Food-Grade GLP-1 Actives Emerge, and APAC Benchmarks Fermentation Readiness

Also: AI-driven crop genetics, palm-free infant fats, and low-cost plant-cell bioreactors.

Hey, welcome to Issue #120 of the Better Bioeconomy newsletter, a curated look at the latest in biotech for food and agriculture, covering commercial developments, funding rounds, scientific breakthroughs, and commentary. Thanks for being here! 👋🏾

Quick note: If you're an investor active in agrifood tech, I’d love to connect and exchange notes on what you’re seeing, what I’m picking up, and where things might be heading. If you’re up for a quick chat, grab a time here, or feel free to reach out at eshan@betterbite.vc if none of the times work.

In case you missed it, I recently had the opportunity to interview Bodil Sidén, General Partner at Kost Capital, an early-stage venture fund and studio backing the B2B layers of the food system.

It was a great chat with lots of insights. Five lessons:

Architecture is strategy: Running a fund and studio under one roof lets Kost turn kitchen-grade tests into decision-grade evidence. Kost’s Danish base helps, drawing on the country’s strengths in food, biopharma, and gastronomy.

Co-invest by design: Collaborative diligence raises quality, derisks deals, and brings more generalist capital into the food and climate sector.

Focus upstream: B2B tends to scale faster and with more defensibility than consumer brands.

People over ideas: At pre-seed, anchored ambition, observable execution, and scalable leadership matter more than elegant concepts (bonus: founder-VC fit helps too).

Be AI-ready early: start with clean, structured data and consistent lab records tied to cost and performance. Complex models can wait, focus on cultivating good data habits early.

Full article: Investing in Europe’s B2B Production Stack for a Better Food System

Alright, let’s get into it #120!

BIO BUZZ

Products, partnerships, and regulations

🇺🇸 Evolv launches "biomimetic” dietary supplement that produces peptide mimicking GLP-1 hormones

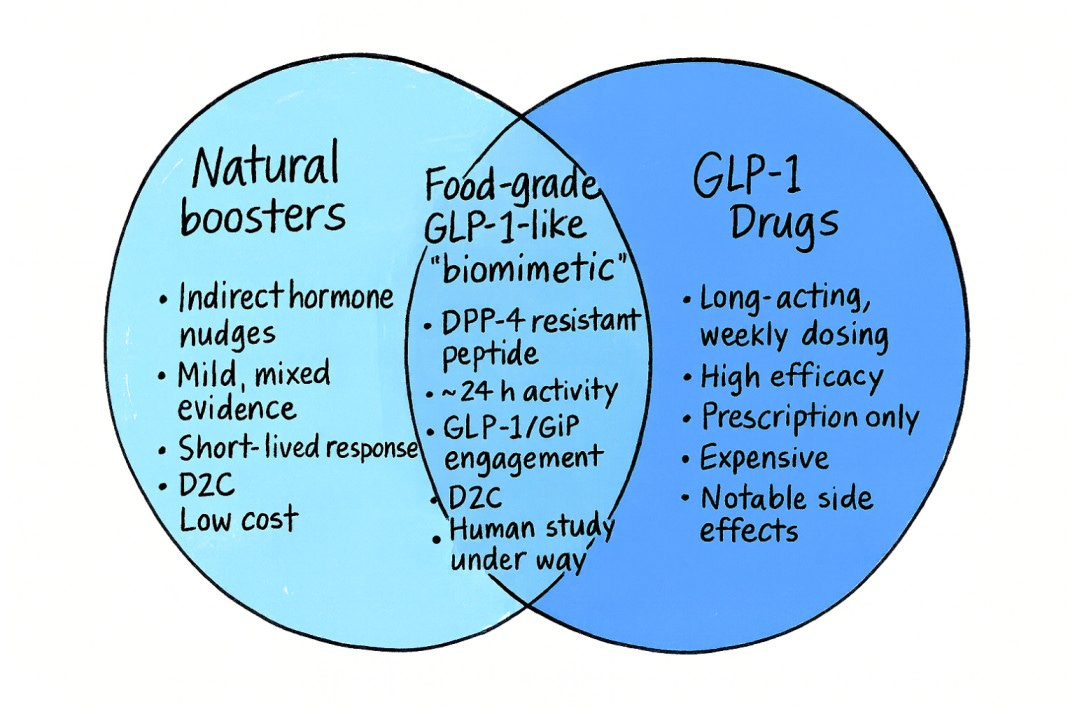

Evolv GLP-1 aims to sit between natural hormone boosters and pharmaceutical drugs. Using genetically engineered baker’s yeast, it produces a peptide that activates GLP-1 and GIP receptors and maintains activity for ~24 hours, unlike natural GLP-1, which degrades in minutes, or injectables that last 5-7 days.

Sold direct-to-consumer as dried yeast rather than a purified peptide, the supplement differs from typical prebiotics or extracts. Its peptide resists DPP-4 enzyme breakdown, helping maintain a steady appetite- and glucose-regulating effect over roughly 24 hours.

The peptide was developed and tested using computational modelling and in vitro receptor assays, with animal studies focused on safety and toxicity. Evolv is now running a 90-day human study with 120 participants to measure weight, appetite, and HbA1C outcomes.

Source: AgFunder

🤔 Thoughts:

The “biomimetics” category blurs the line between drugs and supplements, potentially offering near-pharma efficacy (clinical efficacy versus Rx GLP-1s remains to be demonstrated) in an accessible format. It could broaden access to metabolic health tools, giving those who can’t afford, tolerate, or qualify for prescription GLP-1s another option.

An estimated 12% of US adults had used a GLP-1 drug by mid-2024 despite high costs. Yet a poll shows interest in these drugs drops from 45% to 14% if people learn weight returns after stopping therapy. This could indicate that many seek shorter-term or less intense interventions, which biomimetic supplements could provide.

Two things I’ll be interested in seeing are (1) FDA NDIN outcome and claim posture, and (2) repeat-purchase and adherence vs. GLP-1 discontinuation data.

🇺🇸 Desert Harvest introduced a new menopause support supplement with Helaina’s precision-fermented lactoferrin

Desert Harvest has launched menopause-focused Super Strength Aloe Vera Capsules featuring 300mg of Effera, Helaina’s precision-fermented human lactoferrin, designed to support hormone, immune, and vaginal health.

Effera is a hormone-free, animal-free, and dairy-free form of lactoferrin that’s structurally identical to the human version. This makes it easier to absorb and gentle for long-term use. Combined with Desert Harvest’s patented aloe vera, it’s designed to provide balanced, science-backed support.

Menopause affects ~80% of women with hot flashes, fatigue, bone loss, and immune stress. The supplement acts on oestrogen receptors, improving iron absorption, bone strength, and overall microbiome health.

Source: Green Queen

🤔 Thoughts:

The co-branding playbook where synbio ingredient platforms team up with specialist consumer brands feels like an efficient, repeatable path to market. Instead of building full consumer lines, ingredient companies like Helaina can partner with trusted, domain-specific players such as Desert Harvest in women’s health, improving credibility and distribution while speeding up education.

We’ve seen this approach before from Perfect Day, EVERY, and Geltor. In Helaina’s case, the product itself carries the ingredient brand on the label, which helps consumers and practitioners connect efficacy claims to a named, science-led input.

Meanwhile,, the shift from “animal-free” to “human-identical” reframes the value story from replacement to biological fidelity. Effera is positioned as structurally identical to human lactoferrin, and Desert Harvest markets it as being compatible with women’s biology. That language could resonate with clinicians and consumers who prefer non-hormonal options.

🌏 GFI APAC and Hawkwood Biotech evaluated 9 APAC countries' readiness for commercial fermentation food ingredient manufacturing

Technoeconomic modelling shows that non-dilutive capital support (grants, concessional loans, or guarantees) delivers the highest ROI for both industry and government. They improve facility NPV by up to 78% and drive the most significant long-term tax returns. Tax holidays often yield negative short-term ROI, while labour subsidies show limited impact.

Across biomass and precision fermentation, sugar-based feedstocks make up 30-65% of total costs. Co-location with sugar mills can halve logistics costs, while Thailand and Australia stand out for abundant, export-grade sugar supply. Indonesia and Vietnam offer cost advantages but rely heavily on imports, highlighting the strategic value of domestic sugar infrastructure.

Thailand pairs strong feedstock and rich incentives under its Bio-Circular-Green Economy and Eastern Economic Corridor models. Australia offers regulatory clarity and top-tier infrastructure, but lacks targeted CAPEX incentives. Vietnam’s Resolution 36 sets clear bioeconomy intent, combining 10% investment support and 15-year preferential tax rates with plans to modernise its sugar sector.

Source: GFI APAC

🇺🇸 Profluent Bio partnered with Corteva in a multi-year collaboration to accelerate AI-driven gene editing for resilient crops

The California-based protein design company will integrate its AI models, ProGen3, which was trained on 80 billion protein sequences, and OpenCRISPR-1™, the ‘first’ AI-created genome editor, with Corteva’s Genlytix™ ecosystem.

By combining Corteva’s plant breeding and field expertise with Profluent’s AI-generated biological sequences, the collaboration aims to create customizable gene-editing tools that improve yield, pest resistance, and tolerance to heat and drought.

This partnership highlights the broad potential of Profluent’s AI design platform across industries. It shows how AI-driven protein design can expand the tools available for crop innovation and enable the editing of complex traits that were previously difficult to achieve through conventional methods.

Source: AgTech Navigator

🤔 Thoughts:

Corteva’s Catalyst platform shows how corporate venture programs are moving beyond investment to become active pipelines that channel external AI and biotech innovation straight into R&D.

In 2025, Catalyst supported projects spanning AI-designed proteins (Profluent), precision trait discovery (Phytoform Labs), biocontrol peptides (Micropep), and soil bioenhancers (Puna Bio), signalling a push to externalise discovery while scaling internally.

Instead of developing every capability from scratch or waiting to acquire mature startups, Corteva treats these ventures as extensions of its lab network. Each partnership fills a specific gap, forming a distributed but connected innovation system. This open-innovation approach could help incumbents manage R&D risk and bring advanced technologies to market faster.

🇺🇸🇧🇬 Checkerspot partnered with Huvepharma to scale microalgae-derived human milk fat analogs

The California-based biotech will use its molecular and strain-engineering platform with Huvepharma’s large-scale fermentation and distribution network to produce OPO (oleic-palmitic-oleic or sn-2 palmitate). This lipid improves infant nutrient absorption and supports immune development.

The new algal oil more closely mimics the triglyceride structure of human milk fat than enzymatically modified palm oil. While first-generation substitutes reach 39-65% sn-2 palmitate, Checkerspot’s strain produces 70-75%, aligning with the 65 ± 5% level typical in breast milk. The result is a cleaner, palm-free, and more consistent nutritional ingredient.

Bulgarian biopharma Huvepharma will support regulatory dossiers, clinical validation, and global distribution, positioning the partnership to supply infant formula makers across the US, EU, and China.

Source: AgFunder

🤔 Thoughts:

The growing focus on SN-2 palmitate points is part of a broader push to make infant formula more functional. Alongside ingredients like DHA, ARA, and HMOs, high-SN-2 fats help close the gap between formula and breast milk in how they support infant development.

Structuring fats so that palmitic acid sits mainly in the SN-2 position, as in breast milk, improves calcium and fat absorption, digestion, and even immune support. It also signals a change in how companies approach R&D, moving from imitating breast milk to precision design guided by clinical data, where lipid structure becomes a proprietary advantage rather than a commodity blend.

🇺🇸 Indigo Ag launched microbial seed treatment to combat soybean cyst nematode

The EPA-registered bionematicide, biotrinsic® Nemora FP™, introduces a Pseudomonas oryzihabitans strain that colonises soybean roots and shoots, preventing soybean cyst nematode (SCN) eggs from hatching while maintaining nodulation and root health.

Field trials showed an average 68% reduction in egg hatch and measurable gains in root mass, shoot thickness, and emergence, with no phytotoxicity or halo effects. The product triggers induced systemic resistance (ISR) and recruits beneficial rhizosphere microbes, supporting long-term soil health.

Nemora is available for Spring 2026 planting through Indigo’s CLIPS delivery system or planter-box application. It offers a sustainable biological alternative that supports soil health and reduces yield loss from SCN.

Source: Indigo Ag

BIO BUCKS

Funding, M&As, and grants

🇫🇷 Phagos raised €25M Series A to advance bacteriophage-based drugs to treat bacterial disease in animals

The Paris-based startup will use the funding to scale its phage-based therapies, starting with livestock such as chickens, cattle, swine, and shrimp. The new funding will support deployment, R&D, and international market expansion across Europe, Asia, and the Americas.

Bacteriophages (phages), viruses that naturally kill bacteria, offer a precision alternative to antibiotics. By targeting specific bacterial strains while sparing beneficial microbes, they help reduce the risk of antimicrobial resistance. Phagos’ AI-driven platform “Alphagos” combines microbiology and AI to identify optimal phage-bacteria matches.

The funding follows a World Health Organisation warning about the growing threat of antimicrobial resistance (AMR), which could lead to 39M deaths over the next 25 years. The WHO is calling for more innovation and wider access to effective diagnostic and therapeutic tools.

💰 Investors: CapAgro, Hoxton Ventures, CapHorn, Demeter, Acurio Ventures, and more.

Source: AgFunder

🤔 Thoughts:

The EU approved its first bacteriophage-based zootechnical feed additive, BAFASAL® from Proteon Pharmaceuticals, this year. This decision reduces regulatory uncertainty for animal-health phage products and shows that phages are now an ‘approvable’ category.

For investors and feed-industry strategics, it brings phages closer to established microbial tools like enzymes and probiotics. The EU’s move may also encourage more filings and partnerships, acting as a useful reference point for regulators elsewhere.

Meanwhile, the WHO’s 2025 antibacterial pipeline review shows continued fragility with 90 clinical candidates, down from 97 in 2023. Of these, 40 are non-traditional approaches such as bacteriophages, antibodies, and microbiome-modulating agents, and only 15 are considered innovative. Given this scarcity in traditional antibiotics and regulatory tailwinds, it makes sense that more capital is shifting toward phage platforms.

🇮🇱 Asterix Foods raised $4.2M to produce animal proteins in low-cost plant cell culture platform

The Israeli startup emerged from stealth with the funding to make dairy, egg, and other animal proteins in plant cells grown in suspension. Plant cells natively perform the complex glycosylations required for bioactive glycoproteins like lactoferrin and ovomucoid, which are harder to achieve in microbial hosts.

Asterix runs low-cost, simple bioreactors built around reusable plastic bags sterilised by gamma radiation. Cells grow at room temperature, can run continuously with ~1 month total downtime per year, and secrete product into a low-cost, simple medium that simplifies downstream processing.

CAPEX is positioned as modular and de-risked. Partners can pilot 10 units of 1,000-2,000 L each for ~$1-2M, then add capacity in weeks. The long-term model is to license bioreactors, cell lines, and process know-how to ingredient and dairy companies.

💰 Investors: CPT Capital, Grok Ventures, ReGen Ventures and SOSV.

Source: AgFunder

🤔 Thoughts:

Glycosylation, once a niche concern in pharma, is quickly becoming a performance frontier in food. Independent analyses confirm that proteins made in different hosts carry distinct sugar structures. Eg: a recent study found yeast-derived lactoferrin mostly had simple oligomannose glycans, while natural bovine lactoferrin contained a mix of complex glycans. In short, glycosylation depends on the host, not the gene alone.

In practice, such differences can alter bioactivity (e.g. antimicrobial or immunological efficacy) and even how a protein interacts with the gut microbiome. This evidence validates the idea that microbial hosts hit a wall for certain functional proteins, and more advanced eukaryotic systems (plant or animal cells) may be needed to replicate nature’s complexity.

🇬🇧 Scindo raised £4M seed funding to scale its AI-powered enzyme design platform for petrochemical-free ingredients

The London startup combines generative AI with proprietary enzyme datasets to design “molecular craftsmen” that transform diverse feedstocks into speciality chemicals for food, flavours, cosmetics, and industrial uses.

Scindo focuses on challenging reactions like selective C-H activations and C-C bond cleavages, linking machine learning with lab testing to screen, characterise, and engineer enzymes for selectivity, efficiency, thermostability, and expressibility. Its proprietary data fills gaps in public datasets, improving model accuracy for predicting and designing new enzyme functions.

Its first products use cell-free biomanufacturing, where enzyme systems convert agricultural fatty acids into flavour and fragrance building blocks and a high-value cosmetic ingredient. Pilot-scale production with a partner is in progress, with commercial launches expected within 12 months.

💰 Investors: Kadmos Capital, Clay Capital, PINC, Synbioven, AgFunder, SOSV, Farvatn Venture and Savantus Ventures.

Source: AgFunder

🤔 Thoughts:

AI-driven enzyme design moves away from public datasets toward proprietary, experimentally validated reaction data as a core advantage. Scindo illustrates this shift by collecting new reaction data from complex chemistries and using it to train machine learning models, identifying enzymes with previously unseen capabilities. In short, the moat is moving to the data itself (especially data on underexplored biochemical reactions) rather than algorithms alone.

Across the broader techbio space, this approach is becoming standard. Leading enzyme design firms now run closed-loop systems where high-throughput labs generate fresh data to refine AI models. Experimental testing filters out model errors and accelerates improvement, acknowledging that public enzyme datasets are too limited and inconsistent for novel transformations.

Companies that own unique, experimentally verified datasets are compounding knowledge. Each experiment improves their models while expanding their proprietary reaction space, reinforcing an edge few can catch up to.

🇨🇦 Vive Crop Protection raised $10M to scale nanotech crop protection and accelerate product rollout

The Toronto-based agtech company develops nanotechnology-enabled formulations that enhance delivery and efficacy of conventional and biological actives through its patented Allosperse Delivery Technology. The new capital will scale its High-Velocity Commercialisation Engine (HVCE) and expand reach across Canadian and US row crop markets.

Vive reformulates off-patent and biological ingredients to make them more effective and faster to market, launching products in less than half the time of typical new chemical discoveries. Current R&D includes a fungicide for wheat and canola under field trials on ~2,000 acres in Western Canada.

Upcoming innovations include irrigation-compatible formulations and hybrid biological-synthetic actives for improved performance and resistance management. The funding supports formulation, lab research, field testing, and regulatory submissions to bring more nanotech-enabled products to farmers.

💰 Investors: FCC Capital, Emmertech, iSelect, and BDC Capital.

Source: RealAgriculture

🤔 Thoughts:

Instead of spending a decade and hundreds of millions to discover novel pesticides, Vive accelerates innovation by “reformulating off-patent and biological products to make them more effective, with a shorter path to commercialisation.”

By upcycling off-patent and biological ingredients through its delivery platform, Vive compresses the product cycle from invention to iteration. As the cost and regulatory barriers for new active molecules climb, companies are seeking leverage elsewhere.

Vive’s approach hints at a coming wave of “fast-follower chemistry,” where agility, formulation IP, and regulatory reuse may matter more than blockbuster actives. With 19 major pesticides going off-patent by 2028, this could open an entire secondary market for re-engineered actives that meet new environmental and compatibility standards.

🇺🇸🇳🇱 Gowan Company acquired Ceradis to expand biocontrol and formulation portfolio

Gowan Company has completed its acquisition of Netherlands-based Ceradis, strengthening its footprint across Europe and the Americas. The deal brings Ceradis’ R&D and formulation expertise into Gowan’s global crop protection and seed portfolio.

Ceradis brings patented bio-mineral technology and biocontrol formulations that combine conventional chemistry with natural minerals, helping preserve active ingredient efficacy. These multi-site, mode-of-action solutions will improve Gowan’s integrated disease management programs.

Ceradis will continue operating from Wageningen while joining Gowan’s innovation network, ensuring continuity for customers. The acquisition aligns with Gowan’s long-term strategy to build a diversified, sustainable crop protection platform supporting global food security.

Source: AgriBusiness Global

BIO READS

Articles worth exploring

🤔 Why haven’t we seen more new billion-dollar companies in agriculture?

A thoughtful article examining why founder-led agricultural companies rarely scale past $1B in revenue. He argues that structural barriers like capital intensity, slow adoption, and entrenched distribution make agriculture far harder to disrupt than other industries. (Patrick Honcoop)

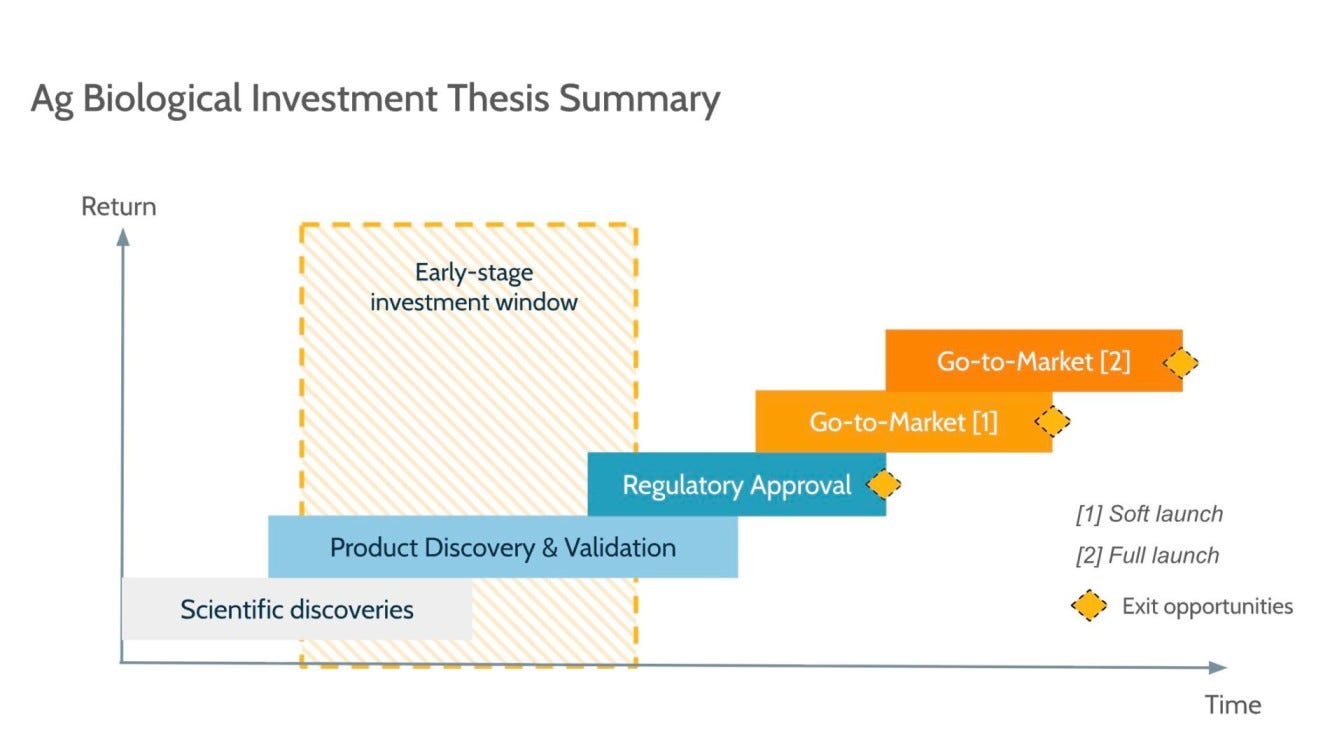

💰 A deep dive into the investment thesis for ag biologicals

The article states ag biologics are set for growth and regulatory acceptance, but investors should recognise their drug-like development, slower farmer adoption, and mid-term returns to set realistic expectations and create sustainable value. (Gustavo Mamao)

💉 Food formulation and precision nutrition in the Ozempic era

As GLP-1 drugs go mainstream, food and techbio players are rushing to build “companion” products that focus on higher-quality protein, improved absorption, and biomimetic actives. They are also preparing for wider adoption, shifting taste cues, and a move toward personalised, microbiome-aware nutrition. (Elaine Watson)

EAR FOOD

Podcast episode of the week

🎙 Lessons from boostrapping an ag biologics startup

Bootstrapping a bio startup can work if you start selling early. Impello focused on bacillus consortia discovery, outsourced manufacturing, sold directly to growers, and later expanded through distributors. The key was pairing patience in adoption with urgency in education.

Biologics are moving from niche to mainstream. The balance is shifting, with biologics expected to handle most of the crop-protection workload while chemicals become specialised tools for specific problems.

Conventional chemistries are facing tougher economics. Rising R&D costs, regulatory hurdles, and resistance are slowing new molecule launches, while biologics often have shorter approval timelines and deliver added soil and plant-health benefits.

Proactive crop health beats reactive fixes. Think probiotics before antibiotics: use biological programs to keep plants resilient, then bring in chemicals only when needed for targeted control.

Selling bio products requires technical depth and trust. Growers burned by weak early products need transparent data, agronomic support, and realistic field trials. Building credibility means combining agronomy know-how with strong distribution partners.

Guests: Michael Key, CEO and Co-Founder of Impello Biosciences

Podcast: The Modern Acre

APAC AGRI-FOOD INNOVATION SUMMIT

Don’t miss your chance to attend the Asia-Pacific Agri-Food Innovation Summit and get 10% OFF with my network code. From breakthrough food systems to next-gen agri-tech, this is where Asia’s innovation leaders connect, collaborate, and create impact.

👀 Use my exclusive partner code for 10% OFF your pass: BIO10

Learn more: https://tinyurl.com/s9k5x3d7

See you in Nov!

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Hi Eshan, how are you doing on this wonderful day? Thank you very much for excellent issue #120. 120 already?! My, how time flies. I had no idea GLP-1 products were used by soooo many people, something like 12%. Thanks for the great information on the new emerging technology in this area. I always learn something valuable from your awesome newsletters. Keep up the fantastic job my friend. The community appreciates all your hard work and efforts 👌 ❤️