Air-Grown Food Factory, Mosa Meat Raised €40M, and EU Tastes Cultivated Meat

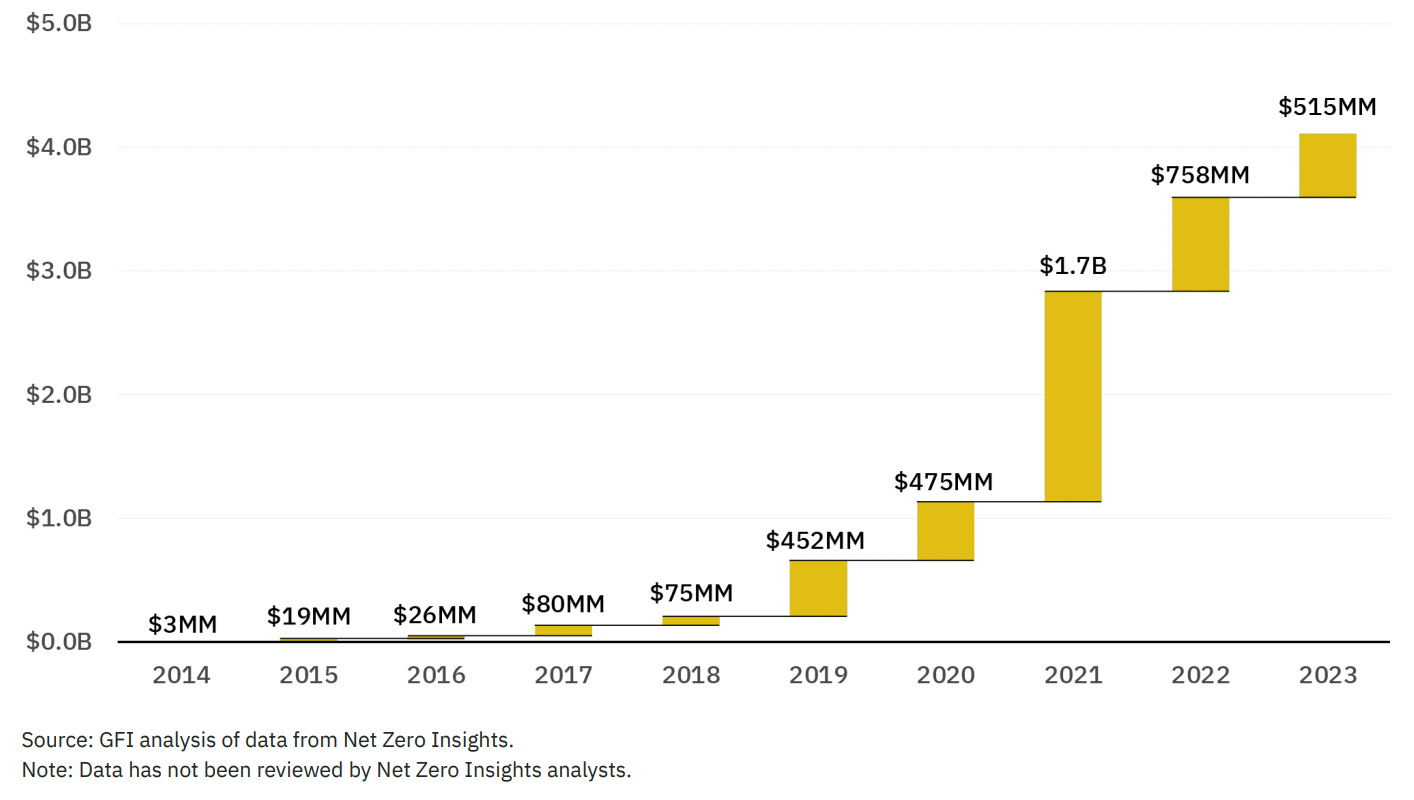

Also: Total investments in fermentation reached $4B

Hi, welcome to issue #61 of the weekly newsletter. Thanks for being here!

Here’s my favourite quote that I came across this week:

“Cultivated meat isn’t a dystopian future, factory-farmed meat is a dystopian present.”

Let’s dig into the latest developments in biotech-enabled food innovation! 🍽

BIO BUZZ

💨 Solar Foods opened Factory 01 in Finland, claimed to be the world’s first factory growing food out of thin air

The Finnish startup's factory is set to produce 160 tons of Solein annually. Solein is a protein made from CO2 and electricity. It was previously only produced in small amounts at a pilot lab.

The production process in Factory 01 is equivalent to the protein output of a 300-cow dairy farm per day but without the environmental impact and demands of traditional agriculture.

The new facility also acts as an R&D hub for future product development. The data collected from here will help the development of another facility, Factory 02.

Source: vegconomist

🇪🇺 Meatable conducted the first public tasting of cultivated meat in the EU

The pork sausage offered at the tasting is a hybrid product, consisting of 28% cultivated pork fat mixed with plant-based ingredients. The feedback from the tasting events will be used to refine the product.

Meatable plans to enter the Singapore market later this year, pending regulatory approval from the Singapore Food Agency. The Dutch company has already conducted two tasting events there.

The hybrid meat strategy is seen as a necessary step for making cultivated meat commercially viable in the short term. This approach aims to improve taste and meet the expectations of meat consumers.

Source: Green Queen

🥛 Nobell Foods rebranded as Alpine Bio and secured its 10th US patent

While continuing to use the Nobell Foods brand for its upcoming cheese products that use animal-free casein, Alpine Bio is expanding its scope to include the development of up to 15 different proteins that can be expressed in various plants.

The molecular farming company has developed a substantial database and intellectual property (IP) portfolio focused on producing recombinant proteins in plants. Alpine Bio's latest patent encompasses the production of these proteins and their application in food formulations.

The company's immediate focus remains on launching cheese products through the Nobell Foods brand. However, the overarching goal is to make plant-derived casein widely accessible to the public under the Alpine Bio brand.

Source: AgFunder

🤝 ProteinDistillery partnered with NETZSCH Group to improve the purification process of Prew:tein

Prew:tein is a fermentation-derived protein from upcycled brewer’s yeast that delivers functionality similar to egg whites. NETZSCH will provide specialised machinery to isolate Prew:tein and also co-develop new purification techniques.

The partnership allows NETZSCH to enter the alt protein industry, using its expertise in manufacturing machinery and instrumentation. It aligns with the company's 150-year history and global presence in production and service.

In the long term, the collaboration aims to scale production, facilitate market expansion, and accelerate the growth of ProteinDistillery.

Source: vegconomist

🍺 Researchers at Nanyang Technological University developed a method to extract 80% of proteins from a beer production byproduct

Brewers’ spent grain (BSG) makes up 85% of the waste from the brewing industry, with a global annual production of 36.4 million tonnes. Current uses of BSG include animal feed, biofuel production, and compost, but a significant amount still ends up in landfills, releasing GHGs.

In partnership with Heineken’s Asia-Pacific division, NTU researchers used a fermentation process with Rhizopus oligosporus to break down BSG. The researchers managed to extract 200g of protein per kg of BSG.

NTU is expanding discussions with Heineken Asia Pacific to scale up its protein extraction method and is seeking partnerships with F&B companies to commercialize the technology.

Source: Green Queen

✅ Kemin Industries received EU Novel Food authorization for microalgae-derived beta-glucan supporting gut health

BetaVia Pure, derived from the algae Euglena gracilis, is a 95% beta-1,3-glucan paramylon ingredient. It is produced through a patented fermentation process, featuring a neutral odour and colour, which improves its versatility.

BetaVia Pure has already obtained regulatory approval in several countries, including the US, Brazil, Japan, and China. It meets diverse dietary needs being GRAS, kosher, halal, vegetarian, gluten-free, allergen-free, and non-GMO.

The authorization allows Kemin to market BetaVia Pure across specific food categories. This includes food supplements for various age groups, diet replacements for weight control, and cereal bars.

Source: Food Ingredients First

⚡️ More buzzes

🍞 Il Granaio delle Idee (IGDI) collaborates with Ginkgo Bioworks to accelerate the growth rate of a new sourdough bakery strain. The strain improves the flavour and aroma profile of baked goods through IGDI’s starter culture product. (Ginkgo Bioworks)

🇵🇹 Portuguese non-profit biotech, GreenCoLab introduced three new algae-based prototypes: a microalgae alternative to sturgeon roe, a microalgae artisanal beer, and an algae-based burger. (vegconomist)

FIRST BITE

💰 Better Bite Ventures’ First Bite scheme is offering early-stage investments to food tech startups in the APAC region

Founders will receive investments of between US$ 50k-150k to help their projects get off the ground.

So far, Better Bite has backed 7 teams from idea to early R&D stage. To learn more, check out the two blog posts: first and second

Is your early-stage company decarbonising rice, palm oil, cocoa, fertiliser, or food waste in the Asia Pacific? Hurry up and apply!

Applications close April 30th

MACRO STUFF

📝 Learnings from GFI APAC's webinar on recent cultivated meat regulatory progress in APAC

In Australia, the application fee for a novel food application is ~A$200,000, posing a significant barrier to innovation, especially for startups. In South Korea, the regulatory approval process could take ~270 working days, and the cost of submission is US$30,000.

MUIS (Majlis Ugama Islam Singapura) suggested that labelling cultivated meat as an "alternative protein source" rather than just "meat" might improve its acceptance among halal consumers. This could differentiate it from traditional meat and better align with cultural and religious perceptions.

There is an opportunity for regulatory bodies across the APAC region to harmonise their approval processes. This could streamline market entry, reduce redundancy, and help companies looking to expand across borders.

Watch webinar: GFI APAC (YouTube)

💸 Total investments in fermentation reached $4B, with $514.7M raised in 2023

In Europe, funding grew by 22% to $179.4 million. The fermentation-based sector also saw a 22% increase in the number of unique investors, reaching a total of 693.

2023 also saw the opening of 7 new fermentation facilities and the formation of 19 new partnerships focused on product development and bioprocess scaling.

Last year, the White House released a Building the Bioworkforce of the Future report that called precision fermentation a growing sector in the US bioeconomy that will benefit from government investment.

Source: GFI’s State of the Industry Report: Fermentation

🇺🇸 Study shows that Americans prefer conventional meat but cultivated meat isn’t far behind despite its limited availability

According to a 1200-person survey by Purdue University, 96% of Americans are open to trying chicken in restaurants, with 67% willing to try cultivated chicken. For beef and pork, the openness is 94% vs 65%, and 88% vs 60% respectively.

Among those who are reluctant to try conventional meats, a considerable percentage would consider cultivated alternatives: 46% for chicken, 26% for beef, and 22% for pork. This indicates a potential market among non-meat eaters and those willing to try new options.

Consumers generally view traditionally farmed meats as tastier and healthier, scoring higher on both flavour and health compared to their cultivated counterparts.

Source: Green Queen

📈 The number of cultivated meat companies increased to 174 in 2023, up from 166 in 2022

In 2023, significant infrastructure developments occurred with the opening of 10 new facilities worldwide, including large-scale plants like Mosa Meat’s in the Netherlands and CellX’s in China.

Total investment in cultivated meat and seafood reached $3.1 billion since 2013, with $225.9 million raised in 2023 alone. However, this represents a decline from the $922.3 million raised in 2022.

Governments in the U.S., U.K., China, Japan, and Israel, among others, have increased their support for cultivated meat through public investments and regulatory advancements.

Source: GFI’s State of the Industry Report: Cultivated Meat and Seafood

BIO BUCKS

🍔 Mosa Meat raised €40M to support the company's growth and expand its production

The new funds will be used to improve the production processes at the Maastricht facility. This facility, which opened in May 2023, is touted as the world's largest cultivated meat facility.

The Dutch cultivated meat pioneer is actively seeking regulatory approvals across various global regions, including North America, Asia, Europe, and the UK, to accelerate its market entry.

Mosa Meat plans to launch its cultivated beef burger first in Singapore, pending regulatory approval. It’s also preparing for public tastings in the Netherlands.

Source: Green Queen

🌾 OlsAro raised €2.5M to expand its climate-smart crop breeding platform

The Swedish startup's salt-tolerant wheat has a 52% higher yield in Bangladesh's saline soils than local strains. OlsAro is also exploring heat tolerance and better nitrogen efficiency to decrease synthetic fertiliser use.

OlsAro uses two main development paths for its wheat varieties: first, by using EMS mutagenesis to create a diverse collection of over 2,000 wheat lines; second, by identifying genetic codes and developing SNPs for trait improvements via gene editing or marker-assisted breeding.

These processes are supported by a comprehensive database and AI-driven tools to speed up development and focus on traits like salt tolerance.

Source: AgFunder

SOCIAL FEAST

🔥 A message to cell ag founders from a founder: “Embrace the scrappy mindset, drop the inflated ego, and go back to the foundation”

Founders should prioritise building with transparency, honesty, and diligence rather than relying on deceptive promises and unrealistic expectations. It's vital to focus on small-scale process optimisation before scaling up.

Reforming the food system and funding mechanisms is essential for the success of this industry. This requires setting realistic goals and maintaining investor trust by avoiding exaggerated expectations and misinformation.

The industry should embrace a humble, scrappy approach, shifting from vanity metrics to meaningful strategies and carefully managing relationships with customers and investors.

Source: Jennifer Côté

🧫 Cell culture media are glorified sports drinks

Source: Elliot Swartz

MORE ON BETTER BIOECONOMY

🌏 APAC's March 2024: 10 noteworthy food biotech advancements

Singapore’s Umami Bioworks and Shiok Meats announced a merger to become a global leader in cultivated seafood.

India is progressing in establishing a regulatory framework for cultivated meat and seafood, with FSSAI formulating safety regulations.

Australia's Cauldron raised AUD 9.5M in Series A funding to scale up its precision fermentation platform.

Check out the full March 2024 roundup

💬 Bio Talks: Conversations with bioeconomy innovators

Synonym's co-founder, Joshua Lachter: Financing and Developing Infrastructure for the Bioeconomy

Bioshyft's founder, Gerrit Feuerriegel: Connecting Innovators, Investors, and Incumbents to Drive the Bioeconomy

Terra Bioindustries’s CMO, Rebecca Palmer: Turning Agrifood Byproducts Into Nutrient-Rich B2B Ingredients

That’s a wrap. Thank you for taking the time to read this issue!

Are you new here?

Know anyone else who would dig this newsletter?

Thanks for another kick ass issue! And thank you for all your wonderful efforts. The community appreciates you ✨️