$350M EU Push for Food and Biotech, AI-Driven Tropical Oil Replacements, and RNA Vaccines for Crops

Also: Agrifood tech startups raised $5.1B in H1 2025, down 37% from $8.1B in H1 2024.

Hey, welcome to issue #109 of the Better Bioeconomy newsletter, your weekly dose of biotech’s latest in food and agriculture. Thanks for being here! 👋🏾

This week, the EU earmarked €350M to push biotech and food innovation, while Terrana Biosciences emerged from stealth with $50M to deliver RNA-based “plant vaccines.” Singapore’s Prefer and Melvados launched Asia’s first ice cream made with bean-free coffee, while Algocell raised $2.8M to help biomanufacturers scale faster with AI-powered digital twins. Also, agrifood tech startups raised $5.1B in H1 2025, the lowest since 2015. All of these and more, let’s dig in!

BIO BUZZ

Products, partnerships, and regulations

🇫🇷 Smey combines AI and fermentation to identify and grow microbes that naturally produce oils as direct substitutes for tropical fats

The French startup’s Neobank of Yeasts uses AI to precision-match over 1,000 natural yeast strains with target fatty acid profiles like stearic acid. This enables the development of new oils in just 30 days, down from the usual two-year timeframe.

Their main ingredients, cHOB (Cultivated High Oleic Butter) and cCB (Cultivated Cocoa Butter), help cut emissions by up to 90% versus conventional oils. By applying adaptive laboratory evolution and solvent-free oil extraction, Smey produces stable, high-yield, non-GMO oils that are scalable and aligned with sustainability standards.

Proprietary engine Smey.AI combines genomic and metabolic data to identify optimal yeast strains for specific product needs, such as melting point and texture. It achieves optimal matches in hours and uses carbohydrates from agricultural byproducts as feedstock.

Source: Green Queen

🤔 Thoughts

AI-driven strain selection is collapsing development timelines that once spanned years into just weeks. While downstream steps like scale-up and regulatory approvals still take time, this acceleration gives startups a real edge. They can iterate faster while others remain locked in longer development cycles. For incumbents, sticking with traditional product pipelines may no longer be enough.

Just as software is scaled by turning code into reusable modules, biotech could do something similar with biological libraries and machine learning. The idea of an “ingredient engine”, where you query a desired fat profile or texture and identify a matching microbe, is beginning to reshape how new products are conceived, even if delivery still depends on fermentation capacity and process optimisation.

Owning curated microbial libraries enriched with metabolic and performance data could be a significant advantage, especially if used to train proprietary models. Companies with deep, structured strain libraries and AI infrastructure move faster and could offer ‘fermentation-as-a-service’ to entire industries, such as cosmetics, food, and oleochemicals. Optionality at scale becomes a defensible moat.

🇬🇧 Multus launched an animal-free media formulation for cultivated meat with the help of AI and automation

The UK startup has introduced Proliferum P, an animal-component-free (ACF) media designed for porcine adipose-derived stem cells. It's described as the first commercially available ACF formulation for this cell type, offering a serum-free option for cultivated meat production.

Proliferum P is said to match or outperform the functionality of FBS (fetal bovine serum) while maintaining stemness and differentiation. It was developed in under six months using AI and lab automation, much faster than a typical 2-4 year development timeline. It was created even faster than the company's previous product, Proliferum B, which took nine months.

FBS has been widely used in cell culture but comes with high costs, ethical concerns, and contamination risks. Multus’s AI-driven approach allows for quicker, tailored media development, aiming to offer scalable and consistent solutions.

Source: Green Queen

🤔 Thoughts

Multus’s rapid, AI-guided media design hints at a new cadence for cellular agriculture. With formulation cycles shrinking from years to months, sub-$1-per-litre media looks plausible, allowing cultivated meat startups to redirect capital from optimisation toward bioreactors, scale-up, and regulatory dossiers.

As each optimised cell line feeds data into the algorithm, first movers like Multus could build powerful network effects, turning growth-media performance into a locked-in advantage.

This could speed up the move toward a more modular supply chain, where specialised media, scaffolds, and cell banks support multiple producers, lowering barriers to entry and shifting the focus toward product differentiation further downstream.

🇸🇬 Melvados and Prefer debut Asia’s first ice cream featuring beanless coffee

Singapore’s gourmet retailer Melvados has partnered with local startup Prefer1 to launch a Coconut Latte ice cream made with a bean-free coffee alternative. Prefer creates its ingredients by fermenting food waste such as surplus bread, okara, and spent grain, using food-grade microbes to unlock familiar coffee aromas.

This ingredient is said to be “up to two times more affordable” for buyers, and “up to ten times more affordable” for companies that license and produce it in-house, while significantly lowering their carbon footprint.

Instead of replacing coffee entirely, Prefer’s product is used in hybrid applications to work alongside traditional coffee, like this ice cream, helping brands balance flavour, cost savings, and sustainability.

Source: Green Queen

🤔 Thoughts

Hybrid coffee could offer a practical way to cut emissions and manage costs without overhauling consumer habits or existing supply chains. Like hybrid EVs, blending beanless and conventional coffee creates a near-term path to reduce impact while keeping flavour and familiarity intact.

More broadly, this reflects a shift across food tech: partial substitution is emerging as a realistic entry point for change. We're seeing similar strategies in blended meat products like plant plus cultivated, or plant plus mycelium, where startups and incumbents work together to create formulations that balance sustainability, cost, and consumer acceptance.

As volatility in coffee and cocoa markets continues, major buyers like Nestlé, Mondelez, and Starbucks could start managing risk by incorporating fermentation-derived ingredients, provided cost and volume can meet demand.

🇩🇪 Bluu Seafood partnered with Van Hees to develop hybrid proteins that blend cultivated fish cells with plant-based ingredients

With nearly 75 years in the business and a presence in over 80 countries, Van Hees brings solid expertise in spice blending and food safety, key assets for scaling these seafood products internationally.

The collaboration focuses on improving flavour, texture, and stability, drawing on Van Hees’s food tech capabilities, its work with flavour specialist Aromatech, and its Food.PreTect centre.

As cultivated seafood startup Bluu Seafood awaits regulatory approval in several regions, this partnership supports its efforts to bring products like cultivated salmon and rainbow trout closer to market.

Source: Green Queen

BIO BUCKS

Funding, M&As, and grants

🇪🇺 EU Commission designated €350M into food and biotech innovation as part of €10B strategy to strengthen Europe’s position in life sciences

Fermentation, particularly precision and biomass types, is highlighted as a promising technology for producing high-value, sustainable products from renewable resources. There’s also a strong push to help startups and SMEs navigate the capital-intensive scale-up process.

To speed up innovation, the EU is planning a new Biotech Act aimed at streamlining regulations for emerging biotech sectors like cultivated meat and novel proteins. With EFSA approvals currently taking around 2.5 years, the Act is expected to encourage quicker, more innovation-friendly processes.

Support measures also include public-private partnerships, annual conferences to connect stakeholders, and an AI-powered tool to help companies better understand and navigate regulatory requirements.

Source: Green Queen

🤔 Thoughts

After years of funding early-stage research, the EU is shifting its focus toward commercialisation and infrastructure. This is a clear signal that it sees fermentation and food innovation as strategic sectors worth serious investment.

For industry, this is a strong green light. It not only validates fermentation as part of Europe’s economic future but also lowers the risk for private capital to follow. Public funding often helps unlock venture and corporate co-investment by making scale-up more viable.

This shift could drive a wave of activity: We might see national governments set up fermentation hubs, universities expand bioprocessing training, and legacy food and pharma players form deeper partnerships with tech startups, all spurred by clear momentum at the policy level.

🌏 Agrifood tech startups raised $5.1B in H1 2025, down 37% from $8.1B in H1 2024

According to preliminary data from AgFunder, investment activity saw a major contraction, with deal count falling from 1,187 in H1 2024 to 551 in H1 2025, indicating reduced investor appetite and/or more selective funding.

The sector hasn't seen such low H1 funding since 2015, when only $3.6 billion was raised.

Ag biotech, previously the top-funded category, slipped to fourth with only one major round (Inari), and ‘Innovative Food’ (which includes alt proteins) saw funding plummet from $828M to $250M.

Source: AgFunder

🇺🇸 Flagship Pioneering launched Terrana Biosciences with a $50M investment to develop RNA-based solutions for crop protection and improvement

With experience in RNA technologies from human health-focused companies like Moderna, Flagship is now bringing that expertise to agriculture. Traditional RNA in agriculture degrades on plant surfaces. Terrana’s breakthrough is RNA penetrating tissue, acting as a “programmable plant vaccine” against viruses, fungi, and pests.

Terrana’s three-pronged approach includes: Prevent (priming plant immunity with RNA like a vaccine), Protect (delivering proteins post-infection), and Improve (adding traits like cry proteins or drought resistance). It’s already shown promise in tomatoes, corn, and soy.

The technology could significantly cut pesticide applications due to the RNA treatments persisting in plants. In Brazil, for instance, this could mean going from 16 fungicide sprays per season on soybeans down to just one.

Source: AgFunder

🤔 Thoughts

This kind of in-season intervention acts as a practical buffer, helping farmers maintain yields without having to relocate orchards or wait years for new, climate-adapted varieties. It reflects a growing demand for tools that enhance climate resilience within cropping systems.

The platform hints at a more “programmable” future, where growers update crop traits between seasons rather than over decades of breeding. However, each new RNA recipe will likely still need development, approval, and manufacturing.

It also tackles another major challenge: agriculture’s heavy reliance on chemical fungicides and insecticides, which are becoming less effective and more tightly regulated. Terrana’s RNA spray offers a targeted biological alternative, delivering protective molecules that persist and replicate within the plant. This enables season-long protection while minimising labour, cost, and environmental impact.

If cost and regulation align, RNA sprays could reduce demand for traditional chemicals, and gene-silencing tools like RNA sprays could become central to the next wave of precision biologicals. Early regulatory moves, including the EPA’s 2024 approval of an RNA-based insecticide, suggest momentum is already building. Yet global harmonisation and cost will ultimately determine how fast this shift happens.

🇮🇱 Algocell raised $2.8M in pre-seed funding to enhance its AI-driven digital twin platform for biomanufacturing

The startup uses machine learning to simulate biological processes, helping teams move more efficiently from lab experiments to commercial production. This approach targets longstanding bottlenecks in biomanufacturing, like achieving consistent yields and reliable process outcomes.

Algocell’s platform is built to support various sectors, including cultivated meat, precision fermentation, therapeutics, and sustainable chemicals. Its goal is to ease the scale-up process, lower production costs, and shorten development timelines.

One key feature is its ability to generate useful insights from limited data, reducing the need for repeated physical trials. This helps R&D and production teams test ideas faster, maintain product consistency, and make informed decisions during scale-up.

Source: Protein Production Technology

🤔 Thoughts

AlgoCell’s fundraise is another marker of the bio-industry’s gradual shift toward Bioprocess 4.0 - integrating AI, digital twins, and automation into manufacturing. While full adoption is still concentrated in big-pharma pilots, the trend is clear.

This mirrors what happened in other industries with digital transformation, although biology’s inherent variability and GMP rules slow roll-out compared with, say, automotive. Companies in food tech and biotech will increasingly compete on process technology innovation as much as on product innovation.

A notable claim from AlgoCell is that its models generate useful predictions from small datasets, potentially opening advanced process control to data-poor start-ups and making it more accessible. We might also see industry standards and collaborations emerge. For instance, consortia sharing data to improve AI models or large firms acquiring startups like AlgoCell to internalise this capability.

GEEK ZONE

Latest scientific research papers

🦠 Evolved soil microbes turned waste straw into feed protein with 280% more protein

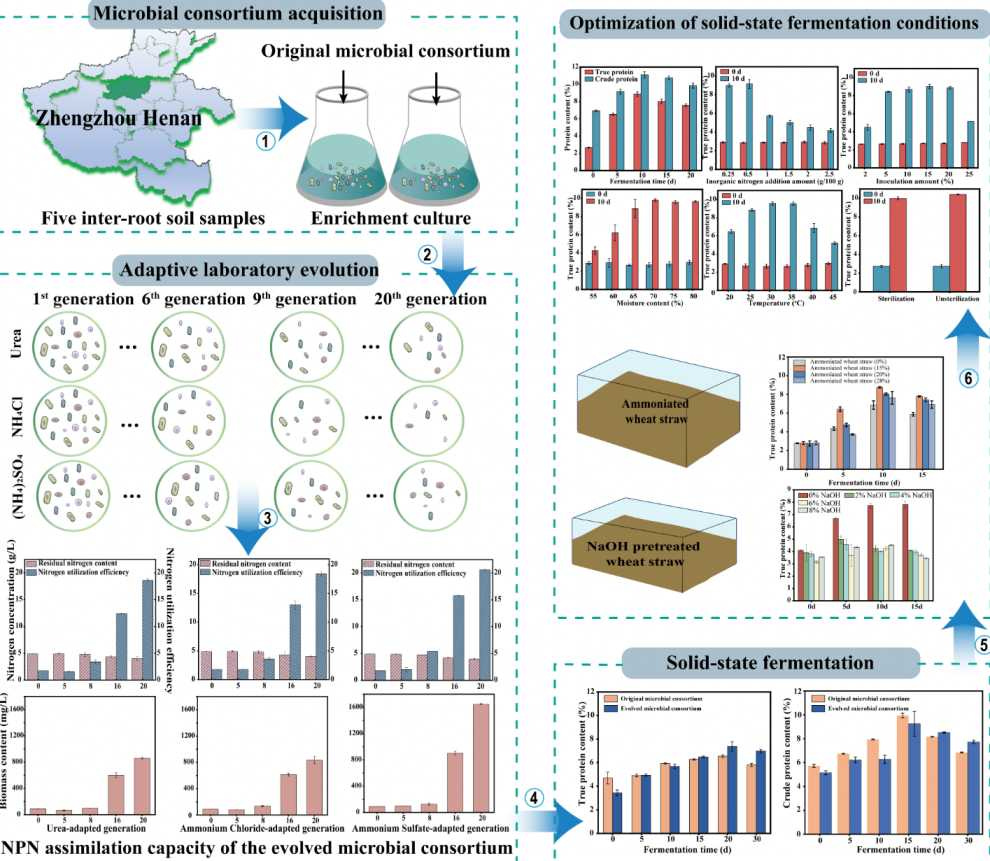

Researchers used adaptive laboratory evolution to engineer a soil-derived microbial consortium that can tolerate and assimilate up to 5 g/L of non-protein nitrogen (NPN) including urea, ammonium sulfate, and ammonium chloride, using wheat straw as the only carbon source. The evolved consortium was applied in solid-state fermentation to convert wheat straw into high-protein animal feed.

Compared to the original, the evolved microbes handled 4× more NPN, performing best with ammonium sulfate. Under optimised conditions, they raised the true protein content of wheat straw from 2.74% to 10.42%. At a 2.5 kg scale, results held steady with 11.6% true protein, 15.34% crude protein, 82.4% NPN conversion, and less than 0.1% nitrogen leftover.

This approach enables low-cost, scalable biotransformation of agricultural residues into protein-rich animal feed without sterilising the substrate. It offers a climate-smart alternative to imported soybean meal, addressing protein shortages and valorising crop waste.

Source: Microorganisms

🧀 Purple bacteria bioprocess from dairy waste valorisation achieved 64% protein and 85% digestibility, outperforming soybean meal

Researchers set up a two-step process to turn deproteinated cheese whey (DCW) into single-cell protein. First, they ran acidogenic fermentation in 1-L and 9-L anaerobic reactors to produce volatile fatty acids (VFAs). These VFAs were then fed to purple phototrophic bacteria (PPB) cultures for protein production.

The 9-L setup reached 84% acidification and supported PPB growth with 64% protein content (per gram of total suspended solids). With a productivity of 379 mg L⁻¹ day⁻¹ and total digestibility around 85 %, it beat soybean meal (67 %) and matched fishmeal.

The approach offers a way to turn dairy waste into high-protein microbial feed, potentially as a scalable, circular alternative to conventional feed ingredients.

Source: Bioresource Technology

🌾 Overexpressing a single gene increased rice seed germination by 40% after ageing, improving seed storability

Researchers overexpressed OsABA2, a key abscisic acid (ABA) biosynthesis gene, in rice. Transgenic lines were evaluated under artificial ageing (42 °C, 100% humidity) for up to 20 days. They also tested a commercially relevant hybrid parent line, Gang46B.

Seeds with OsABA2 overexpression reached 93% germination after ageing, compared to 53% in the wild type. They had 40% less hydrogen peroxide, up to 54% lower MDA (a marker of oxidative damage), 4-5× greater catalase and antioxidant activity, and smaller losses of sugars and starch. Gang46B also saw clear gains in membrane stability and storability.

With seed ageing causing an estimated 15 billion kg of rice loss annually in China alone, OsABA2 offers a targeted, largely yield-neutral strategy to extend seed shelf life in commercial lines.

Source: Rice Journal

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Disclaimer: Better Bite Ventures, where I work, is an investor of Prefer.

Hi Eshan, how are you doing on this very nice day? Thank you very much for awesome issue #109. My, how time flys! It seemed just like last week that you published issue #100. Thanks for keeping us updated on some of the more important developments in the alt protein space. The community appreciates all your hard work and efforts. Have a wonderful week my friend 👍❤️