Mars Taps CRISPR for Climate-Resilient Cocoa, World’s First Cell-Based Dairy Supply Deal, and Ag Biotech Valuations Surge

Also: How the world's leading pure-play seed and crop protection company uses AI to build a faster, smarter discovery engine

Hey, welcome to issue #112 of the Better Bioeconomy newsletter, a curated look at the latest in biotech for food and agriculture, covering commercial developments, funding rounds, scientific breakthroughs, and commentary. Thanks for being here! 👋🏾

Quick note: If you're an investor active in agrifood tech, I’d love to connect and exchange notes on what you’re seeing, what I’m picking up, and where things might be heading. If you’re up for a quick chat, grab a time here, or feel free to reach out at eshan@betterbite.vc if none of the times work.

Let’s get into it!

BIO BUZZ

Products, partnerships, and regulations

🇺🇸 Mars partnered with Pairwise to develop climate-resilient cocoa using CRISPR-based gene editing technology

Mars signed a licensing agreement with gene editing firm Pairwise to use its Fulcrum® CRISPR platform, including the SHARC™ enzyme, for cocoa-focused research and development.

Pairwise’s Fulcrum® platform enables precise, targeted genetic changes. It allows specific traits to be dialled up or down, like a dimmer switch. This makes crop improvements faster and more accurate than with traditional breeding.

Mars plans to use this technology to future-proof cocoa crops, helping them withstand global threats like climate change, plant diseases, and other environmental pressures that currently endanger cocoa supply chains.

Source: Pairwise

🤔 Thoughts:

By licensing Pairwise’s CRISPR platform, Mars is taking a more hands-on role in trait development for supply-critical crops, rather than relying solely on external breeders. It also continues a long run of cocoa genomics work by Mars with public and private partners.

The collaboration’s focus on disease- and heat-tolerant cocoa shows how climate change encourages commodity buyers to invest in biotech. Cocoa, a crop concentrated in a few equatorial regions, is highly vulnerable to shifting weather patterns and emerging plant diseases.

In the 2023-24 growing season, world cocoa production dropped by ~14 % largely due to poor weather. Strengthening the crop’s yield and resilience via gene editing is a form of long-term insurance on future supply and cost.

🇨🇦 Opalia signed the ‘world’s first’ commercial supply agreement for cell-based dairy with Dutch dairy giant Hoogwegt

The Canadian startup secured the two-year deal, set to begin in 2026, following an earlier investment from Hoogwegt. It marks a significant milestone for the emerging cell-based milk sector.

Opalia uses a proprietary method involving immortal bovine mammary cells to produce milk without repeated tissue harvesting. The milk, free of bacteria, doesn’t require pasteurisation and can be processed into familiar dairy products like cheese and butter.

The company has also removed fetal bovine serum from its process, which is a major cost and ethical hurdle. It is now working with the FDA and USDA to gain regulatory approval in North America.

Source: Green Queen

🤔 Thoughts:

When one of the world’s largest dairy ingredient suppliers (operating in 130 countries) signs a deal for cell-based milk, it is an early signal that major dairy channels are willing to pilot cultivated ingredients. However, broader industry adoption will depend on cost and regulatory progress.

One of the biggest opportunities is that Opalia is working toward true whole-milk composition (includes caseins, whey, fats, and lactose), not just individual proteins. This removes the need to piece together dairy analogs from precision-fermentation proteins, plant oils, and starches. Though I’d imagine key components like lactose content and fat profile will still need to be fine-tuned at scale.

If companies can scale this approach cost-effectively (getting rid of FBS is a good start), it could streamline formulation, simplify supply chains, and reduce product complexity. Some post-processing and standardisation will still be needed, but the building blocks are all there.

🇺🇸 Wildtype’s cultivated coho salmon is now served at four US restaurants, with a fifth coming soon

The Californian startup’s offerings are currently available in Oregon, California, Washington, and Texas. However, in Texas, they’ll only be served for a short time due to an upcoming ban on cultivated proteins next month.

Dishes range from a bright, summery pairing with pickled strawberry in Portland to Austin’s multi-course omakase priced at $150-$250, and San Francisco’s sushi menus priced between $119 and $219, placing the salmon in high-end and sustainability-focused dining.

Chefs praised the salmon’s true-to-form flavour, rich texture, and environmental benefits, seeing it as a viable alternative to traditional farmed or wild-caught salmon.

Source: Green Queen

🤔 Thoughts:

Partnering with acclaimed chefs and fine-dining venues is a smart way to help normalise cultivated meat. It builds consumer trust with chefs acting as trusted tastemakers, and creates a sense of exclusivity that can sustain premium pricing.

In this context, chef endorsements function as a consumer adoption de-risking mechanism. They validate the product’s quality and sustainability to diners who might be sceptical, and the high-end setting reframes the novelty as a desirable culinary experience.

This is part of a broader industry pattern where culinary influencers help bring food tech innovations to the mainstream, much as David Chang did for the Impossible Burger. However, cultivated meat faces a steeper novelty barrier than plant-based analogues.

Wildtype’s “restaurant-first, retail-later” approach allows them to refine the product, messaging, and consumer perception while production volumes remain limited, before scaling into retail channels.

🇦🇺🇺🇸 Magic Valley teams up with Pythag Tech to speed up cultivated meat production with AI

Australia’s Magic Valley, the first to produce cultivated lamb using induced pluripotent stem cell (iPSC) technology, is partnering with US-based Pythag Tech to integrate its AI platform and advance scale-up and commercialisation.

The AI will help monitor real-time processes, cut production costs, and bring products to market faster. Pythag Tech’s system works by analysing live bioprocess data, fine-tuning media formulations, reducing cost/kg, adapting to different reactor sizes, and improving performance with every production run.

The collaboration is expected to improve scalability, sustainability, and data infrastructure for regulatory and quality assurance, supporting a more capital-efficient business model.

Source: Protein Production Technology

🇺🇸 Clever Carnivore hosted its first West Coast cultivated pork tastings, ahead of a 2026 launch

The Chicago-based cultivated pork startup held tasting events in Palo Alto and San Francisco on July 29, inviting investors, chefs, and food industry operators as it gears up for a 2026 commercial launch.

The featured product was a hybrid bratwurst made from 10% cultivated pork cells blended with plant-based fat. Attendees, including industry professionals, praised the taste, with some calling it among the best bratwursts they’d had in years.

Beyond flavour, cultivated pork was appreciated for being free of steroids, antibiotics, and GMOs, produced domestically for supply chain security, and provides a hedge against shortages and price spikes in conventional meat.

Source: Green Queen

🤔 Thoughts:

It’s encouraging to see that tasting events suggest hybrid cultivated meat products (even with relatively low cell inclusion) can deliver a satisfying experience in certain formats.

This supports a pragmatic model where blending a small percentage of cultivated animal cells with plant-based ingredients achieves authentic flavour and texture while keeping costs and scale manageable. If ~10% cultivated meat can help bridge the sensory gap, it could offer a near-term path to win over meat-eaters before full-scale cell-based meats are viable.

BIO BUCKS

Funding, M&As, and grants

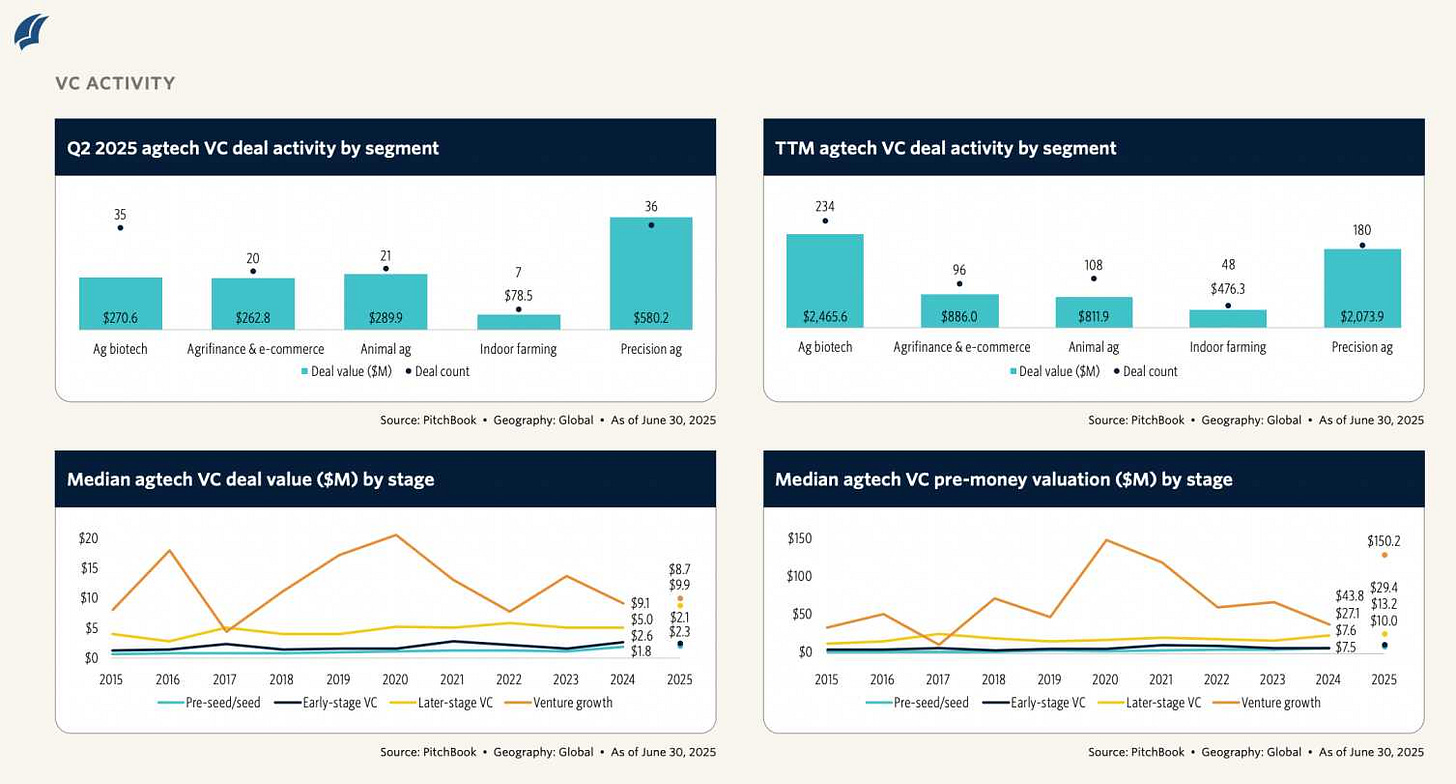

🌏 Q2 agtech VC deals show that ag biotech and precision ag command premium valuations, while animal ag and indoor farming lag

Ag biotech retains high valuations for its IP and food security relevance, while precision ag benefits from AI and automation demand. Median pre-money valuations jumped ~59% YoY to $24M, and deal sizes rose ~61% to $5M, showing capital is favouring strong, scalable models.

The share of late-stage deals has grown to 54% in early 2025 (vs ~33% in 2020), with early-stage deals now under 15% each. Fewer startups are being funded, but those with proven traction are drawing larger checks.

Q2 saw 12 exits, above pre-2021 norms. Corporates are acquiring plant biotech, marketplaces, drone/imagery analytics, and livestock tech to boost efficiency, sustainability, and digital capabilities.

Source: PitchBook

🤔 Thoughts:

Exits are dominated by strategic acquisitions. The agtech liquidity engine runs through incumbents buying startups, which pulls the market away from 2021-style public listings toward steadier trade sales. Investors seem to have internalised the SPAC-era lessons, especially after several high-profile flameouts in capital-intensive models like indoor farming.

This shift has brought more moderate, predictable liquidity. Acquisition prices tend to be lower and grounded in fundamentals, but they also carry less integration risk than relying on public-market enthusiasm, which can fade quickly.

For VCs, the expected outcome is M&A with midrange returns rather than 10-100x IPOs. That tends to make investors more selective and valuation-conscious on entry. On the plus side, a consistent cadence of strategic buyers can also attract capital by providing a clearer path to exit. But, segments without active acquirers may find capital harder to secure funding without the pull of public-market exits.

🇺🇸 BioConsortia raised $15M to accelerate global launch of nitrogen-fixing biofertilizer for industrial corn

Always-N™, BioConsortia’s nitrogen-fixing seed treatment, is a biofertilizer seed treatment that reduces the need for synthetic nitrogen in corn farming, resulting in lower greenhouse gas emissions and better soil health.

Following a successful 2024 debut in New Zealand, Always-N™ is now entering broader markets in the Americas, supported by a key partnership with The Mosaic Company.

Always-N is built on BioConsortia’s proprietary discovery platform. This platform includes tools like Advanced Microbial Selection™ (AMS), GenExpress™, and GenePro™ to identify and enhance beneficial microbes for traits like nitrogen fixation, disease resistance, and longer shelf life.

💰 Lead investor: Otter Capital

Source: Business Wire

🇺🇸 TerraBlaster closed an oversubscribed $4M pre-seed round to develop laser-based soil health analysis technology

The startup’s laser-induced breakdown spectroscopy (LIBS) method uses a pulse laser to break down soil ions in under a millisecond. This allows farmers to quickly measure a broad spectrum of macro- and micronutrients while moving at farm operation speeds of up to 20 mph.

Prototype trials are set to kick off in Iowa this fall. Five different prototypes are planned for use in varied locations and testing approaches. Broader trials are scheduled for the following year.

To prepare for growth, TerraBlaster plans to expand its team from three to six or seven members, ahead of a seed funding round targeted for next year to move toward commercial deployment.

💰 Lead investor: Khosla Ventures

Source: AgTechNavigator

🤔 Thoughts:

Traditional nutrient sensing has been slow and low-resolution. Farmers often send soil samples to labs and wait days or weeks for results, meaning fertiliser plans are based on outdated information. That lag contributes to inefficiency and over-application. Earlier on-the-go tools, like optical sensors or ion-selective probes, ran into issues such as calibration drift and moisture sensitivity, which limited their real-time usefulness.

TerraBlaster’s LIBS system takes a different approach, measuring a broad set of soil elements in milliseconds through a self-contained spectrometer. This allows farm equipment to detect nutrient variability while in motion and adjust immediately, much like how machine vision enabled real-time weed targeting.

In practice, a planter or applicator could apply inputs exactly where needed, in the same pass as planting or tillage. If validated across different soils and paired seamlessly with rate controllers, this kind of measure-and-act loop at field speed could help autonomous machinery optimise inputs more consistently and reduce waste.

💸 More bucks

🇬🇧 Azotic Technologies secured £500,000 in ARIA funding under the “Programmable Plants” initiative to develop a low-cost plant reprogramming method using Gluconacetobacter diazotrophicus. Applied to seeds or crops, this bacterium can deliver bioactive molecules like dsRNA from inside plants, boosting pest, disease, and climate resilience without permanent genetic modification. (Fresh Produce Journal)

🇺🇸 Atlantic Fish Co. received a $305,000 NSF SBIR award to scale cultivated black sea bass production, bringing total non-dilutive funding to over $700K. The startup aims to replicate the taste, texture, and nutrition of wild fish, building on earlier milestones like halibut cell lines and a black sea bass prototype. (vegconomist)

GEEK ZONE

Latest scientific research papers

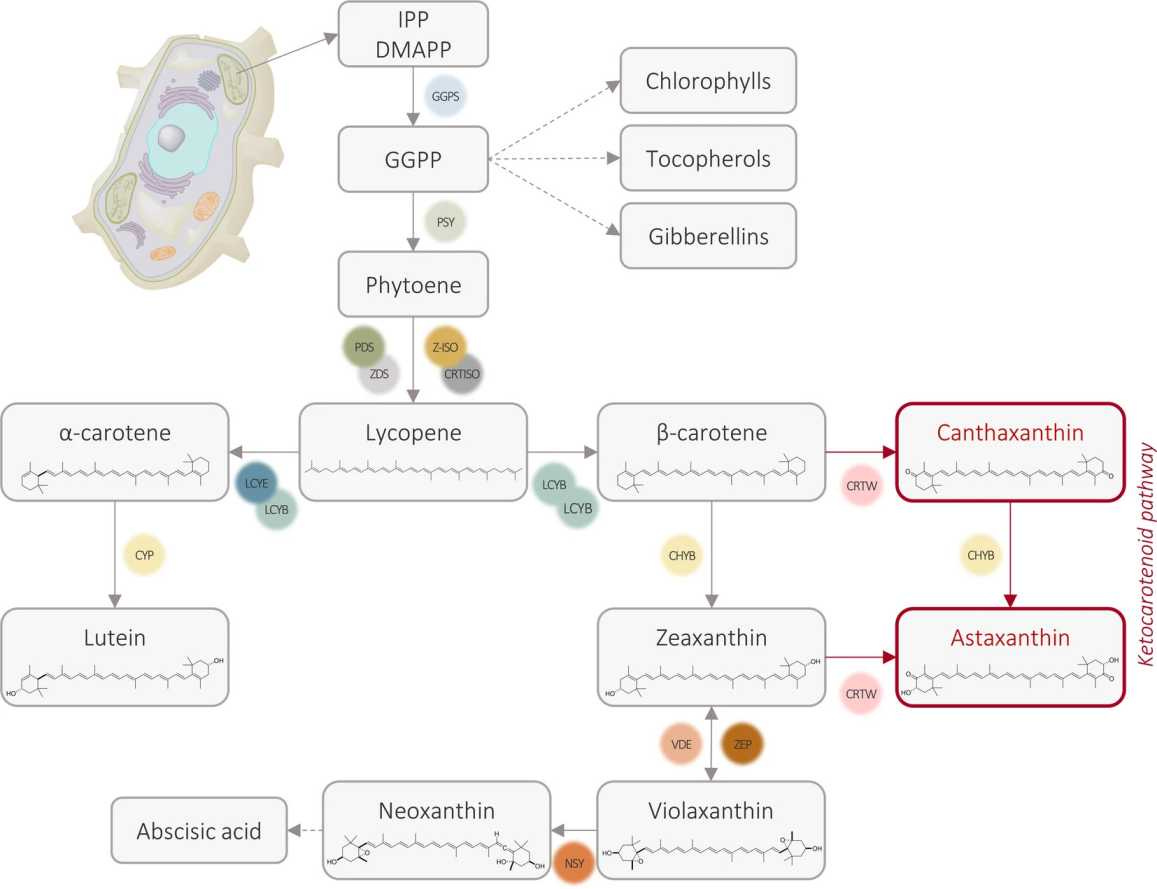

🌱 Reprogrammed tobacco plant cells produced up to 39× more high-value carotenoids

Researchers worked with Nicotiana tabacum BY-2 cell cultures, adding three genes: one from marine bacteria (crtW), one from maize (psy), and one from bacteria (crtI). This filled in the missing steps of the pigment-making pathway in non-photosynthetic cells, increasing the supply of ingredients for astaxanthin and canthaxanthin.

Cells with crtW alone made 20-55 micrograms per gram (µg/g) of canthaxanthin and 90-127 µg/g of astaxanthin. With all three genes, production increased to 788 µg/g canthaxanthin and 139 µg/g astaxanthin, with no effect on growth rate or biomass production.

These modified cells function as compact, scalable ‘plant biofactories’ for valuable pigments. They offer a cleaner and potentially lower-cost alternative to making them from petroleum, with uses in health supplements, beauty products, and animal feed.

Source: Scientific Reports

🥬 Mudflat bacteria cut lettuce rot by 86% and increase plant growth by 37%

Researchers isolated plant growth-promoting rhizobacteria (PGPR) from South Korea’s coastal mudflats. They screened 12 bacterial strains for antifungal activity against lettuce rot and traits like nitrogen fixation, phosphate breakdown, siderophore production for iron absorption, and growth hormone production. The top strains were compared to a fungicide (tebuconazole) in greenhouse trials.

Two top strains, Bacillus subtilis GCM190 and GCM082, controlled lettuce rot like the fungicide (63.6-86.4% disease reduction). They increased the dry weight of leaves, stems, and roots by 31%, 37%, and 7%, respectively. The strains raised chlorophyll levels by up to 13%, formed strong colonies on lettuce roots, and fought several other crop diseases in lab tests.

These mudflat-derived PGPR offer a non-chemical alternative that may reduce reliance on fungicides while improving crop vigour. They have the potential to develop as dual biofertilizer–biocontrol products for lettuce.

Source: Plant Pathology Journal

🥛 Daily fumarate reduced goat methane by up to 22% without reducing milk yield

Scientists ran a 38-day study with 28 dairy goats in early lactation. The goats were split into four groups: no additive (control), fumarate (34 g/day), active dry yeast (ADY, 1.5 g/day), or both. They tracked methane emissions, rumen fermentation, gut microbes, nutrient use, milk output, and blood chemistry.

Fumarate reduced methane production by 11.3% (liters/day), methane per kilogram of feed by 15.5%, and methane per kilogram of milk by 21.9%, all without changing feed intake or milk yield. The methane-cutting effect lasted about 3 hours after feeding. It raised rumen pH, reduced total volatile fatty acids (VFA), and increased bacteria that use fumarate and lactate.

Fumarate shows promise as a feed additive to lower methane while keeping milk output steady and supporting rumen stability. But its delivery method may need adjustment to keep the effect going beyond a few hours, and ADY’s real-world methane-cutting potential is still unclear.

Source: Journal of Dairy Science

EAR FOOD

Podcast episode of the week

🎙 How the world's leading pure-play seed and crop protection company uses AI to build a faster, smarter discovery engine

Corteva Agriscience is using AI to explore an estimated 10⁶⁰ biologically relevant molecules, tens of orders of magnitude more than the grains of sand on Earth! This enormous search space helps uncover novel crop protection compounds that traditional methods would likely miss.

AI is speeding up R&D and enabling the discovery of entirely new molecules and protein targets. Tasks that once took months and significant lab budgets to determine a single protein structure can now be done in hours for just pennies, sharply shortening the path from concept to lab validation.

Tools like Atlas, initially built for pharmaceutical research, are now being adapted to agriculture. By combining chemical, genomic, patent, and academic data, Corteva is breaking down silos and bringing proven AI-driven discovery techniques from other life sciences into farming.

Transformer-based models, similar to those used in natural language processing, are applied to genetic sequences. They translate DNA into protein structures and pinpoint molecules that interact with them. This is key for optimising seed traits and developing targeted crop protection solutions.

While AI spots patterns and suggests candidates, it’s human scientists who interpret, test, and apply these findings. The technology supports expert judgment rather than replacing it, helping ensure new agricultural innovations are safe, sustainable, and commercially viable.

Guest: Brian Lutz, the Vice President of Agricultural Solutions at Corteva Agriscience

Podcast: The AI in Business Podcast

APAC AGRI-FOOD INNOVATION SUMMIT

Super Early Bird rates end August 14! 🇸🇬

Don’t miss your chance to attend the Asia-Pacific Agri-Food Innovation Summit and save $500 SGD, plus an additional 10% OFF with my network code!

From breakthrough food systems to next-gen agri-tech, this is where Asia’s innovation leaders connect, collaborate, and create impact.

👀 Use my exclusive partner code for 10% OFF your pass: BIO10

💰 Save $500 SGD with the Super Early Bird offer before August 14

Learn more: https://tinyurl.com/s9k5x3d7

See you in Nov!

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Hi Eshan, how are you doing on this very nice day? Thank you very much for excellent issue #112! I always learn something valuable from your outstanding newsletters. The community appreciates all your hard work and efforts to help make our world a better place. Have a very nice and peaceful week 👍❤️