€54M for Dutch Fermented Proteins, and First Real-Time Crop Disease Alerts

Also: Bee-saving RNAi, precision fats from waste, and AI for smarter seeds.

Hey, welcome to Issue #118 of the Better Bioeconomy newsletter, a curated look at the latest in biotech for food and agriculture, covering commercial developments, funding rounds, scientific breakthroughs, and commentary. Thanks for being here! 👋🏾

Quick note: If you're an investor active in agrifood tech, I’d love to connect and exchange notes on what you’re seeing, what I’m picking up, and where things might be heading. If you’re up for a quick chat, grab a time here, or feel free to reach out at eshan@betterbite.vc if none of the times work.

In case you missed it, I recently wrote about the “fund-returner” math in venture capital through an agrifood lens. The piece breaks down what it means to “return a fund” and demystifies the numbers behind VC.

The goal is to help you see how this math shapes valuations, ownership negotiations, and follow-on decisions in agrifood tech. To keep it concrete, I used a fictional example of Better Bioeconomy Capital ($20M pre-seed fund) and AgroLugia, an early-stage biofertiliser startup.

TL;DR

Ownership × exit value drives fund returns

6-10% at ~$200-330M can return a $20M fund

What I covered:

🧩 How dilution shifts fund-return odds (and why follow-ons matter)

🏭 Where agrifood-specific dilution creeps in

🤝 Why M&A is the base case for agrifood tech exits, and how buyer mix changes cash vs stock

💵 DPI vs TVPI: unrealised vs real distributions

📊 Scenario grid: ownership × exit to sanity-check outcomes

⏳ Quick IRR primer: timing changes identical dollar outcomes

As always, my understanding evolves as I dig deeper. If you spot something I’ve missed or got wrong, let me know. Thanks to everyone who shared their feedback last week. It helps me better understand the space!

Alright, let’s get into it #118!

BIO BUZZ

Products, partnerships, and regulations

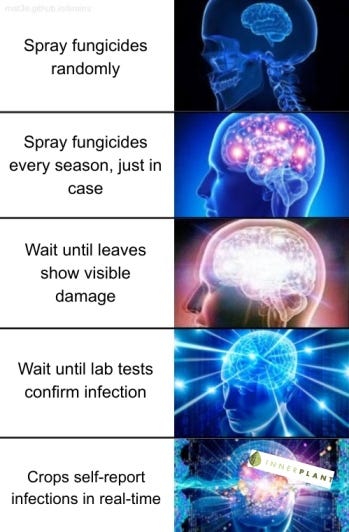

🇺🇸 InnerPlant achieved ‘world’s first’ real-time fungal infection detection in soybeans

InnerPlant’s CropVoice network identified infections in South Dakota and Nebraska before any visible symptoms appeared, giving farmers the chance to act earlier. With timely alerts, growers can apply fungicides when they’re most effective, helping reduce costs, limit risk, and protect yields.

CropVoice relies on InnerSoy™, soybeans engineered to emit optical signals when infected, and layers in lab analysis, scouting, weather data, and advanced modelling. This combination provides reliable, real-time alerts backed by scientific expertise.

InnerPlant’s network already spans 50,000 acres across Illinois, Iowa, Nebraska, and South Dakota in 2025 and is scaling quickly through major retailer agreements to cover over half a million acres by 2026.

Source: CropLife

🤔 Thoughts:

Early disease alerts that arrive weeks before visible crop damage could fundamentally change how and when farmers use fungicides. Instead of spraying prophylactically (preventative, blanket), growers can wait for a verified infection and target treatments at the right time and place.

In practice, that means reduced unnecessary chemical use, potentially big cost savings, and environmental benefits. Major players are already leaning in, eg: InnerPlant is working with John Deere and Syngenta to connect plant-generated infection signals with See & Spray equipment and optimized fungicide programs.

The rapid growth of InnerPlant’s CropVoice network also points to a data flywheel. Each new acre adds sensor data that sharpens detection models and builds trust. The result: early detections prove their value, adoption spreads, and the system keeps getting smarter.

🇺🇸🇰🇷 Michroma partnered with CJ CheilJedang to scale fermentation-based natural pigments

Michroma’s deal with the South Korean food giant gives it access to global biomanufacturing capacity, raw material procurement, advanced production processes, and regulatory compliance expertise. The move aims to secure a reliable supply as demand for natural colourants grows, driven in part by broader shifts such as the FDA’s move to phase out synthetic dyes.

The company’s CRISPR-enhanced fungal pigments are designed to withstand a wide range of pH and temperature conditions, including baking, pasteurisation, and extrusion. They provide much higher colouring capacity than beetroot extract, requiring less product for the same effect, claims Michroma.

Michroma has signed multiple letters of intent, completed paid pilot projects, and is preparing to file a U.S. colour additive petition. It plans to launch with pricing competitive to other natural options, with a longer-term goal of becoming the most affordable natural solution on the market.

Source: AgFunder

🤔 Thoughts:

Michroma says its fermentation-derived colours hold up better to pH swings and heat than many plant-based options. If customer data confirms that, brands could more easily standardise clean-label reds across more product types with fewer reformulations.

What I’m watching next: a major bakery or cereal brand rolling a natural red across multiple SKUs, or announcing a partnership with a biotech color supplier.

🇨🇭🇺🇸 Syngenta partnered with Heritable Agriculture to use AI to determine the best vegetable varieties to offer growers

Syngenta Vegetable Seeds has partnered with Heritable Agriculture, an AI-driven company founded at Google X, to bring advanced decision science into seed selection, ensuring growers get varieties that truly fit their needs.

Heritable’s AI draws on global trial data, genetics, climate patterns, and soil conditions to predict how seeds will perform down to a 10-meter resolution. This level of detail makes it easier to match varieties to specific environments.

Traditionally, seed companies have relied heavily on testing and grower feedback, a time-consuming process. With AI, these steps are complemented and sped up, reducing inefficiencies and helping growers access the right seeds faster.

Source: Food Ingredients First

🤔 Thoughts:

For incumbents, partnering with AI specialists brings in advanced capabilities without the heavy lift of building them in-house. Syngenta’s recent moves, from adding an AI chatbot to its Cropwise platform to now teaming up with Heritable, show how big players are actively bringing external expertise into their operations.

For startups, the appeal runs the other way: access to an incumbent’s decades of data, agronomic know-how, and global distribution gives their models a proving ground that would be impossible to create alone. This kind of incumbent-startup synergy could become the norm as agriculture grapples with complex challenges that marry data science with biological expertise.

Heritable’s platform applies machine learning to uncover patterns breeders might miss. That means (from my understanding) it could analyse how a pepper variety’s genome interacts with local soil pH and climate, or how a tomato hybrid fares given both humidity levels and consumer demand for shelf-life.

If successful, it could mean micro-zone recommendations: within a single region, Variety A might be better suited to cooler, low-lying fields, while Variety B performs better on slightly higher, drier ground.

🇺🇸 GreenLight Bio’s RNA-based treatment gets EPA approval as ‘first’ nature-based solution against mites that threaten honey bee colonies

The approval gives US beekeepers a new tool when existing chemical treatments are becoming less effective due to resistance. According to the Honey Bee Health Coalition, 1.7M colonies were lost in under a year, with commercial beekeepers seeing an average 62% loss, raising concerns for food production and farm costs.

Norroa’s active ingredient, vadescana, works through RNA interference. This natural process specifically targets varroa mites and stops their reproduction. It offers a new mode of action, breaks down quickly in the environment, and provides up to 18 weeks of mite control, longer than current options.

Field trials confirm that Norroa improves overall colony health, does not harm brood, workers, or queens, and fits into sustainable agricultural practices by targeting mites precisely without affecting biodiversity.

Source: AgriBusiness Global

🤔 Thoughts:

This approval shows that precision biologicals (targeted, biotech-driven pest controls) are gaining trust and expanding beyond crop use into pollinator protection. Biotech tools that first proved their value against row crop pests (RNAi biopesticides already have field validation) are now being adapted to critical ecosystem partners like honey bees.

This cross-over suggests regulators and industry increasingly view RNAi as a versatile platform for sustainable pest management, paving the way for targeted biocontrols in apiculture and potentially to other areas that have long depended on broad-spectrum chemicals.

🇵🇭 IPL Biologicals, Mitsui and Ag Smart team up to bring next-gen biopesticides to the Philippines

IPL Biologicals (India), Mitsui India, and Ag Smart Philippines have entered a tri-partite agreement to register, market, and distribute biopesticides in the Philippines. The partnership aims to reduce dependence on chemical pesticides by introducing IPL’s bio-based solutions.

IPL Biologicals offers one of the broadest portfolios in agricultural biologicals, with more than 50 products covering pest and disease management, plant nutrition, and soil health.

In this collaboration, Mitsui brings global reach and investment strength, Ag Smart provides local distribution expertise, and IPL contributes its product range, creating a strong platform for advancing sustainable agriculture in the region.

Source: AgriBusiness Global

🤔 Thoughts:

By combining IPL’s microbial portfolio, Mitsui’s global scale, and Ag Smart’s local network, this collaboration shows how deploying biologicals in fragmented smallholder markets depends less on brand recognition and more on coalition building.

We may see this template replicated across Southeast Asia, where farm structures are similarly fragmented and extension services are relatively thin. Scaling sustainable inputs in the region will depend on pairing product innovation with trusted last-mile distribution which is a role local partners are uniquely positioned to play.

BIO BUCKS

Funding, M&As, and grants

🇳🇱 The Protein Brewery raised €30M Series B to scale fungal protein targeting active nutrition, better-for-you snacking, and GLP-1 markets

The Protein Brewery’s ingredient, Fermotein, is a fungi-based, high-protein, high-fibre ingredient derived from Rhizomucor pusillus. It has already been cleared in the US and Singapore and is awaiting approval in Europe and the UK.

At present, the Dutch startup’s Breda pilot plant produces 100kg/day of mycoprotein, and new funding is set to increase capacity for industrial-scale rollout.

Thanks to its neutral taste, smell, and colour, Fermotein can be used in a wide range of products, from drinks and nutrition bars to non-dairy milks, bakery goods, and snacks. Several launches are planned in the active nutrition and keto-friendly snacking space. The company is also exploring the GLP-1 nutrition space.

💰 Investors: Invest-NL, Brabant Development Agency, Novo Holdings, Unovis Asset Management, and Madeli

Source: Green Queen

🇩🇰 Gates Foundation and Novo Nordisk Foundation extended the Acetate Consortium with $25.6M to turn CO₂ into proteins

The renewed $25.6M investment builds on the original $29M project launched in 2023. During Phase 1, the consortium developed a CO₂-to-acetate platform, created microbial strains that grow entirely on acetate with more than 40% protein content, and set up pilot facilities at Aarhus University. They also identified electricity and infrastructure as the biggest cost challenges.

The process works by capturing CO₂ and converting it into acetate through electrochemical methods. This acetate then feeds microbes, producing proteins that could potentially provide food for over a billion people each year, without relying on sugar or farmland.

In Phase 2, the consortium brings partners from universities, industry, and the food innovation hub Spora. Their efforts will centre on optimising the technology and scaling up production. They will also work on developing food prototypes and evaluating their economic and environmental impacts, to make the results practical and appealing.

Source: Green Queen

🤔 Thoughts:

It’s encouraging to see major philanthropic foundations stepping in as patient, risk-tolerant capital for early food tech. By backing CO₂-to-acetate protein work that private funding might view as too early, they’re taking on the riskiest development phase. In this case, philanthropy acts as catalytic capital, validating platforms and clearing the way for later-stage investors or corporate adoption.

What’s also encouraging is the shift from lab experiments to real food prototypes, with Michelin-starred chefs now involved. That signals CO₂-derived proteins moving beyond technical feasibility into tasting and texture trials. Bringing culinary experts into the process is a deliberate step to translate fermentation outputs into dishes people might actually want, while keeping cultural fit in view.

🇳🇱 Revyve raised €24M in Series B to scale up yeast-based proteins that replace eggs and ultra-processed additives

With this investment, the Dutch startup will expand its team and strengthen collaborations with food manufacturers from multiple continents. It aims to bring new products to market, meet demand at commercial scale, and keep margins positive.

Using Saccharomyces cerevisiae yeast, Revyve applies a proprietary mechanical process that produces clean-label, highly functional, taste-neutral, gluten-free proteins and fibres.

Already in-market for dressings, sauces, bakery items, snacks, and meat alternatives, Revyve is building a versatile ingredient portfolio. Ongoing R&D is focused on replacing even more egg-based and synthetic additives in everyday food categories.

💰 Investors: ABN AMRO Sustainable Impact Fund, Invest-NL, Brabant Development Agency, Danstar Ferment, Grey Silo Ventures, and more.

Source: Green Queen

🤔 Thoughts:

One input delivering gelling, foaming, binding, and emulsification in targeted applications consolidates what used to be a bundle of additives. That consolidation nudges leverage upstream: if one supplier can meet multiple spec sheets and qualify across categories, switching costs rise and long-term supply deals become the norm.

On capital flows, the investor framing around cost competitiveness, scale, and functional performance signals a filter shift. Impact is useful but insufficient. Capital concentrates on near-term unit economics, validated manufacturing, and contracted demand. Still, a subset of early-stage investors engages earlier, provided the technical path to parity is credible.

🇺🇸 ArkeaBio secures $7M in first close of Series A+ round to advance methane-reducing livestock vaccines into field trials

Along with the funding to move its vaccine from animal studies into field trials set for 2026-2027, ArkeaBio appointed Frank Wooten (cofounder of virtual fencing company Vence) as CEO, following the recent hire of Dr. Zach Serber (ex-Zymergen) as CTO.

The vaccine prompts cows to produce saliva antibodies that weaken methanogens, letting other microbes take over. This reroutes hydrogen away from methane production and into volatile fatty acids, which cows can convert into energy for milk and meat. Unlike feed additives that must be administered continuously, the effects of a vaccine are sustained, claims the company.

ArkeaBio aims for an initial 10-15% methane reduction, possibly reaching 20-25% in future versions. At that level, cows could gain ~2.5% more usable energy, supporting productivity. The regulatory pathway remains unclear, though in some markets the vaccine may be treated more like a feed additive than an animal drug.

💰 Investors: Breakthrough Energy Ventures, AgriZeroNZ

Source: AgFunder

🤔 Thoughts:

Seaweed and chemical additives can cut methane sharply in trials, but only if cattle consume them frequently. That dependence on continuous dosing creates a structural bottleneck since most of the world’s herd is pasture-grazed and outside controlled feeding systems. In effect, feed-based solutions can’t reach them.

A vaccine shifts the constraint. Instead of building global supply chains to deliver additives at every meal, the challenge moves upstream to biology: can an immune response last not just a few months, but through a full lactation cycle? Once inoculated, the cow itself becomes the delivery system, continuously producing antibodies that suppress methane-generating microbes.

Early data suggest modest methane reductions per animal, but the broader applicability means a vaccine could form the foundation layer of mitigation. Feed additives, genetics, and management practices can then be layered on top. What’s emerging is less a single fix and more a stacked pathway for livestock climate solutions.

🇸🇬 Terra Oleo emerged from stealth with $3.1M funding and a spot in Bill Gates’s Breakthrough Energy cohort

The Singapore-based startup1 has secured $3.1M and a place in the 2025 Breakthrough Energy Fellows programme, founded by Bill Gates. The program is designed to help climate-smart early-stage innovators move from lab to market by providing capital and mentorship.

The startup’s precision fermentation platform turns low-cost agro-industrial waste into palm oil and cocoa butter alternatives. By engineering yeast to produce application-ready lipids, the process avoids energy-intensive refining and toxic byproducts while reducing emissions by 86%, land use by 90%, and water use by 88%.

With manufacturing in Singapore and Thailand, Terra Oleo is already working with global and regional leaders across food, cosmetics, pharmaceuticals, and personal care on product testing and validation.

💰 Investors: ADB Ventures, The Radical Fund, Elev8.vc, Better Bite Ventures, and a ‘strategic corporate investor’.

Source: Green Queen

🤔 Thoughts:

Instead of going after bulk commodities, Terra Oleo is engineering yeast to produce use-case-specific oils designed for functions like cocoa butter or speciality cosmetics. This move away from generic fats toward tailored lipid profiles points to a bigger shift: fermentation companies are carving out niches where precision and higher margins matter more than scale.

The sharper lens here is the high-margin end of the value chain. Palm oil as a commodity is low-margin, but derivatives like emollients, surfactants, and confectionery fats sit higher up the value curve. By targeting those first, Terra Oleo signals a route for biotech to enter commodity markets via its most profitable segments. It’s less about taking on plantations directly today and more about building a beachhead where incumbents have a limited cost advantage.

🇮🇱 Finally Foods raised $1.2M from CBC Group, which also becomes its first major customer, to scale potato-based dairy protein production

The Israeli molecular farming startup has signed a commercial agreement with CBC Group following its first field trial. The trial showed that engineered potatoes grow just like regular ones while generating enough biomass to move protein extraction from the lab to an industrial scale.

Finally, Foods uses a cost-efficient extraction process built on existing industrial methods and designed to meet regulatory standards. Depending on local market opportunities, the company also plans to use by-products like potato starch.

Unlike microbial systems that produce casein proteins separately, Finally Foods said its potato platform can generate all four casein subunits in a single plant. These proteins naturally form micelles inside the potato, offering a more straightforward route to casein proteins for dairy applications.

Source: AgFunder

🤔 Thoughts:

Having a first major customer also step in as an investor is a strong validation signal for molecular farming. For CBC, early equity and supply help secure a potential edge. For Finally, customer-led financing provides both funding and a market commitment (though no agreement details have been disclosed), helping de-risk its path to market.

If this model gains traction, it could become a prominent route for molecular farming companies, particularly at a time when VC appetite for early-stage food tech remains muted. The open question is how this model scales. Do customer-anchored rounds pull VCs in earlier by reducing risk? Or do they push VCs further downstream, leaving strategics to own the riskiest stage?

EAR FOOD

Podcast episode of the week

🎙 How scientists and farmers work together to turn new crop traits into on-farm solutions

Corteva’s discovery scientists collected soil and plant samples from around the world to identify natural proteins with beneficial properties. For example, a soil bacterium in Iowa yielded a protein that was effective against corn rootworms.

The trait characterisation team at Corteva tests new genes to confirm they work as intended (eg: pest control, herbicide tolerance) while making sure they don’t compromise yield, plant maturity, or other agronomic traits.

Growers host Corteva’s field trials on their farms, where new traits are tested under real-world stressors such as drought, weeds, and pests. These trials give critical feedback on performance before traits go commercial.

Corteva’s soybean growth chamber speeds up breeding by manipulating light cycles to compress growing seasons. This enables researchers to shave months off development timelines and deliver new traits to farmers more reliably.

From discovery scientists mining biology to breeders integrating traits, regulators ensuring safety, and farmers stress-testing in the field, trait innovation is a coordinated team effort to meet evolving challenges in farms.

Guests: Julian Chaky (Corteva Agriscience), and Mark Knupp (farmer)

Podcast: Agriscience Explained

APAC AGRI-FOOD INNOVATION SUMMIT

Don’t miss your chance to attend the Asia-Pacific Agri-Food Innovation Summit and get 10% OFF with my network code. From breakthrough food systems to next-gen agri-tech, this is where Asia’s innovation leaders connect, collaborate, and create impact.

👀 Use my exclusive partner code for 10% OFF your pass: BIO10

Learn more: https://tinyurl.com/s9k5x3d7

See you in Nov!

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Disclaimer: Better Bite Ventures, where I work, is an investor of Terra Oleo.

Hi Eshan! How are you doing on this wonderful fall day? Fantastic issue #118. You provide so much excellent information that I know nothing about. I'm retired from the real eatete business, and live in the heart of Los Angeles. I use my small property as my 'farm.' Ha ha! It's even less than homesteading, but it's very educational on how hard real farmers work every day. Thank you Eshan for keeping your subs updated on some of the latest and greatest developments in the space. Wow! This is a wonderful and exciting time to be alive to see all these great positive developments in food safety and production. Have a very nice and peaceful week. Do something extra special just for you this week 👍❤️