$31M for Mycoprotein Scale-Up, $4.2M for Bean-Free Coffee, and Helping Pollinators With Biotech

Also: How Prime Roots carved out a profitable niche in alt deli meats with its mycelium-based proteins

Hey, welcome to issue #114 of the Better Bioeconomy newsletter, a curated look at the latest in biotech for food and agriculture, covering commercial developments, funding rounds, scientific breakthroughs, and commentary. Thanks for being here! 👋🏾

In case you missed it, I recently wrote an article examining why ag biologicals adoption has lagged and where momentum is building. Here’s the TL;DR:

Why adoption lagged:

Performance & trust: early claims often fell short, benefits less visible than synthetics, unclear modes of action eroded confidence.

High costs & uncertain payback: inconsistent economics and multiple applications make ROI harder to prove.

Knowledge & training gaps: many growers lack awareness or practical know-how to use biologicals effectively.

Poor operational fit: short shelf life, storage needs, and tank-mix issues add friction.

Fragmented regulation: patchwork rules and slow approvals kept products niche for years.

Where momentum is building:

Big-ag channel pull: acquisitions and dedicated divisions bringing scale, bundling, and distribution reach.

Regulatory tailwinds: clearer definitions, harmonised data requirements, and tighter rules on some synthetics.

Better science & field results: improved strains, formulations, and replicated multi-season ROI.

Precision-ag integration: digital tools improving timing, placement, and consistency of results.

Rising adoption rates: penetration expanding beyond early adopters into major row crops and large markets.

I’d love to hear your thoughts on the topic. Like most things I write about, my understanding of this topic keeps evolving, so if I’ve missed something, let me know!

Let’s get into it!

BIO BUZZ

Products, partnerships, and regulations

🇺🇸 Prime Roots carved out a profitable niche in alt deli meats with its mycelium-based proteins

Rather than competing in the crowded burger and nugget market, the company focuses on the deli counter, which has few plant-based choices. This strategy positions them directly against conventional premium-priced deli meats while sidestepping the slowdown in other alt-meat categories.

Prime Roots capitalises on the perception that deli meats are heavily processed and linked to health risks. By offering a clean-label, whole-food protein made from koji, the company appeals to parents and health-conscious shoppers looking for safer everyday lunch options.

The company says it is “unit profitable,” choosing measured growth over aggressive scaling. With scalable production and steady traction, Prime Roots aims for a national rollout by 2026.

Source: AgFunder

🤔 Thoughts:

Prime Roots’ focus on deli-style meat alternatives is a smart play: go after a category where conventional meat already has baggage. Unlike centre-of-plate meats such as chicken breast or steak that consumers might see as “natural,” deli meats are associated with additives, nitrates, and heavy processing. Prime Roots is tapping into a segment where shoppers may be more open to a cleaner swap.

Just as notable is Prime Roots’ claim of unit profitability. While that doesn’t mean the entire business is profitable, it departs from the old “grow-at-all-costs” model. Rather than raising large sums to scale before proving demand, the company has focused on efficient operations, measured fundraising, and showing positive unit economics first.

This capital-disciplined approach, mirrored by a few others, is a more sustainable path forward for alt proteins that could help build stronger foundations for the sector.

🇦🇺 Nourish Ingredients’ precision-fermented fat received FEMA GRAS approval in the US

The Australian startup received Generally Recognised as Safe (GRAS) status from the Flavour and Extract Manufacturers Association (FEMA) for its animal-free fat, Tastilux. The approval clears the way for immediate US sales and supports the company’s plans for global expansion.

Made from Nourish’s proprietary Mortierella alpina biomass through precision fermentation, Tastilux produces animal-free lipids that mimic the flavour and cooking performance of animal fat in plant-based chicken, beef, pork, and more.

Effective at just a 1% inclusion rate, Tastilux offers an alternative to palm and coconut oils. Nourish also targets new applications in snacks, ready meals, and tallow replacements, while progressing regulatory approvals in Singapore, Australia, the UK, and the EU.

Source: Green Queen

🤔 Thoughts:

Nourish’s FEMA GRAS approval shows a lower-friction pathway for getting fermentation-derived ingredients to market. By positioning Tastilux as a flavour additive, the company pursued an alternative to the longer FDA GRAS or food additive routes, achieving clearance in just a few months. While this is limited to flavour use, it’s a practical way to speed up entry and establish credibility for future applications.

What’s also notable is Tastilux’s impact at around 1% inclusion. This points to a potentially viable model for precision-fermented fats: focus on impact per gram rather than bulk replacement. A concentrated ingredient that delivers flavour and texture with only minimal volumes could help address the cost challenges many fermentation startups face.

🇺🇸 Merck spinout develops edible membrane tech for cultivated meat and high-protein pasta

EdiMembre, a spinout from MilliporeSigma (part of Merck Group’s life sciences division), is developing edible membrane technology for whole-cut cultivated meat and high-protein pasta. The company is starting with cultivated meat and seafood startups, with plans to later work with larger meat producers incorporating hybrid or cultured protein.

Their flagship CraftRidge technology uses patented hollow fibre membranes made through a phase-inversion process from legume protein isolates like soy, mung, and lentils. These membranes can support different cell types and bioprocesses, making them useful for producing structured cultivated meat.

The approach also enables pasta with more than 80% plant protein, well above typical levels. It also helps streamline cultivated meat production by reducing costs and allowing fat to be evenly distributed in the final product.

Source: Green Queen

🤔 Thoughts:

By spinning the edible membrane platform into an independent venture led by scientists from its cultivated meat program, Merck can draw on external funding and startup agility without stretching its core operations. It’s a model I’d like to see more incumbents adopting: provide IP and resources, then let a separate venture drive commercialization.

The membrane itself is designed for multiple applications, from cultivated meat to high-protein pasta and even cell-based leather. That flexibility helps manage uncertainty and creates nearer-term revenue options while longer-term markets mature.

It reflects a broader trend where companies build platform ingredients and tools that serve today’s needs, while laying the foundation for more transformative products. It’s a pragmatic way to spread both technical and commercial risk.

🇬🇧🇺🇸 Gowan and Moa Technology formed strategic research collaboration to advance next-generation herbicide solutions

UK-based Moa has developed “Amplifier” molecules, which are compounds that don’t kill weeds directly but improve the performance of existing herbicides. This approach could help farmers use less chemical input while controlling weeds.

In the last three years, Moa has identified 80 new herbicidal modes of action, several of which have proved effective against tough weeds during international trials in North America, Europe, South America, and Australia.

US-based Gowan is backing the partnership with upfront investment and value-sharing arrangements. Current amplifier trials include Australia (annual ryegrass) and the UK (cereal grassweeds), with the context of glyphosate resistance recently reported in Italian ryegrass.

Source: New AG International

🤔 Thoughts:

Moa Technology’s string of deals with Croda, Nufarm, and Gowan signals a deliberate, asset-light model that leans on collaboration across the spectrum of crop protection. By positioning itself as an R&D hub, Moa is developing innovations across synthetic molecules, biologics, and amplifiers while relying on partners for scale-up and commercialisation.

Together, these partnerships span three of the most critical fronts in weed control innovation, suggesting that networks of specialised innovators could become increasingly central in shaping the future of weed control instead of relying solely on vertically integrated giants.

BIO BUCKS

Funding, M&As, and grants

🇺🇸 The Better Meat Co raised $31M Series A to scale its mycoprotein ingredient to commercial production

The funding will help the company shift from pilot runs to full commercial-scale production. So far, it has secured five agreements with major meat producers worldwide, projected to bring in $13M annually, and continues its long-running partnership with Perdue Farms on the Chicken Plus range.

Initially positioned as a meat enhancer, the company’s mycoprotein Rhiza is now finding broader uses in plant-based meat, dairy alternatives (like milk, cheese, yoghurt), and even baked goods such as breads, tortillas, brownies, and nutrition bars. This is thanks to its ability to replace eggs, retain moisture, and add protein.

By adopting a continuous fermentation process, the startup has cut costs by over 30%, while improving efficiency and yields. This step is key to its plan to undercut ground beef prices by 2026.

Investors: Future Ventures, Resilience Reserve, Hickman’s Family Farms CEO Glenn Hickman, Epic Ventures, Sigma Ventures, and more.

Source: Green Queen

🤔 Thoughts:

The round suggests that investors are still writing checks for startups with improving unit economics and credible pathways toward commodity-level pricing, rather than brand-driven plays reliant on premium positioning.

Ingredient-first models are becoming the dominant path to scaling alt proteins globally, as CPGs increasingly seek performance, cost efficiency, and supply chain plug-ins over stand-alone brands.

🇸🇬 Prefer raised $4.2M pre-Series A to expand its bean-free coffee and cocoa internationally, and announced partnerships with Ajinomoto

The Singapore startup1 ferments upcycled food waste such as surplus bread, okara, and brewers’ grain into coffee and cocoa alternatives, achieving up to 85% lower carbon footprint and 50% lower costs than Arabica. It has also signed commercial deals with Ajinomoto in Thailand and CPG brand The Coffee Ferm in Australia and New Zealand.

Its lineup includes roasted coffee, concentrates, RTD lattes, soluble coffee powder, and cocoa-free powder, both of which can replace up to 40% of beans. Soluble coffee powder is driving the most demand, supported by $15M in non-binding offtake agreements across beverage and flavour applications.

The company plans to scale production to 500 tonnes annually using toll manufacturing and licensing. Its proprietary fermentation process shortens development timelines and reduces commercialisation costs, while regulatory approvals remain straightforward since the process is food-safe and non-GMO.

Source: Green Queen

Investors: One Ventures, Chancery Hill Capital, and Forge Ventures

🤔 Thoughts:

Blending up to ~40% of bean-free coffee or cocoa into existing products offers brands a pragmatic way to stretch supply, reduce costs, and hedge against volatile commodity prices. It’s mentioned that these inclusion levels can preserve flavour, and if that holds more broadly, it would let companies adopt such ingredients without asking consumers to change their habits.

The shift is subtle but meaningful: climate-friendly inputs don’t need to replace traditional commodities outright. They can enter the market through familiar formats, reducing dependence on fragile supply chains in a way that feels seamless to the end consumer.

Looking ahead, it’s possible that major coffee and chocolate makers could build 20-40% sustainable extenders into their standard formulations. That would mean not just incremental savings, but also a built-in hedge against climate-driven supply shocks.

🇬🇧 SugaROx secured £1M seed round extension to advance T6P biostimulant trials

The company’s T6P biostimulant, developed from research at Oxford University and Rothamsted Research, blocks SnRK1, an enzyme that signals energy scarcity in plants, helping boost yields and crop resilience. Safety testing wrapped up in early 2024, and with a favourable regulatory outlook.

The £1M seed funding included £400k from global fertiliser company The Mosaic Company and £600k from UK-based investors and funds. This follows a £2.4M Innovate UK grant to help scale production of Trehalose-6-Phosphate (T6P).

Commercial rollout will be phased: a UK wheat product launch is planned for 2027, followed by the EU in 2028. Meanwhile, soybean and maize trials starting in 2025-26 are paving the way for entry into the US and Brazilian markets later

Source: New AG International

🤔 Thoughts:

The involvement of a major fertilizer incumbent like The Mosaic Company in SugaROx’s funding and field trials points to a more collaborative path for ag biologicals. Startups are increasingly working within established agronomy networks to validate and scale their technologies. Mosaic’s involvement could create a feedback loop where new products can be tested, refined, and proven inside an industry leader’s ecosystem. For many biostimulants, adoption may come less from going solo and more from integrating into existing agribusiness infrastructure.

On the financing side, the company paired a substantial Innovate UK grant with strategic equity investment, de-risking its move from lab research to pilot production. This model of using non-dilutive public funding to advance technical milestones, while strategic investors provide market expertise and commercialization pathways could help reduce early capital intensity and can improve the terms on which venture investors engage later.

🇳🇱🇬🇧 Meatable acquired Uncommon Bio’s cultivated meat platform as Uncommon shifts to therapeutics

Dutch startup Meatable has taken over UK-based Uncommon Bio’s cultivated meat platform, including its IP, select cell lines, and key staff. While Uncommon Bio is moving into therapeutics, it saw Meatable as the right fit to carry forward and scale its food-focused technologies.

Uncommon created a polysaccharide-based RNA delivery system and an RNA discovery engine that can reprogram iPSCs into fat and muscle. The system is designed to be scalable, food-safe, and less reliant on costly protein media, helping reduce production expenses.

Since this mRNA method doesn’t alter a cell’s genome, regulators do not consider it GMO. For Meatable, that means new flexibility, adding non-GMO options alongside its existing GMO approach and smoothing regulatory pathways in different markets. The technology also supports faster development of chicken, lamb, and speciality breeds, broadening Meatable’s product scope.

Source: AgFunder

🤔 Thoughts:

The deal was not just about IP, it can be viewed as an acqui-hire that brought in experienced scientists and proven cell lines. In novel fields like cellular agriculture, the know-how, which includes the methods, tricks, and refinements that live in researchers’ heads, can be as valuable as formal patents.

By onboarding Uncommon’s team and “high-performing cell lines,” Meatable gains an immediate R&D boost that could compress development timelines, potentially more than patents alone.

Meatable also inherits cell lines optimised for growth and differentiation, with dossiers already prepared for multiple regions. These assets would otherwise take a lot of time to build from scratch.

🇸🇬 Singrow raised $4.5M Series A to scale its seed breeding and vertical farming business across Asia and beyond

The raise allows Singrow to expand beyond Singapore and China, focusing on innovations like heat-resistant strawberries adapted from Northeast Asian cultivars. These varieties can thrive in hotter climates, and the company’s facilities in China are already exporting to Indonesia and Thailand, with trials underway in Vietnam and Malaysia.

Unlike typical vertical farming startups, Singrow positions itself as a seed and ag-tech company. Its reverse genetics platform enables faster, targeted breeding for various crops. Singrow has also compressed saffron’s long cultivation cycle and added mushroom cultivation to its portfolio.

Singrow’s new facilities will integrate mushrooms and strawberries in a closed-loop system, reusing mushroom-emitted CO₂ as input for strawberries while cutting mushroom farm emissions. The first farm is under construction in Singapore, and another is planned for Houston.

Investors: Finc Pte. Ltd., Cyanhill Capital, Pasudeco, Eastern Wind International, Ritz Venture Partners, and AgFunder.

Source: AgFunder

💰 More bucks

🇬🇧 Bright Biotech was awarded £1M from the Advanced Research and Invention Agency (ARIA)’s Synthetic Plants Programme to apply its proprietary chloroplast technology in developing more productive, resilient, and sustainable crops, advancing efforts to improve global food security. (Bright Biotech)

🇸🇪 Seaqure Labs raised over SEK 5M in a pre-seed round, backed by investors such as Chalmers Ventures, Almi Invest, and West Coast Business Angels. The company develops mycoprotein to replace fishmeal and soy in aquaculture feed, reducing ecosystem pressure and carbon emissions. (Sting)

GEEK ZONE

Latest scientific research papers

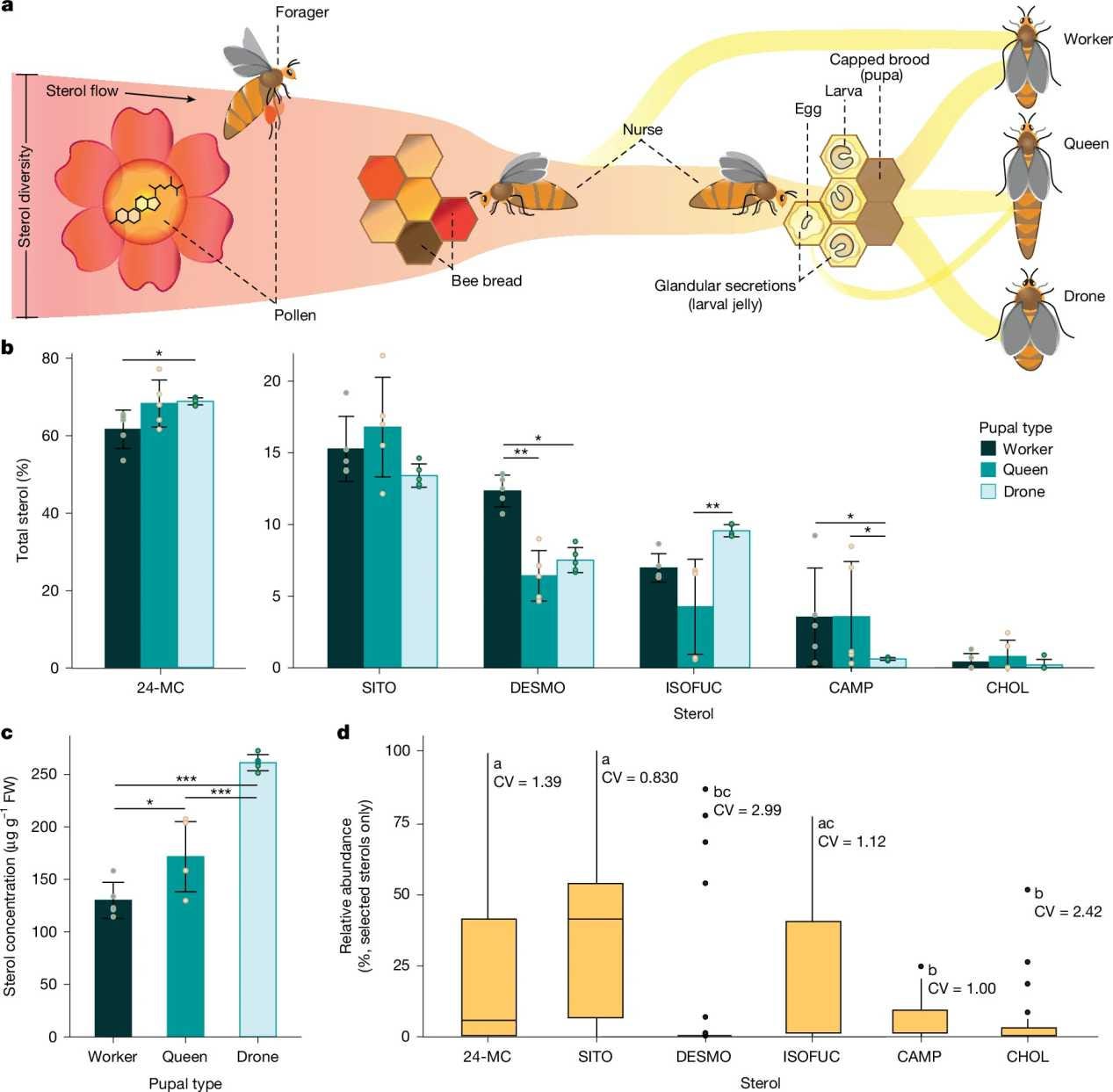

🐝 Engineered yeast provides missing pollen sterols to keep honeybee colonies brooding

Researchers pinpointed which sterols accumulate in honeybee brood, identifying 24-methylenecholesterol as the primary one along with β-sitosterol, desmosterol, and others. They reprogrammed Yarrowia lipolytica to produce this sterol mix and incorporated the inactivated yeast into pollen-substitute diets. Then, they tested the feed with small colonies in semi-field trials without incoming pollen.

The engineered yeast delivered sterols at useful levels. Colonies on this diet reared many more pupae, with 10-40 capped brood cells compared to almost none in controls by day 91. Only the biologically relevant sterols were passed to larvae.

Since current pollen substitutes lack these essential sterols, this yeast-based approach may help colonies maintain brood production when flowers are scarce. It also has the potential to support pollination services and reduce management losses.

Source: Nature

🦠 Endophytic bacterium extracts completely inhibited spore germination and increased seedling shoots by 30%

Researchers studied the endophytic bacterium Nocardiopsis alba B57 by comparing its metabolites in single culture versus co-culture with major crop pathogens (Fusarium, Verticillium). Using metabolomics and pathway analysis, they tracked which antifungal and growth-related compounds switched on under pathogen pressure, then tested B57 extracts directly on fungi and seedlings.

The extracts slowed fungal growth by ~30% and inhibited spore germination across four pathogens. They also promoted plant growth, with roots up to 51% longer and shoots about 32% taller. Mechanistically, B57 shifted toward producing carbapenem, menaquinone, and fumiquinazoline antifungals and activated multiple plant-hormone pathways.

The bacterium acts as a two-in-one bio-input with antifungal plus growth-promotion with identifiable metabolites that could be tracked during development and could potentially lower dependence on synthetic fungicides.

Source: npj Biofilms and Microbiomes

🌱 Mycorrhizal fungi supply 21% of cotton root nitrogen when fertiliser is reduced

Researchers set up a 60-day cotton trial using a compartment system that separated roots from fungal hyphae. This allowed them to see how arbuscular mycorrhizal fungi (AMF) contributed under three nitrogen levels. This approach revealed how AMF supplied nitrate and ammonium to the plant while influencing root traits and soil carbon–nitrogen dynamics.

AMF contributed 21.31% of the root total N under reduced N and shifted N forms. Nitrate contributions increased as N dropped (5.89% → 19.92%), while ammonium contributions decreased overall (24.35% → 13.16%). AMF treatments lowered soil inorganic N and raised nitrate mineralisation. AMF colonisation also positively correlated with root tissue density, biomass, and microbial activity.

In drip-fertilised cotton systems, pairing AMF with moderate N reduction could help maintain nitrate supply while improving root growth and soil health. This would support more efficient fertiliser use and potentially reduce costs and emissions. Field trials will be needed to confirm these effects at scale.

Source: BMC Plant Biology

EAR FOOD

Podcast episode of the week

🎙 Will hybrid wheat pay off? A conversation on genetics, resilience, and farmer ROI

Hybrid wheat shows up to 10% yield advantage over varietals, progress that would typically take a decade to achieve with conventional breeding. It also holds height and leaf mass under heat and drought stress, giving more consistent yields in volatile environments.

Unlike corn, which cross-pollinates and can be detasseled easily, wheat self-pollinates and produces many tiny flowers on each head. That complexity has made controlled hybridisation a challenge for decades.

Corteva’s answer is a nuclear male-sterile system built on genetics, which was first identified in the 1990s and paired with the release of the wheat genome in 2018. This approach allows hybrid wheat seed to be produced at scale, cost-effectively and consistently.

Farmers will adopt hybrid wheat if it pays off in terms of both yield and risk management. Given high variability and abandonment rates (nearly 20% in key wheat states vs <3% for corn/soy), reducing downside risk may be just as important as yield gains.

One more hurdle is cultural. Unlike corn, many wheat farmers still save their own seed to control costs. While certified seed adoption is growing (15–60% depending on region), convincing farmers to pay for premium hybrid seed will require clear proof of value.

Guests: Jessie Alt (Global Wheat Lead, Corteva Agriscience) and Brad Erker (CEO, Colorado Wheat)

Podcast: Agriscience Explained

APAC AGRI-FOOD INNOVATION SUMMIT

Don’t miss your chance to attend the Asia-Pacific Agri-Food Innovation Summit and get 10% OFF with my network code. From breakthrough food systems to next-gen agri-tech, this is where Asia’s innovation leaders connect, collaborate, and create impact.

👀 Use my exclusive partner code for 10% OFF your pass: BIO10

Learn more: https://tinyurl.com/s9k5x3d7

See you in Nov!

GOT A MINUTE?

If you found value in this newsletter, consider sharing it with a friend who might benefit! Or, if someone forwarded this to you, consider subscribing.

This newsletter is free, but if you'd like to support the time and effort behind each issue, a small pledge is always appreciated.

Thank you, and have a great day!

Disclaimer: The views and opinions expressed in this newsletter are my own and do not necessarily reflect those of my employer, affiliates, or any organisations I am associated with.

Disclaimer: Better Bite Ventures, where I work, is an investor of Prefer.

Hello Eshan! How are you doing on this awesome day? Thank you very much for outstanding issue #114. My, how time flies by! I like your breakdown of why alt protein is lagging and where momentum is building. I'll add a biggie. Adoption is lagging because most people do not yet really see and understand the terrible cruelty inflicted on factory farmed animals. Like culling male chicks and tossing them into a spinning shredder alive. WTF! People in general do not "Do unto others as you would have done unto you, or don't do unto others as you would not have done unto you. Necessity is the Mother of Invention so when the tipping point happens, we will see the mass adoption of alt protein. And it may take our children or grandchildren to get us there. Also, factory farmed meat is not optimal longevity as it generally has lots of saturated fats and contamination. But I'm hopeful. I'm optimistic that humanity will one day look back at the barbaric way we treated billions of animals and say never again. I love your great newsletter Eshan because you are helping greatly to usher in a new, better, world. No good actions are in vain. Thank you Eshan for all the fantastic work you're doing. Much love bro ❤️