€56M to Scale AI-Powered Imaging for Food Inspection, and Women’s Nutrition Gets Rebuilt Around Life Stages

Also: MrBeast tried cultivated chicken, fibre becomes programmable, and barns turn into early-warning systems.

Welcome to Issue #134 of Better Bioeconomy, weekly insights on how tech is reshaping food and agriculture for better human and planetary health. Thanks for being here!

This issue marks three years since I started the newsletter! 🎂

I didn’t expect it to become such a meaningful part of my life, but it has. Writing each week (well, almost. I’ve managed ~87% consistency, because some weeks life gets in the way) has sharpened how I think, introduced me to cool people I wouldn’t have met otherwise, and opened doors I am very grateful for. It has, without a doubt, changed the trajectory of my life.

Thanks for reading, replying, sharing, and tolerating the bad takes and cringey memes. I’m excited to keep going.

Okay, now back to work. Let’s dig in! 🍽️

BIO BUZZ

Products, partnerships, and regulations

☕ Gates Foundation-backed pilot equips East African coffee farmers with Helios AI to manage climate risk

Helios AI and the Committee on Sustainability Assessment (COSA) are running a Gates Foundation-funded pilot in East Africa to help coffee farmers make better calls on production and sales. The project delivers weather and market forecasts meant to reduce risk from climate variability and price volatility.

A core goal is data fairness: farmers should benefit from the data they generate. By testing which forecasts and insights matter most, the initiative aims to make climate information practical and usable at the cooperative and farm level.

Helios is adapting technology traditionally used by global commodity buyers to support smallholder farmers. The platform covers more than 75 commodities across 90 countries, and this pilot shows how the same AI tools can serve both agribusiness giants and small farms.

Source: AgTechNavigator

Thoughts 🤔:

Coffee outcomes often come down to who gets good information first. Big buyers usually spot weather and price risk early, then adjust buying. This pilot is interesting because it tries to put that “early warning” in the hands of cooperatives and see if it changes day-to-day decisions like when to pick, when to sell, and how to plan together.

The catch is that information alone rarely shifts the price farmers get. If cash needs, lack of storage, or limited buyer choice force quick selling, the forecast doesn’t become leverage.

So the question is: does the signal connect to action? That will depend on clear playbooks and practical tools like shared storage, short-term credit, and more routes to market.

👀 MrBeast ate cultivated chicken from Upside Foods on camera

It marked a major visibility moment for cultivated meat. With 460 million YouTube subscribers, his on-camera experience put the category in front of primarily Gen Z and Gen Alpha audiences (groups that already engage with food as content and identity).

The lab visit also helps weaken the “lab-grown frankenfood” stigma. Watching him ask questions and taste the product frames cultivated chicken as 'normal, approachable, and worth trying.

For Upside Foods, this is cultural validation with real commercial implications. Even a small wave of consumer interest can shift conversations with restaurants, retailers, and major protein players who still doubt customers will ask for it.

Source: Green Queen

🧠 Cropin launched an AI-driven agrifood platform aimed at reducing risk across the global food value chain

Called Cropin Ecosystem, the plug-and-play offering draws on more than a decade of agricultural data and advanced AI models to support decision-making from sourcing through supply planning. Cropin claims its models deliver over 90% forecasting accuracy, supporting supply assurance and planning for pests, diseases, and price swings.

The platform is built to help companies manage today’s biggest agricultural pressures like climate volatility, geopolitical uncertainty, and supply chain disruption. Better visibility into farms and supply can steady availability, protect margins, support climate-smart farming, and help meet tighter traceability and sustainability rules.

The company says customers can deploy the system quickly and see operational changes within six months. Cropin also points to partnerships with cloud providers, AI and IoT firms, universities, and NGOs as part of its longer-term approach to food-system stability.

Source: AgNewsWire

Thoughts 🤔:

Cropin looks to be repackaging existing ag intelligence into a partner-bundled ecosystem and selling implementation certainty, with claims of sub-six-month deployment and high model accuracy. That six-month promise is a go-to-market tell for buyers under margin pressure who want short payback windows and lower integration risk.

Prediction outputs are being wired into procurement decisions. If they are reliable enough to change contracting terms, hedging posture, and inventory buffers, advantage shifts to whoever owns the data plumbing and workflow integration. If not, this risks becoming a services-heavy integration story where “ecosystem” is mostly packaging.

🍬 2nd Nature applies AI to discover clean-label sweeteners hidden in agricultural side streams

The Cincinnati-based startup will start commercial sampling this quarter. First up are natural, non-caloric sweeteners and umami flavour enhancers meant to help food manufacturers cut sodium. The ingredients are sourced from abundant agricultural side streams.

Its AgWaste Portal runs several AI models like taste prediction, structure-based screening, and sequence-similarity searches to identify candidates faster and improve hit rates. The company pairs discovery with scalable extraction know-how.

Early sweetener candidates are 50-100× sweeter than sugar, clean-tasting, and non-caloric. Because they come from low-cost side streams, the company says they could compete on cost with stevia or monk fruit.

Source: AgFunder

Thoughts 🤔:

2nd Nature shows that ingredient innovation is not always about finding the next rare plant. It’s about pulling value out of what the food system already moves in bulk. When your inputs are commodity byproduct streams, the edge is taking messy, variable feedstocks and turning them into tight specs at a cost that holds.

If this model works, leverage comes from two core assets: steady access to high-volume side streams, and process know-how that standardizes them. Their partnerships with processors, CDMOs, and ingredient suppliers point to the real constraint. Manufacturing and distribution ties can often set time to market more than discovery.

🥛 One.bio allows formulators to add “invisible” fibre to foods and beverages without affecting taste or texture

The California-based startup does this by breaking polysaccharides into soluble, palatable oligosaccharides while keeping the fibres’ functional structure. One.bio is reframing fibre as a family of ingredients (not a single nutrient), and connects fibre structures to microbiome and metabolic outcomes using a database of 4,000+ characterised fibres and a high-throughput fermentation system.

The company plans to launch first through GoodVice, its in-house consumer brand. Early prototypes include a sparkling seltzer with 20g fibre and a chocolate milkshake with 20g fibre and 20g protein.

In a 63-person, two-week clinical study, participants consumed up to 20g/day of one.bio’s oat fibre reported better GI comfort, improved glucose control, and better mood and focus.

Source: AgFunder

Thoughts 🤔:

I like one.bio’s framing of fiber as a programmable input. Start with the outcome you want (eg: more butyrate) then pick the fiber structure and dose that produces it consistently across people. Platforms that own the structure-to-response map and the evidence package brands can use, will have the edge.

The timing is right in the GLP-1 moment. Consumers and brands are increasingly focused on satiety, glucose stability, and gut tolerance, and fiber is a plausible food-based tool for addressing those outcomes. The bar should be clinical data, and it seems like one.bio is moving in the right direction.

🤰🏽 How Helaina is redesigning women’s nutrition from one size fits all to life stage-specific biology

Women’s nutrition has historically been misdesigned, with most legacy ingredients selected for convenience rather than biological relevance. As a result, many women experience tolerance issues, inconsistent outcomes, and formulas that don’t fit the shifts of menstruation, pregnancy, and menopause.

In 2025, several women’s wellness brands launched products using effera, Helaina’s precision-fermented human lactoferrin. Effera is bioidentical to human lactoferrin and is designed to help regulate iron, support gut and immune function, and support metabolism and the microbiome. Because it matches human protein structure, it is better tolerated and more consistent than bovine or other animal-derived options.

Helaina’s bigger move is to design products and run studies by life stage. That means formulations and clinical studies built around real physiological seasons like menstruation, pregnancy and postpartum, perimenopause, menopause, athletic training, and periods of high stress.

Source: Green Queen

Thoughts 🤔:

Credit to Helaina for pushing an evidence-first approach. recision fermentation keeps improving at producing human-sequence proteins, and as more startups learn to make the same molecule, robust evidence starts to become the differentiator.

Helaina is leaning into women-specific studies with pre-specified endpoints that brands can reference in compliant claims. If the results are repeatable in clearly defined cohorts, defensibility shifts away from strain or process IP and toward endpoints, tight protocols, and a mechanism that holds up under scrutiny.

That’s where standard biomarker panels start to matter as legit category infrastructure. They make outcomes comparable, reduce ambiguity, and de-risk procurement decisions for brands.

🐄 Aleph Farms partnered with CDMO Cell Agritech and set up an entity in Singapore to serve as its APAC hub

The move fits the Israeli company’s asset-light approach to scaling cultivated meat, relying on local contract manufacturers instead of building large, centralised plants. By working with Cell Agritech, the company will tap into regulatory-ready pilot and scale-up infrastructure, lowering capital requirements and reducing execution risk.

Aleph’s hub-and-spoke setup pairs Singapore’s R&D and regulatory base with Malaysia’s larger, lower-cost manufacturing footprint, allowing a step-by-step expansion as regional demand grows.

Aleph Farms’ flagship product, Petit Steak, is already cleared for sale in Israel and is under review in several other markets. The company is targeting restaurant launches in Israel and Singapore by 2027.

Source: Green Queen

BIO BUCKS

Funding, M&As, and grants

🐔 Orbem raised €55.5M Series B to expand its AI-based MRI inspection systems across poultry and produce markets

The German company will use the funds to enter the US, expand its poultry offering, and add fruit and vegetable quality checks. Its Magnetic Resonance Imaging (MRI) scanners run in under a second and operate automatically. Orbem says it has already scanned more than 170 million eggs.

Orbem’s flagship products, Genus Focus and Genus Scale, allow hatcheries to identify egg sex and fertilisation status without opening the egg, replacing inefficient or banned practices like male chick culling. These solutions also create new revenue streams and significantly reduce food loss.

Since its founding, Orbem has scanned eggs, fruits, and seeds at high volume to build a large biological dataset. The company says this dataset will support future models that may carry insights from agriculture into non-invasive human health uses.

Investors: Innovation Industries, Supernova Invest, General Catalyst, 83NORTH, The Venture Collective, Possible Ventures, and several angel investors.

Source: EU-Startups

Thoughts 🤔:

Orbem’s story is a sign that internal quality data is becoming operational. If MRI can run at line speed, non-destructively, and without constant human tuning, it creates a new QC layer. That layer is routine internal phenotyping in hatcheries and potentially packhouses, going beyond surface proxies.

Once “inside quality” is measurable at scale, it can move from a private sorting edge to a tradable attribute. That could tighten specs, reduce disputes, and enable outcome-based contracts. But only if buyers accept scan-derived grades as auditable and stable across seasons, varieties, and facilities.

🧬 Barnwell Bio raised $6M to turn barn microbiomes into early outbreak signals

Building from pandemic-era biosurveillance, Barnwell is deploying barn-level monitoring using metagenomic sequencing, starting with facilities in the Midwest and Southeast and is working with academic and industry partners.

The New York-based startup doesn’t run one-off tests for a single pathogen. It samples the whole barn environment by collecting foot swabs that pick up faecal material and the broader microbial ecosystem. Those samples create a microbiome fingerprint for each facility, so producers can spot unusual spikes and track whether the barn’s microbial balance is shifting.

The company turns results into risk scores and simple visuals that inform day-to-day decisions. Producers and veterinarians can step in sooner with targeted antibiotics, biosecurity upgrades, or nutritional and water-based treatment.

Investors: Twelve Below, Max Ventures, Dorm Room Fund, Banter Capital, Planeteer Capital, AgVentures Alliance, Daybreak Ventures, and Alumni Ventures.

Source: AgFunder

Thoughts 🤔:

Poultry barns are essentially closed, high-density ecosystems. If you can read that ecosystem through routine environmental sampling, you get a path to earlier, cheaper signal than waiting for sick birds or running one-off diagnostic panels.

Could the COVID playbook of population surveillance translate into farm-environment surveillance as a standard operating layer for animal ag? It only becomes real infrastructure if turnaround times fit day-to-day decision cycles and if outputs are tied to clear playbooks (what changes in biosecurity, treatment, or management when risk moves).

Metagenomics pushes the frame beyond “is pathogen X present?” toward “is this barn drifting from its normal microbial state?” That could enable systems-level health management beyond outbreaks, because you are tracking stability and stress over time.

🎨 Octarine Bio raised €5M to bring its precision-fermented pigments to market for food, textiles, and personal care

The Danish startup has now raised €12.8M in its Series A. It plans to move from industrial validation into sales, while continuing work with existing partners. The funding will support PurePalette’s fully bio-based pigment line, produced through precision fermentation, with an initial market launch planned for 2026.

This year, Octarine Bio is scaling three lead colours: PurePurple, PureGreen, and PureBlue, and doing formulation work with partners. The company has already produced 100kg of its first flagship pigment, and says this round will help bring more colours to the same stage.

Octarine Bio says its pigments can match synthetic dyes on price even at early volumes, pointing to double-digit yields per litre, high colour strength, and stable performance. The process cuts environmental impact and offers an alternative as regulators and consumers scrutinise synthetic colourants more closely.

Investors: The Footprint Firm, Edaphon, Unconventional Ventures, DSM-Firmenich Ventures, Óskare Capital, and angel investors.

Source: Green Queen

🌾 Heritable Agriculture secured $4.98M grant from the Gates Foundation for AI-driven climate-resilient crops for smallholder farmers

The funding will support the company’s “Joint AI-driven Smallholder Omics aNalytics” (JASON) initiative, which combines AI with genomic “omics” tools to accelerate crop improvement. The goal is to speed up gene discovery and shorten breeding cycles to bring resilient crop varieties to farmers more quickly.

JASON helps smallholder farmers in low- and middle-income countries (LMICs), where rising heat, drought, and other climate pressures are increasing risks to food security. California-based Heritable integrates AI with genomic, remote-sensing, and historical crop data to identify traits that enhance stress tolerance and develop resilient germplasm.

The effort comes as climate-driven yield losses intensify in smallholder systems, which produce up to 80% of food in LMICs. The initiative also aligns with the Gates Foundation’s push for digital innovation in agriculture. It could create partnership opportunities for seed companies, agribusinesses, and investors looking to strengthen climate-resilient supply chains.

Source: FoodBev

Thoughts 🤔:

The promise here is an engine that uses genomics, remote sensing, and other data to spot useful traits faster, then translate them into climate-adapted seed for smallholder systems.That’s a big deal because weather volatility is accelerating, while new crop varieties still take years to develop and prove in the real world. If you can compress that cycle, it becomes a form of climate adaptation.

The risk is that prediction speed gets ahead of reality. Field proof still takes seasons, and real impact still depends on seed multiplication plus trusted local partners who can distribute seed and support adoption.

Will this produce farmer-ready lines that perform reliably across sites and years, and is there a credible path to getting those seeds into farmers’ hands at scale?

🍄 Maia Farms secured C$3.75M to expand specialty mushroom and mycelium ingredients focused on functional and nutritional health

The Vancouver-based startup says it is shifting from “farm to pharmacy,” positioning its ingredients as part of a broader move toward health-led food innovation that puts public health at the centre of everyday eating.

Maia Farms has developed two proprietary processes: Maia Form, a dry extrusion process that produces shelf-stable textured mushroom ingredients, and Maia Fresh, a fermentation-based process that yields high-moisture mycelium pulp. Together, they support up to 200,000 kg of capacity and have already powered 20+ product launches across North America.

The company says its ingredients can compete on cost and performance. At a 4oz serving, they’re cheaper than beef and chicken mince, while still delivering functional benefits at low inclusion rates.

Investors: Active Impact Investments, NYA Ventures, Ag-West Bio, PIC Investment Group, and Deep Checks.

Source: Green Queen

BIO READS

Thought-provoking opinions

📈How the state’s ‘visible hand’ is driving China’s new agrifood investment playbook

China’s agrifood tech scene is still moving fast despite the global slowdown. This is because state strategy actively builds the enabling infrastructure. High-standard farmland serves as a large-scale innovation testbed, and biomanufacturing clusters help reduce scale-up friction for synthetic biology platforms.

Matilda’s core claim is that “what’s investable” in China is shifting to strategic fit. Companies that solve national priority chokepoints get policy support, infrastructure, and capital pathways that make commercialisation and scale more feasible than in many other markets.

She also argues liquidity is returning through a mix of reopened public markets, stronger M&A channels, and government-backed funds that can finance capital-intensive growth stages and provide exits. This creates a tighter public-private loop where the state supplies patient capital and private GPs execute.

Source: Matilda Ho (AgFunder)

🚜 Why autonomous machinery in agriculture hasn’t scaled (yet)

Autonomous farm machinery has made real technical progress, moving from early retrofit experiments to hundreds of deployed units, but it is still tiny compared to the global equipment fleet.

Patrick argues that the usual explanations (regulation, farm complexity, rural connectivity) are incomplete. The more immediate blockers are safety proof, unclear liability, farmer trust, and systems that are not yet robust or versatile enough to remove labour rather than shift it.

Even as ROI improves through falling hardware costs and models like subscriptions or robotics-as-a-service, adoption will remain slow until autonomy works predictably across tasks and farm sizes, and until the surrounding standards and support ecosystem catch up.

Source: Patrick Honcoop

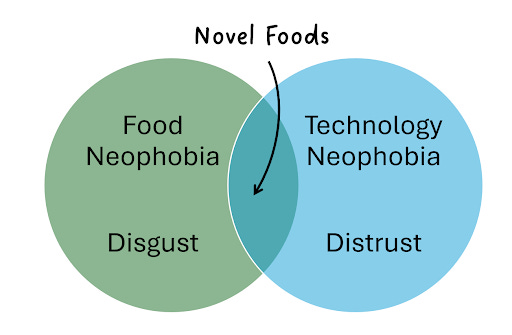

🤢 Where disgust meets distrust: The viral psychology behind the “Ultra-Processed Food” narrative

Dr. Sophie argues the “ultra-processed food” story spreads because it plays on our food neophobia. It treats processing and unfamiliar ingredients as contamination, which cues disgust and fear.

She says this lumps nutritionally weak junk foods together with a wide range of often beneficial staples and newer climate-friendly innovations like plant-based, upcycled, and fermentation-derived foods, which could be important for food security and sustainability.

To blunt the disgust-and-distrust loop, the piece suggests changing how new foods are sold and talked about. That could mean drawing clear lines between categories, presenting novelty as craft or status, and building familiarity through formats people already trust.

Source: Dr. Sophie Attwood (Green Queen)

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.