Alt Seafood Alliance, Italy Bans Cultivated Meat, and Germany’s Big Protein Transition

Also: Scientists shouldn't become real estate developers

Hi there!

Before we dive into this week’s edition, I need to address a correction regarding last week's Bene Meat news. Last week, I mentioned that "Bene Meat Technologies is the first company to receive EU approval for producing and selling cultivated meat for pet food."

To clarify, Bene Meat is the first to list its cultivated pet feed on the official EU register. However, it's important to note that listing on the register is not equivalent to regulatory approval.

As reported on Green Queen, "Bene Meat has listed their cultivated cells of mammalian origin in the EU feed materials register... so it is true that cultivated meat could be classified as a feed material." It's important to emphasize that this listing is "not the same as an EU regulatory approval or certification."

Apologies for the mix-up! 🙏🏾

BIO BUZZ

🤝 Future Ocean Foods, an association for advancing alt seafood, has 36 inaugural members aiming to address challenges in the seafood industry

The seafood industry faces significant challenges, such as environmental issues, GHG emissions, and overfishing leading to the depletion of fish populations and marine ecosystems. Despite these challenges, global seafood consumption is projected to increase, creating a need for sustainable alternatives.

Future Ocean Foods seeks to build a more sustainable and ethical global food system through alternative seafood. The association is focused on community-building, knowledge-sharing, and collaboration among its members. It aims to raise awareness about the benefits of alternative seafood for human health and environmental sustainability.

The association collaborates with industry stakeholders, including seafood operators, advocacy groups, and research organisations. It plans to host events, publish reports, and spearhead a global study on the health and environmental benefits of alternative seafood.

Read full article - Green Queen

🍨 Yali Bio unveiled its precision-fermented dairy fat alternative with customisable attributes

The California-based food tech company focuses on formulating customised fats to enhance flavours and functionalities in plant-based alternatives for meat and dairy.

Yali Bio's neutral-flavored fat, customisable in attributes like melting point, has applications beyond ice cream, improving taste, texture, and nutritional profiles in non-dairy butter, cheese, baked goods, and candies.

The product contains half the saturated "bad fat" and five times the monounsaturated "good fat" compared to coconut.

Read full article - vegconomist

🇳🇱 Meatable has inaugurated a new pilot facility in Netherlands, aimed at expanding its cultivated pork production capacity

The inauguration follows a successful $35 million Series B funding round, bringing the Dutch biotech company's total raised capital for cultivated pork to $95 million. The new 3300 m2 facility is twice the size of the previous space.

The new facility boasts a bioreactor capacity of 200 L (potentially 500 L in the future), allowing Meatable to scale up its production from the previous 50 L. This increased capacity is a crucial step in preparing for a commercial launch in Singapore in 2024.

Meatable's strategic partnership with Esco Aster in 2022 positioned it as Singapore’s first cultivated pork producer. The new facility is a milestone in scaling and accelerating the commercial launch, bringing Meatable closer to its mission of creating sustainable cultivated meat products.

Read full article - vegconomist

🇦🇺 Magic Valley is expanding its production capacity to 150,000 kg of product annually by establishing an advanced pilot facility at Co-Labs

The Australian cultivated meat company plans to increase its production capacity to 3,000-litre bioreactors.

Magic Valley claims to have developed a scalable platform for growing various types of meat, such as beef, lamb, and pork, without using fetal bovine serum.

With a focus on innovation and scalability, Magic Valley aims to revolutionise the cultivated meat industry, positioning Australia as a key player in this rapidly growing sector, projected to be worth AUD$945 billion by 2040.

Read full article - vegconomist

🇵🇹 MicroHarvest launches pilot plant in Portugal, accelerating path to single-cell protein commercialisation

The in-house pilot plant allows MicroHarvest to operate beyond the lab scale, facilitating a faster journey towards commercialisation and market availability. The plant achieves a daily production of 25 kg.

The company aims to launch its first product within the next three months.

MicroHarvest's proprietary technology, capable of producing high-quality protein ingredients within 24 hours, offers a sustainable alternative with over 60% raw protein.

Read full article - Aqua Feed

🧬 SciFi Foods CEO on cultivated-plant hybrid meat: “SciFi Foods is not the future we fear. It’s the future we dream of.”

SciFi Foods recognises the emotional aspect of choosing meat alternatives and believes that the appeal of cultivated meat lies in more than just reducing animal deaths.

SciFi Foods opts for a hybrid approach, combining plant-based meat with cultivated meat cells. The company believes that introducing a product with cultivated beef cells as a key ingredient will attract a broad consumer base, including meat-eaters.

Despite the hybrid approach, SciFi Foods acknowledges challenges in cost and scale. The company has achieved price parity with conventional beef through innovative processes, including high-throughput cell line engineering and CRISPR technology.

Read full article - Green Queen

MACRO STUFF

💡 7 alt protein takeaways from GFI APAC’s State of the Industry Report

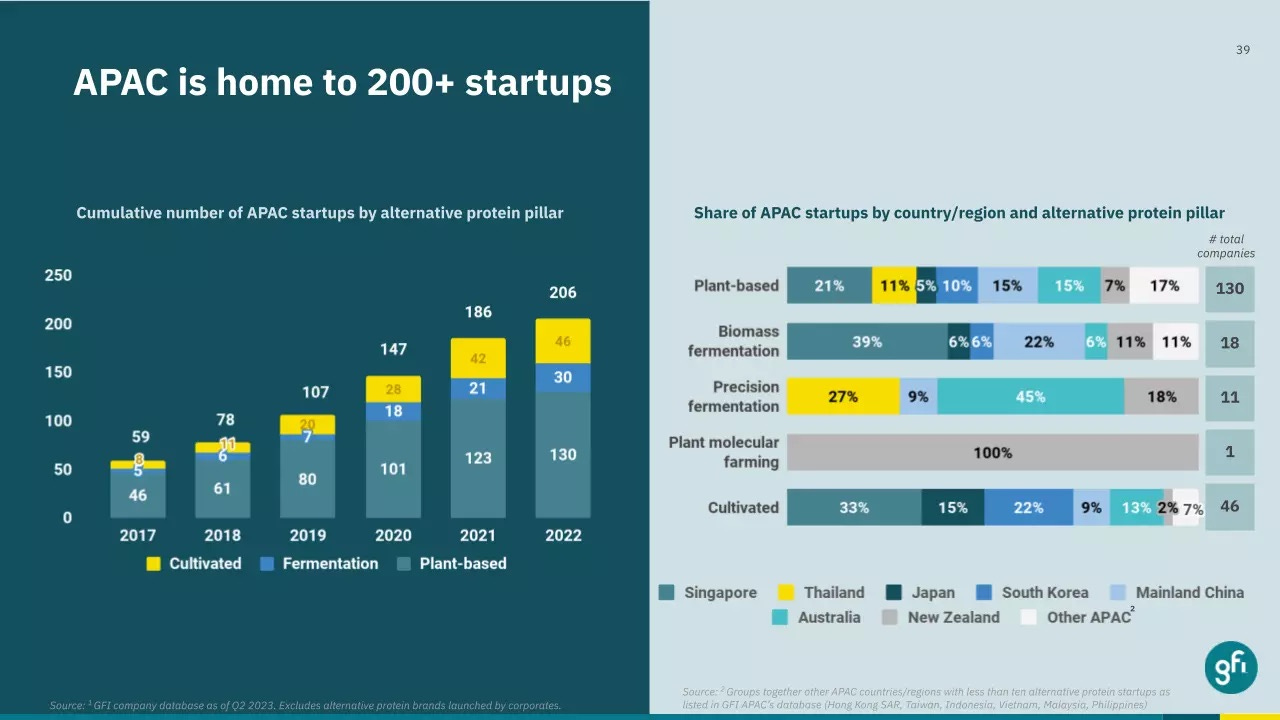

APAC private alt-protein investment reached a peak in 2022 but experienced a significant decline in the first half of 2023. Singapore, initially a leader, gave way to Australia/New Zealand in alt-protein investments in the first half of 2023.

APAC boasts a rapidly growing alt-protein business ecosystem with 206 startups, 20 of which launched in 2022. Singapore remains a global testbed for R&D, housing 24% of all alt-protein startups in APAC.

Despite record funding, alt-protein represents only 0.5% of climate finance. Alt-protein could significantly reduce environmental impact, with potential annual funding requirement of $10.1B.

Read all 7 takeways - Green Queen

🇬🇧 Alternative proteins could make up around a third of the UK protein market by 2040

Despite a 400% growth in the UK alternative meat market over the past decade, recent stagnation has raised concerns. The report states that improving taste, cost, and nutritional value is crucial for success.

To ensure the success of the alt protein market, the report recommends increased government support. This includes easing regulations, potentially accelerating the approval of cultivated meat, subsidizing retail prices of meat alternatives, and investing in research.

The report highlights the vast potential benefits of alternative proteins, including the production of tasty, nutritious, and affordable food without the environmental and animal welfare costs associated with factory farming.

“The forecast market share of alternative proteins falls from 32% to 14% in a scenario where cultivated meat fails to scale and achieve cost competitiveness”

Read full article - vegconomist

Read full report - Social Market Foundation

📉 Italy has passed a law that bans the production and sale of cultivated meat within the country

The law also includes a prohibition on using terms like ‘steak' and 'salami' on plant-based meat product labels. The move has been criticised for restricting food choices and negatively impacting the growing plant-based market in Italy.

The far-right government, led by Prime Minister Giorgia Meloni, justifies the ban by citing health concerns, a perceived threat to Italy's food tradition, and a need to protect the livestock industry.

The ban has sparked controversy and opposition from various corners in Europe. Critics, including the opposition and industry bodies, view it as ideological propaganda, stifling innovation, and possibly violating EU law.

Read full article - Green Queen

🚀 Cultivated meat is far from dead, but it’s time for a trillion-dollar moonshot

Despite FDA and USDA approvals for cultivated meat companies, the industry faces an "existential crisis" with challenges such as expensive inputs, bioreactor design, and expanding beyond burgers and meatballs. There is a need for a success story to secure investor confidence.

Some prominent cultivated meat companies, like Eat Just and Upside Foods, have faced financial challenges, including layoffs and questionable use of funding. The industry is grappling with the balance between raising substantial capital and using it judiciously.

Prolific Machines, backed by Breakthrough Energy Ventures, presents a potential breakthrough with an innovative approach to addressing challenges in cultivated meat production, reducing costs, and increasing yields. The industry needs not just bigger investors but also new ideas to overcome existing hurdles.

Read full article - Fast Company

New here? Devour the free subscription and join a list of founders, investors, and biotech enthusiasts leading the food revolution!

BIO BUCKS

🇩🇪 German federal budget 2024: €38M for “conversion of animal husbandry” and promotion of alternative protein sources

The budget includes funding for the conversion of animal husbandry to improved forms. Pig farms, for instance, will receive subsidies totaling at least 705 million euros until 2033 to support the transition to better forms of husbandry.

A clear commitment to the protein transition is evident through the allocation of funds for plant-based alternatives. This includes amending the protein crop strategy to prioritise proteins for human nutrition over animal feed and the creation of a competence centre, 'Proteins of the Future,'.

The budget allocates 8 million euros for the amended protein crop strategy, 20 million euros for transition support, and 10 million euros for production and processing methods in 2024.

Read full article - vegconomist

💰 $11.4M investment to advance novel plant-based food with a focus on creating a whole-muscle salmon product

The initiative involves a collaboration between three companies—New School Foods, Liven Proteins, and NuWave Research—to bring to market a plant-based whole-muscle salmon product. The product is designed to transform from raw to cooked, providing the same taste and texture as conventional salmon.

Each company in the collaboration brings specialized expertise to the project. New School Foods employs recently developed production techniques, Liven Proteins uses precision fermentation for animal-free proteins, and NuWave Research contributes with its patented vacuum microwave technology to expedite production processes.

The project receives a total funding of $11.4 million for research and development. Protein Industries Canada invests over $4.5 million, with consortium partners funding the remaining portion.

Read full article - vegconomist

🍫 The vegan chocolate market to reach $2B in 2032 at a CAGR of 13.1%

The increasing demand for vegan chocolate is attributed to a heightened focus on sustainability, animal-friendly options, and the perceived health benefits of plant-based products.

Potential constraints on the market include limited production capacity, difficulties in sourcing ingredients at reasonable costs, and the intricate process of replicating the taste and texture of dairy-based products in plant-based chocolate.

To overcome challenges, the report suggests using innovative ingredients and superfoods such as chia seeds, goji berries, acai powder, or spirulina. Unique flavours like chilli, matcha, and lavender are recommended to help plant-based chocolate products differentiate themselves in the market.

Read full article - Allied Market Research

🇨🇦 Protein Powered Farms, Canada’s largest plant protein extraction facility, acquired Lovingly Made Ingredients

The acquisition allows Protein Powered Farms to expand its offerings, including pea and faba proteins for dairy-free products and fibers made from pulses. The newly acquired facility in Calgary, Alberta, will be open for co-manufacturing opportunities, providing customised plant protein blends for various applications.

Meatless Farm, the previous owner of Lovingly Made Ingredients, faced bankruptcy but was successfully taken over by VFC. Despite the challenges, Meatless Farm quickly resumed operations, and its products were relisted at major retailers.

The CEO of Protein Powered Farms, Heidi Dutton, believes the acquisition enhances the company's ability to meet client needs, while the President of Lovingly Made Ingredients sees the vertical integration as a source of expertise and innovation for a customer-focused business.

Read full article - vegconomist

Last call to apply for Vevolution Pitch & Plant 2023

Are you building the future of plant-based, food tech, cellular agriculture, or next-gen materials? The final and biggest Vevolution Pitch Event of the year is scheduled for December 7, 2023! Complete your application by the deadline of November 20.

How to qualify in two easy steps:

1. Upload your investment round to Vevolution: https://lnkd.in/ew6DdKTF

2. Fill out the application form: https://lnkd.in/eCQ8VPRj

The investor panel for Pitch & Plant 2023:

Uwe Richter of REWE Group

Ricardo Brás of Sonae SparkFood

Heather Courtney of Alwyn Capital

Lykke Westgren (Abdon) of Nicoya Capital

REWE Group, SparkFood, Alwyn Capital, and Nicoya Capital all share the common goal of investing into a more innovative food system. The Pitch & Plant 2023 jury invests in companies focused on alternative proteins, food as medicine, sustainable value chain, biotech solutions, and next-gen materials. Portfolio companies of the jury include: Bluu Seafood, Evra, Bon Vivant, Foodiq, Oatlaws, New School Foods, Geltor, and others.

SOCIAL FEAST

🚫 VCs, stop your portfolio companies from building private lab spaces

VCs should discourage their portfolio companies, especially those in early stages with less than $10 million in capital, from investing in private lab spaces. The focus should be on developing a viable product rather than getting caught up in unnecessary real estate ventures.

Highlight the importance of directing resources towards achieving commercial viability rather than getting distracted by the allure of specialised lab spaces. The key is to ensure that capital is spent on essential aspects of product development rather than on long-term liabilities.

Acknowledge the value of VC dollars and stress the need for optimising their use. Boards should intervene to prevent the diversion of funds towards glossy science experiments and elaborate lab facilities, ensuring that investments contribute directly to the company's path to success in the market.

Read full post on LinkedIn - Vishaal Bhuyan

👎🏾 5 biggest reasons why many startups will go under in the next few months

Startups should resist the temptation to diversify into new markets or products during a downturn, as it often strains limited resources. Effective cash management is crucial, and companies must find ways to pull back on spending.

Hiring decisions should prioritise solving the company's significant problems over superficial credentials, as individuals with impressive backgrounds may struggle in a startup environment.

The integrity and commitment of the founder are vital. Some founders may be more focused on personal branding and ego than on seeing the startup through to success.

Read full post on LinkedIn - Jennifer Stojkovic

🔄 The dynamic interplay between fear, innovation, and societal values of 20th-century belief systems still influence our approach to food

The 20th-century outlook on the future of food can be categorised into three main belief systems: Cornocopians, Malthusians, and Egalitarians. These belief systems are interconnected, with Malthusians creating anxiety, Cornocopians responding with technological innovations, and Egalitarians focusing on social justice.

Contemporary perspectives on the future of food are represented by the "Integral Framework," which includes Technocrats, Modern Malthusians, Egalitarians, and Ecologists.

The collaborative efforts of these four archetypes aim to create an ideal food system that is innovative, resource-efficient, equitable, and environmentally friendly.

Read full post on LinkedIn - Marina Schmidt

Got a taste for this newsletter? Dish it out to your friends!👇🏾

EAR FOOD

🎙 Mighty Earth’s Glenn Hurowitz shares one of the best ways to protect the earth's biodiversity: alternative proteins

Show: The Plantbased Business Hour

Host: Elysabeth Alfano

Guest: Glenn Hurowitz, Founder and CEO at Mighty Earth

The episode discusses the importance of addressing the destruction of nature, which is at the core of the extinction crisis, which is even more severe than the climate crisis.

There is an urgent need to stop deforestation, especially in relation to the meat industry. Success stories in breaking the link between deforestation and agriculture in Southeast Asia show that change is possible and economically viable.

The meat industry's significant influence on policymaking, both in Washington and globally, is discussed. Glenn highlights that the meat industry is lobbying against alternative protein products and that there is a misconception that the meat industry represents farmers.

THAT’S ALL FOR THIS WEEK!

Take care, and have an awesome week! 🙌🏾

Are you new here?

Know any other geeks who would dig this newsletter?