Turning the Industrial Biomanufacturing Graveyard Into a Winning Playbook

First Bight Ventures’ Veronica Breckenridge on what failed biomanufacturing companies reveal and how to build biotech companies that scale, survive, and win.

Hey folks!

Thanks for being here. For Issue #125 of Better Bioeconomy, I had the opportunity to interview Veronica Breckenridge, the Founder and Managing Partner of First Bight Ventures. First Bight is an early-stage venture fund positioned to capture the massive value-creation opportunity in the multi-trillion-dollar industrial transition from petroleum to bio-based manufacturing.

Veronica has one of the most interesting operating backgrounds I’ve come across in this space. She has scaled teams and complex supply chains at Apple and Tesla before moving into industrial biomanufacturing.

First Bight recently published the Industrial Biomanufacturing Graveyard report, a must-read report that turns decades of painful outcomes into decision-grade lessons. I open this article with a short primer on that report to clarify the context, then move into how Veronica applies those lessons in practice.

Let’s jump in!

The graveyard of industrial biomanufacturing is crowded. It includes biofuels that never cleared cost, platform molecules that ran out of runway, and plants that went far over budget.

None of that is a reason to retreat. It is a reason to learn. Failure leaves clues. It shows where market selection went wrong, where scale assumptions broke, and where capital stacks turned fragile under pressure. Read those clues well, and you avoid paying the same penalty twice.

That spirit is what inspired First Bight Ventures to publish its recent Industrial Biomanufacturing Graveyard report, one of the clearest attempts to turn decades of painful outcomes into a usable dataset and required reading for anyone building or backing industrial bio.

Veronica and her team treat the graveyard as a data source, not a warning sign. The result is a playbook that turns cautionary tales into operating procedures.

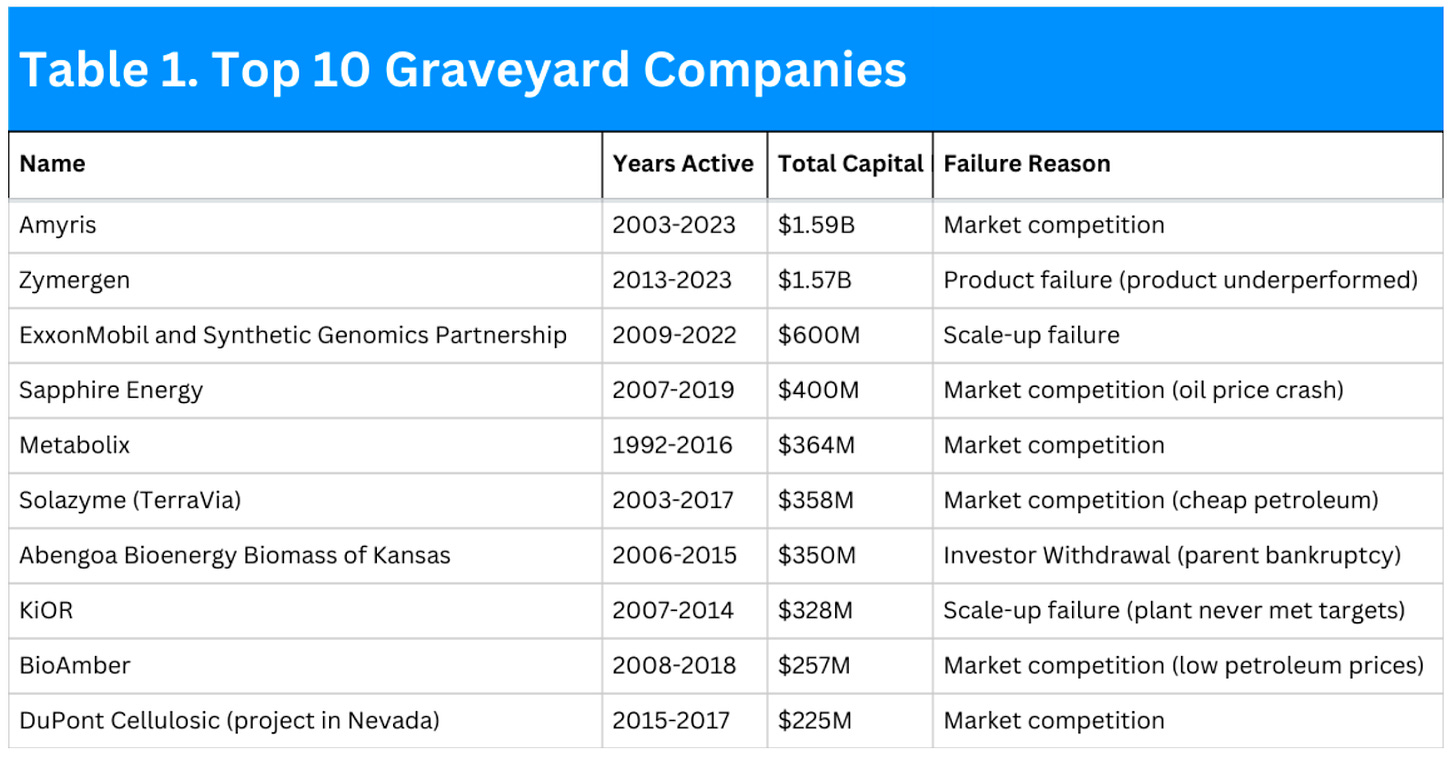

Key findings from the Industrial Biomanufacturing Graveyard report

The report maps where the first wave of companies aimed and where they fell. Most failures occurred after biofuels and broad “platform” molecules, which were low-margin, scale-driven markets where incumbents already sat on cheap feedstocks and fully depreciated assets. Only a small fraction started in higher-margin speciality applications, meaning many teams chose the hardest economic battleground as their first act.

Just as important as where they played is why they failed. Across the cases the report tracks, the dominant reasons are commercial and operational, not scientific. Market competition and poor product-market fit top the list, followed by scale-up issues and CAPEX overruns. Lab and pilot often worked well enough. The breakdown happened when processes hit the plant and could not produce at a cost or volume the market would accept.

Three recurring mistakes stand out. Founders consistently underestimated manufacturing cost at scale and assumed customers would pay a generous green premium that never materialised. They chased large commodity markets to make the TAM slide look exciting, only to collide with petro incumbents on price. And they led with novel products that required new supply chains and customer behaviour, adding friction at every step.

The report is equally sharp on scale-up and capital. First-of-a-kind plants frequently ran 3 to 5 times over budget because teams treated industrial assets like software, relying on equity-heavy cap tables and expecting smooth, rapid growth. Factories do not behave that way. They need staged risk removal, manufacturability designed in from day one, and capital stacks that blend equity, equipment finance, incentives, and strategic support. The failures often stemmed from capital that didn’t align with factory timelines, leading to premature scaling, unfocused plant builds, and a lack of discipline in techno-economic analysis.

The conclusion is not that industrial biomanufacturing is doomed. It’s that the game is winnable if teams internalise these patterns. Start in markets where biology can win on function and acceptable cost. Design for manufacturability and realistic price corridors from the start. Treat scale-up as a series of gates, not a single leap, and match capital to those gates with partners who know how to build and run plants. The graveyard is large, but it reads like a manual of what not to do, and a blueprint for doing it differently.

From Apple and Tesla to the future of industrial biomanufacturing

Veronica’s path runs through scaled execution before it runs through biology. At Motorola, she helped set the China strategy for the mobile devices business. She led a team scouting technologies that would push phones past voice into richer experiences, including an early prototype that foreshadowed what we now know as Siri.

At Apple, she built the Enterprise and Education business for Greater China, growing revenue nearly one hundredfold to about one billion dollars while building the teams, channels, and programs that turned a complex portfolio into repeatable sales.

At Tesla, she launched the company in China as Vice President, recruited and built the national organisation, opened stores across several cities, and owned the full stack from government relations to service and sales.

Those chapters were followed by a move into venture capital at Hone Capital, where she helped pioneer a data-driven seed strategy that produced one of the highest ratios of unicorns per assets under management. The through line is disciplined scale under real constraints, and the habit of turning frontier technology into systems that ship.

That operating muscle is what she now brings to industrial biomanufacturing. Her pivot came from a conviction she could not ignore: biology’s cost curves were accelerating and would eventually force a rewrite of how materials, chemicals, and ingredients are made.

She had seen this dynamic before. When cost curves bend, industries reorganise. Biology had the ingredients for a similar shift, but adoption kept stalling at the factory gate. Products missed price corridors, processes failed manufacturability gates, and materials did not slot cleanly into existing supply chains. That was the gap she chose to work on.

First Bight Ventures is her answer to that gap. She set it up to invest early and close the distance between lab, pilot, and purchase order. The firm pairs capital with hands-on de-risking and anchors that work through real buyer specs. It sits inside a regional buildout in Houston, with access to talent, partners, and pilot capacity that compresses learning cycles.

Why a concentrated portfolio works in industrial bio investing

Unlike a typical early-stage fund that backs 20 or more startups, Veronica runs a concentrated portfolio with just seven companies in First Bight. She shared that this is because industrial bio is manufacturing-heavy, and most early teams are scientific founders who have never run a plant or a business. They need help with commercial viability, manufacturability, market selection, and team buildout, which is hard to do from afar and demands a hands-on investor. A concentrated portfolio allows First Bight to provide that hands-on support to each of its portfolio companies.

The exit sizes of startups are another factor contributing to the concentration. Biomanufacturing is not software where you can rely on a 1000x outlier and a <1% hit rate to generate returns for the fund while all the other bets fail. Here, the realistic upside is more like 20-30x, so you need a concentrated portfolio with good survivability and exits, where one or two hits already get you to a 5-6x fund. To deliver that, you concentrate both ownership and attention.

The founder profile that scales science and operations

Failures in biomanufacturing are rarely about science (or the market) alone. Many come down to the team’s ability to make disciplined choices as the company scales. That is why Veronica prioritises three signals when she backs founders.

Coachability comes first. Many scientific founders have not run a plant or a P&L. Founders who take feedback and adapt quickly are far more likely to grow into the operational demands of running a plant.

Business bias is the second signal. The founders she backs understand they are trying to commercialise a technology, not just build great science. Curiosity about customers, costs, and pricing separates teams that chase novelty from teams that build for adoption. She often finds this in repeat founders, including some who have failed before, because they have already learned the hard way what a real go-to-market and real unit economics look like.

The third signal is the founder’s ability to grow with the company. Companies change shape as they grow. The founder who can hire ahead of themselves or recruit a seasoned operator at the right moment improves survival odds.

Start with higher-margin niches with a drop-in pathway

Commercial traction shows up fastest when the product slots into existing infrastructure. Veronica prefers drop-in or near-drop-in molecules that leverage existing feedstocks, CDMOs, equipment, and downstream integration. Novel molecules can be powerful, but they often require changes at multiple points in the chain and long cycles of education. Those cycles typically belong on big-company balance sheets. Startups need proof sooner.

The Graveyard analysis backs this. Targeting commodities to tell a big story was common and pushed teams into scale traps they could not fund. The more feasible path, as Veronica emphasises, is to begin in speciality and higher-margin niches where functional advantages justify the price and volumes are small enough to learn without blowing out the cap table. Broader markets come later, once the process is validated and the cost story is real.

Defensibility still matters. Veronica is not interested in me-too processes that simply plug into existing systems. She wants technology that is meaningfully differentiated, but where adoption sits mostly inside today’s infrastructure rather than requiring a new system at every step.

This is less ideology than economics. Many founders assumed the market would pay a green premium. In reality, price corridors are tight, and procurement pressure erodes even modest premiums. Starting where biology offers a clear spec-level edge and can already run on existing lines buys time to fix yields, recovery, and downstream performance.

More radical, non-drop-in approaches will have their moment once biomanufacturing infrastructure is more built out and the industry reaches a more mature stage. For now, the priority is products that can clear real-world constraints and start flowing through the pipes we already have.

Equity capital efficiency beats the fantasy of CAPEX-light

When it comes to financing a first-of-a-kind (FOAK) facility, equity cannot and should not carry the entire plant. Veronica frames the goal as making equity capital efficient rather than pretending biomanufacturing can be CAPEX-light. FOAK means real hardware: fermentation tanks, utilities, downstream equipment, and all the supporting infrastructure.

Her push is to keep as much of that hardware as standard and financeable as possible. The more you rely on established equipment and standardised agreements, the easier it becomes to lease, refinance, or sell pieces of the asset if needed.

She takes the same view on government support. FOAK should lean on regional and national programmes that underwrite land, infrastructure, and jobs so that scarce equity does not pay for concrete and steel. Strategics play a similar role. Partners who have built plants before and carry large balance sheets can co-invest or hold parts of the asset, bring in their own engineers, and reduce execution risk in ways a startup alone cannot match.

The common thread is that the capital stack must align with the project’s physical reality. Venture equity is there to take early technical and commercial risk. Equipment finance, incentives, and strategic capital have to carry more of the load once foundations are being poured and lines are being installed.

Blueprint for building an industrial biotech company today

When I asked Veronica how she would build an industrial biotech company today, her answer built on themes we had already covered. She would still begin in a speciality, higher-margin niche with a clear drop-in or near-drop-in pathway, where the technology offers a functional edge and the economics can absorb early inefficiencies. The goal is a focused application that can reach profitability sooner and avoid the scale traps that pulled many first-wave companies into the graveyard.

From there, she turns to sequence and capabilities. She is blunt about bringing commercial leadership in early. B2B cycles are long, and selling into corporates is its own craft. Someone has to own the path from the first conversation to repeat order while the technical team runs experiments.

Corporate partners should also be engaged early so specifications, pricing, and use cases are shaped with a real buyer. Regulatory and quality expertise come in sooner than most founders expect, ensuring the process being designed will pass the reviews that matter.

Grants and other non-dilutive funding should target commercial milestones rather than pure science projects, so each tranche of capital is tied to progress that a customer can feel.

The manufacturing lead deserves the same early attention. Veronica wants someone who has commissioned lines and has lived through utilities, permitting, vendor management, and maintenance, all involved well before FOAK. That person will spot design choices that create headaches later and save quarters of runway by avoiding rework.

Near-term opportunities that biomanufacturing can bank on

For Veronica, the next investable opportunities in industrial biomanufacturing sit closer to the consumer, in categories that already support real margins. Personal care, food, and nutrition are at the top of her list, along with niche, high-end applications where speciality economics allow earlier profitability.

These categories are bankable now because they can absorb some early inefficiency, as long as the product matches petro-based incumbents on performance and lands in a price range buyers can live with. Feedstock strategy is part of that story. She prefers alternative or waste streams that lower COGS and avoid competing with food, which makes the whole proposition easier to finance.

Modular and local manufacturing is the long-run structural advantage Veronica sees for biology. Smaller, distributed assets that sit closer to feedstocks or customers and still hit spec are more attractive than a single mega-plant. She expects that shift to unfold over decades rather than years, with near-term wins coming from products that already match buyer priorities and can run on existing lines without major retooling. As she put it, “People forget the petrochemical industry had over a hundred years to reach today’s efficiency. Biomanufacturing just started.”

A small ask from Veronica

If you are an investor who is passionate about industrial biomanufacturing, already backing startups in this space, or looking to get more involved, Veronica and the First Bight team would love to connect. Reach out to contact@firstbight.com to explore how you might partner to support founders and help grow this emerging sector.

Takeaways from my conversation

The graveyard is a dataset, not a warning sign. Treating past failures as structured information reveals patterns in market choice, manufacturability, and capital structure that teams can design around. The question shifts from “is this too risky?” to “which risks can we remove early?”

Concentration and involvement beat portfolio volume. Biomanufacturing companies need investors who are close to market selection, manufacturability, team buildout, and scale-up decisions. Veronica’s venture model is a counterweight to the ‘more shots on goal’ approach, arguing that a tighter focus and deeper participation provide better returns.

Market selection and product design must honour how the supply chain already works. Starting in higher-margin, drop-in or near-drop-in applications gives biology a fair fight. Adoption should live inside existing infrastructure.

Forget “CAPEX-light”, optimise for equity capital efficiency. Biomanufacturing will always involve real hardware and construction risk. The job is to structure it so equity doesn’t carry the full weight.

If you found value in this newsletter, consider sharing it with a friend who might benefit from it! Or, if someone forwarded this to you, consider subscribing.