pushing companies like Barry Callebaut to actively explore cocoa-free alternatives.

Compound Foods, known for its beanless coffee brand Minus Coffee, is now offering its tech platform to food businesses facing tighter margins, supply chain disruptions, and urgent reformulation needs.

The company recreates the sensory experience of coffee by mapping over 800 compounds and rebuilding them with agricultural byproducts like seeds, cereals, and fibres, using techniques like roasting, extraction, and fermentation.

Source: Green Queen

🇺🇸 Following the FDA's potential phase-out of synthetic petroleum dyes, food manufacturers are turning to fermentation-based pigments

With the FDA planning to phase out synthetic dyes like Red #3 and Red #40 by 2026 over health concerns, F&B companies urgently need stable, vibrant natural alternatives. Many current plant-based options still struggle with taste, stability, and supply challenges, and biotech-based solutions could help fill the gap.

Michroma’s Red+ colourant and Chromologics’ Natu.Red excel in varying pH levels and temperatures. Red+ uses less product than beetroot powder for vibrant colour and has 20 letters of intent and paid pilot projects. Natu.Red is water-soluble, heat- and pH-stable, cost-competitive with carmine, and reliably available year-round.

Phytolon is unlocking a wide palette of yeast-derived pigments by engineering baker’s yeast, with support from Ginkgo Bioworks. Their pigments deliver high purity, stability, and cost efficiency without the off-tastes common in plant-based colours, and they are already collaborating with major players like Rich Products.

Source: AgFunder

🤔 Thoughts:

This is a clear example of regulation driving food tech transformation. As governments tighten regulations on artificial additives, they are also accelerating the shift toward biomanufacturing.

For food companies, investing in biotech-based solutions is becoming less of an R&D experiment and more of a necessity to stay compliant and competitive. We’re seeing the food additive supply chain pivot away from petrochemical processes, as many artificial colours are petroleum-derived, and move toward bioprocesses instead.

Over time, this shift could expand beyond colours to cover flavourings, preservatives, and sweeteners, pushing a broader replacement of synthetic additives with fermentation-derived compounds. And as consumers grow more familiar with “clean label” products made with biotech colours, it could also ease broader acceptance of biotech in food.

There’s a supply chain angle too: fermentation-based production can happen closer to end markets, in factories, rather than relying on crops grown in specific climates or sourcing from insects, helping reduce both geopolitical and crop-related risks.

⚡️ More buzzes

🇫🇮🇺🇸 Solar Foods has developed Solein protein shake, a dairy-free, ready-to-mix protein powder made from CO₂, delivering 10g of complete protein (with iron and B12) per 16g serving, designed for athletes and gym-goers in the US. (Green Queen)

🇨🇦 Nova Scotia launched the Neptune BioInnovation Centre in Dartmouth, a 51,000-square-foot facility supporting precision fermentation and spray drying for biotech, agriculture, and alternative proteins. (vegconomist)

BIO BUCKS

Funding, M&As, and grants

🤝 Moolec Science is set to merge with Bioceres Group, Nutrecon, and Gentle Tech in an all-stock deal with “synergies on multiple levels”

The molecular farming company announced the agreement, which will involve issuing up to 87 million new shares and 5 million warrants. Expected to close in Q2 2025, the deal will see Moolec become the parent company.

Following the merger announcement, Moolec’s co-founder and CEO Gastón Paladini resigned, although he will continue to support the company as a shareholder and founder. The merger will expand Moolec’s focus beyond food ingredients, moving toward a broader cradle-to-cradle agricultural model to tackle challenges like farm profitability.

The merged entity posted over $500M in sales in 2024, operates in more than 50 countries, holds more than 800 patents and 550 product registrations, and plans to drive cost savings, revenue growth, and product diversification.

Source: Green Queen

🇳🇿🇺🇸 BioLumic raised $8.3M in Series B Extension to speed up the commercial rollout of novel light-activated, non-GMO seed traits

Called xTraits™, the UV light-triggered system can boost hybrid corn yields by up to 20% and speeds up trait development by as much as 90% compared to conventional breeding. It also improves stress resilience and nutritional value, and works alongside existing trait packages.

Focusing on key food and forage crops, BioLumic is rolling out solutions for corn, soybeans, rice, and pasture grasses, with plans to capture 10% of the non-GMO seed trait market in the next 5 years.

BioLumic’s traits also support climate goals by reducing the need for rice paddy flooding and cutting methane emissions from livestock through improved forage quality.

💰 Investors: Ki Tua Fund, Azolla Ventures, iSelect Fund, DYDX Capital, Rabo Ventures, AgriZero, and more.

Source: Access Newswire

🤔 Thoughts:

BioLumic’s light-activated traits offer a promising approach to climate mitigation, starting with the seed. Eg, traits activated by UV could enable rice varieties that support rice cultivation with reduced flooding, thereby reducing methane emissions from paddies, or forage grasses that are more digestible, thereby reducing methane emissions from cows.

This tackles a key problem: how to make staple crops and livestock feed more climate-friendly without major changes to farming practices to change practices or accept new GM varieties. It also improves farm economics, higher yield and nutrient-rich crops mean fewer inputs and better resilience.

Notably, in BioLumic’s funding, a dairy giant (Fonterra, via its venture arm) joined seed-focused investors. This suggests that downstream players, such as dairy cooperatives, are viewing upstream seed technologies as critical to both their climate targets and business outlook.

We’re seeing a systems approach to climate goals: improvements at the seed level can ripple through to fewer emissions per litre of milk or kilogram of grain. In that context, seed innovation could emerge as a strategic lever, linking productivity, resilience, and climate impact through a single point of intervention.

🇦🇷 Puna Bio raised Series A funding to expand adoption of extremophile-based biofertilizers, with Corteva Catalyst’s first LATAM investment

Puna Bio develops biofertilizers using extremophile microorganisms from the Argentine Puna, boosting crop resilience and yields by 10–15% even in degraded soils, offering non-GMO seed treatments.

The company has rapidly expanded operations in the US, Brazil, Paraguay, and Argentina, with two products (Kunza and Kanzama) already covering over 800,000 acres in just three commercial seasons.

Corteva sees strategic value in Puna Bio’s discovery platform. It highlights how Puna’s expertise in extremophiles and LATAM’s biodiversity are key assets for developing novel biological products that meet the increasing challenges of extreme weather, pests, and soil degradation.

💰 Investors: Corteva Agriscience (Corteva Catalyst), At One Ventures, SP Ventures, SOSV, Builders VC, and Dalus Capital.

Source: AgTechNavigator

🤔 Thoughts:

Instead of treating soil as an inert medium to be dosed with NPK fertilisers, the focus is moving toward managing it as a living ecosystem. By introducing extremophile microbes adapted to harsh environments, farmers could bring nature’s resilience into their fields.

It suggests that future productivity gains could increasingly come from bioaugmentation (adding beneficial microbes) rather than relying solely on agrochemicals.

This could help agriculture move away from fossil fuel–intensive inputs and support the growing push toward regenerative practices. Just as probiotics help rebalance the human gut, extremophiles could help restore life and fertility to degraded soils.

Corteva’s investment, as one of the world’s major seed and pesticide companies, highlights growing industry interest in biological solutions. It’s also a play on risk mitigation: biologicals may offer a more resilient, locally sourced alternative to chemical fertilisers, which are increasingly exposed to price volatility, fossil fuel dependence, and tighter regulations.

🤝 ICL set to acquire operations of Evogene’s microbiome-focused agbiotech subsidiary Lavie Bio

Under the signed definitive agreement, ICL will purchase the majority of Lavie Bio’s operations, along with Evogene's MicroBoost AI for AG platform. The deal is expected to close in Q2 2025.

Assets being transferred include Lavie Bio's core team, BDD technology platform, microbial bank, data assets, development programs, and commercial products. Existing partnerships held by Lavie Bio will stay with its shareholders.

This deal builds on over two years of close collaboration between ICL and Lavie Bio, previously centred on creating biostimulant solutions for crops facing abiotic stress.

Source: PR Newswire

GEEK ZONE

Latest scientific research papers

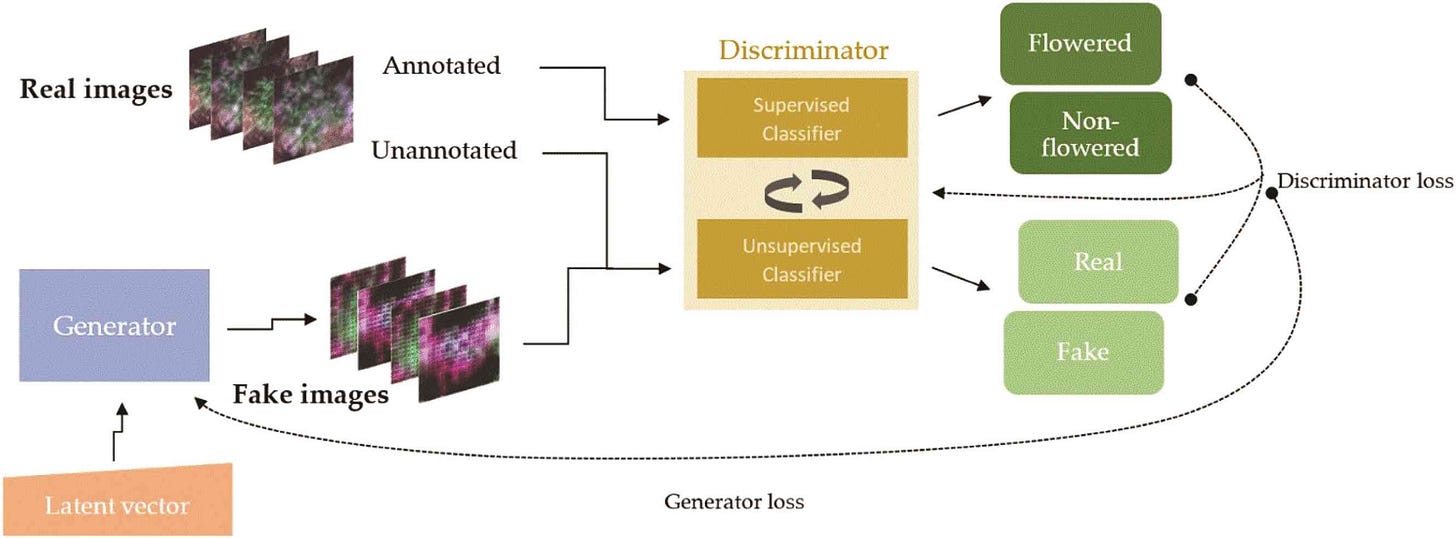

📷 AI tool detects plant flowering 9× faster from aerial images, using minimal training data to accelerate phenotyping

The ESGAN (Efficiently Supervised Generative Adversarial Network) model allowed detection of flowering (panicle emergence) in Miscanthus species by analysing UAV imagery, making the process about 9 times faster than human fieldwork.

ESGAN semi-supervised learning required only 32 labelled images (1% of 3,137 total) to maintain high accuracy (F1 score ~0.85–0.87), compared to 314 images needed for ResNet-50 and 941 images for a traditional convolutional neural network.

Even when trained on only 1% of the data, ESGAN reached 87% to 89% accuracy, outperforming other models. Shifting from traditional field inspections to UAV imaging with ESGAN also cut labour time from 36 hours to about 4.3 hours per phenotyping round.

Source: Plant Physiology

🦠 A newly identified rhizobacterium from Spain shows promising plant growth-promoting abilities

Researchers isolated a new bacterial species, Pantoea phytostimulans C3T, from the sorghum rhizosphere in Spain. Its genome measures 5.05 Mb with a G+C content of 51.1 mol%, and it displays traits that support plant growth.

The bacterium can solubilise important soil nutrients like phosphate, potassium, calcium, and silicon, offering a natural way to boost soil fertility and support sustainable farming without chemical fertilisers.

It also produces plant hormones like indole-3-acetic acid (IAA) that promote root growth and siderophores that increase iron availability, critical for plant health and yield improvement.

Source: International Journal of Systematic and Evolutionary Microbiology

🔮 Computational model uses genetic markers and dynamic mode decomposition to better predict plant traits

A new method called dynamicGP tracks how plant traits change over time. It was tested on maize (347 lines) and Thale cress (382 accessions), focusing on geometric, morphometric, and colourimetric traits measured at 25 and 13 timepoints, respectively.

Traits with more stable heritability over time were predicted more accurately, with dynamicGP reaching a mean prediction accuracy of 0.44 (±0.32) in maize using the iterative approach, well above baseline results.

Both iterative and recursive dynamicGP versions outperformed traditional ridge-regression best linear unbiased prediction (RR-BLUP) models, achieving up to 89% higher accuracy for traits like blue pixel value in maize images. This enables better understanding of genotype and environment interactions affecting crop traits over time.

Source: Nature Plants

EAR FOOD

Podcast episode of the week

🎧 Breaking barriers in solid-state fermentation to scale mycelium: Lessons from Ecovative’s MyForest Foods

Hosts: Karl and Erum

Guest: Eben Bayer, Board Chair at MyForest Foods

MyForest Foods has worked through tough scaling challenges with its unique aerial mycelium growing method. Today, they’re producing mycelium slabs at near-direct margin profitability across farms in the US, Canada, and the Netherlands, using a distributed farming model.

Their flagship product, MyBacon, has outpaced pork bacon in some markets and is selling at 2.5-3x the rate of the leading plant-based bacon brand, even while being priced about 50% higher, highlighting that taste and texture still drive consumer choices.

Building on MyBacon’s momentum, MyForest Foods is gearing up to launch shredded mycelium products for centre-of-plate dishes like pulled pork and tacos, sticking to the same simple, clean-label recipe.

Unlike many processed plant-based meats, MyBacon keeps the natural nutritional benefits of oyster mushroom mycelium, offering high fibre, beta-glucans for heart health, and lower levels of salt and sugar.

After holding off large-scale retail expansion to ensure steady supply, MyForest Foods is now in more than 1,300 stores (eg, Whole Foods) and plans to reach 4,000 by the end of the year.

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Got any feedback/suggestion? Drop them here:

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organizations I am associated with.

Hello Eshan! WOW WOW WEE! Congratulations on the fantastic milestone of 100 awesome issues! What an amazing accomplishment! Lots of very good news in this great issue. I like your cute graphics ; ) And here's a toast to your next 100 upcoming issues. It's going to be interesting to see the progress made in the alt protein space in the next few years. I'm really optimistic that we will see cruelty free pet foods for sale in the next few years. The community appreciates all your hard work and efforts Eshan. Have a very nice and peaceful week 😊