World's First High-Function Recombinant Whey, $29M for Whole-Cut Cultivated Steaks, and China Calls for Alt Protein Acceleration

Also: Engineered oleaginous yeast increased lipid yield by 230%, offering a platform for sustainable palm oil alternatives.

Hey, welcome to issue #98 of the Better Bioeconomy newsletter. Thanks for being here! 👋🏾

This week, Verley (formerly Bon Vivant) introduced recombinant dairy proteins that outperform conventional whey in both nutrition and functionality. Hoxton Farms is bringing cultivated pork fat to Asia through a strategic partnership with Sumitomo, while BioCraft secured regulatory approval to sell its cultivated mouse meat for EU pet food.

In China, political leaders signaled stronger support for alt-proteins and synthetic biology, and Aleph Farms raised $29M to slash cultivated steak costs with a novel bioreactor approach. Plus, an Italian startup is using sound waves to supercharge microbes, and researchers boosted yeast lipid yield by 230%, a leap forward for palm oil alternatives.

Alright, let’s dig into the latest updates on how biotech is transforming food and agriculture for a climate-friendly food system.

BIO BUZZ

Products, partnerships, and regulations

🇨🇳 Chinese lawmakers issued calls for faster development of the local alternative protein ecosystem at an annual political summit

At the Two Sessions summit, Chinese leaders called for boosting biotech capacity and a faster development of alternative proteins, emphasizing R&D, manufacturing, IP protection, and regulatory support.

Technologies like gene-editing and synthetic biology are being promoted to create novel, high-function, high-nutrition foods, with a strong push for multidisciplinary integration.

Government leaders pushed for improved IP protections, new talent development programs, and the establishment of clear, flexible regulations to support the industry’s development and global competitiveness.

Source: Green Queen

🤔 Thoughts

When China’s top policymakers put alternative proteins on the national agenda, it’s a strong signal of the industry’s growing strategic value. This kind of high-level backing suggests alt proteins are being seen through the lens of food security and innovation, not just novelty.

Given China’s scale and manufacturing strength, its involvement could help drive down costs and accelerate adoption globally. If the country aims to have, say, X% of its protein from ‘alt sources’ by 2030 (and some experts suggest 50% by 2060 for decarbonization), it would unlock major resources: R&D funding, factory incentives, and workforce training, all accelerating industry progress.

China isn’t just a major consumer market, it could also shape global standards and scale if the government really gets behind a sector.

🇫🇷 Bon Vivant rebrands to Verley, unveils ‘world’s first’ functionalized recombinant dairy proteins that outperform conventional options

The French startup has developed two key ingredients: FermWhey MicroStab, which is heat- and acid-stable (ideal for UHT drinks and high-protein foods), and FermWhey Gel, which helps cut out gums and stabilizers in products like yogurt and cheese for cleaner labels.

FermWhey MicroStab also packs 11% more leucine than native whey protein isolate, giving it a nutritional edge, especially for sports and functional nutrition products. With FermWhey Gel, manufacturers can skip additives like carrageenan and gums while still meeting protein and texture goals.

According to Verley, while being "animal-free" and reducing scope 3 emissions are advantages, the ability to command premium pricing depends on delivering superior functionality and nutritional value.

Source: AgFunder

🤔 Thoughts

By improving precision-fermented proteins to be more heat-stable or better at gelling than conventional whey, Verley isn’t just replicating dairy, they’re creating an ingredient that could be more useful for manufacturers.

This approach recognizes that adoption tends to be driven by performance and value, not just ideology. The message is shifting from “we can make whey without cows” to “we can make whey that works better.”

If these proteins offer superior functionality, food companies may be willing to pay more or make the switch, even without a push from consumers, because it helps them build a better product.

🇬🇧🇯🇵 Hoxton Farms partners with Japan’s Sumitomo Corporation to bring cultivated pork fat to Asia-Pacific

The collaboration will see Hoxton Fat incorporated into a range of food items, such as soups, sauces, savory pastries, and processed meats, through partnerships with local manufacturers.

As pork demand grows across Asia, driven by rising incomes, urbanization, and population growth, traditional supply chains face pressure from disease risks and other disruptions. Cultivated fat offers a promising way to help address these challenges.

The UK-based startup’s custom fat profiles and proprietary bioreactors enable scalable production, while regulatory submissions are planned in the UK, US, Singapore, and Japan.

Source: AgFunder

🤔 Thoughts

Sumitomo’s involvement signals mainstream corporate buy-in to cell-based ingredients. This could be an indicator of how cultivated products might actually go to market: less as standalone items and more as components that improve taste or sustainability in existing foods.

Using cultivated fat in familiar products, instead of launching entirely new ones, positions the technology as a way to improve quality and supply chain resilience. This could also make adoption easier, as corporations and consumers may be more comfortable with a blended product than a wholly new food.

🇺🇸🇦🇹 BioCraft Pet Nutrition received registration from Austrian authorities to sell its cultivated meat ingredient to EU pet food producers

The Delaware-based company, which operates a lab in Vienna, is now registered to use Category 3 animal byproducts, paving the way for its cultivated mouse meat to enter the EU pet food market.

Following three years of testing, BioCraft demonstrated that its product is made from non-GM, non-immortalised cells and is free from contaminants like pathogens and heavy metals.

Nutritionally, it’s on par with chicken slurry, and costs only $2–2.50/lb, thanks to a plant-based growth medium replacing expensive animal-derived ones. BioCraft can now commercialize its flagship cultivated mouse meat in the European market, offering it as a 1:1 replacement in wet or dry pet food formulations.

Source: Green Queen

🤔 Thoughts

Gaining EU market access for a cultivated pet food ingredient is a meaningful step forward for the alt protein industry, not just for pet food, but for consumer acceptance more broadly.

It introduces cultivated meat into daily life in a low-friction way. As pet parents proudly share that their cat’s food didn’t involve slaughter, it helps normalize the idea of cultivated protein which could lay the groundwork for broader acceptance in the human food market.

BIO BUCKS

Funding, M&As, and grants

🇮🇱 Aleph Farms raised $29M to commercialize lower-cost whole-cut cultivated steak

The funding includes $22M through a SAFE and $7M from existing investors. Another $10M–15M is expected in the coming months, which will support scaling its pilot facility in Israel and setting up mid-scale production sites in Europe and Asia.

The Israeli cultivated meat company’s new “1.2” method combines cell growth and differentiation into a single bioreactor. This reduces complexity and production time by 60% while improving efficiency and enabling the production of thicker, whole-cut steaks.

Aleph has achieved a 97% cost reduction since 2020. With help from AI-driven process optimization and zero-waste strategies, the company is targeting production costs of $14/lb at a 2,000–5,000L scale and as low as $6–7/lb at full industrial scale.

Source: AgFunder

🤔 Thoughts

By streamlining growth and tissue formation into one step, Aleph is eliminating a major source of complexity and cost in cultivated meat production. The result is a thin-cut beef steak grown at single-digit dollars per pound costs at scale. This is a major leap from the $300,000 lab burgers of a decade ago.

Just as important is Aleph’s strategic focus on whole cuts. While some of the other cultivated meat companies are focusing on ingredients, Aleph is zeroing in on a true replacement for steak or bacon. If they succeed, it could reset expectations for what cultivated meat can deliver, not just in terms of cost, but consumer appeal and product experience.

🇺🇸 GreenLight Bio secured $25M in Series C funding from Just Climate for global expansion of RNA-based crop protection technology

The company’s flagship product, Calantha, is the first-ever RNA crop protection spray to be registered and is now available in the US and Ukraine. It offers potato farmers an effective, eco-friendly alternative to traditional chemical pesticides.

GreenLight is also moving forward with two key pipeline products: Norroa, aimed at helping beekeepers combat varroa mites amid a 62% average honeybee colony loss, and Fortivance, an adjuvant designed to improve the performance of existing agrochemicals while reducing environmental impact.

As part of its global expansion, GreenLight Bio is focusing on Brazil and Latin America and has opened a new research station in Spain to support sustainable agriculture innovation and collaboration in Europe.

Source: GreenLight Biosciences

🤔 Thoughts

It’s encouraging to see RNA-based pesticides taking shape with products like Calantha. It’s a shift from broad-spectrum chemical sprays to more precise, programmable pest control, kind of similar to how medicine moved from blanket antibiotics to targeted gene therapies.

The need is clear: pesticide resistance is on the rise, and pollinator populations are under pressure. Solutions that can balance effectiveness with species-specific targeting are gaining traction, and GreenLight’s investor backing and global rollout plans reflect that.

🇺🇸 Ecovative raises $11M to meet surging demand for mycelium-based MyBacon, the ‘top-selling’ plant-based breakfast item

MyBacon, made by Ecovative’s food spinout MyForest Foods, is claimed to be the fastest-selling plant-based breakfast item in the natural channel, boasting 3x the average sales velocity of competitors.

The company has now raised a total of $156M, with $82M raised for MyForest Foods. The new funding round will help boost production capacity, hire additional staff, launch a new whole-cut mycelium product, and bring MyBacon into the foodservice sector.

Powered by its proprietary AirMycelium technology, Ecovative grows mycelium at scale in vertical farms, delivering a clean-label, umami-rich product with a naturally meat-like texture. No additives or complex engineering are needed.

Source: Green Queen

🤔 Thoughts

Ecovative’s approach flips the script on alt meat. Instead of engineering plant proteins into meat-like textures, they grow whole slabs of mycelium and simply season and slice them into bacon-like strips. Thanks to mycelium’s naturally fibrous texture, the result performs like meat without a long ingredient list or heavy processing.

MyBacon’s strong performance comes as many plant-based alternatives are being criticized for being overly processed. With just a handful of familiar ingredients (mushrooms, salt, sugar etc.), MyBacon delivers on taste and texture without the baggage.

Their $11M raise signals that capital is still flowing to companies with clear traction and a differentiated product. MyBacon shows there’s real market appetite for cleaner, simpler solutions that meet consumer expectations.

🇩🇪 Differential Bio raised €2M in pre-seed funding to de-risk biomanufacturing scaleups with an AI-driven virtual platform

The Munich-based startup’s platform combines microbiology, robotics, and lab automation to help companies replace costly physical trials with virtual simulations. This cuts costs and boosts yields and cell viability across industries like food, cosmetics, and specialty chemicals.

In one project, the platform helped a client switch from animal- to plant-based fermentation media, leading to a 4x increase in yield and a 16% reduction in production costs.

Starting with hands-on services for clients, Differential Bio is transitioning to a no-code, drag-and-drop virtual experimentation platform, with built-in privacy protections and pretrained AI models adaptable to clients’ proprietary strains.

Source: AgFunder

🤔 Thoughts

This reflects a broader shift toward digitalization and automation in biomanufacturing. Startups are turning to digital twins and high-throughput “self-driving labs” to replicate large bioreactor conditions at lab scale.

The approach fits with ongoing trends in AI-led strain engineering and continuous fermentation, all focused on tackling the scale-up challenge. It’s also a sign that investors are looking beyond end products, showing growing interest in the underlying biotech infrastructure.

Tools like data platforms, robotics, and modeling are becoming key areas where real innovation is happening.

🇮🇹 HypeSound raised €1.2M pre-seed to accelerate biomanufacturing using its sound-based biotech platform

The Italian startup’s patented So’Sweep technology uses low-frequency sound waves to boost microbial productivity, without relying on chemicals or genetic modification, supporting more sustainable bioproduction.

With new funding, HypeSound will expand its research lab in Perugia, grow its team, and advance So’Sweep for integration into large-scale microbial production systems.

Initially focused on microalgae, the company is now applying its tech to other microorganisms like yeast and bacteria, aiming to support sectors such as food, agriculture, health, and materials science.

💰Investors: Eatable Adventures, Ulixes Capital Partners, CDP Venture Capital SGR, Vento, Athena FH, and NextUp

Source: iGrow News

🤔 Thoughts

By integrating sound into bioprocesses, HypeSound aims to make production more efficient, scalable, and resource-light. If the tech holds up at industrial scale, it could reduce the cost of everything from alt proteins to vaccines by shortening production cycles or boosting yields with the same bioreactor volume.

In a world where biomanufacturing capacity is stretched, this resonant tech could be a force multiplier. Imagine fermentation tanks producing faster or more efficiently, simply by layering in sound to optimize conditions. HypeSound’s approach of blending “nature’s intelligence with technological innovation” reflects the kind of creative problem-solving the industry needs.

💸 More bucks

🇮🇱 Brevel secured $5M in seed extension, raising total seed funding to $25M to scale production and partnerships for microalgae ingredients. The company combines light and fermentation to produce nutrient-rich microalgae at high yields and low cost, without the need for genetic modification. (Green Queen)

🇺🇸 Vestaron raised over $20M to accelerate the commercialization of its peptide-based bioinsecticides. The capital supports growth in the US and Europe, following early entry into Europe. (GlobeNewswire)

GEEK ZONE

Scientific research papers

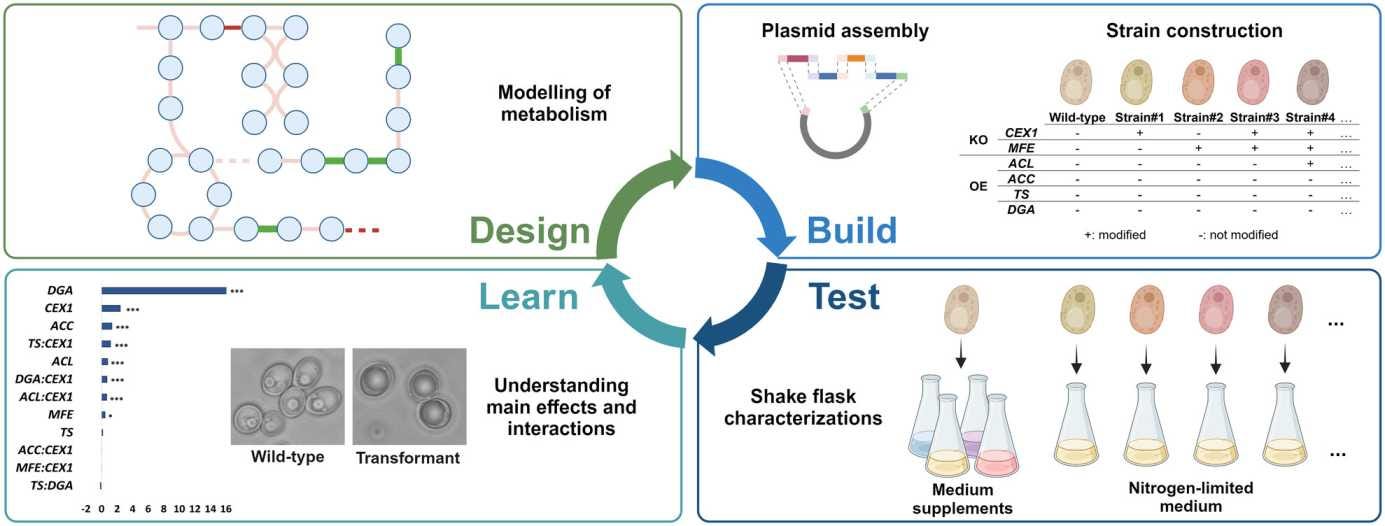

📈 Engineered oleaginous yeast increased lipid yield by 230%, offering a platform for sustainable palm oil alternatives

Using a systematic Design-Build-Test-Learn (DBTL) strategy, the study combined computational modeling and lab experiments to guide genetic and media modifications for higher lipid output in Yarrowia lipolytica.

Overexpressing threonine synthase (TS) and DGA1 in a strain lacking β-oxidation and citrate export functions led to a 200% increase in lipid content (56% w/w) and a 230% rise in lipid yield on glycerol.

Among all tested genes, DGA1 overexpression had the most consistent impact, achieving a 3.35x increase in lipid accumulation when paired with TS in the modified strain.

Source: Microbial Biotechnology

🌾 Seed-based DNA delivery using modified carbon dots offers a reliable approach for transient gene expression in diverse plant species

The study introduces a method using modified carbon dots (MCDs) to transiently transfer DNA into seeds, bypassing the need for genotype-specific transformation. It achieved whole-plant expression in wheat and showed similar results in over eight other species.

Once inside the plant cells, the plasmid DNA can replicate and spread, staying active for up to 10 days. This provides a consistent window for studying gene function without long-term integration.

The approach broadens the toolkit for functional genomics and epigenomics, especially in crops that are difficult to transform, and opens up new possibilities for crop bioengineering.

Source: Plant Biotechnology Journal

☀️ Engineering cyanobacterial systems for cytochrome P450 expression improved their role in light-driven biosynthesis

The study showed that directing the plant-derived P450 enzyme CYP79A1 to the thylakoid membrane of bacteria Synechocystis sp. using elements of the native PetC1 protein increased oxime production. The best-performing design achieved an 18× boost in product levels compared to the unmodified enzyme.

Oximes are organic molecules that serve as intermediates in making various bioactive compounds. The most effective setup involved PetC1 fusions with two predicted transmembrane domains, which resulted in both strong enzyme expression and high oxime output.

The work advances the use of cyanobacteria as green cell factories for efficient light-driven biosynthesis of valuable natural products by enhancing the expression and function of complex, membrane-bound enzymes like P450s.

Source: ACS Synthetic Biology

EAR FOOD

Podcast episode of the week

🎧 Faster, cleaner, and collaborative: Meatable is redefining how cultivated meat can fit into the future of food

Host: Alex Crisp

Guest: Jeff Tripician (‘Trip’)

Meatable sees itself as a collaborator to the traditional meat industry rather than a competitor. Instead of replacing meat products, it offers cultivated meat as a 25% ingredient blend, helping producers lower their environmental footprint while keeping the same taste and format.

Trip estimates Meatable will reach profitability in ~3 years, with production scaling from pilot to plants producing 25M-100M lbs annually. The company licenses its technology and offers franchise-style support, including media, tech, and on-site staff to help partners run bioreactors.

Unlike traditional livestock, which takes 1-3 years to raise, Meatable’s process delivers meat in just 12 days. This short cycle helps with supply planning, cuts down on waste, and significantly reduces land, water, and feed use, supporting food security.

Asia, particularly Singapore, Thailand, and South Korea, is moving quickest in terms of regulation and consumer openness. Meatable is working with local meat companies to lead the approval process, making it easier to enter those markets.

Trip emphasizes cultivated meat as a response to climate stress, soil degradation, water scarcity, and rising protein demand. It relieves pressure on traditional livestock, with no threat to farmers, just a complementary solution to meet future protein demand.

CHECK IT OUT

I'm happy to share that Better Bioeconomy is a Media Partner for HackSummit!

HackSummit returns to Lausanne on May 15-16, bringing together top climate builders, investors, scientists, and operators to double down on climate deep tech. Across two action-packed days, expect game-changing talks, rapid-fire pitches, hands-on workshops, and city-wide side events to accelerate investment into impact.

💰 Save 20% with discount code "BETTER20" when you book your place here!

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Got any feedback/suggestion? Drop them here:

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organizations I am associated with.