How Ajinomoto Group Ventures Invests in the Future of Food and Health

Ajinomoto Group Ventures’ Hiroyuki Saito on how the CVC balances strategic and financial returns, and what startups need before reaching out.

Hey folks!

Thanks for being here. For Issue #126 of Better Bioeconomy, I sat down with Hiroyuki Saito, Manager and Asian Region Lead of Ajinomoto Group’s corporate venture capital (CVC) team, Ajinomoto Group Ventures.

Ajinomoto Group is a ¥1.5 trillion-revenue multinational that launched the world’s first commercial umami seasoning in 1909. It has since grown into a global food and biotechnology enterprise spanning seasonings, frozen foods, sweeteners, amino acids, and even electronic materials.

Today, it operates across 31 countries and regions, supplying everything from tabletop seasonings in Asian kitchens to functional ingredients embedded in soups, snacks, ready meals, and beverages made by other brands.

Ajinomoto Group Ventures sits on top of that legacy. The CVC arm invests across healthcare, ICT, food & wellness, and green domains, backing startups that can leverage Ajinomoto Group resources to make an impact.

In our conversation, Saito walked me through how the team defines true strategic fit, the three pillars guiding its agri-food investing, how they balance strategic and financial returns, where they see the next wave of food-health innovation, and what founders need in place before reaching out.

Special thanks to Yuichiro Ohno for helping facilitate the conversation and coordinating internally throughout the process. 🙏🏾

Let’s jump in!

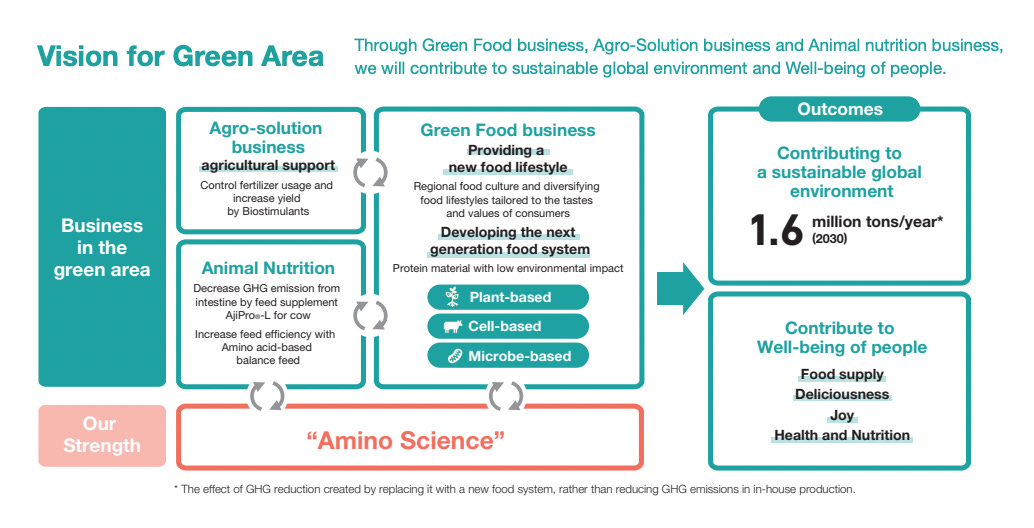

Ajinomoto Group maps its agri‑food bets across three domains

Ajinomoto Group Ventures is a strategy-first investor. For Saito and his team, the startups worth engaging are those that map directly onto the group’s mid-term growth domains. These domains are clearly scoped business areas with internal owners, budgets, and operating mandates.

Within food and agriculture, Ajinomoto Group Ventures is paying attention to three areas:

Green Food

This is where the group focuses its efforts on alternative proteins and next-generation ingredients, leveraging its legacy in taste, texture, and fermentation.

In this pillar, the company has invested in Australia’s v2food to pair its plant-based protein platform with Ajinomoto Group’s “Deliciousness Technology” and global network to make cleaner-label protein ingredients more scalable across markets.

The group is also working with Finland’s Solar Foods to bring Solein, a microbial protein made from CO₂ and renewable energy, into consumer products. Their collaborations sit under Ajinomoto Group’s Atlr.72 brand in Singapore and span early launches across desserts and beverages.

On the coffee side, Ajinomoto Group is co-developing bean-free coffee with Singapore’s Prefer. The partnership allows Prefer’s upcycled, fermentation-derived coffee to be blended into Atlr.72 brand’s GRe:en Drop Coffee line, reducing the drink’s carbon footprint while keeping a familiar flavour profile for local consumers.

Agro-solution

This is Ajinomoto Group’s umbrella for agri-biologicals. The group is building on its existing biostimulant fertiliser products and expanding into a broader set of biological tools.

In Saito’s framing, this spans bio-pesticides, nitrogen fixation, carbon sequestration, and soil analysis and improvement. These are areas where Ajinomoto Group sees biology complementing or replacing conventional agricultural inputs, and where its long history with biostimulants gives it a starting point for deeper collaboration with startups.

Animal nutrition

This pillar is built around Ajinomoto Group’s leadership in lysine formulations for livestock. Its flagship product, AjiPro®-L, is a rumen-protected lysine that improves amino acid balance and reduces greenhouse gas emissions from cattle.

Ajinomoto Group holds a top global market share in lysine additives and is now converting AjiPro®-L’s GHG reductions into carbon credits through Japan’s J-Credit Scheme, targeting one million tons of annual reductions by 2030.

Saito’s team is looking for startups that can complement this strategy, especially those advancing feed efficiency or livestock emissions reduction.

Strategic fit drives investment, but financial returns keep the collaboration alive

Every cheque from Ajinomoto Group Ventures is anchored in the group’s roadmap for where it wants to play and what capabilities it needs to build or access. Within that frame, Saito thinks in two time horizons.

Some investments are made with relatively short-term collaboration in mind, where joint projects and commercial returns can be sketched out early. Others are made for “market sensing,” where the goal is to stay close to an important emerging area with a mid to long-term perspective, even if the collaboration pathway is not yet obvious.

Strategic alignment on its own is not enough, though. Collaboration only compounds if the startup grows, so the team also looks at financial returns and scalability as part of the review. Growth potential and sound economics are treated as prerequisites for any strategic partnership to work over time, not as a separate, purely financial exercise.

Ajinomoto Group’s position in Asia adds another layer. The group enjoys strong brand recognition and deep distribution in the region, which means “the necessity of investment is always a point of discussion internally.” In some cases, Saito says, Ajinomoto Group Ventures may decide not to invest but still move forward through collaboration or a venture-client model, using its channels and capabilities without taking equity.

Because of this mix of tools, he encourages founders to treat the CVC as the front door into the group. The team acts as a primary point of contact, helping startups navigate to the right internal counterparts and shape collaboration structures that make sense for both sides.

In practice, strategic fit, growth potential, and choice of collaboration model are all part of the same conversation. Ajinomoto Group Ventures is investing where it wants to learn and build, but remains selective about when equity is the right instrument and expects any partner to show a credible path to scaling alongside the group.

Ajinomoto Group sees the future of food‑health in tailored diets

When the conversation turned to food and health, Saito pointed to a recent program run by Ajinomoto Group Thailand, the group’s ASEAN hub. That accelerator focused on three themes: personalised nutrition, alternative proteins, and fermentation technology, which now anchor Ajinomoto Group’s thinking at the food-health interface.

The personalised nutrition piece builds on work already in market. In Japan, Ajinomoto Group operates a meal-planning service powered by a proprietary nutrient profiling system, allowing it to generate tailored diets. As D2C and e-commerce channels expand across Asia, Saito sees greater potential to deliver and iterate on these personalised offerings beyond traditional retail.

Alternative proteins and fermentation technologies sit closer to the Green Food pillar, but the emphasis is on how these tools integrate into everyday diets, not on standalone novelty. Ajinomoto Group’s strengths in taste, fermentation, and formulation can help these new ingredients fit more naturally into local cuisines and health needs.

Across these themes, the company is looking for places where its existing capabilities in ingredients, flavour design, and nutrition science can support more tailored, health-aware food services.

Supporting startups through deep R&D, distribution, and global reach

Ajinomoto Group Ventures’ value to startups goes far beyond capital. Saito describes a system of scientific depth, operational experience, and global infrastructure that few food companies can match.

Upstream, Ajinomoto Group works directly with startups on R&D, bringing together its proprietary bio and fermentation technologies with decades of experience designing “deliciousness” across taste and texture. In areas like cultivated meat, that means supporting media formulation and technical development while also helping make end products more appealing and consistent. The goal is hands-on collaboration that improves both performance and sensory quality.

Downstream, Ajinomoto Group can open sales channels across Asia. Its long history of selling seasonings, ingredients, and finished products into retail and foodservice gives startups a practical route for pilots and early roll-outs. For many companies, testing and scaling with a partner who already understands how to navigate Asian markets is more valuable than a cheque.

For startups working with Ajinomoto Group, that combination of global reach and speed stands out. As Jake Berber, co-founder of beanless coffee startup Prefer, told me, “It’s rare to find a company that is globally impactful, innovative, and works with velocity. They’ve been the perfect partner for us to scale with.”

He added, “Launching our first product with Ajinomoto Group’s Green Business Development Department in Japan and partnering with Ajinomoto Thailand has been an incredible experience, and we’re excited for even bigger collaborations ahead.”

Ajinomoto Group Ventures also supports global expansion. The team has bases in Silicon Valley and Tokyo, and the wider group operates innovation hubs across the United States, Japan, Europe, and other regions, with a presence in 31 countries and territories. These hubs act as sensing and execution nodes, helping portfolio companies explore new markets over time.

Saito’s long-term aim is to connect these hubs more organically so that a startup working with Ajinomoto Group in one geography can more easily extend into others without starting from scratch.

Localisation of food is one of Ajinomoto Group’s greatest strengths

All of Ajinomoto Group’s global machinery sits on top of something older and more fundamental: a hard-won ability to localise food country by country without losing what makes its products work. As Saito puts it, localisation of food is one of Ajinomoto Group’s greatest strengths.

Sensory science provides the universal anchor. Umami is recognised globally as a basic taste, and glutamate activates the same receptors whether you are eating in Japan, Thailand, Brazil, or Nigeria. Ajinomoto Group’s core amino acid and taste technologies can travel.

What changes is everything around that core. Raw materials differ by geography: sugarcane-derived feedstock for MSG in Japan, tapioca starch from cassava in Thailand. The chemistry is similar, but the agricultural and economic logic is local.

Product development also shifts with food culture. In Indonesia, for example, Ajinomoto Group sells seasoning products designed specifically for tempeh-based dishes, rather than simply exporting Japanese formats.

Distribution is another layer of localisation. Over decades in Southeast Asia, Ajinomoto Group has built relationships with small shop owners and foodservice operators and learned how to work across many sales routes, not just modern retail. That infrastructure is a real advantage for startups that need to adapt formats and pricing to fragmented, on-the-ground realities.

Even its startup investments follow this pattern. In Brazil, Ajinomoto Group backed Manioca, which develops products using tucupi, a traditional ingredient from the Amazon. The core ingredient and food science can travel, but the expression is rooted in local cuisine.

For founders, the implication is straightforward. Ajinomoto Group Ventures looks for globally relevant core technologies and strong ingredient R&D, paired with application layers that can be localised in product, branding, and route-to-market.

What startups must have before reaching out

For startups looking to reach out to Ajinomoto Group Ventures as a strategic investor, what should they have in place?

First, Ajinomoto Group Ventures usually does not lead rounds. The CVC takes a follower stance, with priority on strategic value rather than ownership targets or round construction. The CVC prefers to co-invest alongside an institutional VC that has already set terms and valuation. For Saito and his investment committee, third-party financial validation is an important part of the internal decision process.

Second, the strongest pitches come with a wide surface area for collaboration. A single pilot or narrow use case rarely justifies the effort of building a long-term relationship. Ajinomoto Group Ventures wants founders to lay out multiple ways the partnership could develop over time: R&D work, formulation and ingredient development, manufacturing, sales channels, and even future business hypotheses. Clear pathways give different teams inside the group something concrete to react to.

Third, founders need sharp competitive positioning. A clear explanation of who else is in the space and why the startup stands out. A crisp articulation of competitors and differentiation makes both collaboration and investment far more likely.

Finally, Saito emphasises that Ajinomoto Group Ventures is not a financial VC with a bit of “strategic” on the side. The group’s real value lies in collaboration, such as joint development, access to sales channels, and venture-client models, even when no equity is involved. Founders who approach the CVC with a partnership mindset, rather than as a funding source, tend to get much further.

A small ask from Saito

Saito is open to connecting with startups and investors aligned with Ajinomoto Group Ventures’ focus. If you are interested, feel free to reach out at hiroyuki.saito01.3cc@asv.ajinomoto.com.

If you found value in this newsletter, consider sharing it with a friend who might benefit from it! Or, if someone forwarded this to you, consider subscribing.