World’s First Alt Protein Bond Criteria, Pureture Unveils Clean-Label Casein, and Syngenta Acquires Intrinsyx Bio

Also: Nearly half of consumers in four EU nations are willing to try cultivated meat if approved by the EFSA.

Hey, welcome to issue #102 of the Better Bioeconomy newsletter. Thanks for being here! 👋🏾

This week, the Climate Bonds Initiative launched the first-ever certification framework for alternative proteins, aiming to drive more sustainable investment into food innovation. Pureture unveiled a fermentation-derived casein that’s 30% cheaper than dairy, and Multus introduced a new food-grade basal media to help cultivated meat scale. Vivici secured US manufacturing through Liberation Labs, while an EU consumer survey revealed strong interest in cultivated meat, though slow approvals could hold it back. Meanwhile, Syngenta acquired Intrinsyx Bio to expand its presence in the fast-growing biologicals space.

Alright, let’s dig into the latest updates on how biotech is transforming food and agriculture for a climate-friendly food system.

BIO BUZZ

Products, partnerships, and regulations

🇺🇸🇰🇷 Pureture developed a fermentation-derived casein that is 30% cheaper than traditional dairy protein while mimicking functionality

After testing more than 400 yeast strains, the team developed a six-step fermentation process that produces a highly digestible, complete-amino-acid casein. It also naturally binds water and fat, just like dairy casein.

With growing interest in clean-label foods, Pureture’s process avoids the need for common additives like emulsifiers and gums, meeting the demand for simpler, more natural ingredients.

Co-founder Rudy Yoo is now combining the strengths of his two companies, Pureture and Armored Fresh, to launch Piilk: a line of dairy-free protein shakes made with clean, animal-free ingredients that aim to deliver the whole dairy experience.

Source: Green Queen

🤔 Thoughts:

Many plant-based and lactose-free products still rely on emulsifiers and thickeners like carrageenan, guar gum, or xanthan gum to stay stable and mimic dairy’s texture. They get the job done, but they also bulk up ingredient list and increasingly turn off consumers seeking ‘clean labels’.

Pureture’s casein-equivalent protein changes that by delivering emulsifying power from within. It’s a “built-in” function, not a “bolt-on” fix, no need for extra additives to keep things creamy and uniform.

That means food developers can drop multiple additives, which simplifies procurement pipelines, trims QA testing, and shortens new-product development cycles, especially useful for teams working with tight R&D resources. Fewer ingredients also mean fewer supply-chain shocks and less paperwork when specifications or allergen statements change.

The timing matters. Regulators are tightening oversight of traditional stabilisers: the EU has banned titanium dioxide (E171) in food and introduced stricter purity rules on mono- and diglycerides (E471). Pureture helps brands stay ahead of that curve with a cleaner, more resilient formulation.

🇬🇧 Multus launched a new food-grade basal media designed for cultivated meat production scale-up

The UK-based startup introduced DMEM/F12-FG, a food-grade basal media packed with key nutrients like sugars, salts, and vitamins tailored for cultivated meat cell growth, helping the industry advance toward commercialisation.

To ensure the media is suitable for large-scale use, Multus teamed up with global food and feed ingredient suppliers. The result is a formulation that meets both quality and regulatory standards, backed by transparent performance data.

AI played a key role in the process, helping Multus identify food-grade alternatives to traditionally biopharma-only ingredients that still deliver on function and safety.

Source: FoodBev Media

🤔 Thoughts:

Standard DMEM was never meant for the dinner table, it’s priced for lab work at roughly US$50–100 per litre, putting large-scale food production out of reach. Multus’s new basal medium swaps pharma-grade inputs for food-grade ones and shoots for around US$10 per litre when produced at scale.

That lower price removes a major hurdle: instead of pouring cash into custom media plants or fighting for slots at biopharma suppliers, startups can simply source from a specialist like Multus.

That said, recombinant growth factors and serum replacements (Multus already offers Proliferum B for the latter) are still a big part of the bill of materials. This launch chips away at one layer of the expense stack. Expect future suppliers, maybe even Multus, to tackle the growth-factor piece next.

🇺🇸🇳🇱 Liberation Labs set to produce Vivici’s animal-free whey protein at its biomanufacturing facility, with commercial operations starting next year

This move helps Dutch-based Vivici establish a US manufacturing presence and boost supply reliability for American customers. The site's first phase, 600,000 litres of fermentation capacity, is set to wrap up by year-end, and a Department of Defence-funded study is underway to explore expansion to 4 million litres.

Despite being a newer player, Vivici has advanced quickly by using the expertise of its founders (Fonterra and DSM-Firmenich) in dairy proteins and industrial-scale biomanufacturing. It raised €32.5M this year and has already scaled production in Europe.

Vivici’s whey protein targets high-value nutrition markets like sports and active nutrition. It also plans to launch bovine lactoferrin later this year, using the same production setup to streamline operations and expand its protein lineup.

Source: AgFunder

🇪🇨 Ecuador approves Cibus' herbicide-tolerant rice traits, treating them as conventional

Ecuador’s Ministry of Agriculture and Livestock has determined that Cibus’ HT1 and HT3 rice traits are equivalent to those developed through conventional breeding. As a result, they won’t be subject to the country’s GMO regulations and can move forward with registration and commercialisation.

Cibus, which develops and licenses plant traits for seed companies, uses its Rapid Trait Development System™ (RTDS®) to make precise genetic changes without introducing foreign DNA, aligning with regulations on traditional agricultural practices.

Through its partnership with Interoc, a major player in Latin American rice breeding, Cibus plans to roll out these herbicide-tolerant traits across the region. The approval in Ecuador also sets the stage for potential regulatory clearances in other Latin American markets.

Source: Cibus

🇮🇱 BlueTree Technologies targets major fruit-exporting regions with patented sugar reduction tech using ultrafiltration and adsorption

BlueTree’s sugar-reduction tech has been successfully scaled with Israeli juice maker Priniv, resulting in a 33% sugar reduction in orange juice now available on the market, sold as “sugar reduced”.

The company has signed new deals in Thailand, where sugar taxes have recently expanded, and Latin America, including a dairy partnership aiming for near-zero sugar milk. It’s also working to establish sugar-reduction hubs in major fruit-producing areas like Brazil, Mexico, and Southeast Asia.

BlueTree's patented process selectively removes disaccharides (like sucrose and lactose) using ultrafiltration and adsorption (like zeolite). This maintains the juice’s sweetness (as sweeter monosaccharides remain), making the process compatible with methods like high-pressure processing.

Source: AgFunder

🤔 Thoughts:

Health and nutrition policies are acting as a catalyst for food tech upgrades. BlueTree’s momentum in regions with aggressive sugar policies shows how regulation can accelerate tech adoption in supply chains.

As sugar taxes and labeling laws roll out (Thailand’s beverage sugar tax, Chile’s front-of-pack warnings, etc), food companies aren’t just shrinking portion sizes or adding warnings. They’re turning to ingredient processing innovations to reformulate products from the inside out.

It’s a bit like how auto makers responded to emissions standards by engineering cleaner engines rather than simply paying fines. Regulation is spurring innovation.

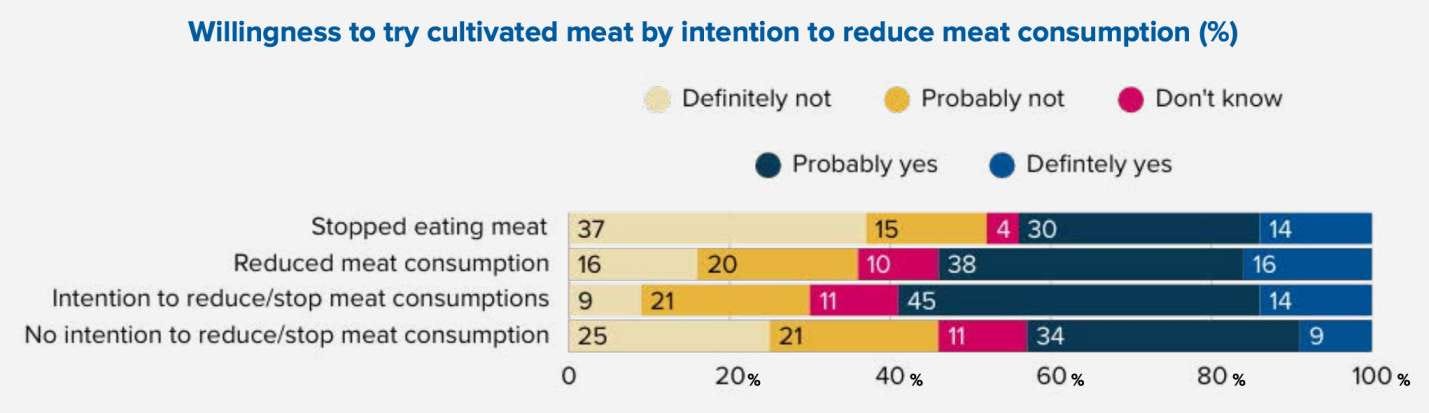

🇪🇺 Nearly half of consumers in four EU nations are willing to try cultivated meat if approved by the EFSA, a survey of 4,000 shows

The survey of people in Belgium, Italy, Portugal, and Spain found 44–56% are open to trying cultivated meat if approved. However, in the report, Euroconsumers warns that the EU’s current 3–5 year approval timeline is too slow for startups, which could drive innovation abroad and slow progress on climate and food goals.

While 51% of Europeans are concerned about long-term health risks from cultivated meat, 38% would be willing to include it in their diets if proven healthier. Notably, two-thirds trust EFSA’s safety judgment, and one in three see cultivated meat as safer than traditional options due to the absence of antibiotics and bacterial risks.

Nearly half of Europeans would only consider cultivated meat if it mimics traditional meat's taste and texture. Price is another major hurdle: 60% wouldn’t buy it if it costs more than regular meat, and just 13% feel well-informed about the product, despite 50% being aware of it.

Source: Green Queen

⚡️ More buzzes

🇨🇭 🇬🇧 Syngenta Vegetable Seeds and Tropic will partner to apply the innovative GEiGS gene-editing and silencing platform to enhance disease resistance in commercially important vegetables. Tropic’s GEiGS merges gene editing and gene silencing (RNAi) for improved plant resilience. (Tropic)

🇳🇿 After two years of screening over 90 native strains, the Cawthron Institute and startup Nutrition from Water (NXW) identified 14 promising microalgae strains from New Zealand for sustainable nutrition and export opportunities across Asia Pacific. Among them, Galdieria sulphuraria emerged as a standout thanks to its extremophilic traits and strong commercial potential. (NXW)

BIO BUCKS

Funding, M&As, and grants

🌏 The Climate Bonds Initiative introduced the ‘world’s first’ Alternative Protein Criteria to channel investment into climate-aligned food systems

This marks the first certification tool focused on alternative proteins. It aims to attract sustainable investment in climate-friendly food technologies, an important step toward cutting food system emissions. Developed over two months of public consultation, the framework looks at both types of proteins and strategies to scale up the industry.

It focuses on two core areas: replacing animal proteins with lower-emission alternatives and improving the sustainability of alternative protein production itself, especially through energy transition, raw material sourcing, and waste management.

The criteria outline a wide range of eligible actions for investment, from updating recipes and staff training to consumer outreach and pricing strategies to increase the adoption of meat alternatives. However, only human food products qualify, and cultivated meat companies must phase out fetal bovine serum by 2030 to maintain certification.

Source: Green Queen

🤔 Thoughts:

Food production is no longer peripheral to climate finance. With new certified criteria, alternative proteins are now eligible for green bonds, a mechanism that helped scale renewables like wind and solar many years ago.

This signals a shift: capital markets are starting to treat sustainable proteins as critical climate infrastructure (as they should!). For alt protein companies, that unlocks new tools like green bonds, sustainability-linked loans to finance the kind of scale-up that venture capital alone can't sustain: production plants, supply chains, and R&D.

The green debt market hit $1 trillion in 2024. If alt proteins tap even a fraction of that, they could gain a more stable, long-term funding pipeline and accelerate the protein transition from niche to climate-aligned norm.

🇨🇭🇺🇸 Syngenta acquires Intrinsyx Bio to strengthen its position in nutrient use efficiency, the fastest-growing segment in biologicals

Intrinsyx Bio’s nutrient use efficiency (NUE) products span multiple key regions like the US, UK, Benelux, and Iberia, with room to grow globally, helping expand Syngenta’s reach.

The NUE sector is the fastest-growing within the biologicals market, and this move gives Syngenta a strategic edge by integrating Intrinsyx Bio's advanced R&D and product pipeline.

This deal reinforces Syngenta's focus on sustainable agriculture, supporting its mission to help farmers achieve higher productivity with reduced environmental footprint, a core pillar of Syngenta Group’s Sustainability Priorities.

Source: Syngenta

🤔 Thoughts:

Nitrogen losses are still a big issue, with about 50–70% of applied nitrogen fertiliser escaping into the environment through runoff, leaching, or volatilisation. That’s not just costly, it also worsens eutrophication and N₂O emissions. Intrinsyx Bio tackles this with endophytic bacteria that live inside plants, helping them fix atmospheric nitrogen and use nutrients more efficiently.

Syngenta’s buy-out of Intrinsyx Bio inserts a microbial “nitrogen factory” directly inside the seed. Field trials with its NUELLO iN endophyte mix have shown >10 % fertiliser savings without compromising yield.

The bigger play is positioning inside nutrient-use efficiency (NUE) now the fastest-growing slice of the $17B biologicals market. Fertiliser prices hit record highs in 2022 and regulators in the EU, India and parts of Latin America are pressing for 20–30 % nutrient run-off cuts.

That triple squeeze has turned NUE biologicals from niche curiosity into a key competitive front: Corteva (Symborg + Stoller), Bayer (Ginkgo/Joyn) and Mosaic Biosciences are all buying or partnering for in-plant N boosters.

🇺🇸 Meati Foods is being sold for $4M, a dramatic decline from its $650M valuation in 2022 following a bank-induced crisis

The Colorado-based mycelium meat producer had raised $450M in total funding, including $150M in Series C and $100M in Series C1 rounds.

Things took a turn in February when Meati’s bank unexpectedly pulled two-thirds of its cash reserves due to a technical default on a financial agreement, even though the company was up to date on its payments. This move halted a key internal funding round meant to keep operations running into 2026.

Now, a $4M asset sale to a new company called Meati Holdings has been proposed in court. The goal is to preserve value and avoid liquidation, but the court still needs to approve it, and the company's future remains up in the air.

Source: Green Queen

🤔 Thoughts:

Big yikes.

The co-founder and General Partner at Siddhi Capital, Steven Finn, shared some great insights on this collapse. Do check it out!

💸 More bucks

🇺🇸 Hoofprint Biome raised $15M Series A to shift the microbial balance in a cow’s rumen, improving nutrition while reducing methane emissions. By using enzymes made with yeast, the company targets methane-producing microbes while helping cows absorb nutrients more efficiently. (TechCrunch)

🇦🇺 Levur raised $1.2M in pre-seed funding to develop a fermentation-based oil alternative using engineered yeast. Their solution aims to replace palm oil without disrupting existing supply chains or harming the environment. (Startup Daily)

GEEK ZONE

Latest scientific research papers

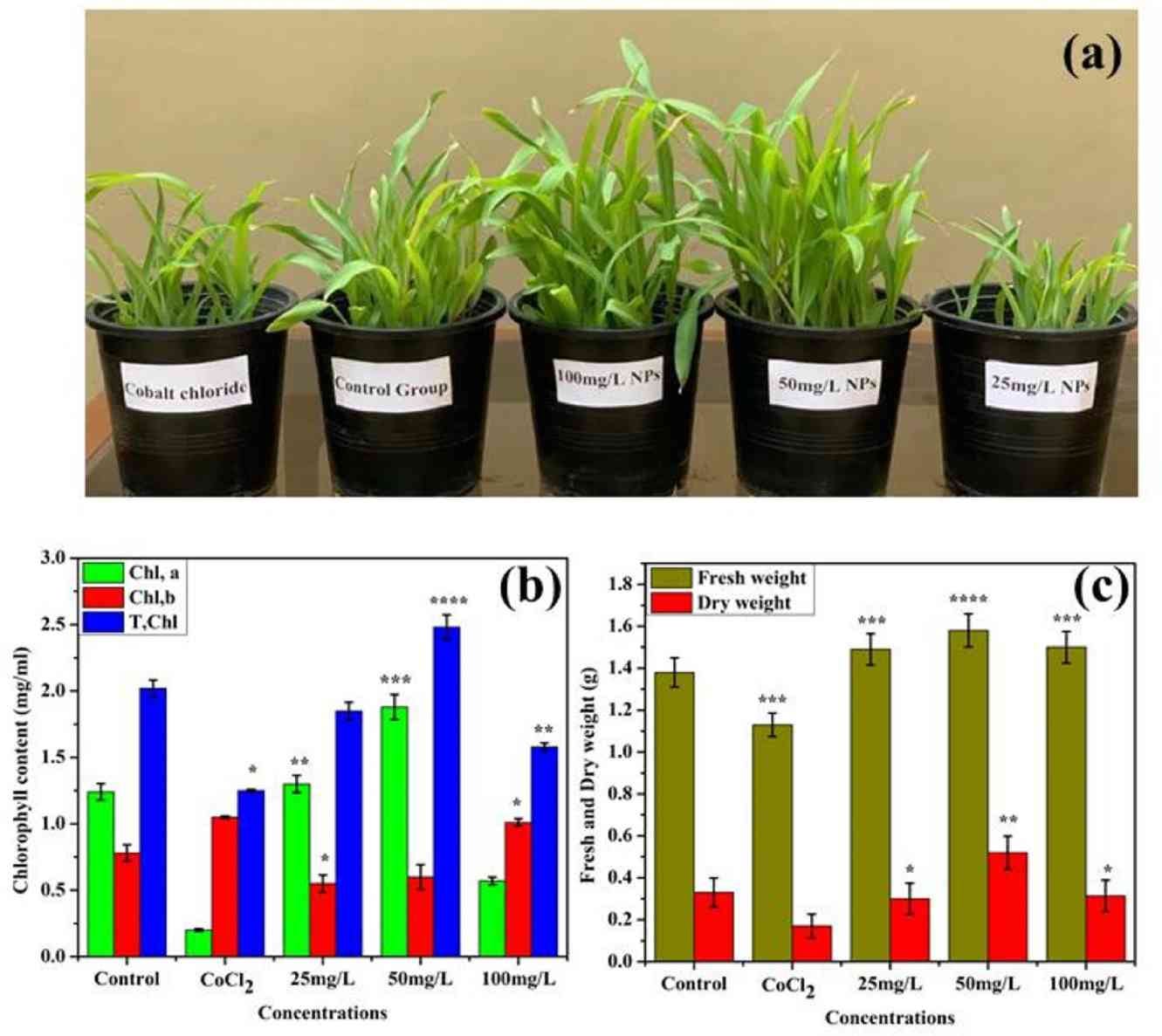

🌽 Nano-bioengineered cobalt oxide biostimulant increased corn shoots by 15% and chlorophyll by 23%

Researchers biosynthesised cobalt-oxide (CoO) nanoparticles with Withania coagulans extract and dosed hydroponic maize at 25, 50, and 100 mg L⁻¹, with bulk CoCl₂ as a control. Over 25 days, they tracked growth, pigments, metabolites, and antioxidant activity.

The 50 mg L⁻¹ dose hit the sweet spot: shoot length and fresh weight each up 15 %, chlorophyll a up 51 % (total chlorophyll up 23 %). At 25 mg L⁻¹ pigments and antioxidants rose modestly, while 100 mg L⁻¹ or bulk cobalt salt turned harmful, slicing chlorophyll a by 46–84 % and soluble sugars by 96 %.

Low-dose, plant-derived CoO nanoballs serve as both micronutrient and stress buffer, outperforming conventional cobalt salts and pointing to cleaner nano-fertilisers that could trim inputs and keep maize productive under climate pressure.

Source: Scientific Reports

🍐 Microbial biofertilizers increased pear-tree biomass by up to 84% by rewiring soil microbiome

Researchers compared two biofertilizers, Bacillus velezensis SQR9 and Trichoderma harzianum NJAU4742, against a standard organic control on field-grown pear saplings, tracking nutrient shifts, microbiome changes, and metabolites with amplicon sequencing plus culture assays.

SQR9 increased pear biomass by 68% and enriched soil organic matter and phosphorus. T4742 pushed biomass up 84%, raised nitrogen, potassium, iron, and zinc, and doubled the number of beneficial taxa compared with SQR9.

The results lay out a strain-specific playbook for precision biofertilizers, showing how tailored microbe mixes could help reduce reliance on synthetic inputs by remodelling the rhizosphere.

Source: Plant, Cell, and Environment

EAR FOOD

Podcast episode of the week

🎧 Solving for P in NPK fertilisers by combining protein engineering with automation and AI

Host: Dan Goodwin

Guest: Ben Scott, Engineering Biology Platform Lead at the Global Institute for Food Security

The global food system has a quiet phosphorus problem. Unlike nitrogen, which cycles through the atmosphere, usable phosphorus must be mined from limited deposits.

One of the world’s largest sources is a 100-kilometre conveyor belt in Western Sahara that moves phosphate rock from the desert to the coast, where it’s shipped around the world. It’s a single point of failure for global agriculture, and when excess phosphorus runs off into waterways, it fuels harmful algal blooms.

To make things trickier, 50–80% of the organic phosphorus in soils and manure is locked up in phytate, a complex molecule that also binds micronutrients like iron, zinc, and calcium, making them inaccessible to plants.

While there are commercial enzymes that break down phytate, they’re built for animal guts, warm and acidic, not for field conditions, which are cooler (under 15°C) and closer to neutral pH. So they don’t work as well in soil.

Ben’s team at the Global Institute for Food Security uses lab automation and machine learning to design new phytase enzymes, screening thousands of variants to find ones that stay active for weeks in real-world soil conditions. It’s a promising step toward unlocking soil-bound phosphorus and making fertiliser use more efficient and sustainable.

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Got any feedback/suggestion? Drop them here:

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Hi Eshan! How are you doing on this very nice day? Thank you very much for excellent issue #102. There is a lot going on in the alt protein space, and your awesome newsletter helps keep me informed on some of the biggest and most important developments. Every day we are becoming a better civilization, and you are helping move the progress along. You rock Eshan 🎸 👍❤️