Major Cultivated Seafood Milestone, Australasia's Food Biotech Advances, and Chinese Alt Protein's Pivotal Year

Also: Biomanufacturing capacity has to 20x to reach industry growth of $200B by 2040

Hi, thanks for being here!

Here’s my favourite quote that I came across this week:

“Understand what people want.

Ask Grace the economist how precision fermentation could put near-shoring on steroids. Show Sam the farmer GMOs that help keep production going amidst increasing droughts. Bring Toby the musician into a creative experience using electrical signals from living things. Share ideas with Anna the urban planner about biophilic design that makes people’s lives better. Don’t expect Larry the congressman to care about your new bio shiny thingy that will save the world in 20 years if you succeed. […] It’s not about making it sexy. It’s about making it relevant. We all care too much about ourselves already so why don’t you grow something people want?”

That was Sofia Sanchez on how to make synbio more mainstream. Love it!

Alright, let’s dig into the latest developments in biotech-enabled food innovation! 🍽

BIO BUZZ

🐟 BlueNalu is the first cultivated seafood company to join the National Fisheries Institute (NFI)

The NFI is the leading trade association in the US, representing the nation’s seafood industry. This is a significant milestone in cultivated seafood's acceptance within the traditional industry.

Beyond membership, BlueNalu will serve as a founding member of the NFI’s inaugural Sushi Council. "We believe that collaboration across the seafood industry is crucial to meeting the growing demand for high-quality, sustainable seafood," said Lou Cooperhouse, founder and CEO of BlueNalu

As BlueNalu progresses with its development of cultivated seafood tech, it anticipates actively working alongside the NFI and its members. The company aims to promote collaboration, share knowledge, and drive positive change within the seafood industry.

🇩🇪🇰🇷 Infinite Roots partners with Pulmuone to develop innovative protein products catered to the South Korean market

Infinite Roots has developed a patented tech for using mycelium in food production. The German startup recently secured $58 million in a Series B round, marking Europe's largest-ever investment in mycelium.

Pulmuone is known for its tofu products and owns the Nasoya brand, which includes the popular plant-based steak line Plantspired. The company is well-positioned to cater to the growing interest in plant-based products in South Korea and the US.

To maximise market potential and customer adoption, the partnership plans to conduct consumer research and retail testing in select distribution channels in South Korea. They aim to develop, produce, and sell a wide range of meat substitute products.

🇳🇿 New Zealand's ‘first’ company to develop non-GM cell lines for the cultivated meat industry has launched a range of porcine cells

Opo Bio has launched Opo-Oink, a range of porcine cells for cultivated pork production, including primary cells like satellite cells, pre-adipocytes, and fibroblasts from pigs with “high-health” status.

The startup identified a gap in the market due to the short supply of commercially available cell lines for cultivated meat production. Opo Bio aims to fill this gap with their cell line products, starting with bovine and porcine cells.

Besides offering a range of cell lines for purchase and licencing, Opo Bio provides services to support research and production. This includes protocols, access to experts, and resources for cell culture to support companies in scaling and developing efficiently.

💬 Cargill’s CTO on the alt protein “trifecta” and how the global food giant is helping overcome them

According to Florian Schattenmann, alt protein companies need to solve what he refers to as the "trifecta.” Successful alt protein products must have a superior taste, cost-effective pricing compared to animal protein, and a positive nutritional profile.

Cargill capitalises on its supply chain advantage to develop plant protein products, focusing on ingredient innovation. It’s also engaging in strategic collaborations, like with Cubiq for its oil portfolio to improve mouthfeel with fewer calories.

For cultivated meat, Cargill is engaging through strategic investments in companies. It sees a potential role as a growth media supplier, which accounts for some of the most expensive parts of cultivated meat production.

🇬🇧 Zya developed an enzyme that can convert sugar into fibre inside the digestive system

American adults consume an average of 17 teaspoons of added sugar daily. This contributes to high rates of obesity, type 2 diabetes, and other health issues. Only 5% of Americans meet the recommended fibre intake, which is important for reducing health risks.

The UK-based startup’s enzyme, an enhanced version of inulosucrase, rearranges sugar molecules into inulin fibre, promoting healthy gut bacteria. This process can convert up to 30% of sugar into dietary fibre without altering the food's taste profile.

With £4.1M in funding, Zya plans to launch its product, Convero, in the US by 2026. The tech has shown promising results in animal tests and will soon undergo human trials.

MACRO STUFF

🇨🇳 Chinese alt protein sector could see a “pivotal chapter” in 2024

China's National Health Commission is potentially speeding up its regulatory approval process, as evidenced by the acceptance of 22 novel food ingredient applications and drafts for 17 new ingredients last year. The commission has reportedly also started research into cultivated meat safety, indicating a potential readiness for approval.

Sales of functional foods are on the rise in China, with the nutritional and health food industry reaching 588.5 billion yuan ($82.63 billion) in 2022 and expected to exceed 800 billion yuan by 2027. Alternative proteins and plant-based ingredients are gaining popularity for their health benefits.

Meanwhile, economic challenges have led to industry consolidation, with expectations for further consolidation among Chinese alt protein companies. A number of established brands have temporarily backed out of China or delayed plans for expansion into the country.

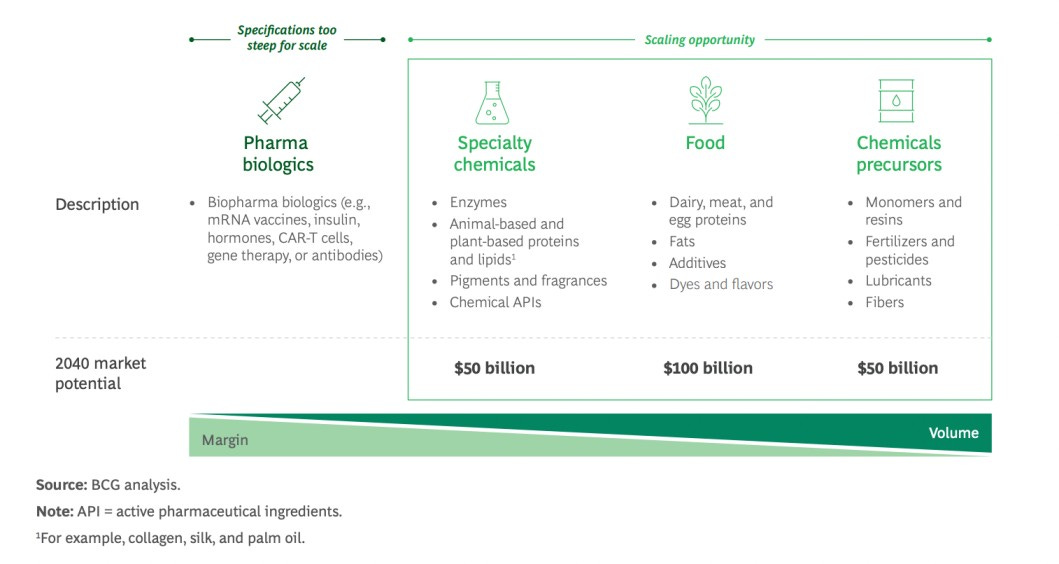

💡 New report by Synonym and BCG shows that biomanufacturing capacity has to 20x to reach industry growth of $200B by 2040

The report highlights the necessity of transitioning to biomanufacturing for sustainability and cost-efficiency. It also notes the current high production costs due to rigorous quality standards as a significant barrier to the broader adoption of precision fermentation tech.

There is a need for a 20x increase in biomanufacturing capacity, from the current 50 million liters to 2.4 billion liters. This increase would be achieved through the creation of 1,000 biofoundries worldwide, aiming to achieve economies of scale and meet future market demands.

The importance of immediate investment in biomanufacturing infrastructure to seize growth opportunities and benefits for the planet and human health.

BIO BUCKS

🇦🇺 $3.9M project to upgrade QUT Pilot Plant to boost Australia's novel food ingredient production through precision fermentation

The upgrade, co-invested by QUT and Australia’s Food and Beverage Accelerator (FaBA), will transform the facility into a leading large-scale food-grade research translation facility. This project is part of an overall $16 million upgrade.

This development will allow for faster and more cost-effective product development in the F&B sector by providing early-stage scale-up capabilities. It addresses the global lack of scale-up infrastructure for precision fermentation, particularly in the APAC region.

The project supports the goal of doubling the value of Australia’s F&B manufacturing sector by 2030. It receives significant contributions from QUT and partners under the FaBA program, with support from the Australian Government’s Department of Education through the Trailblazer Universities Program.

“Precision fermentation allows us to manufacture new high-value food ingredients like proteins that can boost our bioeconomy in Australia and provide new domestic and export opportunities for our agricultural and food and beverage industries,” said QUT’s Professor Ian O'Hara

🇪🇸 Government of Catalonia invests €12M in open-access, pre-industrial facility for alternative protein ingredients and food development

The goal is to support R&D and pre-industrial manufacturing for companies. The facility will include production lines for plant protein extraction, wet extrusion, and final product processing. It also offers a precision fermentation facility and an analysis laboratory to help companies bring their innovations to market.

The initiative is part of the Biohub Cat, supported by the EU, and includes launching the first industrial biopark in the region to promote a sustainable industrial model. The facility is expected to be operational by the end of 2025 and create 10-15 new jobs.

The Good Food Institute has praised the investment as indicative of Catalonia's emerging role in fostering innovation for sustainable food systems and enhancing food security in Europe.

🇨🇭 Food Brewer raised over CHF 5M in seed funding for cell-cultured cacao and coffee

The Zurich-based biotech startup is developing a platform for large-scale production of commodities through plant cell culture. It’s addressing traditional agricultural challenges such as land scarcity, climate change, and ethical issues.

The startup has developed cell cultures for cultivating coffee and cocoa in bioreactors under controlled conditions. When these cells achieve the target biomass, they are collected, dried, and roasted.

To achieve cost efficiency and price competitiveness with traditional commodities, Food Brewer has partnered with Fruitful AI for advanced growth tracking and German machine builder Steinecker for bioreactor tech.

🇬🇧 Innovate UK awarded £500k in grant funding to support cultivated meat project in the North East

The companies involved are the Centre for Process Innovation (CPI), MarraBio, and Aelius Biotech. They will work together to develop low-emission food production systems at a lower cost than is currently possible.

The project, using MarraBio's tech, aims to use engineered protein materials as a cost-effective alternative to current expensive inputs for large-scale cell-based meat production. It focuses on creating protein-building blocks that promote cell growth and can be scaled up for industrial food production.

The initiative supports the North East's ambition to become the UK hub for sustainable food production. It highlights the project's significance in reducing carbon emissions and advancing the development of cultivated meat.

💰 Better Bite Ventures opened applications for the latest funding round, offering early-stage investments to food tech startups in APAC

This edition of the First Bite scheme will focus on startups in 5 categories: rice production, palm oil, cocoa and coffee, fertilisers, and food waste. Funding per startup ranges between $50,000-$150,000.

Better Bite Ventures has previously invested in about 25 startups, including notable names like Change Foods, Miruku, Greenest, Green Rebel, Fable Food, CellX, TiNDLE, Prefer, and 70/30 Food Tech.

The funding gap in the APAC region is significant. Agrifood tech startups in the region received $6.5B in 2022, accounting for only 21% of global agrifood investments despite being “responsible for 42% of all global food-agri climate emissions.”

Read full article or Apply now! (Deadline: March 20th)

BIO TALKS

♻️ My conversation with Terra Bioindustries’ CMO, Rebecca Palmer

I had the privilege of interviewing Rebecca Palmer, the Chief Marketing Officer of Terra Bioindustries, a Toronto-based startup that is decarbonising supply chains with upcycled ingredients.

Rebecca took a unique journey from plant biotech to marketing. She shared insights into Terra Bioindustries’ approach to transforming agrifood byproducts into sustainable B2B inputs.

What you can learn from this article

Overview of Terra Bioindustries

Terra’s 100% upcycled ingredients that are loved by businesses

How to tell stories that resonate with your audience

Food industry trends from a B2B perspective

Biggest lesson learned from building a brand in the food industry

Terra Bioindustries’ next steps

SOCIAL FEAST

💸 Exhaust all alternatives like grants, loans, and network support before diluting your equity for VC funding

Early-stage capital for startups is often the most expensive. It requires significant equity for modest funding due to high risks and challenges like immature tech and small IP portfolios.

Reflecting on his time as the CSO of Vow, James praises the founders, Tim Noakesmith and George Peppou. He admires their entrepreneurial resourcefulness in bootstrapping their MVP through government grants and innovative resource use before seeking VC funding.

James’ advice: “Early capital comes at a high cost. Exhaust all alternatives—grants, loans, network support—before diluting your equity. When you do raise, maximize every dollar. Explore government and institutional support, to stretch your money further.”

Read full post on LinkedIn - James Ryall

🤔 Want to make synbio mainstream? Make something people want, not just "sexy"

The focus should be on making synthetic biology (synbio) relevant to everyday people's interests and needs. Rather than trying to make it universally captivating, it should be tailored to specific audiences.

By understanding what different groups want, such as precision fermentation for economists, GMOs for farmers, creative uses of biological signals for musicians, and biophilic design for urban planners, synbio can become more integrated into various aspects of society.

The focus should be on practical applications that impact people's lives directly, making synbio important for its utility rather than its novelty or technological fascination.

Read full post on Substack - Sofia Sanchez

🤣 For the lolz

FUTURE FOOD FERMENTAT10N: FEBRUARY

🤩 10 notable developments in fermentation-based food innovation

3 positive observations from February’s roundup:

✅ Big CPGs embrace animal-free whey

✅ Big commercial partnerships

✅ Going beyond alt ‘proteins’

Check out the February roundup

That’s a wrap. Thank you for taking the time to read this issue!

Are you new here?

Know anyone else who would dig this newsletter?

Terrific edition! Thank you so much 👏👏👏👏👏👏👏