Australia and New Zealand Approve Cultivated Meat, Tetra Pak Backs Fermentation, and AI-Powered Ag Peptides

Also: EU backs 16 climate-smart agrifood startups as inflation and environmental risks grow.

Hey, welcome to issue #108 of the Better Bioeconomy newsletter, your weekly dose of biotech’s latest in food and agriculture. Thanks for being here! 👋🏾

This week, Vow became the first cultivated meat company approved in three countries. Hoxton Farms teamed up with Mitsui to turbocharge their modular bioreactor scale-up. Clever Carnivore hit an industry-low cost of $0.07/L for cultivated pork media. Tetra Pak opened a new fermentation hub to fast-track novel food producers. Micropep is joining forces with Corteva to bring AI-discovered biocontrol peptides to the field. And France’s Fungu’it secured €4M to turn food waste into fungi-derived flavour enhancers.

Heads up: I’m taking a short break in Thailand this week, so there won’t be a newsletter next week. I’ll be back in your inbox the week after! 🇹🇭

Alright, let’s dig in!

BIO BUZZ

Products, partnerships, and regulations

🇦🇺🇳🇿 Vow's cultured quail becomes the first cultivated meat approved for sale in both Australia and New Zealand

The Sydney-based startup made history following Food Standards Australia and New Zealand (FSANZ)'s amendment to the Food Standards Code after a multi-year evaluation. These include clear labelling requirements (like “cell-cultured”) and limits on use in special purpose foods unless further assessed.

Vow’s product will first appear at high-end restaurants such as Bottarga and Nel, featured in dishes like parfait and foie gras under its Forged brand. Supermarket sales are expected to follow later this year.

Already available in Singapore, Vow1 is now the only cultivated meat company approved in three markets. The company reports 200% month-over-month sales growth in Singapore.

Source: Green Queen

🤔 Thoughts:

This milestone marks a step forward in global acceptance of cultivated meat and the rise of dedicated regulatory pathways. FSANZ’s move to establish specific standards for cell-cultured foods makes Australia and New Zealand the second region, after the US, to implement a tailored approval process. It’s a sign that cultivated meat is shifting from novelty to an officially recognised food category.

By setting a clear precedent, this decision could influence regulators elsewhere, especially across the Asia-Pacific, increasing confidence and encouraging others to follow suit. In short, Australia’s approval might help unlock broader regulatory alignment and expand access to new markets for cultivated proteins.

🇬🇧🇯🇵 Hoxton Farms forms strategic partnership with Mitsui Chemicals, including direct investment from the Japanese chemicals giant

The collaboration centres on integrating Mitsui’s speciality polymers into the UK-based cultivated fat startup’s custom-built bioreactors to improve manufacturability and help scale production of cultivated fats and other cell-based products.

Unlike conventional stirred tank reactors (STRs), Hoxton uses a modular “ultra scale-out” (USO) system made up of many small, low-cost units. This setup reduces capital costs by more than 10x and offers a simpler, more scalable production process suited to large-scale stem cell culture.

Although the current work focuses on cultivated fat, the partnership also looks ahead to broader uses, like in cosmetics and pharmaceuticals. Meanwhile, Hoxton is gearing up for regulatory submissions in the UK, US, Singapore, and Japan, aiming for commercial launches in the Asia-Pacific region by 2026/2027.

Source: AgFunder

🤔 Thoughts:

Hoxton’s scale-out approach reflects a broader shift in how cultivated foods might be manufactured. Rather than following the biopharma playbook of using massive 10,000–20,000 liter stirred-tank reactors, the industry is exploring a more distributed model.

Perhaps scaling “out” beats scaling “up” for cultivated foods, meaning the future factories might look more like server farms (with arrays of modular bioreactors) rather than breweries with a few giant tanks. It also reduces the risk of single-point failure. If one small bioreactor has an issue, it doesn’t halt the entire production.

With distributed systems, there’s also room for innovation in automated control, remote monitoring, and predictive maintenance. This opens a niche for startups building operating systems or AI copilots for modular bioreactor farms, much like the OS layer that enables true plug-and-play scalability.

🇸🇪 Tetra Pak opened a New Food Technology Development Centre to support biomass and precision fermentation-based food producers

Open to companies of all sizes, from early-stage start-ups to established businesses, the centre offers two main programmes: Process Evaluation for moving from lab-scale to demo production, and Productivity Validation to refine and enhance existing production methods.

Recognising the difficulties many companies face in attracting investment in the novel food sector, Tetra Pak is using its expertise in equipment and formulation to help businesses address challenges related to profitability and scaling.

The centre also collaborates with Tetra Pak’s facilities in Lund, providing companies with a space to test product formulations, build brand identity, and shape go-to-market strategies, thereby helping to speed up the path from concept to launch.

Source: FoodBev

🇺🇸 Micropep and Corteva launched a multi-year collaboration to co-develop peptide-based biocontrol and biofungicide products

Corteva Catalyst, which previously invested in Micropep’s Series B round, is teaming up with the startup for joint R&D and field testing of its small linear peptides. Corteva Catalyst will have exclusive rights for use in biocontrol and biofungicide applications.

Micropep’s proprietary Krisalix platform uses computational biology and AI to screen genomes and identify short peptide sequences (5–20 amino acids) with potential in weed and disease control, opening the door to novel agricultural biological solutions.

Over the next few years, the collaboration will test a large number of peptides, gradually narrowing the list to a few promising candidates for product development, helping Corteva move faster without expanding its internal team.

Source: AgFunder

🤔 Thoughts:

Chemical pesticides are facing growing challenges, from rising resistance in pests and pathogens to tighter regulations and environmental concerns. Peptide-based biocontrols offer a fresh approach: they work through different biological mechanisms than conventional herbicides or fungicides and tend to break down quickly in the environment, thanks to their composition from naturally occurring amino acids.

Like RNAi and microbial biopesticides, peptides are part of a broader shift away from broad-spectrum chemicals toward more precise, mechanism-driven solutions. If Micropep and Corteva can show these peptides perform consistently in the field, it could pave the way for peptide discovery to become a scalable platform, one that generates a pipeline of targeted biocontrols across multiple pest and disease categories.

🇺🇸 Clever Carnivore has brought its cultivated pork culture media cost down to an industry-leading $0.07 per litre at pilot scale

The Chicago-based startup has achieved this milestone by cutting out costly ingredients like bovine serum albumin (BSA) and fetal bovine serum (FBS), mixing its own media in-house, and making its own growth factors. It’s aiming to launch its cultivated pork in the U.S. as early as summer 2026.

To keep production costs down, Clever Carnivore uses secondhand and custom-designed stainless-steel bioreactors, working with food-grade equipment suppliers instead of pricier biopharma vendors.

Clever Carnivore’s porcine cell lines are developed to thrive in minimalist, animal-free culture media, allowing fast growth (doubling time under 14 hours) without relying on microcarriers or genetic modification.

Source: Green Queen

🤔 Thoughts:

Clever Carnivore’s cost breakthrough signals a maturing phase in the cultivated meat sector, where unit economics and scalability are taking center stage. While the pioneers laid the groundwork by securing regulatory approvals and showing the tech works, now, newer entrants are demonstrating just how much production costs can be streamlined.

Hitting a $0.07/L media cost points to a broader trend of rapid bioprocess innovation. This could catalyse a broader push among startups and incumbents to invest in bioprocess efficiency, potentially leading to a virtuous cycle. As costs drop, more investors and partners may regain confidence in cultivated meat’s commercial viability.

Regulatory pathways are evolving too. While first movers had to navigate the FDA and USDA without much precedent, fast-followers like Clever Carnivore are taking a more deliberate path, waiting until their processes are closer to commercial scale before submitting. That strategy reduces rework and speeds things up once approvals are underway. With clearer frameworks now in place, the bar to entry is effectively lowering, opening the door for future players to move faster and with more confidence.

🇪🇺 EU backs 16 climate-smart agrifood startups as inflation and environmental risks grow

The EU, through EIT Food’s RisingFoodStars program, selected startups for its 2025 cohort, addressing the EU’s rising food inflation (3.3% YoY) and environmental challenges with scalable, science-based solutions in sustainable farming, low-carbon ingredients, and eco-friendly packaging.

About half of these startups are working on alternatives to palm oil and cocoa. UK-based Clean Food Group and Finland’s Perfat Technologies are developing sustainable fat substitutes, while Israeli startups like Kokomodo and Celleste Bio are creating climate-resilient cocoa substitutes.

Precision fermentation stands out in the cohort. Companies like Imagindairy (animal-free dairy), PFx Biotech (human lactoferrin), and ProteinDistillery (Prew:tein from beer waste) are driving innovation in protein alternatives and functional ingredients.

Source: Green Queen

🤔 Thoughts:

The EU’s backing of these startups helps close a critical funding and support gap for climate-smart food innovations. Many technologies in this space, like precision fermentation, have long development cycles and high scale-up costs that private capital often won’t carry alone.

By stepping in, the public sector is accelerating the path from lab to market, helping these innovations clear the “valley of death” and gain traction in real supply chains.

If this momentum continues, hopefully, we could see more systemic policy integration. This could include public procurement favouring low-emission ingredients, fast-tracked regulatory pathways for bio-based alternatives, and emissions targets explicitly tied to food system transformation.

BIO BUCKS

Funding, M&As, and grants

🇫🇷 Fungu’it raised €4M to scale its fungi-based tech that turns food waste into natural flavours for meat and cocoa alternatives

The funding will be used to build an industrial-scale pilot plant capable of producing several dozen tonnes per year, secure patents for its process, and develop a database that tracks flavour outcomes from testing hundreds of fungi and food waste combinations.

The French startup's solid-state fermentation method uses upcycled materials like wheat bran and brewer's grains. It cuts water use by 90%, reduces energy consumption by 50% compared to submerged fermentation, and lowers the carbon footprint by 92%, according to life-cycle analyses.

The process yields a wide array of flavour profiles, including umami, smoky, roasted, and cocoa-like, through fermentation with well-known, food-safe fungal strains, optimised for consistent and scalable production.

💰 Investors: Asterion Ventures (lead), Evolem, and UI Investissement

Source: Green Queen

🇮🇱 Lembas raised $3.6M in pre-seed funding to develop a food-grade bioactive peptide designed to activate the body’s GLP-1 hormone

The Tel Aviv-based startup has launched GLP-1 Edge, a proprietary peptide that supports appetite regulation by stimulating the secretion of GLP-1. While GLP-1 drugs like Ozempic are commonly used in the U.S., with about 1 in 8 Americans having tried them, they come with high costs (around $1,000 per month) and side effects such as nausea, anxiety, and changes in taste.

Lembas takes a different approach, using AI to create food-grade peptides that can be added to foods and supplements. This could potentially offer a more accessible way to activate GLP-1 without prescriptions or injections, and with fewer side effects.

The company is tapping into the growing food-as-medicine trend, aiming to help food companies deliver functional products. Its AI platform is built to discover new bioactives that go beyond weight management, targeting broader metabolic and wellness benefits.

💰 Investors: Flora Ventures (lead), Bluestein Ventures, Fresh Fund, Longevity Venture Partners, Maia Ventures, Siddhi Capital, Mandi Ventures and SDH.

Source: Green Queen

🤔 Thoughts:

With GLP-1 drugs like Ozempic suppressing appetites and siphoning revenue from weight-loss programs and snack aisles, food companies are being forced to rethink their role in metabolic health.

Lembas‘ biotech-enabled counterpunch could be an early signal that the food industry is starting to adopt pharma’s tools like IP, mechanistic targets, and preclinical trials to regain lost ground.

If such products succeed, could we see “prescription snacks” emerge, with food products bundled with wellness programs or reimbursed by insurers as part of weight management regimens?

🇧🇪 Biotope by VIB secured €5M in the first close of its €9M second fund to support early-stage biotech startups focused on planetary health

The fund plans to invest €250,000 in each of up to 30 international startups. These startups go through a competitive selection process and a basecamp program, receiving targeted support on tech development, regulatory planning, and IP strategy.

Biotope's first fund backed 16 startups, which have attracted €30M in follow-on financing (including grants), achieving a capital leverage of over 10x.

Diversity remains central to Biotope’s model, as 75% of its portfolio companies have mixed-gender founding teams, with women comprising 58% of their employees. The initiative has also helped create 48 full-time jobs.

💰 LPs: BNP Paribas Fortis, Agri Investment Fund, SFPIM Relaunch, Anacura, the Flemish Biotechnology Institute (VIB), and family offices The Nest and Edaphon.

Source: Protein Production Technology

GEEK ZONE

Latest scientific research papers

🍇 Biostimulant-biocontrol combo cuts grapevine downy mildew disease incidence by 68% via synergistic defence activation

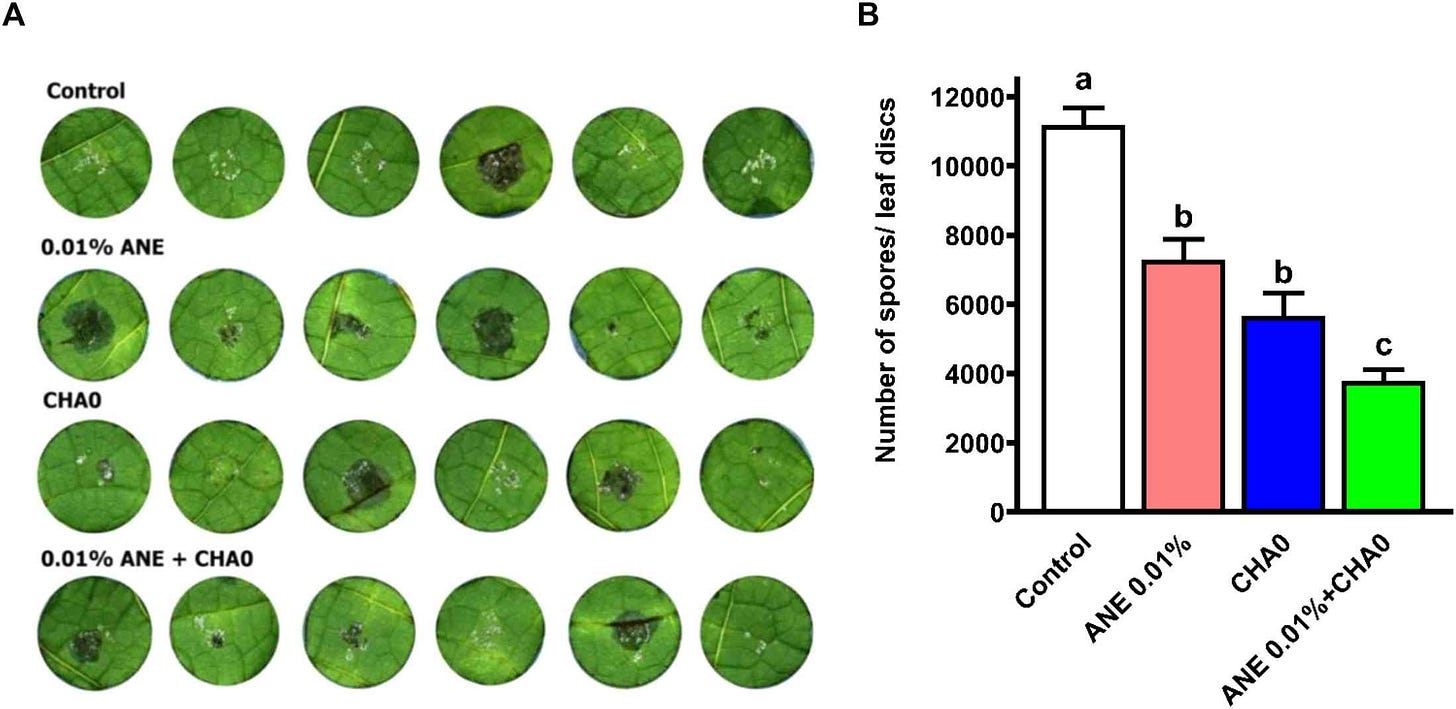

Downy mildew, caused by Plasmopara viticola, poses a major threat to grapevine production. Researchers tested the combined effects of Ascophyllum nodosum extract (ANE, a biostimulant) and Pseudomonas fluorescens CHA0 (a biocontrol bacterium) on downy mildew in grapevines, using in vitro assays and greenhouse trials to assess disease suppression and immune activation.

The dual treatment lowered zoospore levels by 89-93%, reduced spore counts by around 66%, and brought disease incidence down to 22%, compared to 40-50% with single treatments and 70% in controls. It also activated key plant defences, with up to 69% fewer empty sporangia and increased activity in defence enzymes and jasmonic acid-related genes.

This synergistic, non-chemical approach provides a promising new tool for sustainable viticulture, reducing reliance on fungicides while boosting grapevine immunity.

Source: Frontiers in Plant Science

🦠 RNAi knockdown in microalgae improved lipid output by 71% without compromising quality

Using RNA interference (RNAi), researchers downregulated UGPase, an enzyme involved in carbohydrate biosynthesis, in Nannochloropsis salina microalgae, redirecting carbon from storage polysaccharides toward biomass and lipid production.

The modified strains delivered up to 76.9% more biomass and a 71.0% jump in lipid productivity (196.3 mg/L/day) over the wild type. Fatty acid methyl ester (FAME) analysis showed no significant difference in lipid composition across strains.

This RNAi strategy effectively enhances lipid output without compromising quality, offering a genetic lever to enhance lipid yields in industrial microalgal production.

Source: Frontiers in Microbiology

🧬 Engineered Bacillus subtilis cut mutation rates by 89% and increased production stability 16× in industrial-scale simulations

Genetic instability remains a major hurdle for scaling microbial bioproduction. To address this, researchers introduced two complementary strategies in the bacterium Bacillus subtilis: SiteMuB, which identifies low-mutation genomic sites for stable gene integration, and ChassisLMR, a low-mutation chassis constructed by removing unstable elements and enhancing DNA repair.

In industrial-scale simulations (76 generations), SiteMuB and ChassisLMR increased N-acetylneuraminic acid titres by 15.9× and 11.1×, respectively, while reducing mutation rates by up to 89.1%. Together, they improved T7 expression system stability by 2.1× over 74 generations and increased GFP plasmid expression stability by 1.38×.

These approaches reduce reliance on biosensors or metabolically burdensome control systems, offering a potentially scalable and versatile path to more genetically stable strains for protein and metabolite production.

Source: Microbial Biotechnology

🕷 Gene-edited beneficial predatory mites show 23x resistance to pesticide, staying active while sprays hit the pests

In integrated pest management, the goal is to combine control strategies that work well together. Neoseiulus californicus, a key predator of crop pests, often gets knocked out by the very pesticides meant to get rid of pests. To tackle this, researchers used CRISPR/Cas9 and ReMOT Control to disable a pesticide target gene (nAChRα6) in the mite.

The engineered strain (FZ-α6KO) was 23x more resistant to the pesticide spinetoram than the wild-type. The resistance was inherited in an autosomal recessive pattern and was tightly linked to the targeted gene edit.

This study could help address a long-standing challenge in integrated pest management: ensuring the survival of beneficial mites following chemical treatments. With added resistance, N. californicus could better coexist with selective pesticide use, supporting more robust pest control programs.

Source: Pesticide Biochemistry and Physiology

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Disclaimer: Better Bite Ventures, where I work, is an investor of Vow.