Amazon for Proteins, South Korea's Major Cultivated Meat Move, and Scientist Founders

Also: A $30M fund to invest and incubate early-stage food tech startups

Hi, welcome to issue #63 of the weekly newsletter. Thanks for being here!

Here’s my favourite quote that I came across this week:

“[Scientists] have been trained to complete the background research and get to >95 percent confidence before making judgement calls. That training is working against you when it comes to entrepreneurship.”

Let’s dig into the latest developments in biotech, shaping the future of food! 🍽

BIO BUZZ

🤖 Shiru introduced the ‘world’s first’ AI-powered protein discovery platform described as ‘Amazon for proteins’

ProteinDiscovery.ai allows companies to search, discover, pilot, and buy sustainable proteins for various applications, including food and agriculture.

The platform has a database of >33 million natural protein sequences. It uses AI to improve automated biochemistry workflows, greatly speeding up the process of finding and using new proteins.

Shiru's platform also helps derisk and accelerate the development of bio-based ingredients, potentially saving millions in R&D costs and years of development time.

Source: Green Queen

🐷 MyriaMeat developed a cultivated pork fillet using 100% pig cells, without scaffolds or added plant proteins

The German biotech startup uses patented technology that uses pluripotent stem cells (iPSC) and parthenogenetic stem cells, which allow natural muscle growth. This allows the startup to grow whole cuts, addressing one of the challenges of cultivated meat.

What sets them apart? “Our muscle can contract, this is what makes it so special. We are of the opinion that only pure muscle meat made from iSPC, which has the ability to contract and is free of other additions, is able to reproduce an animal muscle as well as possible,” said Dr. Timm Eifler, CMO.

MyriaMeat is preparing to scale up its technology for broader applications, including a tasting event later this year. The startup is also expanding its network of industrial partners and potential investors to support its next growth phase.

Source: vegconomist

🇮🇱 Aleph Farms partnered with BioRaptor to integrate AI into its cultivated meat production process to optimize costs and scalability

As a leader in cultivated beef, Aleph Farms’ growth strategy involves increasing production to ensure long-term success while minimizing risks. Collaboration with BioRaptor plays a key role in this strategy by improving R&D capabilities before making big infrastructure investments.

By implementing BioRaptor's AI tools, Aleph Farms' R&D team can collect and analyze real-time and historical data. This improves the evaluation of experimental findings and helps scale production processes more efficiently.

Aleph Farms produces meat in controlled environments with a focus on optimizing cell growth. The AI integration will improve the monitoring and analysis of cell growth parameters, leading to more effective and cost-efficient production scaling.

Source: vegconomist

🧫 Mewery established a stable cell line for its proprietary co-cultivation involving pork cells and microalgae

Developing a stable cell line allows the cells to grow continuously and retain their desired properties over many generations without the need to take animal cell samples.

A stable cell line allows for precise control and consistency across batches of cultivated pork, ensuring high quality. A consistent source of cells for meat production will also allow cells to be grown on large scales and become commercially viable.

With expanding its cell bank to include multiple non-GMO porcine cell types, the Czech cultivated meat company plans to optimise growth conditions further and test its co-cultivation process in larger bioreactors.

Source: vegconomist

MACRO STUFF

🇰🇷 South Korea designated a regulation-free zone for cultivated meat development to accelerate commercialization

The zone, titled the Gyeongbuk Cell-Cultivated Foods Regulatory-Free Special Zone, will support 10 cultivated meat companies and has exemptions for using biopsies and same-day slaughtered tissues to support the mass production of high-quality cultivated meat.

Since introducing Regulatory-Free Special Zones (RFSZs) in 2019, the government has supported startups with R&D funding, tax breaks, and a regulatory-free environment to test innovative technologies.

This cultivated meat RFSZ is the first focused on food, demonstrating the government's endorsement of the sector. The zone will be operational from next month until December 2028, with a budget of ₩19.9 billion ($14.4 million).

Source: Green Queen

🇸🇬 Singapore's Prime Minister mentioned "novel food biotechnologies" as a key area for future job prospects

Under Lee Hsien Loong’s two-decade leadership, Singapore has developed into a global hub for food tech, supported by favourable research, funding, manufacturing environments, and progressive regulations.

Lee also quickly explained the term: "That means you take a plant and you make it look like wagyu beef.”

Singapore's status as a leader in the food tech industry is exemplified by the influx of global startups selecting the city-state as their preferred market entry point.

Source: Green Queen

BIO BUCKS

🍄 Maia Farms raised CAD 2.3M in pre-seed financing to expand its fungi-based biomass fermentation technology

The Vancouver-based company is focusing on scaling up the production of CanPro, a blend of mushroom and plant protein. This product, currently available in different particle sizes (ground, shred, bites, and strips), is used by food manufacturers to create meatballs and burger patties.

Maia Farms is investing in a new mycology and fermentation lab in Vancouver to boost its core R&D capabilities. The lab features equipment with capacities from 1L to 50L.

The company claims that its mycoprotein yields are much higher than those of traditional species used in similar systems. It uses agricultural byproducts instead of basic sugars as feedstock, offering a more sustainable production model.

Source: AgFunder

💰 Betagro Ventures is equipped with a $30M fund to invest and incubate early-stage food tech and agritech startups

Betagro Public Company Limited (BTG), Thailand's leading integrated food company, launched Betagro Ventures, a new subsidiary focused on supporting innovation across the BTG ecosystem.

The fund will target global early-stage startups strategically aligned with Betagro Ventures' objectives to improve the quality and safety of food, develop sustainable protein sources, and create resilient agro-industrial-food supply chains.

Beyond financial investments, Betagro Ventures will incubate and scale internal business ventures, leveraging BTG’s industry expertise and network. This helps stimulate innovation and build strategic partnerships within and beyond the Betagro ecosystem.

Source: Betagro

💨 Jooules raised NZ$1M in pre-seed funding to advance technology that converts CO2 into protein ingredients

The New Zealand-based startup uses gaseous fermentation and ancient microbe strains. This process is said to be highly efficient, using 600x less water and 99% less land than traditional methods.

The new funds will be used to expand Jooules's technical team and improve its production platform. The startup aims to launch initially in the APAC region, targeting markets with similar novel food regulations for future expansion.

Early testing of Jooules’s climate-positive proteins shows that they are nutritionally dense, contain all nine essential amino acids, and meet FAO‘s standards for complete proteins.

Source: vegconomist

🔬 Caladan Bio raised $5M in a seed funding round to build lower-cost bioreactor systems with higher experimentation throughput

The Brooklyn-based startup’s first product, the Caladan 250, includes modular 250ml bioreactors equipped with a suite of sensors. These sensors are designed to improve data collection using AI tools for process optimization.

Caladan’s goal is to reduce the cost of experiments and increase data output. The startup makes experimentation more affordable than traditional methods involving costly single-use reactors or sterilization processes.

The company targets synthetic biology companies, particularly those outside the pharmaceutical sector, to help them achieve cost parity with traditional products.

Source: AgFunder

SOCIAL FEAST

💪🏾 Scientists who "aren't ready to start a company yet" are usually much more ready than they’re giving themselves credit for

Scientists often underestimate their readiness to start a company due to their academic training, which focuses on thorough background research and high levels of certainty before making decisions.

There is no perfect moment to start an entrepreneurial journey; waiting to feel fully prepared can delay or prevent action. Younger or less experienced people are often already taking risks, learning, and progressing in the entrepreneurial space.

Engaging in entrepreneurship with a scientific discovery can lead to two outcomes: successfully commercializing the science or gaining valuable experience, which will improve employability in the biotech industry.

Source: Katie Bashant Day

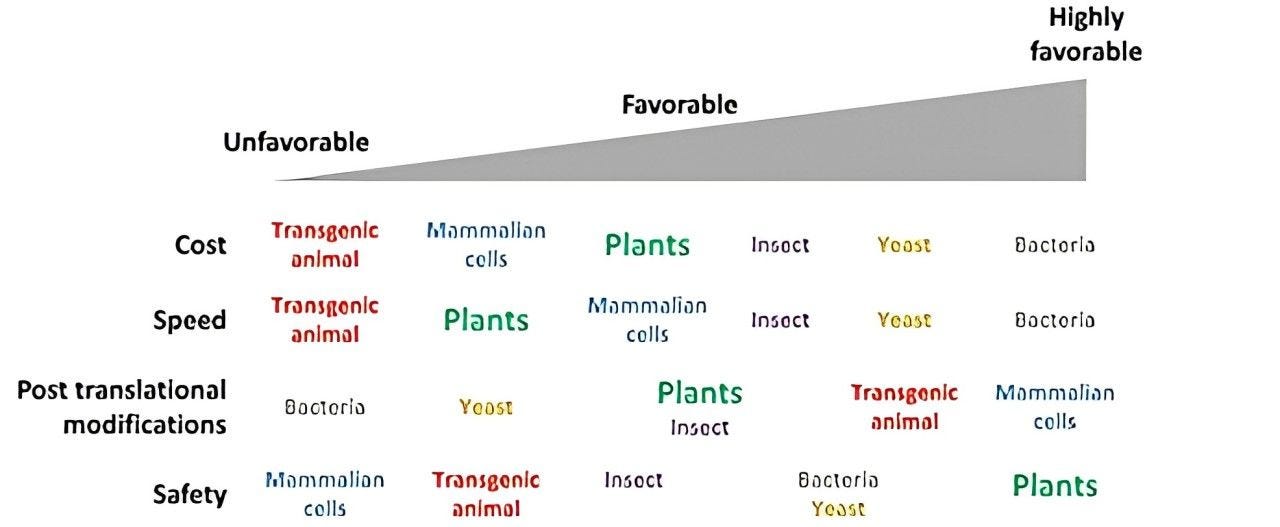

🧐 A comparative look at protein production hosts

Bacteria like E. coli are favoured for their rapid production rates but may require complex purification processes and produce non-functional proteins. Conversely, mammalian cells, although slow and costly, are ideal for creating high-quality proteins that closely mimic natural structures.

Yeasts and filamentous fungi present a balance between cost-effectiveness and lower health risks, making them practical for extensive research and commercial production.

Different hosts vary in their ability to perform necessary post-translational modifications, impacting the proteins' functionality. For example, mammalian cells are preferred for therapeutic proteins due to their ability to add correct sugar modifications, a capability less efficient in yeast and insect cells.

Source: Maya Benami

MORE ON BETTER BIOECONOMY

💬 Bio Talks: Conversations with bioeconomy innovators

Synonym's co-founder, Joshua Lachter: Financing and Developing Infrastructure for the Bioeconomy

Bioshyft's founder, Gerrit Feuerriegel: Connecting Innovators, Investors, and Incumbents to Drive the Bioeconomy

Terra Bioindustries’s CMO, Rebecca Palmer: Turning Agrifood Byproducts Into Nutrient-Rich B2B Ingredients

That’s a wrap. Thank you for taking the time to read this issue!

Are you new here?

Know anyone else who would dig this newsletter?