Recombinant Human Lactoferrin Scales, First Cultivated Pet Food Approved in Asia, and Biofertiliser with a Green Discount

Also: Provectus Algae raised $10.1M Series A and $2.5M government grant to scale livestock methane-reducing feed additive.

Hey, welcome to issue #111 of the Better Bioeconomy newsletter, a curated look at the latest in biotech for food and agriculture, covering commercial developments, funding rounds, scientific breakthroughs, and commentary. Thanks for being here! 👋🏾

Quick note: If you're an investor active in agrifood tech, I’d love to connect and exchange notes on what you’re seeing, what I’m picking up, and where things might be heading. If you’re up for a quick chat, grab a time here, or feel free to reach out at eshan@betterbite.vc if none of the times work.

Let’s get into it!

BIO BUZZ

Products, partnerships, and regulations

🇸🇬🇺🇸 Friends & Family Pet Food Company becomes the first to receive regulatory approval to sell cultivated meat for pets in Asia

The California-based startup received approval from Singapore’s Animal & Veterinary Services (AVS) to sell cultivated meat products for dogs and cats. The company will launch in Singapore, “priced competitively in the premium Southeast Asian market.”

Its first product will be freeze-dried treats containing 65-70% cultivated cells from Kampung chickens, a breed native to Malaysia and Indonesia. The focus is on minimal processing to help preserve both nutrition and flavour.

The treats also feature a proprietary mix of nutritional yeast and prebiotic fibres. Backed by more than 20 peer-reviewed studies, these ingredients support digestion, nutrient absorption, and immune health in pets.

Source: Green Queen

🤔 Thoughts:

Using 65-70% cultivated meat in pet treats marks a clear shift from earlier products with only small amounts of cultured ingredients. It shows cultivated meat can headline a premium pet product, at least in freeze-dried, small-format treats where high margins could offset production costs. These are encouraging signs, delivering a more tangible experience of what cultivated meat can offer.

By launching in Singapore’s high-spending pet market, the company is betting that targeted features, such as prebiotics for gut health, taurine, and trace minerals for overall wellness, matter more to early adopters than price.

Their treats are positioned as science-driven, nutrition-first pet food, reflecting a performance-focused approach that addresses real pet health issues like digestion or allergies and justifies a premium, not merely sustainability or ethics. It shows how novel foods can compete on performance, not just principles.

🇺🇸🇮🇱 Believer Meats received FDA regulatory approval and completed the construction of the world’s largest cultivated meat facility

The Israeli startup is the first non-US company to get the green light from the FDA. It uses centrifuge-based perfusion and media rejuvenation to help lower production costs by cutting back on nutrients and water. Last year, it also introduced an animal-free culture medium priced at just $0.63 per litre.

A new bioreactor setup enables continuous biomass growth, yielding 43% and reaching 130 billion cells per litre over 20 days. This could bring the cost of cultivated chicken down to $6.20 per pound.

The $123M, 200,000 sq ft North Carolina-based plant has a capacity of 12,000 tonnes annually. Believer Meats is also working with GEA to reduce emissions, minimise resource use, and adopt circular economy practices.

Source: Green Queen

🤔 Thoughts:

Regulatory velocity is real with five FDA “no‑questions” letters across different species since late 2022 show a maturing pathway, even as a less regulation‑friendly administration and seven state bans generate political noise.

If USDA sign‑off and Believer’s $6.20 / lb cost model materialise, capacity could fill via food‑service pilots and hybrid B2B ingredients. On the flip side, if this factory operates well below capacity due to slow market uptake or regulatory hiccups, it could serve as a cautionary tale about over-scaling too early.

Either way, stainless‑steel is now on the ground, shifting the debate from can we build it? to who captures demand under fragmented state‑level politics?

🇺🇸 Mission Barns completed full US regulatory approval for its cultivated pork fat, clearing the way for its market debut this quarter

Its hybrid meatballs and bacon, made by combining plant-based ingredients with small amounts of cultivated fat, are set to roll out this quarter at Fiorella Sunset in San Francisco and Sprouts Farmers Market in Oakland. Sprouts will be the first US grocery chain to stock cultivated meat.

Cultivated pork fat, used at low inclusion rates, is said to enhance the sensory qualities of the products, such as flavour and juiciness. It’s also more cost-effective to produce than lean cultivated meat, which makes it a practical fit for hybrid products.

On the growth front, Mission Barns is partnering with companies across the meat and plant-based space and licensing out its bioreactor tech and regulatory know-how to help scale cultivated meat production more broadly.

Source: Green Queen

🤔 Thoughts:

The planned debut of Mission Barns’ hybrid cultivated pork meatballs in Sprouts Farmers Market (Q3) will be a real-world experiment in consumer acceptance of cultivated ingredients. It would be a major step beyond limited restaurant pilots, and one that the industry would be looking at closely.

It opens a feedback loop with consumers informing on purchasing behaviour, price sensitivity, and any confusion or interest in such products. Depending on how it goes, it could either pave the way for wider retail adoption or highlight areas that need more work, shaping go-to-market strategies and regulatory communication for future cultivated products.

🇺🇸 Helaina scales precision fermented human lactoferrin to metric ton scale with 10 million servings per production run

Targeting women’s iron deficiencies, digestive discomfort from supplements, and the needs of athletes, Helaina’s human lactoferrin (brand name is Effera) supports iron regulation, inflammation reduction, and immune function throughout life.

Clinical trials confirm that Helaina’s human lactoferrin does not trigger antibody formation, unlike bovine lactoferrin, which is often rejected by the immune system and considered an allergen. This makes Helaina’s product safer and more effective for human use.

Effera is already included in multiple consumer wellness products like Kroma Wellness, Levelle, and Kepos, with more launches and a partnership with Mitsubishi International Food Ingredients in the pipeline.

Source: AgFunder

🤔 Thoughts:

This milestone gives Helaina a strong first-mover/early-mover advantage. By successfully scaling up production of a complex glycoprotein, Helaina is accumulating proprietary know-how in strain optimization, fermentation process control, and downstream purification that competitors might find difficult to replicate quickly.

That edge is further strengthened by early supply deals and growing brand recognition. These early partnership allows Helaina to secure early customer relationships and distribution (of course, not all deals are exclusive) before others reach scale. As the category matures, Helaina’s head start in industrial-scale production, market validation, and customer trust could translate into a durable edge if it maintains cost and quality leadership.

🇮🇱 PoLoPo pivoted its business model to protein-enriched potatoes, targeting the snack sector using its molecular farming platform

Initially focused on supplying egg protein (ovalbumin), the Israeli startup is now targeting the $53B global chip market using molecular farming to enrich native potato protein (patatin).

Their proprietary SuperAA molecular farming platform can triple potato protein levels, producing chips that contain ~18 grams of protein per 100 grams. Their tech fits into existing chip production lines without requiring changes, making it easy for manufacturers to adopt.

After a successful pilot in Israel, PoLoPo is now partnering with US companies to bring high-protein potato chips to market. It aims for regulatory approval by late 2025.

Source: Green Queen

🤔 Thoughts:

There are clear economic upsides to this approach. Raising a crop’s protein content at the source can shift some ingredient value upstream to the farm, provided IP and contract terms allow it.

By keeping patatin inside the tuber, PoLoPo avoids extraction and spray-drying, which helps cut energy use, capital costs, and logistics-related emissions in the process.

With the protein embedded in the potato, the crop itself delivers the nutritional functionality that would typically require a separate ingredient supply chain, potentially easing cost pressures for snack brands.

🇸🇪 OlsAro conducts large-scale field trials for salt-tolerant wheat in multiple markets as it moves closer to commercialisation

The Swedish startup runs large-scale field trials in India and other regions like Bangladesh and Pakistan to commercialise wheat and crops that can thrive in saline and challenging conditions.

With 6.75M hectares affected by soil salinity and expanding by 10% annually, India offers a significant opportunity. OlsAro’s partnership with DCM Shriram has shown promising results in Rabi 2024-25 trials across Uttar Pradesh and Bihar, with yields outperforming local varieties.

OlsAro adapts its development strategies to local rules. Using either a non-GM EMS mutagenesis method or gene editing. It also applies AI to identify beneficial traits using proprietary and open-source genetic and field data, improving crop performance under stressors like salinity and heat.

Source: AgFunder

🤔 Thoughts:

Breeding priorities are shifting from a singular focus on maximising yields under ideal conditions to developing crops that thrive in stressful environments. OlsAro’s progress is a good example of this resilience-first approach, aiming to “enable farming on otherwise unfarmable land”. It shows that climate adaptation traits (salt, drought, heat tolerance) are becoming just as critical as yield, as rising salinity and extreme weather shrink arable land.

It’s also encouraging to see ‘emerging markets’ become the proving ground and first launch market for such climate-resilient crop innovations. Is the Global South taking the lead in adopting climate-adapted seeds, driven by immediate agricultural necessity? Regions like South Asia and Africa face pressing challenges that demand urgent solutions, and seem to be more willing to trial new resilient varieties.Still, adoption ultimately depends on economics. Resilience alone isn’t enough, farmers need to see clear ROI. Salt-tolerant lines must deliver better yields and stay affordable to be viable at scale.

BIO BUCKS

Funding, M&As, and grants

🇦🇺 Provectus Algae raised $10.1M Series A and $2.5M government grant to scale its livestock methane-reducing feed additive

The Australian startup’s modular, biomanufacturing platform uses LED-controlled precision photosynthesis to control gene expression of algae, accelerating Asparagopsis (red seaweed) growth and targeting valuable bioactives.

With its fully enclosed system, Provectus can tightly control growing conditions, helping deliver consistent product quality, something that’s been difficult with traditional ocean or pond-based methods.

Its Surf ‘n’ Turf additive is formulated to easily fit into existing livestock feeding systems. Its focus is on delivering ROI through productivity gains rather than depending on green consumer premiums.

💰 Investors: At One Ventures, Methane Mitigation Ventures, Mort & Co, Hitachi Ventures.

Source: AgFunder

🤔 Thoughts:

Provectus insists its seaweed-based feed additive must boost cattle productivity (e.g. better feed efficiency or weight gain) rather than rely on consumers paying a “green premium” for low-emission beef. This touches on a key challenge in methane mitigation: who bears the cost of cutting emissions?

Their approach suggests the solution is to eliminate the cost barrier by aligning sustainability with farm profitability. It’s further validation that for methane-reducing feed tech to scale, solutions must compete on yield and ROI and plug directly into farmers’ profit models.

🇬🇧 NetZeroNitrogen raised €5.6M in seed funding to expand its biofertiliser with ‘green discount’ to Southeast Asia

The UK-based startup’s core innovation is a biofertiliser made from endophytic bacteria that colonise plant roots and help crops draw nitrogen from the atmosphere. These bacteria are applied directly to seeds, especially effective with rice, and can reduce synthetic nitrogen fertiliser use by up to 50%.

By using fermentation instead of the Haber-Bosch process, NZN aims to offer its product at least $50 per hectare cheaper than synthetic alternatives. In Southeast Asia, this could translate to savings of 30-40% for farmers, with environmental gains like reduced fertiliser runoff.

The biofertiliser is non-GMO, helping NZN navigate regulatory approvals more easily and access organic markets. It’s also simple to use and doesn’t require new equipment, making it a practical “green discount” option for growers.

Source: TechCrunch

💰 Investors: World Fund and Azolla Ventures

🤔 Thoughts:

NZN’s biofertilizer tackles the economic pain point of synthetic fertilisers, which have become costly and volatile. Farmers worldwide have struggled with soaring fertiliser prices, a problem exacerbated by wars, which sent prices to record highs and left regions scrambling for affordable fertiliser.

Solving the cost issue matters because fertiliser is often farmers’ largest input expense. A “green” product that lowers costs (instead of adding a green premium) directly improves farm profitability while also being sustainable.

It shows that climate-friendly agtech doesn’t require subsidies or altruism to scale - it can compete on pure ROI for the farmer. If NZN and similar offerings truly deliver a cost advantage (“greener and cheaper at the same time”), adoption could accelerate rapidly through market forces alone.

🇨🇿 Mewery secured €2.9M from grants to scale cultivated pork production and initiate pilot projects with meat producers

The public grants from Horizon Europe and Alliance will support the Czech startup’s ambition to expand its cultivated pork production and conduct collaborative pilot projects with EU-based meat producers.

Production is scaling up from lower kilogram volumes in a mid-sized bioreactor to deliver sufficient biomass for partner testing. These trials are expected to start by the end of the year and will shape the next commercialisation phase.

Mewery’s unique co-cultivation process combines pork and microalgae cells. It is said to achieve up to 10 times greater yield than industry standards, cutting costs and replacing costly inputs like fetal bovine serum.

Source: Green Queen

🤔 Thoughts:

It’s encouraging to see public grants step in for cultivated meat just as VC funding slows. This shows that Europe sees this space, and biotech more broadly, as strategic for food security and climate goals.

Public funding is required to bring these technologies to pilot and commercial scale, VC funding alone won’t be enough. It’s also helping de-risk the field, laying the foundation for private capital to return once costs drop and the tech matures.

GEEK ZONE

Latest scientific research papers

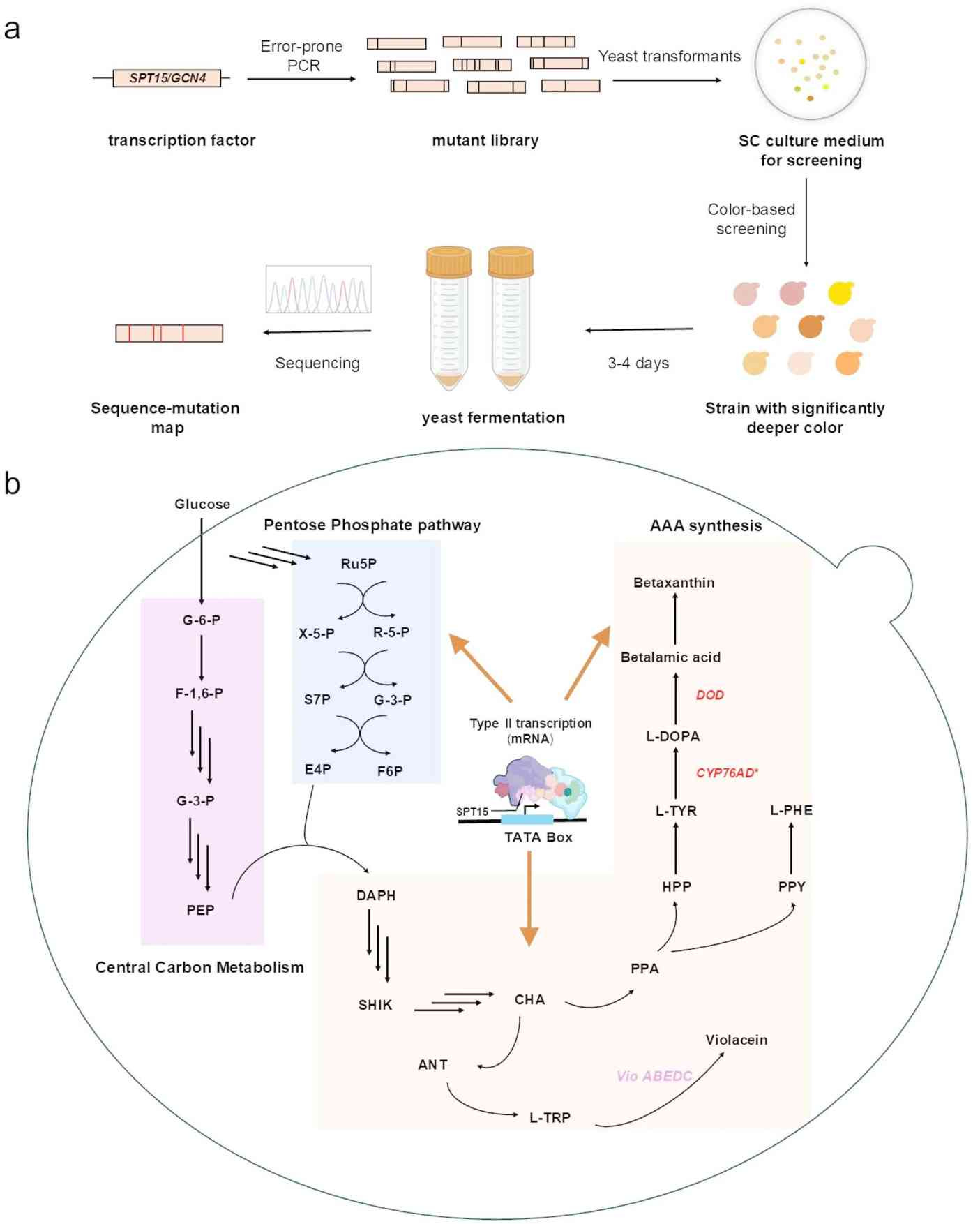

🧬 Engineering yeast for pigment bioproduction led to a 2x increase in yield via global transcription tuning

Researchers modified S. cerevisiae to produce the pigments betaxanthin (from tyrosine) and violacein (from tryptophan), combining metabolic pathway optimisation with global transcriptional reprogramming. By mutating the transcription factors Spt15p and Gcn4p, they adjusted yeast metabolism and used colour-based colony screening to identify improved strains.

A single mutation in Spt15p (R238K) raised betaxanthin output by 2.17x, while a Gcn4p variant boosted it by 1.89x. Further screening led to a strain (CBVS-1) that produced 59.9% more betaxanthin and 66.7% more violacein. In a 1 L fed-batch flask, this approach achieved 208 mg/L of betaxanthin, which is said to be the highest level reported in yeast.

The results show how global transcription factor engineering, beyond tweaking individual enzymes, can significantly enhance production across complex biosynthetic pathways. It’s an encouraging approach for co-producing high-value compounds like natural pigments from shared biosynthetic precursors.

Source: Microbial Cell Factories

🍇 Vineyard-native bacteria and mycorrhizal fungi increased grapevine root growth by 26% and induced beneficial microbiome shifts

Scientists screened 200 rhizobacteria from vineyard soils, both healthy and stressed, for plant growth-promoting traits. Two standout strains, Pseudomonas veronii and P. brassicacearum, were combined with commercial mycorrhizal fungi (Rhizophagus irregularis and Funneliformis mosseae) and applied to young grafted grapevines grown in microbially imbalanced soil.

This co-inoculation boosted root biomass by 26% and suppressed Botrytis cinerea in the root endosphere. It also led to a 559% increase in bacterial co-occurrence networks, a sign of a more connected, potentially resilient microbiome.

The results point to a promising approach for managing vineyard soils affected by replanting challenges or microbial imbalance using tailored microbial inputs.

Source: Scientific Reports

🌾 Thermo-sensitive embryoless rice increased yield and doubled shelf life by reallocating energy to grain

Researchers modified the OsBZR4 gene in rice, which guides embryo development by controlling auxin. Disabling this gene produced “embryoless” seeds, where the endosperm grows into the space usually taken up by the embryo. The effect was tested across different rice varieties and temperatures.

The bzr4 lines produced 60-100% embryoless seeds, especially at higher temperatures, directing more energy to endosperm growth. This resulted in 33% less lipid, 10% more amylose, a 2.5% increase in milled rice yield in top cultivars (without affecting quality), and up to twice the storage life by reducing rancidity markers.

Reallocating resources to grain, bzr4 lines provide more starch and better storability, supporting processing, storage, and premium rice products. Their heat sensitivity suits warm climates or perennial cropping systems.

Source: Nature Communications

EAR FOOD

Podcast episode of the week

🎙 How Tropic aligns gene editing with real grower needs in the tropics

Host: Adrian Percy

Guest: Dr. Eyal Maori, co-founder of Tropic Biosciences

Tropic Biosciences has developed gene-editing tools tailored for tropical crops like banana, coffee, and rice. These tools allow for transgene-free edits and can create disease resistance without needing to identify host plant genes.

The company focuses on the tropics (surprise!), where food insecurity is more severe and population growth is highest. By working on bananas, a staple in these regions, Tropic aims to bring innovation to growers and consumers who are often overlooked in agtech.

Because bananas reproduce asexually and lack established biotech tools, Tropic had to create core infrastructure from the ground up. This included building systems like embryogenic cell suspensions and regeneration pipelines. In the early days, they screened over 20,000 plants before they were able to edit reliably.

Growers are involved throughout the development process. Tropic invites them to field trials and uses their feedback to shape trait priorities. This helps ensure the traits meet real needs and builds trust around adoption.

Although regulation was a big question mark at the start, countries such as Guatemala, Colombia, Costa Rica, and the Philippines have now set up clear approval paths for gene-edited crops. Tropic’s bananas are among the first to be approved in these markets, with some approvals happening in just 2 to 6 months.

Podcast: AgTech360

APAC AGRI-FOOD INNOVATION SUMMIT

Happy to share that Better Bioeconomy is returning as a Marketing Partner for the Asia-Pacific Agri-Food Innovation Summit 2025! 🇸🇬

From breakthrough food systems to next-gen agri-tech, this is where Asia’s innovation leaders connect, collaborate, and create impact.

👀 Use my exclusive partner code for 10% OFF your pass: BIO10

💰 Save $500 SGD with the Super Early Bird offer before August 14

Learn more: https://tinyurl.com/s9k5x3d7

See you in Nov!

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Woah woah biotech market is booming