Major Cultivated Seafood Merger, $60M Bezos-backed Alt Protein Fund, and Co-fermented Fish Fillet

Also: My conversation with Bioshyft's founder, Gerrit Feuerriegel

Hi, thanks for being here!

Here’s my favourite quote that I came across this week:

“We need to feed ten billion people with healthy, sustainable food throughout this century while protecting our planet. We can do it, and it will require a ton of innovation. Our world is poised for transformation, for a future not constrained by compromise. Solutions to our greatest challenges often come from the quiet persistence of those willing to question, reimagine, and innovate.”

- Lauren Sánchez, vice chair of the Bezos Earth Fund

Alright, let’s dig into the latest developments in biotech-enabled food innovation! 🍽

BIO TALKS

🌎 My conversation with Gerrit Feuerriegel: Connecting innovators, investors, and incumbents to drive the bioeconomy

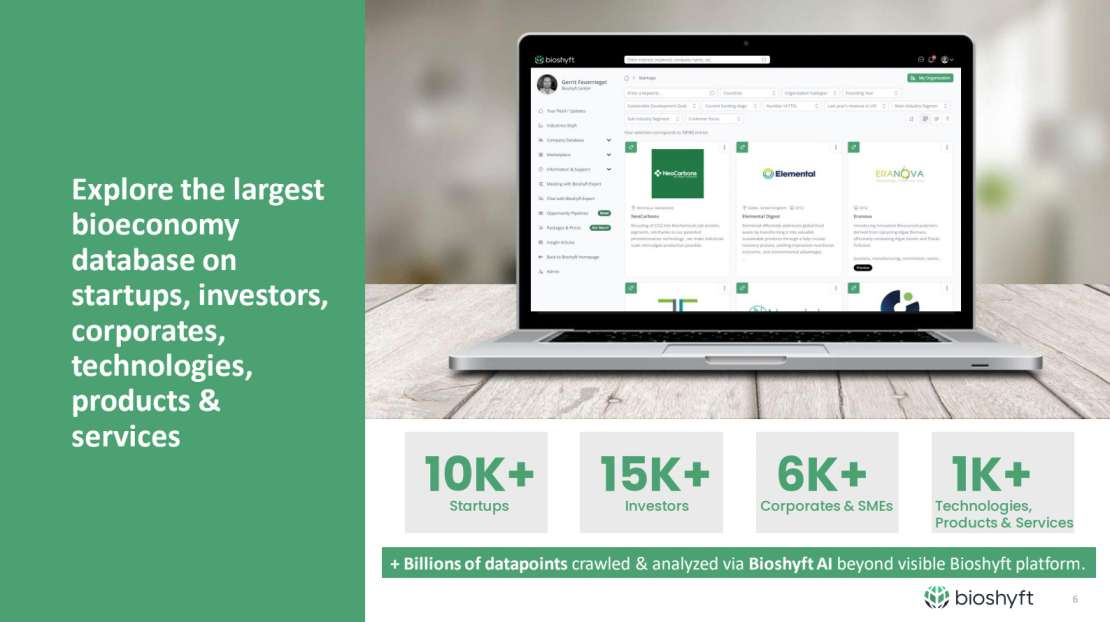

Recently, I spoke with Gerrit Feuerriegel, the Managing Director and CEO of Bioshyft, a platform aiming to accelerate growth in the bioeconomy sector. Based in Hamburg, Germany, Gerrit is a serial entrepreneur passionate about bioeconomy innovation.

Bioshyft provides a comprehensive database of more than 32,000 startups, investors, and corporations. It also has a marketplace for products and services to accelerate growth in the bioeconomy, offering a range of benefits tailored to various stakeholders.

The platform is structured around six "shyfts" representing important sectors of the bioeconomy: Foodshyft, Agrishyft, Oceanshyft, Materialshyft, Energyshyft, and Watershyft.

What sets Bioshyft apart from other bioeconomy platforms?

Unique features of Bioshyft include the "funnel" feature for investors to create lists of potential startups and Bioshyft AI, an AI model trained to understand industry connections and recommend technologies. The platform also offers personalised services, providing custom lists of potential solutions based on specific project requirements. It also offers consulting services through Shyft Management Consulting for in-depth market, competitor, and supply chain analysis.

How Foodshyft can help food biotech startups overcome challenges

Food biotech startups face challenges such as insufficient funding, lack of B2B customer feedback, qualified employees, and "smart" equipment.

Foodshyft helps startups tackle funding challenges by providing access to a network of over 15,000 investors and offering free feedback on pitch decks. It also addresses the lack of B2B customer feedback and collaboration by introducing a marketplace where corporations can post challenges and startups can collaborate on solutions.

While currently focused on these two challenges, Foodshyft plans to expand its offerings in the future to address the lack of qualified labour and the need for smart digitization and infrastructure.

How can startups adapt to the tough funding environment?

To adapt to tough funding environments, Gerrit suggests a focus on customer needs and a "camel" model, which focuses on efficient resource use and steady growth.

Key areas for startups to consider include flexible personnel expenses, reducing CAPEX, focused expenses, early engagement with B2B customers, and favourable payment terms with suppliers.

Bioeconomy trends and developments

Some of the trends Gerrit is seeing include increased government support in Europe, the development of alternatives to key raw materials like chocolate, and the potential of closed-loop bioeconomy systems (eg: pairing yeast fermentation facilities with microalgal photobioreactor systems).

Dive straight into Bioshyft by signing up for free!

BIO BUZZ

🐟 Koralo scaled its co-fermentation biomass process to 5,000 L in South Korea to increase production of its mycelium-based fish fillet

The German startup's fermentation process uses microalgae to feed mycelium, emulating the natural diet of fish. This results in a fish-like taste and nutrient-rich alternatives that are more sustainable.

The mycelium-based fish fillet, ‘New F!sh’, is a clean-label product. It offers a range of nutrients such as omega-3, complete protein, probiotics, and vitamins B2 and B12. New F!sh is said to have a texture that mimics real fish when cooked.

While Koralo is building a pilot facility in Germany, its current focus is on the South Korean market, where it launched its flagship fish fillet. With this scaling milestone, Koralo can supply its product to more restaurants and food service distributors.

Source: vegconomist

🇩🇰 Swan Neck Bio, a spin-off from White Labs, launched patented FlexCell tech for rapid and affordable fermentation scaling

FlexCell technology is a single-use bioreactor system allowing controlled fermentation from 5 to 1,000 L. It is said to “dramatically” de-risk the scaling process and claims to be 10-100x cheaper than current solutions.

The Copenhagen-based company aims to help businesses avoid high CMDO manufacturing costs and unnecessary CAPEX on pilot plants. They offer solutions for the inoculum phase, which is crucial for large-scale fermentation processes.

Swan Neck Bio also offers services designed to optimise biomanufacturing outcomes at the pilot scale. These services include improving microorganism robustness, increasing yields, and enhancing efficiency.

Source: vegconomist

🇨🇳🇬🇧 BSF Enterprise partnered with Ivy Farm Technologies to support fundraising, launch, and scale cultivated meat production in China

BSF Enterprise recently established BSF Enterprise Hong Kong to build a distribution and partner network in the Greater China market. Using its presence and investor network in Asia, BSF will support Ivy Farm's ongoing funding round.

Ivy Farm aims to produce 12,000 tonnes of cultivated meat from a single facility powered by renewable energy. This would lead to a 92% reduction in greenhouse gas emissions and a 90% decrease in land use compared to industrial farming.

The partnership focuses on scaling up to larger production-sized bioreactors and entering the Chinese market through securing investment and collaborations with key manufacturers.

Source: Cell Base

🇮🇳 Biokraft Foods partnered with ICAR-Directorate of Coldwater Fisheries Research to produce cultivated snow and rainbow trout

ICAR-DCFR will develop the necessary fish cell lines, while Mumbai-based Biokraft Foods will use its 3D bioprinting and custom bioinks to create the final seafood products.

This collaboration aims to conserve the snow trout, a species facing extinction and listed on the IUCN red list. It also seeks to exploit the commercial potential of the rainbow trout, known for its taste and nutritional value.

The Food Safety and Standards Authority of India (FSSAI) is in the process of establishing a regulatory framework for cell-based foods, including cultivated meat and seafood.

Source: vegconomist

🥩 Planted launched a clean-label, whole-cut steak made using fermentation

The steak uses a patent-pending solid-state fermentation process. It contains 17g of protein, 182 calories, 0.9g saturated fat, and 5.8g dietary fibre. It also has 25% of the daily recommended value for iron and 72% for vitamin B12.

The Swiss startup's steak is being introduced in European foodservice, with plans for retail and D2C channels later this year. The R&D process included working with over 50 gastronomy professionals to perfect its taste, texture, and culinary application.

Planted plans to expand its whole-muscle platform technology to other product categories, producing 15 tons of steak per day and planning further scaling up.

Source: Green Queen

📰 More buzzes

🐙 Revo Foods launched the world’s first vegan octopus for retail using 3D-printing technology and fungi-based mycoprotein. Named ‘The Kraken’, the product offers a sustainable and ethical alternative to octopus, avoiding issues like cadmium poisoning. (Green Queen)

🇺🇸 Superbrewed Food received a no-questions letter from the FDA for its postbiotic cultured protein’s GRAS status. This postbiotic cultured protein is said to be the first FDA-notified, bacteria-derived biomass ingredient, similar to nutritional fungal proteins. (Cell Base)

🐮 Bored Cow has launched a "first of its kind" drinkable animal-free yoghurt range made with fermented proteins. The new yoghurt alternative is offered in three flavours: strawberry, vanilla, and passion fruit mango. (vegconomist)

MACRO STUFF

😋 Study shows that people who have tried cultivated meat will eat it again

Tasting is believing. A majority of consumers at Huber's Butchery and Bistro in Singapore who tasted Eat Just's Good Meat chicken indicated a willingness to consume it again.

The acceptance score for cultivated chicken was high (4.19/5), and the willingness to try it again and recommend it to others was even higher (4.41/5 and 4.45/5, respectively).

Despite the positive reception in terms of taste, cost remains a significant barrier to the widespread adoption of cultivated meat. 63.5% of diners cite high markups as the biggest turnoff.

Source: Green Queen

JOIN EUROPE’S LARGEST CLIMATETECH GATHERING

The HackSummit, Europe’s largest gathering of ClimateTech builders and investors returns to Lausanne Switzerland on June 13-14th for two days of networking and deal-making.

👀 See the full lineup of speakers here.

Use the code BetterBioeconomy20 to save 20% on your pass!

BIO BUCKS

🇸🇬 Umami Bioworks and Shiok Meats plans to merge

Umami Bioworks' CEO Mihir Pershad is set to lead the new entity, with Shiok Meats CEO Sandhya Sriram exiting the company. This merger positions the combined company as a global leader in cultivated seafood.

The combined efforts of the two Singaporean startups will continue Shiok Meats' focus on crustaceans, including lobster, shrimp, and crab. It aligns with Umami Bioworks' strategy on endangered, threatened, and protected species.

The merger has been in planning for about eight to nine months. It aims to expedite commercialization, enhance go-to-market efficiencies, and accelerate regulatory approvals and market entry.

Source: Green Queen

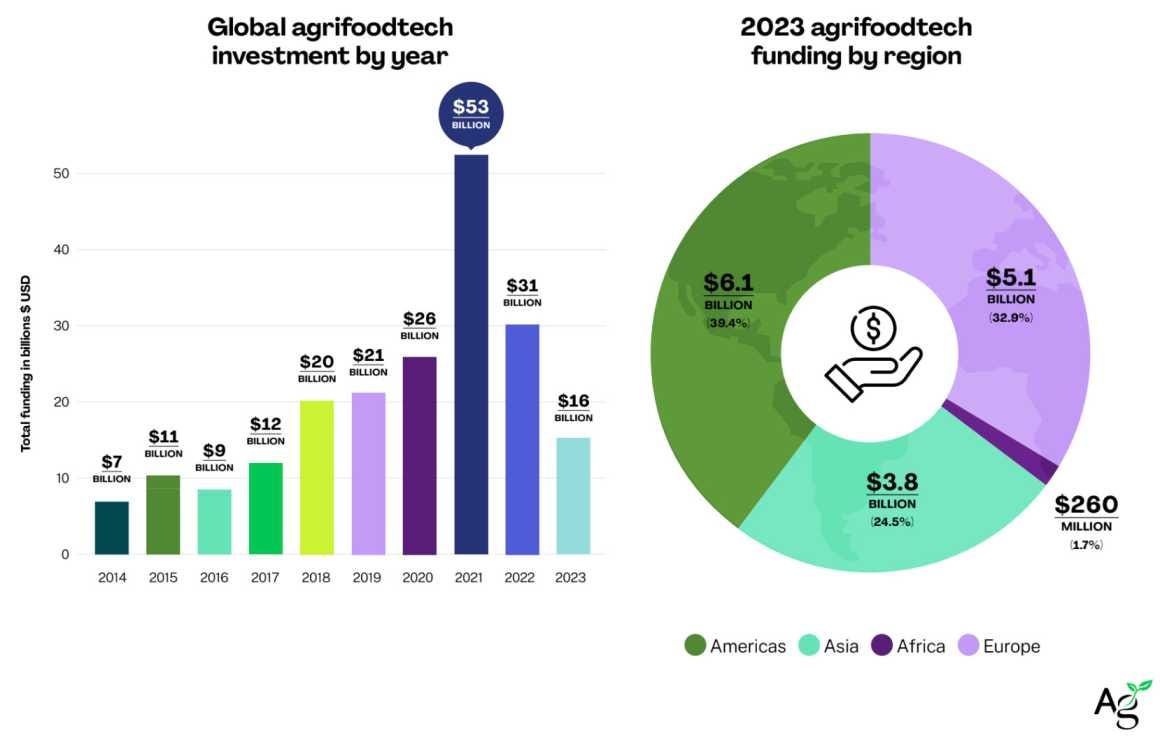

📉 Agrifood tech startup investment dropped nearly 50% from 2022-2023, marking the lowest point in six years

The share of agrifood tech in global VC funding decreased to 5.5% in 2023, down from 6.7% in 2022 and 7.6% in 2021. This indicates a retreat by generalist investors from previously hot areas like alt protein and vertical farming.

The decline in agrifood tech startup investment outpaces the overall 35% year-over-year drop seen in the broader VC market.

The decline has been particularly pronounced in Asia. The region has not returned to pre-Covid investment levels, raising only $3.8 billion. In the US, share of agrifood tech funding dropped to 30% of global funding, below its typical 40%

Source: AgFunder

💸 Bezos Earth Fund commits $60M to the Bezos Centers for Sustainable Protein as part of its $1B commitment to food transformation

The Centers aim to overcome technological barriers in alt protein development. They focus on reducing costs, improving quality, and enhancing nutritional benefits through advancements in science and technology, specifically in cell biology and engineering.

Lauren Sánchez, vice chair of the Bezos Earth Fund, highlighted the necessity of innovation in food production to feed 10 billion people sustainably while protecting the planet.

The fund addresses the challenges posed by food production and agriculture, which are major contributors to climate change, deforestation, and biodiversity loss.

Source: Food Bev

🥩 Orbillion Bio raised additional funding to scale up cultivated beef production and develop its biotech platform

This takes the Californian B2B cultivated meat producer’s total capital raised to $15M. In September, it successfully completed a 200 L production run, which enables over four million lbs of cultivated meat production annually.

Orbillion has developed an algorithm for bioprocessing that significantly reduces the cost and increases the speed of manufacturing cultivated meat. This focuses on scaling mammalian cell culture from 2D to 3D environments at "unmatched speed.”

Orbillion uses an asset-light strategy, avoiding expensive, custom equipment by using existing infrastructure, supported by a partnership with Solar Biotech. Additionally, a collaboration with Luiten Food in 2022 expanded Orbillion's distribution to 1,200 points across foodservice, specialty retailers and butchers.

Source: Green Queen

🧬 Tierra Biosciences raised $11.4M in Series A funding for AI-guided cell-free technology for high-throughput custom protein synthesis

This technology allows for the rapid production and scale-up of custom proteins, facilitating easier screening, discovery, and downstream development.

By using microbial cell bio-machinery, the California-based startup's platform can produce proteins without the need for traditional, inefficient cell-based methods. This enables the production of hundreds of proteins simultaneously and the generation of large amounts of data for AI models.

With the new funds, Tierra plans to expand its platform, team, and AI data generation efforts. The startup has already produced >5,000 proteins for industries like pharmaceuticals, biotech, agriculture, food, and others.

Source: AgFunder

SOCIAL FEAST

💡 A little cheat sheet for founders to improve pitch decks

Pay attention to small details like file names; a clear and professional file name like "AcmeCo Series A 20240413.pdf" is preferable. Make sure your pitch deck is visually appealing and free of formatting errors to avoid distractions and negative impressions.

When using DocSend, allow your deck to be downloaded so investors can review it offline and retain the version they based their investment decision on. Be respectful of investor privacy and do not add their email addresses to your mailing list without permission.

Support your statements with evidence, preferably customer testimonials. Claims about your product's benefits are more convincing when validated by actual users who are experiencing and paying for those benefits.

Source: Ryan Grant Little

🤔 Should you develop a product or build a platform?

Product development focuses on solving specific challenges with specialised solutions. They offer high market rewards but also come with higher risk because it might be easier for customers to switch to a competitor.

Platforms create foundational technologies that enable multiple products or applications. It provides long-term sustainability and scalability, but the initial ROI is slow, and it’s more capital-intensive.

Entrepreneurs should decide based on their vision, resources, and the impact they want to make. Product development suits those with a clear, innovative solution. Platform development is for those looking to establish a broader ecosystem of solutions.

Source: Erum Azeez Khan

😂 For the lolz

That’s a wrap. Thank you for taking the time to read this issue!

Are you new here?

Know anyone else who would dig this newsletter?