World’s First Undergraduate Degree in Cellular Agriculture, 48-Hour Cultivated Meat Growth, and USDA-Backed $25M Loan for Precision Fermentation Facility

Also: COP28 happened

BIO BUZZ

📚 Tufts University Center for Cellular Agriculture (TUCCA) has introduced the world's first undergraduate degree in cellular agriculture

The program is designed as an interdisciplinary minor, integrating expertise in tissue engineering, synthetic biology, and food science. It combines various disciplines to provide a comprehensive understanding of cellular agriculture, a complex and cutting-edge field.

Elective topics such as Food, Nutrition, and Culture; Food Systems: From Farm to Table; and Bringing Products to Market allow students to tailor their education to specific interests within cellular agriculture.

The degree aims to empower undergraduates in tissue engineering research, enabling them to translate cellular agriculture research into innovations within the food industry.

Read full article - vegconomist

🥩 ProFuse Technology and Gelatex Technologies partnered to optimise muscle growth to expedite the commercial viability of cultivated meat

The companies claim to have reduced the average chicken muscle growth cycle to 48 hours and achieved a fivefold increase in muscle protein compared to conventional methods.

The showcased results highlight the potential of both companies' technologies to bring about cost efficiencies, scalability, and improved nutritional value in cultivated meat production.

ProFuse and Gelatex plan to offer interested parties access to Gelatex’s plant-based nanofiber scaffolds and integration protocols by ProFuse, aiming to facilitate favourable muscle growth outcomes for the broader cultivated meat industry.

Read full article - vegconomist

🥛 Vivici and Ginkgo Bioworks partner to advance the production of sustainable animal-free dairy proteins

Vivici, a Dutch B2B ingredient startup, uses precision fermentation to create animal-free dairy proteins, addressing the growing global demand for sustainable and appealing protein sources.

Ginkgo Bioworks will provide protein production services, leveraging its generative AI platform. The company's strategic role involves creating a comprehensive library of top-performing strains through screening and cultivation, which will be delivered to Vivici for final evaluation.

Vivici's CEO expressed confidence in Ginkgo's scale and AI-driven approach for designing strains, anticipating efficient and scalable strains that can support Vivici's speed to market in the production of sustainable dairy proteins.

Read full article - vegconomist

🧫 MyriaMeat, founded by researchers from the University of Göttingen, claims it can cultivate 100% “real meat” from stem cells

The startup, founded in 2022, has developed medical technology based on pluripotent stem cells (iPSC) and parthenogenetic stem cells. This technology allows the growth of functional muscle, enabling the production of entire meat cuts.

MyriaMeat's muscle cells are uniquely capable of contracting, a feature not possible with hybrid products. This allows the company to differentiate itself from competitors by claiming to grow 100% muscle without the use of hybrid products with plant proteins.

The company aims to scale its technology to provide sustainable and ethical alternatives to traditional meats such as Wagyu beef, pork, and deer. MyriaMeat can produce all-natural, contaminant-free meat, addressing ethical concerns related to animal suffering and contributing to the reduction of emissions.

Read full article - vegconomist

🐶 CULT Food Science has unveiled its third proprietary ingredient for alternative pet food

Bmeaty is produced through a fermentation and fractionation process, combining yeast extract, hydrolyzed yeast, and carrier yeast. It contains approximately 40% protein, along with fibre and B vitamins. The production method aims to provide a savoury, umami flavour appealing to both cats and dogs.

The ingredient offers various health benefits for pets, including support for digestion, cognitive health, and heart health. With its nutritional composition, Bmeaty contributes to a well-rounded diet for animals.

The release of Bmeaty expands CULT Food Science's lineup of patented ingredients for pet food, complementing existing products like Bmmune and Bflora.

Read full article - vegconomist

🤝 HIFOOD and Alianza Team developed a clean-label, plant-based fat alternative to replace tropical oils and chemical emulsions

The new product combines MirrorTissue, a plant-based lipid solution by Alianza Team, with HIFOOD's proprietary proteins, plant fibres, and technologies. This collaboration resulted in a protein emulsion with superior performance, featuring a blend of allergen-free plant proteins, soluble plant fibres, and local oils and fats.

HIFOOD, a subsidiary of CSM Ingredients based in Italy, specialises in natural ingredient research and development. Alianza Team Europe, headquartered in Germany, represents the European division of the Colombian multinational company Alianza Team, focusing on vegetable fats and oils.

HIFOOD and Alianza Team Europe received the Plant-Based Innovation Award at the Fi Europe Startup Innovation Challenge 2023 for MirrorTissue.

Read full article - vegconomist

🍼 Danone is entering the vegan infant formula segment through a collaboration with Canadian brand Else Nutrition

Else Nutrition stands out by using ingredients like almond butter, buckwheat flour, and tapioca maltodextrin in its vegan infant formulas. The company offers two products for toddlers, including a complete nutrition powder and one enriched with omega-3 and omega-6 fatty acids for brain development.

Danone, the world's second-largest baby formula maker, plans a multi-stage partnership with Else. The initial phase involves licencing Else's products for production, marketing, and sale under Danone's branding.

Else Nutrition has experienced rapid growth, winning awards for its products and expanding from being available only in North America to reaching 13,000 stores across the region.

Read full article - Green Queen

👑 Green Queen COP28 Daily Digest: Everything you need to know in food and climate news

The UAE's president, Sheikh Mohammed Bin Zayed, announces a significant $30 billion investment fund for global climate solutions. The fund aims to bridge the climate finance gap and catalyse $250 billion in investments by 2030, aligning with the host country's commitment to addressing climate change during COP28.

Documents seen by the Guardian and DeSmog shows that meat and dairy companies and lobby groups plan to use COP28 to promote sustainable meat messaging. The communications plan aims to present meat as "sustainable nutrition" and influence the FAO to feature "positive livestock content" during the summit.

A survey by the Potential Energy Coalition across 23 countries reveals that 77% of respondents believe it is essential for their governments to take decisive actions to limit the effects of climate change. Despite widespread global support, the survey notes that the United States ranks the lowest in terms of policy support, influenced by political polarization.

And a lot more!

Green Queen’s editorial team has curated the must-reads, the must-bookmarks, and the must-knows from COP28 so that you won't feel overwhelmed.

Click on the banner (or click here) and check out Green Queen COP’s coverage!

Thanks Green Queen for keeping us updated! 🙏🏾

MACRO STUFF

🚧 Alternative meat companies are grappling with a harsh reality

Many companies in the alternative meat sector, including major players like Beyond Meat, are experiencing financial challenges. Smaller companies have even closed down, indicating a period of financial hardship in the industry.

Despite the setbacks, some companies see the current challenges as an opportunity for good products to stand out. They compare the situation to a "boomtown" where thinning out the competition allows the stronger alternatives to shine.

Entrepreneurs in the industry are learning from recent hardships with a shift in advertising strategies. Instead of focusing solely on intellectual appeals, there's a recognition of the importance of appealing to the deeper, unconscious satisfaction that consumers associate with meat.

Read full article - Time

💡 The University of California Berkeley and Givaudan whitepaper identifies challenges and opportunities in the alt protein industry

The alternative protein sector faces challenges such as supply chain issues, sustainability concerns, and post-Covid-19 impacts, but there are opportunities for those who adapt, including exclusive distribution rights and acquiring startups.

Efficiency is crucial for success in the alt protein industry, and the whitepaper outlines four key areas for improvement: ingredient selection, exploring hybrid products, optimising processes, and fostering collaborations for innovation.

The whitepaper emphasizes that alternative proteins can reduce environmental impact and improve human health, and Givaudan plans to collaborate with global startups to turn these insights into real innovations

Download white paper - Givaudan

💪🏾 A study by ProVeg finds plant-based meat substitutes are often healthier than animal-based meat products

On average, plant-based meat substitutes in the study had less saturated fat, fewer calories, and more dietary fibre compared to animal-based meat products. Plant-based products demonstrated a slightly better composition in terms of the risk of lifestyle diseases, especially when enriched with higher iron and vitamin B12 content.

Contrary to concerns about ultra-processed foods, the study found that the degree of processing alone does not indicate whether plant-based meat substitutes are healthy. Similar to animal meat, there are both healthy and less healthy plant-based products, and the degree of processing is not a sufficient indicator of their overall healthiness.

The study challenges the stereotype associating plant-based meat substitutes with ultra-processed products, showing that their nutritional value is generally better than what is typically associated with highly processed foods.

Read full article - ProVeg

🇬🇧 A new report criticised the UK government’s inaction on key environmental measures such as reducing meat sales

The report by The Food Foundation highlights the absence of mandatory disclosure for retailers and food service providers regarding the percentage of sales from animal versus plant-based proteins.

Few major businesses publish or aim to reduce these figures, and commitments to sustainable and healthy diets have decreased compared to the previous year.

There is an imbalance in marketing and multibuy deals. A significantly higher percentage (21.5%) of such deals are on meat and dairy products compared to fruits and vegetables (4.5%). Similarly, a substantial portion of advertising spend (9%) is on animal products, while only 1% is on fresh produce.

The Food Foundation urges mandatory reporting of three key metrics for businesses in retail and out-of-home sectors: sales of HFSS foods, animal versus plant protein, and fruits and vegetables.

Read full report - The Food Foundation

🇬🇧 UK's Food Standards Agency released guidance on the authorisation process for cell-cultivated products in England and Wales

The guidance covers definitions, application details, and recommendations on product safety, labelling, and tasting trials for cell-cultivated products, highlighting a rigorous and independent safety assessment before market placement.

The UK government aims to streamline approval for cultivated meat to improve food security and sustainability, with Aleph Farms being the first company to submit a pre-market authorization dossier to the FSA.

The FSA requires businesses interested in cell-cultivated products to apply through their regulated product application service, with different regulatory routes depending on the specific product and production methods.

Read full article - vegconomist

New here? Devour the free subscription and join a list of founders, investors, and biotech enthusiasts leading the food revolution!

BIO BUCKS

🇺🇸 Liberation Labs secured a $25M USDA-backed loan to support its first commercial-scale precision fermentation facility

The purpose-built facility in Indiana will have a capacity of 600,000L and is expected to be operational by the end of 2024. The plant aims to produce bio-based proteins and other building block ingredients to meet the needs of both new and established CPG companies and other industrial manufacturers.

The loan is a USDA business and industry loan designed to promote economic development in areas with fewer than 50,000 residents. Liberation Labs sees it as confirmation of the importance of adding biomanufacturing capacity in the US and a validation of the strength of their business plan.

Liberation Labs is currently in the late stages of a series A fundraising round to secure the remaining funds needed for the project. The CEO talked about the current investor interest in ventures with a higher probability of achieving cash flow positivity or profitability in the near term.

Read full article - AgFunder

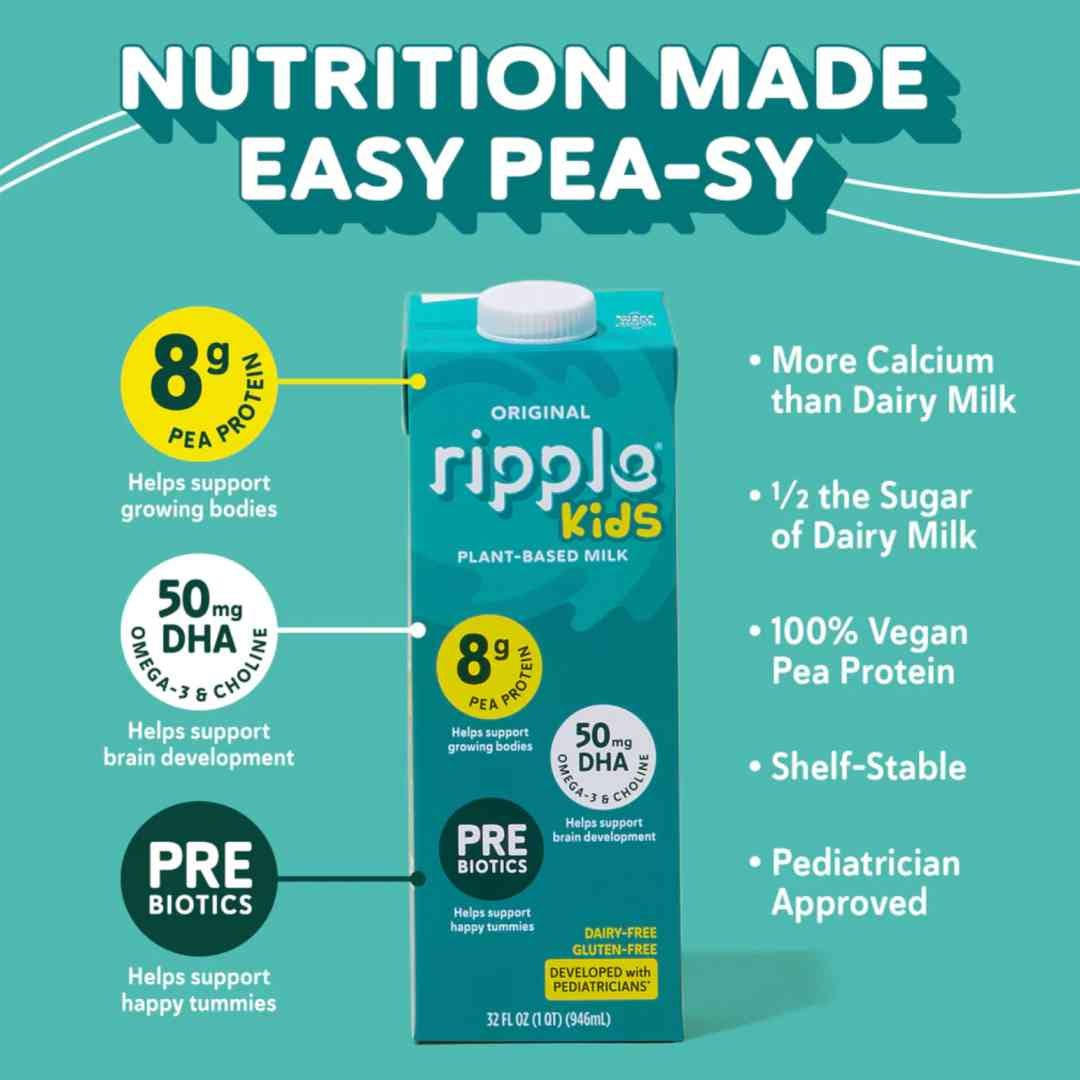

🥛 Ripple Foods has secured $49M in funding round, bringing its total funding to over $274M

The pea milk maker differentiates itself by using innovative technology to create 'Ripptein,' a neutral-tasting protein extracted from yellow peas, allowing for high protein content and reduced sugar in its plant-based milk.

Ripple Foods' plant-based milk offers allergen-friendly options, being soy-, dairy-, and nut-free, with half the sugar and 50% more calcium than 2% dairy milk and eight times the protein of almond milk.

Despite challenges in certain product categories like plant-based yogurt and 'superfood' milks, Ripple Foods has reported a successful year, surpassing category growth and achieving high consumer loyalty, with plans for distribution expansion and innovative products like Ripple Kids.

Read full article - AgFunder

💨 Synonym obtained funding from Open Philanthropy to advance its research in gas fermentation technology for sustainable food production

Synonym plans to utilize the funding to conduct comparative techno-economic assessments of single-cell protein production using various gas fermentation techniques.

The company aims to evaluate the financial benefits of gas fermentation compared to traditional processes that rely on plant-based carbon sources like dextrose.

Synonym's team, comprising process engineering and capital markets experts, will conduct a thorough examination of capital expenditures and operating expenses related to different gas fermentation process designs. The focus will include nutrient media, staffing, utilities, and more.

Read full article - vegconomist

🧀 The vegan cheese market is expected to almost double in value from $4B to $8B by 2032

This is attributed to factors such as increased consumer awareness of animal welfare, health, and sustainability. New technologies, such as high-protein cheese alternatives made from fermented legumes, are contributing to market growth by enhancing taste, texture, and nutritional value.

Soy-based vegan cheese is projected to hold a significant market share, accounting for two-fifths, while almond-based products also show notable growth. Mozzarella and parmesan alternatives are expected to dominate the market variety-wise, with mozzarella being particularly popular due to its versatility.

Europe is anticipated to dominate the vegan cheese market due to substantial R&D investments. However, challenges exist, such as consumer preference for dairy cheese flavour. Producers need to focus on continuous innovation to improve sensory properties.

Read report overview - MarketResearch.biz

SOCIAL FEAST

🤔 The complexity behind “eat less meat” - a touchy subject, sparking controversy and challenging long-held dietary beliefs

Despite the growing movement to reduce meat consumption for health and environmental reasons, advocating for eating less meat is not universally accepted and may be perceived as offensive or challenging.

The deeply personal nature of dietary choices, which are often tied to cultural, religious, and ethical considerations, making it essential to approach discussions on reducing meat intake with nuance and respect.

A poorly framed message may backfire. There is a need for a nuanced and respectful approach to encouraging less meat consumption and fostering open dialogue without shaming or stigmatising individuals who eat meat.

Read full post on LinkedIn - Hon Mun Yip

🔍 The best source for investor lead lists is your competitors

The process involved reaching out to CEOs of similar-stage competitors and proposing the mutual sharing of CRM information on venture capitalists, highlighting its simplicity and the fact that many founders overlook this strategy.

Through this process, both companies can benefit by exchanging CRM data containing relevant leads. Given the significant number of conversations required to secure investments, sharing leads that were not successful in the past can be valuable.

Particularly in industries with a mission-driven focus like climate, CEOs may be willing to collaborate for the greater cause. The example of a CEO introducing a competitor to their future seed round lead investor illustrates the potential for strategic networking in such impactful sectors.

Read full post on LinkedIn - Alex Shandrovsky

Got a taste for this newsletter? Dish it out to your friends!👇🏾

EAR FOOD

🎙 Sustainable food systems transformation with Monitor Deloitte’s Mathias Cousin

Show: The Plantbased Business Hour

Host: Elysabeth Alfano

Guest: Mathias Cousin, Managing Director of Monitor Deloitte

The podcast delves into the realm of engineered biology and synthetic biology, exploring innovations in areas such as novel therapies, biofuels, biomaterials, and food tech. The potential of these technologies to address challenges in commercialising innovations was mentioned.

The discussion touches on the challenge of educating consumers about the benefits of sustainable food products. It emphasises the importance of connecting sustainability with consumer preferences and behaviour change, acknowledging that the sustainability argument alone may not be enough to drive widespread adoption.

The episode underscores the global impact of the sector, showcasing examples of carbon-neutral initiatives within the food system transformation. The importance of conveying strong sustainability messaging to make the sector more attractive is also discussed, along with the challenges of aligning sustainability with affordability and accessibility for consumers.

THAT’S ALL FOR THIS WEEK!

Take care, and have an awesome week! 🙌🏾

Are you new here?

Know any other geeks who would dig this newsletter?