€30M for Gut-Health Binding Proteins, and Robot Cowboys Comes to Ranches

Also: Why transformative ag companies can still be built in any macro environment to drive outlier VC returns.

Hey, welcome to Issue #133 of Better Bioeconomy, weekly insights on how tech is reshaping food and agriculture for better human and planetary health. Thanks for being here! 👋🏾

This week’s issue spans the full stack, from consumer-facing product launches to deep infrastructure bets. On the food side, I look at how protein is “menu-modified” into everyday routines in India and what that says about foodservice as a scaling channel for new ingredients.

In gut health, Bactolife’s €30M round points to a potential shift from reshaping the microbiome to controlling its outputs, with implications for how claims, dosing, and trials are designed.

On the farm, several stories converge on the same question: what actually works at scale. RNAi-based crop protection is moving past target novelty toward delivery, stability, and cost per hectare. AI-driven trait discovery is reframing where defensibility really lies as gene-editing tools commoditise. Autonomous mustering drones highlight a different agtech wedge altogether, shifting from per-animal hardware to ranch-level capacity economics.

I also cover a notable jump in South Korea’s public R&D spend, a strategic biocontrol acquisition by BASF, and why AI agents, not just GLP-1s, could represent a more serious structural threat to Big Food.

Let’s get into it!

BIO BUZZ

Products, partnerships, and regulations

🇮🇳 Starbucks India launches a new line of cold foams made with SuperYou’s yeast protein

Starbucks India has launched protein cold foams across all 500 stores, tapping into India’s growing demand for high-protein functional foods, with each serving adding 11-18g of protein for ₹50 (~$0.55).

It also has added probiotics for gut wellness. India is the first market outside North America to get Starbucks’ protein cold foams, and the first to offer them as a non-dairy option. SuperYou’s protein powder is produced from brewer’s yeast grown on molasses in bioreactors and later purified.

The lineup includes sugar-free vanilla, chocolate, and banana. SuperYou says the powder provides 24–27g of protein per 36g serving, includes all nine amino acids, and has a PDCAAS score of 1.0.

Source: Green Queen

Thoughts 🤔:

Protein is getting “menu-modified” into everyday routines. A ₹50 add-on delivering ~18g reframes protein from a product category into a default upsell, like extra espresso or oat milk. The question is whether this survives beyond novelty: repeat orders will tell us if proteinization is moving from fitness to habit.

It also highlights why foodservice can often scale ‘newer’ proteins faster than CPG shelves. Chains bring distribution and trust, but they are brutal filters on functionality. Foam stability, taste masking, speed-of-service, and supply reliability matter more than the protein’s origin story.

🇬🇧🇳🇱 Moa Technology and Certis Belchim partner to accelerate next-generation herbicide Moa Amplifier solutions for global agriculture

Moa will bring its discovery engine, including more than 80 newly identified herbicidal modes of action, over the past three years, while Certis Belchim will handle development, registration, and commercialisation.

The companies plan to co-develop a new Moa Amplifier molecule designed to work with a specific active ingredient. This is intended to help farmers protect yields more safely, sustainably, and effectively than current approaches.

Moa Amplifiers don’t kill weeds on their own, but they can make herbicide programs work with lower doses or concentrations. Using the proprietary Moa Gamma platform, Moa has already identified hundreds of these amplifier candidates and is now advancing them with commercial partners.

Source: AgriBusiness Global

Thoughts 🤔:

Globally, resistance has been documented in 273 weed species across 21 of 31 known herbicide sites of action. That base rate is why ‘incremental’ innovations can still matter, if they reliably reduce dose or improve control across real-world variance.

Incumbents are starting to place more bets earlier on platform-derived efficacy enhancers because discovering and commercialising a truly new herbicide mode of action still takes a long time, and costs a lot, while resistance continues to compound.

🇧🇷 Vitalforce and Bsafe Biotech Inc to co-develop an RNAi-based bioinsecticide for fall armyworm

RNA interference (RNAi) works by using double-stranded RNA to trigger degradation of a target organism’s messenger RNA, preventing production of vital proteins. Since the mechanism is sequence-specific, it can deliver narrower-spectrum control with fewer non-target effects than conventional broad-spectrum insecticides.

The partnership targets fall armyworm, one of the most economically damaging pests in tropical agriculture, especially in Brazil’s commodity systems. Embrapa-documented losses of 30% in soybeans and 40% in corn under heavy infestation underscore why fall armyworm’s biology and resistance profile make it a top priority.

The program is structured around an 18-month R&D cycle followed by regulatory preparations, with milestones split into 9 months of lab efficacy work and 9 months of field validation. If field performance is strong, they plan to compile the safety/efficacy dossier and pursue commercialisation in late 2027 to early 2028.

Source: AgroPages

Thoughts 🤔:

Brazil is the stress-test market for next-gen insect control. The scale and year-round pest pressure speed up resistance and expose weak links in agronomy, logistics, and price.

As Bt performance slips, growers are demanding new modes of action. If RNAi insecticides can deliver repeatable field control across regions, stay stable in heat and humidity, hit a workable cost per hectare, and clear Brazil’s three-agency safety review, they’ll be de-risked for other high-pressure geographies.

🇬🇧 🇺🇸 Wild Bioscience and The Traits Company team up to speed development of new soybean varieties

UK-based Wild Bioscience is partnering with The Traits Company, a North Carolina trait discovery specialist backed by global seed leader GDM, validating demand for Wild Bio’s AI-based trait design system in a crowded crop innovation market.

Wild Bio uses machine learning and evolutionary biology to design traits for resilience and efficiency, cutting development timelines. The Traits Company will pair that design work with its soybean development pipeline to move candidates through testing and into market-ready varieties at scale.

Backed by GDM’s global reach, the partnership will focus on next-generation soybeans aimed at resilience, nutrition, and climate adaptability.

Source: AgTechNavigator

🇦🇺🇬🇧 CSIRO and the University of Leeds are developing an open-access AI tool to convert food waste into fermentation-based proteins

The two-year project is funded by a $2M grant from the Bezos Earth Fund. It will use farm and food sidestreams, including damaged or unharvested vegetable crops, grain leftovers such as canola meal, rice bran, and brewer’s spent grain, and byproducts from cheese production.

Around one-third of the world’s food is wasted, creating about 10% of global emissions and roughly $1 trillion in economic losses.

The team plans to use AI-tuned biomass fermentation to convert these sidestreams into microbial protein powders that can compete with conventional proteins on cost and performance for people and animals.

Source: Green Queen

BIO BUCKS

Funding, M&As, and grants

🇩🇰 Bactolife raised €30M to launch its gut-health-boosting binding proteins and start human study programme

The Danish startup is building a new functional gut-health ingredient category using binding proteins inspired by IgG fragments found in camelid milk (camels, alpacas, llamas), produced using precision fermentation.

Binding proteins bind specific harmful metabolites (toxins) so they pass through the GI tract without disrupting the gut microbiome. Unlike antibiotics, they don’t kill gut bacteria, don’t penetrate the gut barrier, and don’t activate the immune system. They also work at low daily intake, with a fast onset and observable impact soon after ingestion.

The new funds will support a human study programme spanning the US, Asia, and low- and middle-income countries, alongside investments in production and supply capacity. Commercially, the rollout begins in the US before expanding to the EU and Asia, while also aiming to improve access for women and children in lower-income markets.

Investors: Cross Border Impact Ventures, EIFO, Novo Holdings, and Athos.

Source: Green Queen

Thoughts 🤔:

Bactolife is a nice marker for a potential shift in gut-health ingredients. It’s a move away from “feeding the microbiome” and toward “controlling outputs” (metabolites) with binders. The idea isn’t new in principle (gut sequestration has plenty of precedents), but the bet here is higher selectivity and a cleaner mechanism-to-claim pathway.

I’m curious to see: the trial endpoints that move biomarkers, disclosed effective dose and cost per serving, no meaningful off-target binding (nutrients/meds), and early repeat-order rates post-launch.

🇬🇧 Biographica raised a £7M seed round to scale its AI-driven crop trait discovery platform

Traditional crop development suffers from a <1% hit rate, forcing companies to test thousands of edits to find a single success. The London-based startup’s AI-driven approach streamlines this by identifying high-value targets 12x faster, significantly reducing the time and risk involved in innovation.

Unlike traditional GWAS methods that only show correlation, Biographica uses knowledge graphs and foundation models to understand the mechanistic “why” behind genetic traits. This “lab-in-the-loop” system allows the AI to self-improve by constantly integrating experimental feedback into its predictive algorithms.

The company trained its models on large public and self-generated datasets. This strategy has already secured trust and active R&D projects with two of the top-five global seed firms.

Investors: Faber VC, SuperSeed, Cardumen Capital, The Helm, and Chalfen Ventures and Entrepreneurs First.

Source: AgFunder

Thoughts 🤔:

As gene editing is increasingly commoditized, the scarce capability is upstream. The hard part is identifying causal targets and choosing edit strategies that survive the messy reality of pleiotropy (single gene influencing multiple traits) and environment-by-genotype effects.

A platform can reliably reduce the number of edit events, lines, and seasons needed to land a usable trait, could shift trait-development unit economics more than incremental improvements in CRISPR tools.

🇩🇪 SenseUP Biosciences raised €3M seed funding to expand its dsRNA-based biopesticide portfolio that addresses cost, stability, and use case challenges

The German startup is building RNA interference (RNAi) sprays that use double-stranded RNA (dsRNA) to switch off specific genes in target pests. The goal is targeted control without the broad collateral damage linked to many chemical pesticides.

The patented Corynebacterium-based platform tackles some of RNAi’s biggest hurdles. It keeps dsRNA stable for more than 18 months at room temperature, reduces manufacturing costs through high-throughput strain screening, and supports multi-pest control in a single formulation.

The company says early field trials are promising, and it has about 15 products in development. Larger trial readouts are expected in 2026. SenseUP plans to file regulatory submissions with large partners, starting with the US and South America, with Europe also on the roadmap.

Investors: Capnamic, Simon Capital, Rockstart, CHECK24 Impact and HBG Ventures.

Source: AgFunder

Thoughts 🤔:

With commercialisation in mind, the differentiator in RNAi crop protection is shifting from target novelty to delivery and unit economics. The key is consistent field performance at a cost per hectare farmers will tolerate, in a product that fits existing spray workflows. Shelf-stable biology is becoming table stakes because logistics friction is a quiet adoption killer.

Encapsulating dsRNA inside microbial cell walls reframes RNAi as a fermentation and formulation problem (titer, downstream simplicity, shelf life), not just RNA design. It would be interesting to see the cost per acre at commercial dose, and how regulators treat multi-target and cell-based formulations.

🇦🇺 GrazeMate raised $1.2M in pre-seed funding to launch fully autonomous cattle-mustering drones run from a mobile app

Ranchers can send a drone out from their phone to move cattle, cutting hours spent on horses, bikes, and other vehicles. This directly tackles the “hair-on-fire” problem of skilled labour being scarce, expensive, and time-intensive.

Early pilots in Queensland and New South Wales cover 1.7 million acres and are mustering thousands of cattle each week. The drones use reinforcement learning to respond to cattle in real time, backing off when animals show signs of stress. The system can also handle monitoring, and a second-generation beta estimates cattle weight and dry matter availability.

Instead of selling hardware, GrazeMate leases drones and charges a monthly fee based on ranch size and cattle numbers, aiming to undercut current mustering costs. The value proposition improves as cattle are moved more frequently, supporting rotational grazing and regenerative practices that lead to better grass and soil over time.

Investors: Y Combinator, Antler and NextGen Ventures.

Source: AgFunder

Thoughts 🤔:

If GrazeMate can prove that one off-the-shelf drone and a base station can take a big chunk of mustering hours off large ranches, it’s a shift from per-head hardware economics (smart collars) to ranch-level capacity economics (shared autonomy).

But that only holds if the system keeps working in real terrain and weather, supply risk (DJI) don’t force a big jump in CAPEX or OPEX, and customers keep renewing even with seasonal use.

The key is cost lumpiness. Collars scale roughly linearly with herd size because every additional animal adds hardware and subscription cost. Drone mustering looks like a capacity service because once a ranch has enough drone and base coverage, adding animals shouldn’t cost much.

🇩🇪🇺🇸 BASF Agricultural Solutions acquires AgBiTech from Paine Schwartz Partners to strengthen its biocontrol capabilities

Founded in 2000, Texas-based AgBiTech develops insect control products using nucleopolyhedrovirus technology for corn, cotton, soybean, and specialty crops. Its solutions are already commercialised across Australia, Brazil, and the U.S., serving major row crops like corn, cotton, and soybeans.

The acquisition (amount undisclosed ) is expected to close in the first half of 2026, pending regulatory approval. It will complement BASF’s existing biological portfolio aimed at disease management, residue reduction, stress tolerance, and resistance management.

Brazil is a major strategic opportunity for BASF due to its rapidly expanding biologicals market and recurring pest pressures. AgBiTech’s proven solutions against lepidoptera caterpillars address a critical challenge for Brazilian farmers.

Source: AgTechNavigator

🇰🇷 South Korea’s agriculture ministry plans to invest KRW 234.8B ($162.2M) in agricultural R&D in 2026, up 17% from last year

Climate resilience and risk management received the largest allocation, with KRW 73.2B allocated to address climate change impacts, emerging diseases, and agricultural disasters.

To modernise farming systems, KRW 51B is earmarked for smart agriculture, including AI, robotics, and drone technologies. These investments are intended to raise productivity, optimise resource use, and support large-scale precision farming.

Beyond production, funding is spread across biotech (KRW 33.5B), commercialisation and talent development (KRW 38.2B), and future food and K-Food innovation (KRW 38.9B) to strengthen global competitiveness.

Source: AgTechNavigator

BIO READS

Thought-provoking opinions

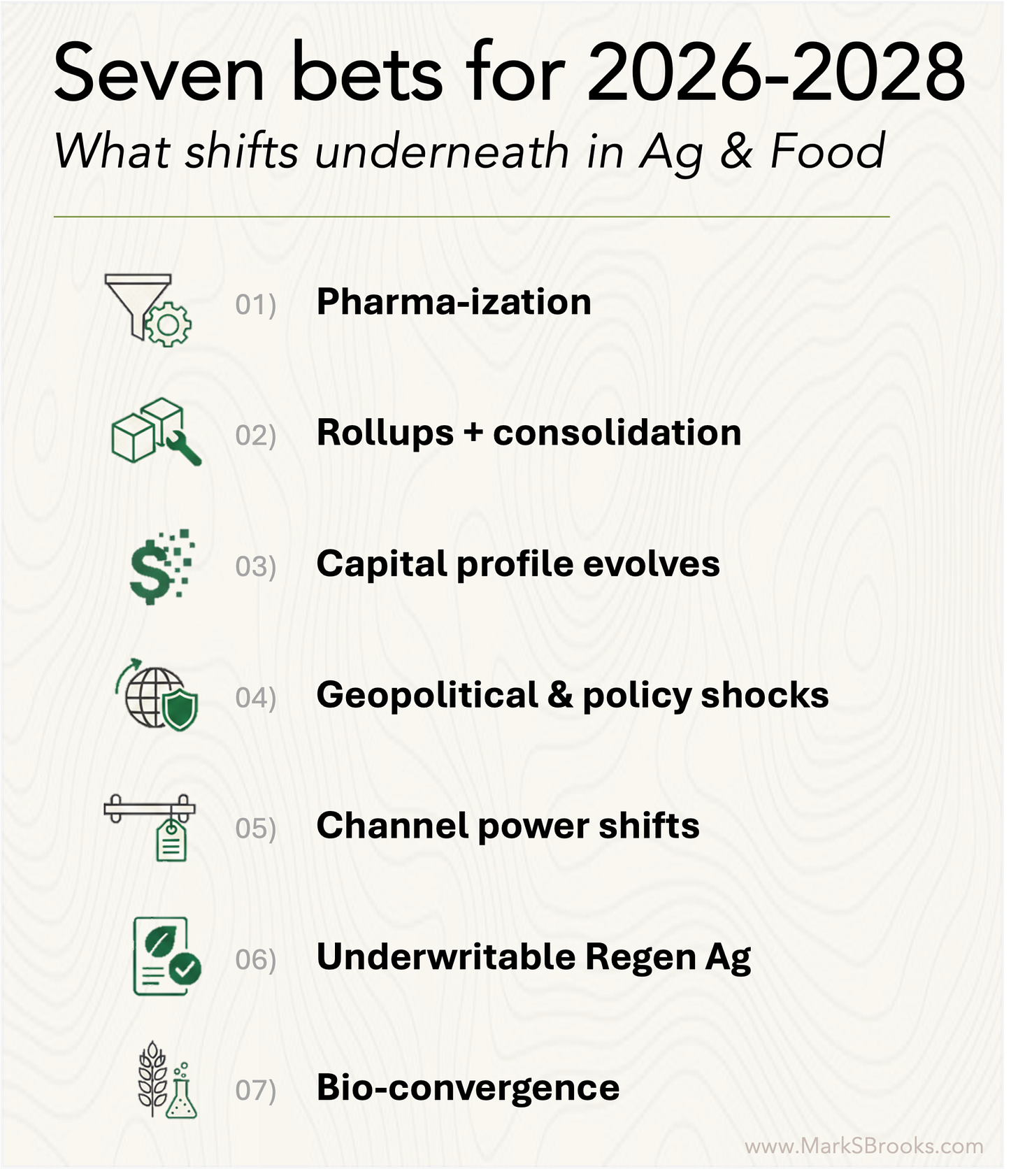

⚖️ Agriculture’s great repricing goes beyond the downcycle

Mark’s core claim is that agriculture is not in a normal downcycle. Markets are pricing it as a riskier system, so the cost of capital rises as moats fade faster and regulation, litigation, and geopolitics move to the centre.

He points to surface signals across the stack: FMC down ~80% in market cap from end-2023 to end-2025, agrifoodtech VC dropping, and 25,000+ strategic role cuts since 2023. His take is that the industry is starting to look like pharma: AI makes discovery cheaper, but development, registration, manufacturing, and adoption stay the bottlenecks.

So the money shifts to choke points that compound: formulation and manufacturing, IP platforms, distribution and advisory networks, finance tied to inputs and offtake, and data plus verification. Consolidation becomes defensive, and the next cycle favours long-horizon operators over pure discovery engines.

Source: Mark S. Brooks

🤖 The end of impulse: Why AI agents are Big Food’s existential threat

Antony argues that Big Food is mispriced if investors treat GLP-1s as a modest 1-3% volume headwind. The bigger risk is a shift in how people buy: AI agents become the shopping interface, turning grocery into a planned reorder and squeezing out impulse purchases.

He adds other shocks that could stack on top: stricter dietary guidance aimed at ultra-processed foods, rising litigation and liability risk that is starting to look like the tobacco playbook, retailers moving shelf space toward healthier private-label and perimeter categories, and insurers pricing diet into premiums.

He ends with a capital rotation point: the spending won’t vanish, but it may move to products and supply chains that can prove “quality” with data. This pushes the advantage upstream into biology, provenance, and measurable nutrient density.

Source: Antony Yousefian

🧫 China is coming for agricultural machinery: Are Western OEMs ready?

Chinese agricultural machinery makers are starting to follow the automotive EV playbook: move from “low-cost manufacturing” into credible, feature-rich products, then export aggressively, with Agritechnica 2025 as a visible inflection point.

Patrick maps the challengers (e.g., YTO, Foton Lovol, Zoomlion) and the conditions for a real Western breakthrough: step-change quality and compliance, credible dealer and service networks, trust and brand building (including acquisitions), and financing and residual-value support that makes total cost of ownership workable for farmers.

Western OEMs should take note. As dealers consolidate and tech becomes less distinct, incumbents lose protection. The response is to move faster on product, tighten customer value, and treat Chinese entrants as a real medium-term threat.

Source: Patrick Honcoop

EAR FOOD

Podcast episode of the week

🎙 David Friedberg: ‘Transformative ag companies can be built in any macro environment to drive outlier VC returns’

“Farm impact” has to be a loud signal. Friedberg’s bar is: if gains don’t clearly beat field noise, the market won’t pay. In ag, uncertainty and seasonality make it hard for growers to trust marginal gains, so the value prop needs to be both measurable and repeatable fast.

Ohalo’s entry point is turning vegetative crops into true-seed markets, which changes farm economics. The potato example: instead of hauling ~4 tons of planting material per acre (plus storage, fungicide, diesel, and labour), you plant small, uniform true seed and aim for both lower costs and higher yields.

Pricing and adoption follow the usual “share the upside” rule: charge about one-third of the added profit you create. He frames this as the Monsanto-style seed model and analogous to enterprise software pricing (capture a slice of created value,).

Agtech is structurally slower to scale than typical software because the “iteration loop” is annual. Capital efficiency is constrained by once-a-year selling windows and waiting a full season for results before customers renew/expand and before product teams can iterate. That cadence caps how much capital the sector can productively absorb.

He thinks the sector may be normalising after a long bubble, not just in a temporary trough, and that this will be painful for undifferentiated VC funds. But power-law reality doesn’t change: truly transformative companies can still be built in any macro environment, and most VC returns depend on rare outliers rather than “the category.”

Guest: David Friedberg, CEO and co-founder of Ohalo Genetics

Podcast: The Modern Acre

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Hi Eshan, thank you very much for excellent issue #133. I want to share this positive news story on how the demand for factory farmed meat has significantly decreased.

Nearly 5,000 expected to be laid off at 2 Tyson Foods plants on Tuesday, SPRINGDALE, Ark. (KNWA/KFTA) —

A pair of Tyson Foods beef plants are expected to lay off a total of nearly 5,000 workers on Tuesday as part of the company’s plan to “right size” its beef business.

After its beef segment posted a record $1.135 billion loss in fiscal 2025, or $426 million adjusted, Tyson announced in November that it would end operations at its Lexington, Nebraska, beef facility and convert its Amarillo, Texas, beef facility to a single, full-capacity shift.

All 3,212 employees are expected to be laid off at the Lexington facility, and the move to a single shift at the Amarillo plant will eliminate 1,761 jobs, according to Texas and Nebraska Worker Adjustment & Retraining Notification (WARN) notices.

Keep.up the fantastic job my righteous friend 👍❤️