Bezos-Backed Fund’s Alt Protein Hub, World’s 1st Agricultural Carbon Tax, and Corn Emission-Reducing Bacteria

Also: Mycoprotein leader enters the blended meat category

Hi, welcome to issue #66 of the Better Bioeconomy newsletter. Thanks for being here!

Here’s my favourite quote that I came across this week:

“If we can bring new people on the meat reduction journey with us, no matter which way they join, then that is only a good thing for the health of people and the planet. […] To create the change the planet needs, we have to find new ways to reduce meat consumption…[it’s] about providing solutions for everyone”.

- Quorn CEO Marco Bertacca on entering the blended meat category

Let’s dig into the latest developments in biotech, shaping the future of food! 🍽

BIO BUZZ

🍄🐷 Quorn Foods enters the blended meat category as part of foodservice and hospital offerings

The blended products (50% mycoprotein and 50% conventional meat) will be available in foodservice settings, including NHS hospitals. Quorn is still in development stages of its catering partnerships and is currently “working with one of the largest catering companies in the world”.

The blended meat products target the growing flexitarian population in the UK, which makes up 14-25% of the total population. The British mycoprotein leader aims to encourage more people to reduce meat consumption for health and environmental benefits.

CEO Marco Bertacca highlights that their mycoprotein can address global issues like climate change and human obesity by reducing carbon emissions, saturated fat, cholesterol, and increasing fiber intake.

Source: Green Queen

🥤 Strive Nutrition and TurtleTree partner to launch immunity beverage and protein powder using TurtleTree's precision-fermented lactoferrin

The products are aimed at adult and sports nutrition markets, featuring TurtleTree's LF+ lactoferrin protein and Perfect Day’s beta-lactoglobulin protein.

This marks the first commercial use of precision-fermented proteins from two separate companies in one product.

The immunity beverage will be sold in 8oz cartons with 12-15g of Perfect Day’s whey, 250mg of LF+, and 23 essential vitamins and minerals. It is expected to be available via Amazon, Walmart, and other retailers.

Source: Green Queen

🥚 Revyve to introduce a powdered egg substitute made from upcycled brewer's yeast

The product offers the same binding and emulsification properties as eggs, without the typical downsides of supply chain issues, animal abuse, price volatility, and allergy risks.

The egg replacer is cost-competitive with chicken eggs due to Revyve's patented technology, which avoids fermentation and minimises production costs. The yeast is sourced from the beer industry, eliminating the need to produce Revyve’s own biomass.

The yeast is processed through washing, a proprietary micro-milling process, and separation to optimize its protein and fibre content. The product replaces artificial additives in plant-based meats, offering clean-label alternatives with improved firming, gelling, and foaming functions.

Source: Green Queen

🌽 N2OFF expanded its bacterial technology from wheat to corn, reducing N₂O emissions by up to 50%

The company’s proprietary bacterial technology, which previously reduced N₂O (nitrous oxide) emissions by 40-50% in wheat, shows similar promising results in corn.

N₂O is a greenhouse gas that is 265x more potent than CO₂. Reducing its emissions is crucial, with agricultural activities contributing to 80% of the N₂O emissions in the US.

These advancements could support the agricultural sector in meeting global food demands sustainably and contribute to the Paris Agreement's goal of limiting global temperature rise to 2°C.

Source: iGrow New

🧬 Cibus secured new patents for 10 plant gene editing and trait families, strengthening its IP portfolio to support seed companies

The company uses its Rapid Trait Development System (RTDS), incorporating Gene Repair Oligonucleotides (GRON) and Transcription activator-like effector nuclease (TALEN) technology, for developing complex traits such as pod shatter reduction in canola and herbicide tolerance in rice.

The development of IP, including legacy traits from the merger with Calyxt, is central to Cibus' strategy, enhancing its capacity to edit complex traits across multiple crops.

With over 1,000 patents and patent applications, Cibus' comprehensive IP coverage supports commercial advancements and accelerates the timeline for bringing protected traits to farmers worldwide.

Source: Cibus

🤝 Novo Holdings and DLG Group partnered to enhance sustainable crop production, with Novo Holdings acquiring 25% of Sejet

Owned by DLG Group, Sejet specializes in developing high-yield, resource-efficient crop genetics for wheat and barley. Sejet uses advanced breeding technologies to improve crop robustness and reduce CO2 emissions.

The collaboration aims to scale Sejet's business, invest in new technologies, and expand its market share in Europe, focusing on creating climate-resilient and high-quality crops.

Plant breeding, improving yields by 1% annually, is crucial for climate resilience and sustainable agriculture. Advanced techniques like CRISPR could be further used pending EU regulation changes.

Source: PR Newswire

MACRO STUFF

🇩🇰 Denmark will be the first country to introduce a tax on carbon emissions from agriculture

The tax aims to help Denmark reduce emissions by 70% from 1990 levels by the end of the decade. It includes a 60% income tax deduction for farmers, effectively reducing the initial levy to 120 kroner ($17) per tonne.

Farmers will pay $100 per year for each cow's GHG emissions, with the tax starting at 300 Danish kroner ($43) per tonne of CO2e in 2030 and rising to 750 kroner ($108) in 2035.

The initiative, resulting from five months of negotiations, will be supported by a 40B kroner ($5.7B) investment for the green transition, aiming for Denmark to become climate-neutral by 2045.

Source: Green Queen

📉 The REAL Meat Act has been reintroduced to ban federal funding of cultivated meat

The REAL Meat Act aims to prohibit US government investment in cultivated meat, affecting research, promotion, and federal nutrition programs like SNAP (Supplemental Nutrition Assistance Program).

The original REAL Meat Act, introduced in 2019 by Senator Deb Fischer, targeted plant-based meat labelling, but did not pass. Fischer reintroduced it last year, and it is currently under review.

The 2024 version has been referred to the House Committee on Agriculture. It echoes similar bills like the Fair and Accurate Ingredient Representation on Labels Act by Roger Marshall, targeting alt protein product labeling.

Source: Green Queen

BIO BUCKS

🇬🇧 Bezos Earth Fund opened its 2nd alt protein hub, this time at Imperial College London with $30M funding

The London centre, supported by a $30M investment over 5 years, spans 7 academic departments and focuses on precision fermentation, cultivated meat, bioprocessing, automation, nutrition, and AI.

The centre aims to improve the quality and cost of alt proteins through sustainable and efficient production using bioengineering and AI-guided strategies. The first Center for Sustainable Protein was launched in North Carolina and the third center is planned for Southeast Asia.

This initiative is part of the $1B Future of Food Program by the Bezos Earth Fund, which initially invested $60M in alt protein hubs and has now extended the investment to $100M.

Source: Green Queen

🇦🇺 Tenacious Ventures secured $18M in the first close of their $50M target for Fund II

Tenacious focuses on early-stage Australian agrifood startups with a positive climate impact. Their first fund in 2021 achieved $35M in commitments and invested over $23M in agtech startups, which subsequently raised more than $240M in additional follow-on capital.

US investors recognize Australia's unrealized competitive advantage in agtech, appreciating Tenacious Ventures' differentiated portfolio, experience, global presence, and strong post-investment support.

Tenacious aims to leverage its specialized knowledge to lead investments, attract additional funding, and provide critical support for climate-smart innovation in the agrifood sector.

Source: Startup Daily

💰 AgFunder takes over investment management of Blue Horizon’s growth fund, boosting its assets under management to $300M

Limited Partners (LPs) in the Growth Fund benefit from AgFunder's global presence, including offices in Silicon Valley, London, and Singapore, and a transitioning team from Blue Horizon.

LPs will access AgFunder's extensive resources, including AgFunderNews, comprehensive research, and GAIA, AgFunder's proprietary database and AI platform with over 60,000 agtech and foodtech startups.

Meanwhile, Blue Horizon strategically refocuses on its core business of accelerating the global transition to a sustainable food system and exits the investment advisory sector.

Source: AgFunder

🇸🇬 Cellivate Technologies won Channel News Asia’s business reality show, The Big Spark

The Singaporean startup could receive SGD 4.15M (around $3.3M) in funding from 5 venture capital firms.

The funds will be used to expand R&D, production capabilities, and the company’s team, along with adding a commercial unit for business growth.

Founded in 2019, the company initially focused on FBS-free media and microcarriers for cultivated meat but has since expanded to cosmetics and cultivated leather.

Source: vegconomist

🇿🇦 Immobazyme raised $1.3M to scale up its precision fermentation platform

The South African company uses yeast as biofactories to produce recombinant proteins. It has developed a modular protein expression system for cost-effective and efficient growth factors used in cultivated meat, stem cell research, tissue engineering, and regenerative medicine.

Immobazyme also developed PepTrap, an enzyme immobilization platform that improves enzyme efficiency and stability, with dextranase as its flagship enzyme for improving sugar industry processes.

Dextranase breaks down dextran gums, contaminants in sugar production, converting them into simple sugars. This improves production efficiency, reduces waste, lowers costs, and produces high-quality sugar.

Source: vegconomist

SOCIAL FEAST

🇪🇺 The EU's food regulatory framework is often criticized for stifling innovation, but this reputation is undeserved

Unlike the rapid reforms seen in countries like Singapore, the EU must harmonize regulations across 27 Member States, which naturally takes more time.

The EU and its Member States have been actively working on improving the regulatory framework, with some countries like the Netherlands, Estonia, and Iceland (following EU food legislation) holding cultivated meat tastings due to the flexibility in pre-market approval regulations.

The EFSA has increased engagement with applicants by providing better guidance for submitting novel food dossiers, hosting colloquiums, and updating scientific guidelines.

Credits: Mathilde Do Chi

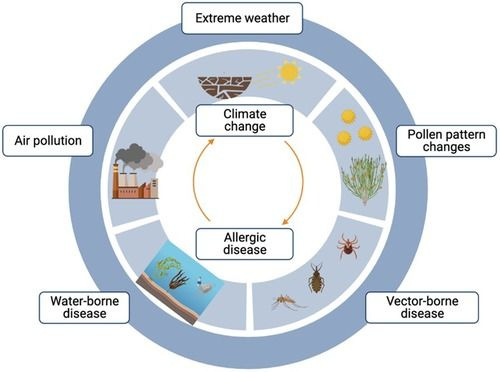

🤧 Allergies are the 4th most common global pathologic condition, climate change could make it worse

Over 50% of Americans are affected by food allergies and sensitivities, with a notable increase in childhood food allergies by 50% and a tripling of peanut/tree nut allergies and hospitalizations for food allergies from the late 1990s to mid-2010s.

The economic burden of allergies in the US is substantial, costing $24.8B annually, including $5.5B in out-of-pocket expenses for families.

Climate change exacerbates allergy issues through longer and more intense pollen seasons, increased airborne pollen and mold spores, and changes in crop growth and food protein composition. These changes lead to heightened sensitivities and new allergenic reactions.

Credits: Maya Pritsker Ben Ami

BIO TALK

🤝 ICYMI, my conversation with James Ryall: Bridging science and business to support startups using biomanufacturing

What you can learn from this conversation:

About James’ time as the CSO of Vow

How James is helping biotech startups

Positive developments in Australia's cultivated meat industry

Why James is bullish on B2B cultivated meat companies

A promising yet untapped area in cultivated meat

The biggest challenge cultivated meat startups face

Read full article: Better Bioeconomy

MORE ON BETTER BIOECONOMY

💬 Bio Talks: Conversations with bioeconomy innovators

Synonym's co-founder, Joshua Lachter: Financing and Developing Infrastructure for the Bioeconomy

Bioshyft's founder, Gerrit Feuerriegel: Connecting Innovators, Investors, and Incumbents to Drive the Bioeconomy

Terra Bioindustries’s CMO, Rebecca Palmer: Turning Agrifood Byproducts Into Nutrient-Rich B2B Ingredients

That’s a wrap. Thank you for taking the time to read this issue!

Are you new here?

Know anyone else who would dig this newsletter?