Nestlé Goes Deep on Biotech, India's Push for AgriBiotech Investment, and Spearhead Bio's Crop Gene Editing Breakthrough

Also: Thailand’s first precision fermentation dairy startup lands strategic funding from VCs and a Japanese food giant

Hey, welcome to issue #103 of the Better Bioeconomy newsletter. Thanks for being here! 👋🏾

This week, Nestlé announced a cutting-edge deep tech hub focused on AI-driven precision nutrition and advanced biotech ingredients. In New Zealand, Daisy Lab developed a high-yield recombinant bovine lactoferrin that surpasses the concentration of that in cow’s milk. Spearhead Bio unveiled TAHITI, a gene-editing companion tool enhancing CRISPR’s precision for crop improvement. In Thailand, Muu attracted strategic funding to advance animal-free dairy proteins, while Indian initiative Biowave seeks to amplify VC funding into agrifood life sciences.

Let’s dig into the latest updates on how biotech is transforming food and agriculture for a climate-friendly food system.

BIO BUZZ

Products, partnerships, and regulations

🇨🇭Nestlé set to open new deep tech centre to drive AI- and biotech-led food innovation

Set to launch in the first half of 2026 at the System Technology Center, the new hub will support Nestlé’s move toward a more digitally connected, AI-driven operation.

It’ll work on technologies like smart coffee machines, self-adjusting equipment, and tools using AI, robotics, and mixed reality to improve efficiency and support precision nutrition.

The centre will also focus on developing next-gen screening tools and precision fermentation processes to create advanced bioactives and biotics (post- and synbiotics) for tailored nutrition solutions for people and pets.

Source: AgFunder

🤔 Thoughts:

A food giant leaning into biotech R&D suggests that the future of food could be as much about health impact as taste (“food as medicine”). Large food companies might increasingly operate like nutrition-tech platforms, using genomics, microbiome science, and fermentation to develop clinically validated bioactives.

The long-term opportunity may lie in building portfolios around proprietary ingredients tailored to specific life stages, such as maternal health or ageing, or outcomes like gut health or cognition.

🇳🇿 Daisy Lab has developed a high-yield recombinant bovine lactoferrin that surpasses the concentration of that in cow’s milk

The New Zealand-based startup has created recombinant bovine lactoferrin via yeast precision fermentation at yields “more than an order of magnitude” higher than what's found in cow’s milk (0.02g–0.2g/L).

Once scaled, Daisy Lab expects to produce lactoferrin at up to 10x lower cost than the current market price of $750–$1,500/kg. Since it usually takes 10,000 L of milk to extract just 1kg of lactoferrin, this breakthrough is a potential game-changer for supply and affordability.

Instead of competing with traditional dairy producers, Daisy Lab is looking to team up with them, using existing infrastructure to help scale its technology in a mutually beneficial way.

Source: Green Queen

🤔 Thoughts:

Daisy Lab's cooperative approach of offering its high-yield lactoferrin as a tool for the dairy industry rather than against it solves several strategic challenges. For one, it eases the route to market since dairy companies already have the infrastructure to purify proteins and formulate them into products. By enabling existing dairy processors to make animal-free lactoferrin, Daisy Lab avoids the need to build that entire supply chain itself.

It also addresses trust and adoption: major food companies and consumers may be more comfortable if the new ingredient comes through known dairy brands or facilities, rather than a standalone “disruptor” startup.

For incumbents, plugging Daisy Lab’s strain into under-used whey or lactose streams could, in principle, turn a conventional plant into a fermentation hub, buffering earnings against volatile milk-solids prices.

🇺🇸 Spearhead Bio, a new startup from Danforth Technology Company, introduced crop gene editing tool to address CRISPR’s major limitations

Their technology, called Transposase Assisted Homology Independent Targeted Insertion (TAHITI), works alongside CRISPR by making it easier to insert genes precisely, something CRISPR doesn’t do as well on its own.

Unlike random gene insertion, which can disrupt essential gene functions, TAHITI allows for highly specific insertion locations, which is important for crop traits like pest resistance, disease tolerance, and higher yields.

TAHITI takes advantage of the plant's natural genome rearrangement systems, offering a way to perform evolutionary changes, but it does so in a faster, more controlled way. It's already shown promise in soybeans and could be applied to other crops like cassava, cowpeas, and some vegetables.

Source: AgFunder

🤔 Thoughts:

If CRISPR is the genetic equivalent of a pair of scissors (snipping DNA at a target spot), TAHITI acts like a molecular glue gun that can take a new DNA “patch” and affix it exactly where you want in the genome.

With a reliable insertion method, scientists can think beyond deletions. Scientists can now add entire biosynthetic pathways for nutrient fortification, natural pest resistance, or climate resilience, all in a single step. That kind of precision could shrink breeding and trait-development timelines from years to months.

When paired, CRISPR + TAHITI form a true “cut-and-paste” genome-engineering toolkit, though teams will still need to optimise cassette size limits, transformation protocols and screening pipelines to realise its full potential.

🇩🇰 Enduro Genetics plans to deliver its first two commercial projects this year, aiming to help companies boost bioproduction by ‘tricking’ cells

The Danish startup’s platform uses genetic circuits that make sure only high-producing cells keep growing. This leads to more efficient bioreactors, with improvements of ~30% in product titers for optimised strains.

By linking cell survival to product output through essential gene regulation, Enduro’s system helps avoid the usual drop in productivity caused by non-producing cell populations over time, even after 40–60 generations.

Enduro's solution is introduced once at the master cell bank stage, doesn’t introduce foreign DNA, and fits into existing processes without needing changes to media or additives. For clients concerned about IP, the solution can be implemented in-house using digital DNA sequences provided by Enduro.

Source: AgFunder

🤔 Thoughts:

By tying productivity to survival, Enduro boosts titers without bigger tanks, making each fermenter more valuable. That could reduce the need for costly new infrastructure. More importantly, it reframes what “scale” means in biotech.

Instead of spending millions on a new plant, companies may start by upgrading the cells inside their current one. If this model takes off, we’ll see intensive growth over extensive. More product per liter, not more liters. That shift could lower entry barriers, enabling smaller players to match output once limited to industrial giants.

🇳🇱🇬🇧 Mosa Meat filed for regulatory approval in the UK to sell its cultivated beef fat ingredient

The move comes two months after the Dutch startup joined the UK Food Standards Agency’s cultivated meat ‘sandbox’ programme, which supports eight companies working to accelerate product approvals. Mosa Meat has also submitted approval dossiers in the EU, Switzerland, and Singapore.

The product can be blended with plant-based ingredients to make hybrid foods like burgers and meatballs. It could reach the UK market by 2027, in line with the FSA’s aim to greenlight at least two products during the two-year scheme.

By combining cultivated fat with plant-based ingredients, companies can improve taste and texture while keeping costs lower than using only cultivated meat, tackling two major hurdles in the industry.

Source: Green Queen

🇬🇧 Better Dairy is now producing osteopontin, a bioactive protein found in human milk, using precision fermentation

Osteopontin offers diverse health benefits, notably for infant growth, immunity, cognition, and adult bone and tissue health, making it attractive for infant formula, sports nutrition, and supplements.

Though abundant in human milk, the protein is scarce in cow’s milk. It’s been available only in limited quantities for research due to the high cost and inefficiency of extracting it, requiring thousands of litres of cow’s milk to yield just one kilogram.

The UK-based startup’s edge comes from its patented method for phosphorylation in yeast, a key step for osteopontin’s function. The team is now scaling up production and targeting GRAS self-affirmation by Q1 2026 to move toward commercialisation.

Source: AgFunder

🌏 What’s happening in food tech? Insights from SynBioBeta 2025

B2B and biopharma gain ground: Food tech has pivoted decisively toward B2B models, prioritising offtake agreements and corporate buyers over CPG. With funding tight, some are also exploring biopharma as a more viable revenue path.

AI and fermentation drive operational edge: AI is not just a novelty but a core operational tool to cut costs and operate efficiently. Meanwhile, fermentation remains a key innovation area, with success hinged on input optimisation.

Realism replaces hype: Founders are no longer driven by climate rhetoric (more about supply chain resiliency instead) or fundraising optimism. They're tackling business fundamentals like profitability, capital economics, and regulatory hurdles.

Source: Green Queen

BIO BUCKS

Funding, M&As, and grants

🇮🇳 Biowave, a new initiative by Omnivore and partners, aims to address the lacklustre VC investment into India’s agrifood life sciences sector

In 2024, India topped the developing world in agrifood tech funding with $2.5B, a 63% jump from 2023. This was driven mainly by quick-commerce players like Swiggy and Zepto and ag marketplaces. But when it came to life sciences, particularly ag biotech, only $12M was raised across 12 deals.

India’s life sciences sector is underfunded, especially compared to the US and China, which attracted $1B and $418M, respectively, for ag biotech in 2024. Despite India's large population and talent pool, the sector remains neglected.

Biowave, founded by Omnivore, Nucleate, and IndieBio, with support from BIRAC, C-CAMP, IKP, the Bangalore Bioinnovation Centre, Venture Centre, and SINE at IIT Bombay, seeks to bridge this gap by connecting startups with investors and building greater awareness around opportunities in agrifood life sciences.

Source: AgFunder

🤔 Thoughts

As food delivery and ag marketplaces mature (and saturate), the next wave of innovation (and returns) will come from science-driven startups. Digital solutions alone won’t “future-proof” agriculture, especially in a climate-stressed country like India.

It's hard to scale deep tech without deliberate ecosystem design. Biowave could mark the beginning of a shift toward more patient capital in agrifood with longer timelines, hybrid funding models, and tighter academia-industry ties. A move away from the “move fast, break things” mindset toward a “move thoughtfully, solve fundamental problems” approach.

If successful, this might not just build better startups, but also force a rethink of what innovation infrastructure looks like for other developing markets where life sciences investment is lagging.

🇹🇭 Thailand’s first precision fermentation dairy startup lands strategic funding from VCs and a Japanese food giant

Bangkok-based Muu has secured funding from A2D Ventures, Leave a Nest Japan, and an unnamed Japanese food giant to help scale its production and bring its animal-free dairy proteins to market.

The startup’s four-step production process uses local, cost-effective agricultural inputs and significantly reduces land, water, and GHG emissions. It is among the few startups globally producing both casein and whey proteins, enabling animal-free dairy products like barista milk, chocolate, and cheese.

With strong consumer interest—92% have tried plant milk and 97% are open to cultivated meat—and growing government support, Thailand is emerging as a regional hub for next-gen proteins and biotech innovation.

Source: Green Queen

🤔 Thoughts:

Muu’s growth comes as Thailand ramps up investment in biotech infrastructure. BBGI, the biotech arm of energy group Bangchak, is partnering to build Southeast Asia’s first large-scale precision fermentation facility (1 million-liter capacity). This could reduce dependence on global dairy imports like milk powder and support the growth of high-tech agri-food jobs locally.

Muu’s approach uses affordable, locally available feedstocks, likely sugars from cassava or sugarcane, which helps lower production costs and opens up new income opportunities for Thai farmers.

In the long run, this blend of agriculture and biotech could diversify rural livelihoods and strengthen food system resilience. Unlike field-based agriculture, fermentation runs year-round in controlled environments, making it far less exposed to the floods and droughts that disrupt Thailand’s farms.

🇦🇺 Bovotica secured A$3.4M seed funding to develop pre- and probiotic blend to regulate cows' rumen microbiome and reduce methane

The Queensland University of Technology spinout aims to lower methane output by up to 50% while redirecting up to 12% of feed energy, normally lost as methane, into more efficient energy use.

Bovotica is developing two products: a feed supplement and an oral drench. Both use a blend of hydrogen-metabolising probiotics to re-engineer the cow’s digestive microbiome.

With livestock responsible for 70% of emissions from Australia’s agriculture sector and 13% of the nation’s total, Bovotica's solution could have substantial climate benefits.

💰 Investors: AgriZeroNZ (lead), InnovationClub, Melt Ventures, Cultiv8 Funds Management, Better Bite Ventures1 and Lord Pastoral

Source: Startup Daily

🇳🇿 The largest global female investor collective backed Opo Bio to advance the development of high-quality cell lines for cultivated meat

Epic Angels joined a funding round for New Zealand-based Opo Bio to help scale the development of high-quality cell lines for cultivated meat and collagen. The funding will help with team expansion, R&D, and IP growth.

The startup targets a key challenge in biomanufacturing: producing reliable and affordable cell lines that support industries like cultivated meat and collagen.

By addressing the costly and complex step of cell cultivation, Opo Bio enables downstream innovation and helps companies lower environmental impact, making sustainable biomanufacturing more commercially viable.

💰 Other investors: WNT Ventures (lead), Booster NZ, Inventors Fund, and Callaghan Innovation

Source: Epic Angels

GEEK ZONE

Latest scientific research papers

🐷 High-performance pig stem cells differentiated into fat cells with high efficiency post-immortalisation for efficient cultivated fat production

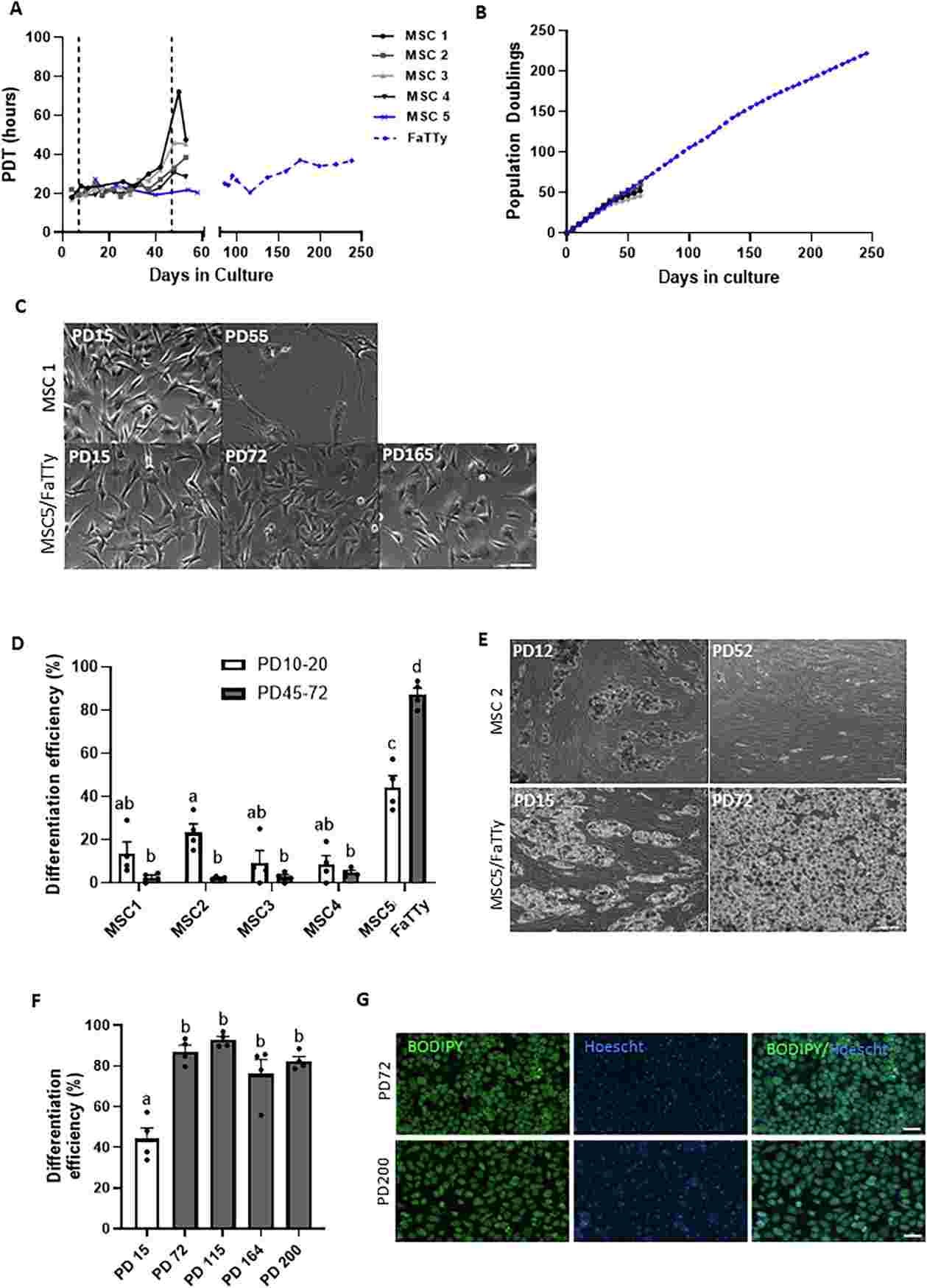

Scientists developed a unique pig cell line, called FaTTy, by repeatedly growing mesenchymal stem cells from pig fat until one line spontaneously became immortal. Unlike most primary cells that slow down or stop growing, FaTTy kept dividing beyond 200 population doublings and stayed highly efficient at becoming fat cells.

By population doubling (PD) 72, FaTTy reached nearly 100% adipocyte differentiation and maintained strong performance (76–93%) through PD 200, while standard cells typically drop below 5% with repeated use. The in vitro fat closely resembled natural pig fat but had double the monounsaturated-to-saturated fat ratio (3.2 vs. 1.4), suggesting a healthier fat profile.

FaTTy offers a non-GMO, regulator-friendly cell source that can be expanded indefinitely and reliably produces mature fat. This addresses a critical bottleneck in cultivated meat. Its high yield and scalable performance could accelerate the commercialisation of fat-rich cultured products.

Source: npj Science of Food

🧬 Engineered yeast hits record zeaxanthin levels at mild fermentation conditions

Zeaxanthin is a valuable natural pigment used in food, but its production in yeast is often limited by the low heat tolerance of CrtZ, the enzyme that makes it. Researchers used a computational approach to design CrtZ variants with improved thermostability and catalytic performance. After testing several candidates, they selected the M83L mutant and introduced it into Saccharomyces cerevisiae (Brewer's yeast).

Zeaxanthin titers jumped by 121.2% in shake flasks (to 156.8 mg/L) with M83L alone, and by another 138.9% (to 374.6 mg/L) when paired with RFNR/FD3. In 5 L fed-batch fermentation at 30 °C, production hit 814.6 mg/L, the highest yield reported in yeast under these mild conditions.

The study removes the necessity for low-temperature fermentation, reducing energy costs and facilitating scale-up. This positions brewer's yeast as a commercially viable chassis for high-yield, cost-efficient zeaxanthin production.

Source: Journal of Agricultural and Food Chemistry

EAR FOOD

Podcast episode of the week

🎧 Using crushed rocks to remove atmospheric CO₂ while improving soil health for agriculture

Host: Paul Shapiro

Guest: Ana Pavlovic, CEO of Eion

Eion speeds up a natural process called enhanced rock weathering by spreading finely ground olivine on farmland. When it rains, the olivine reacts with CO₂ in the air, locking it away while also improving soil health.

The solution integrates directly into agriculture. Farmers already use agricultural lime to manage soil pH, and Eion swaps in olivine as a drop-in replacement. Because olivine dissolves more slowly due to its crystalline structure, it may provide longer-lasting pH benefits, meaning fewer applications and lower costs over time.

Eion recently secured a $33M carbon removal deal with Frontier, a coalition of tech companies funding long-term carbon solutions. The agreement covers 80,000 tons of CO₂ removal by 2030, at a price of $300–400 per ton. Crucially, CO₂ captured through olivine can stay out of the atmosphere for over 10,000 years, making it a more permanent solution than forestry-based offsets.

Eion’s proprietary soil fingerprinting tech enables cost-effective and scientifically rigorous measurement of CO₂ removal. Their ability to lower MRV (measurement, reporting, verification) costs is a core advantage.

Eion also works with companies like Perdue on “insetting”, removing emissions within the supply chain itself. For example, by using olivine-treated feed crops, Perdue can lower the carbon footprint of its chicken products, helping them meet scope 3 emissions goals more directly than traditional offsets.

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Got any feedback/suggestion? Drop them here:

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Disclaimer: Better Bite Ventures, where I work, is an investor of Bovotica.

Thanks Eshan for excellent issue #103! Your great work gives me hope and encouragement that one day in the foreseeable future we will see alt protein products widely available as a consumer options to factory farmed meat. I like your use of helpful graphics in #103. Keep up the outstanding job and have a very nice and peaceful week 👍❤️

Hey team!

Given your interest in Biotech/biomanufacturing, you might enjoy my recent piece on eXoZymes Inc. They’ve just commercially launched a cell-free enzyme biocatalysis platform that converts biofeedstocks into targeted chemical products.

Plus they just announced their first subsidary which synthesises N-trans-caffeoyltyramine (NCT) to treat MASLD/MASH. Very very interesting compound that has immense potential. This is just the first of many asset compounds in the nutraceutical/API/industrial/food flavours/fragrances space.

https://www.slack-capital.com/p/exozymes-research-report